Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help solving part 1,2,3 . I appreciate your help. CPA Wood Works Inc. manufactures wood furniture that is ergonomically designed for optimal studying

i need help solving part 1,2,3 . I appreciate your help.

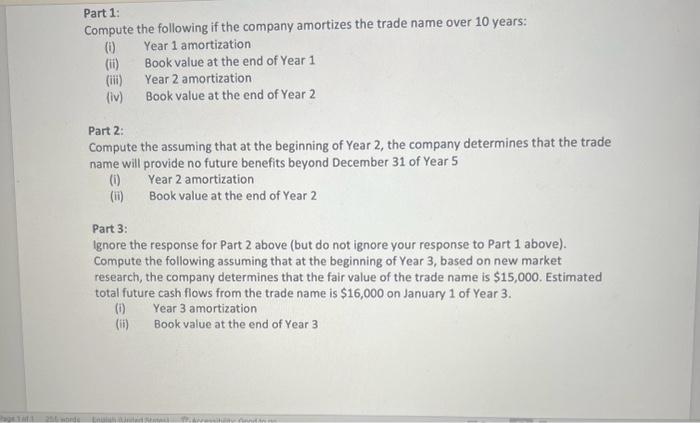

CPA Wood Works Inc. manufactures wood furniture that is ergonomically designed for optimal studying for the CPA exam. The company went viral for its TikTok videos showing dance moves around its ergonomic furniture. Based on its new popularity, the company has been forced to secure a trade name for its products. In early January of Year 1 , the company applied for a trade name, incurring legal costs of $16,000. In January of Year 2 , the company incurred $7,800 of legal fees in a successful defense of its trade name. Part1: Compute the following if the company amortizes the trade name over 10 years: (i) Year 1 amortization (ii) Bookvalue at the end of Year 1 (iii) Year 2 amortization (iv) Book value at the end of Year 2 Part 2: Compute the assuming that at the beginning of Year 2, the company determines that the trade name will provide no future benefits beyond December 31 of Year 5 (i) Year 2 amortization (ii) Book value at the end of Year 2 Part 3: Ignore the response for Part 2 above (but do not ignore your response to Part 1 above). Compute the following assuming that at the beginning of Year 3 , based on new market research, the company determines that the fair value of the trade name is $15,000. Estimated total future cash flows from the trade name is $16,000 on January 1 of Year 3 . (i) Year 3 amortization (ii) Book value at the end of Year 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started