i need help solving the questions ASAP

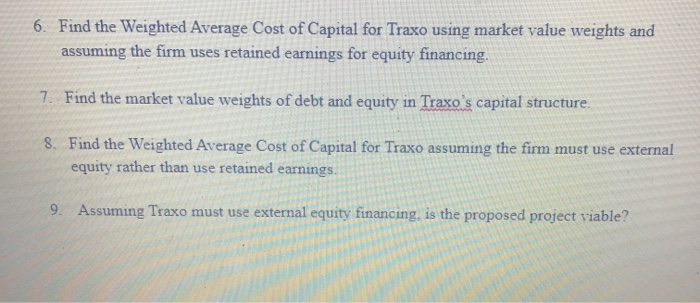

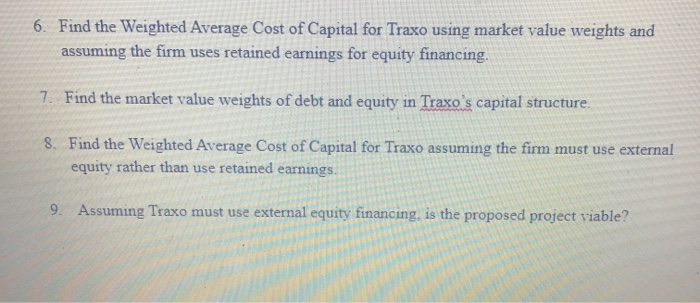

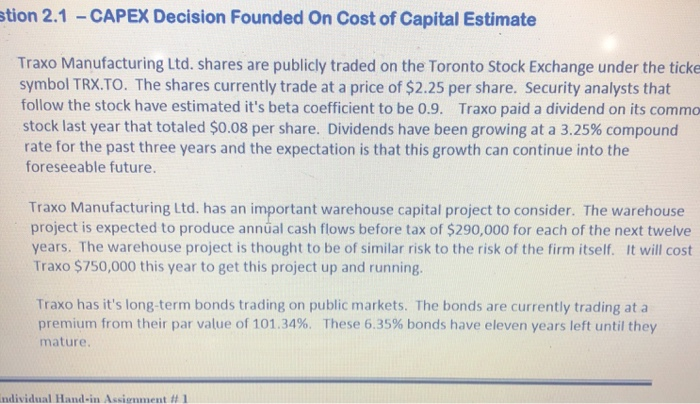

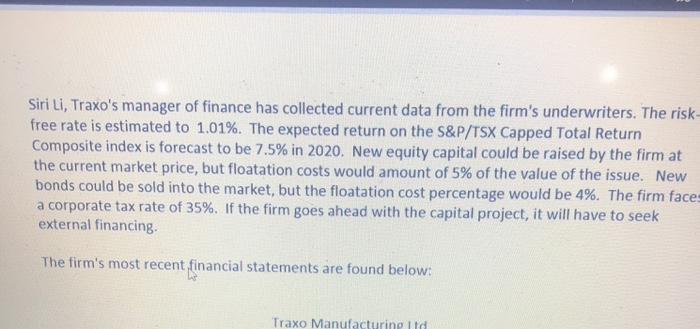

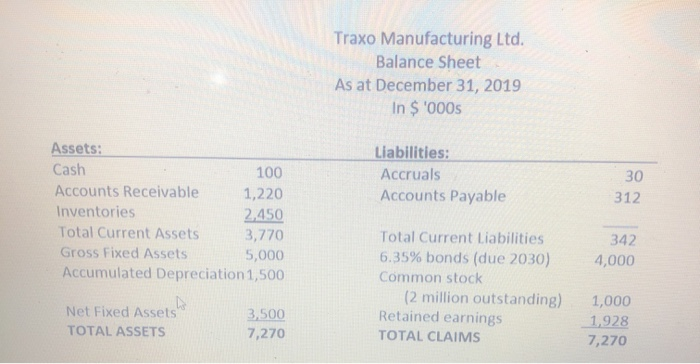

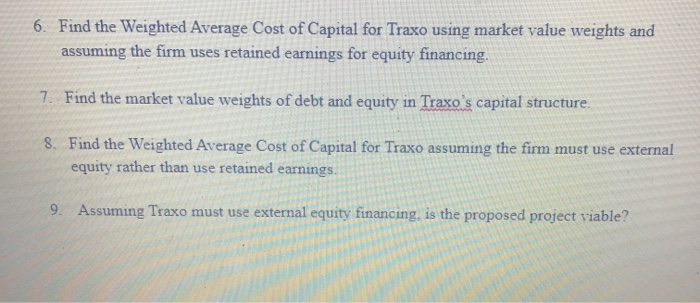

6. Find the Weighted Average Cost of Capital for Traxo using market value weights and assuming the firm uses retained earnings for equity financing, 7. Find the market value weights of debt and equity in Traxo's capital structure. 8. Find the Weighted Average Cost of Capital for Traxo assuming the firm must use external equity rather than use retained earnings 9. Assuming Traxo must use external equity financing, is the proposed project viable? stion 2.1 - CAPEX Decision Founded On Cost of Capital Estimate Traxo Manufacturing Ltd. shares are publicly traded on the Toronto Stock Exchange under the ticke symbol TRX.TO. The shares currently trade at a price of $2.25 per share. Security analysts that follow the stock have estimated it's beta coefficient to be 0.9. Traxo paid a dividend on its comma stock last year that totaled $0.08 per share. Dividends have been growing at a 3.25% compound rate for the past three years and the expectation is that this growth can continue into the foreseeable future. Traxo Manufacturing Ltd. has an important warehouse capital project to consider. The warehouse project is expected to produce annual cash flows before tax of $290,000 for each of the next twelve years. The warehouse project is thought to be of similar risk to the risk of the firm itself. It will cost Traxo $750,000 this year to get this project up and running. Traxo has it's long-term bonds trading on public markets. The bonds are currently trading at a premium from their par value of 101.34%. These 6.35% bonds have eleven years left until they mature individual Hand-in ssirnment Siri Li, Traxo's manager of finance has collected current data from the firm's underwriters. The risk- free rate is estimated to 1.01%. The expected return on the S&P/TSX Capped Total Return Composite index is forecast to be 7.5% in 2020. New equity capital could be raised by the firm at the current market price, but floatation costs would amount of 5% of the value of the issue. New bonds could be sold into the market, but the floatation cost percentage would be 4%. The firm face: a corporate tax rate of 35%. If the firm goes ahead with the capital project, it will have to seek external financing The firm's most recent financial statements are found below: Traxo Manufacturing ltd Traxo Manufacturing Ltd. Balance Sheet As at December 31, 2019 In $ '000s Liabilities: Accruals Accounts Payable 30 312 Assets: Cash 100 Accounts Receivable 1,220 Inventories 2,450 Total Current Assets 3,770 Gross Fixed Assets 5,000 Accumulated Depreciation 1,500 342 4,000 Total Current Liabilities 6.35% bonds (due 2030) Common stock (2 million outstanding) Retained earnings TOTAL CLAIMS Net Fixed Assets TOTAL ASSETS 3,500 7,270 1,000 1,928 7,270