Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help solving Exercise 7 and Manageria... x ents Compute depreciation using different methods. ents lanagerial Edition E9.7 (LO 2) Linton Company purchased a

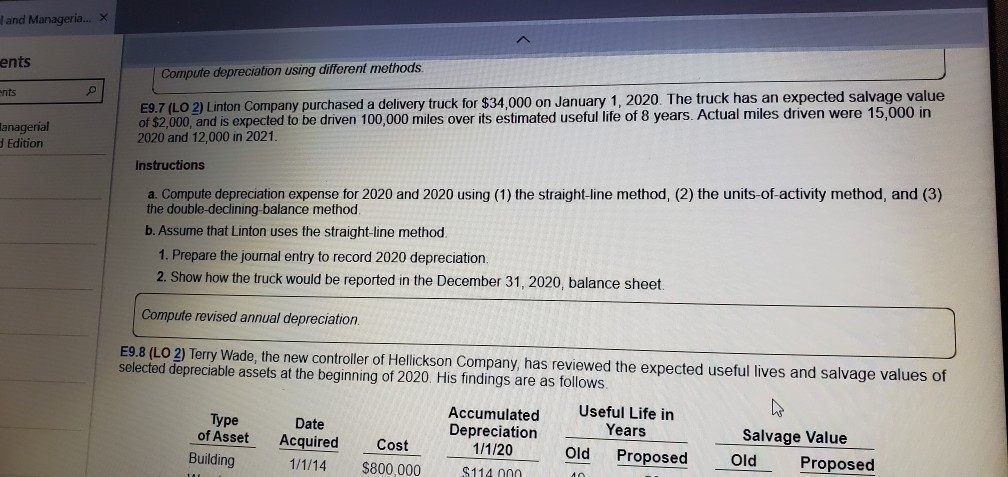

I need help solving Exercise 7

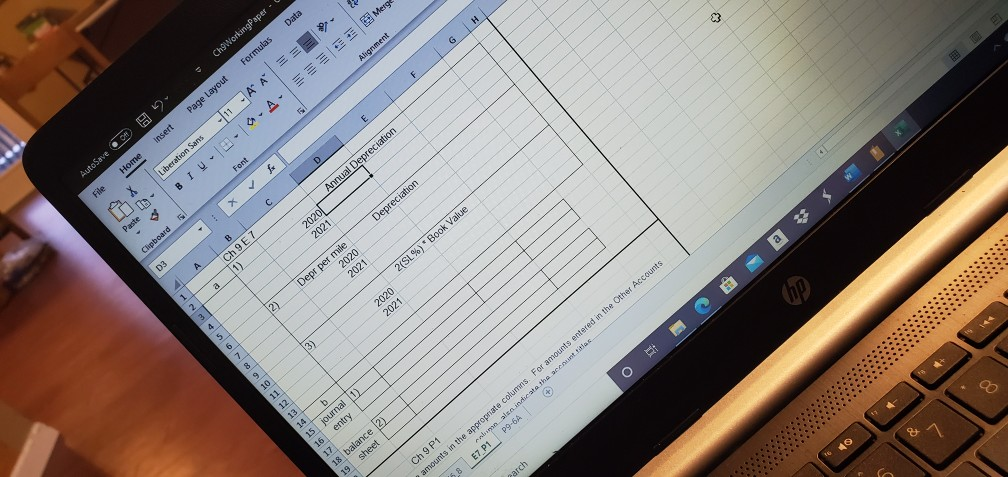

and Manageria... x ents Compute depreciation using different methods. ents lanagerial Edition E9.7 (LO 2) Linton Company purchased a delivery truck for $34,000 on January 1, 2020. The truck has an expected salvage value of $2,000, and is expected to be driven 100,000 miles over its estimated useful life of 8 years. Actual miles driven were 15,000 in 2020 and 12,000 in 2021. Instructions a. Compute depreciation expense for 2020 and 2020 using (1) the straight-line method, (2) the units-of-activity method, and (3) the double-declining-balance method. b. Assume that Linton uses the straight-line method. 1. Prepare the journal entry to record 2020 depreciation. 2. Show how the truck would be reported in the December 31, 2020, balance sheet Compute revised annual depreciation E9.8 (LO 2) Terry Wade, the new controller of Hellickson Company, has reviewed the expected useful lives and salvage values of selected depreciable assets at the beginning of 2020. His findings are as follows. Type of Asset Building Date Acquired 1/1/14 Cost $800,000 Accumulated Depreciation 1/1/20 $114 000 Useful Life in Years Old Proposed Salvage Value Old Proposed H G ChoWorking Paper - Formulas Data Merge Alignment F = Page Layout A insert Liberaten AutoSave Home File 5 Depreciation Paleo BIU-10.0.A. Font - f BL C D E Ch 9 E7 Annual Depreciation 2020 Clipboard 2021 A 1) 2020 2021 2(SL%) Book Value a Depr per mile A 1 2) 2020 2021 . L 15 journal 1) entry 18 balance 2) 19 sheet Ch 9 P1 amounts in the appropriate columns For amounts entered in the Other Accounts aatha areas 68 E7 P1 P9-6A parchStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started