Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help solving these 4 questions 1. You bought a stock one year ago for $50 per share and sold it today for $55

I need help solving these 4 questions

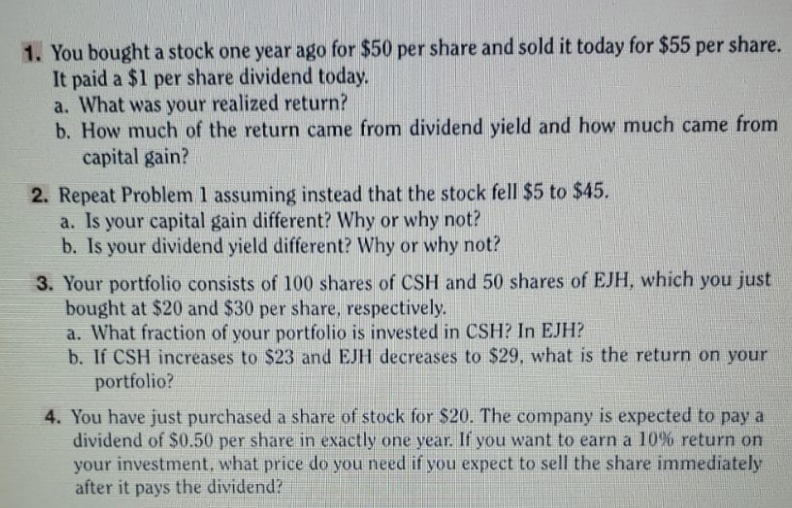

1. You bought a stock one year ago for $50 per share and sold it today for $55 per share. It paid a $1 per share dividend today a. What was your realized return? b. How much of the return came from dividend yield and how much came from capital gain? 2. Repeat Problem 1 assuming instead that the stock fell $5 to $45. a. Is your capital gain different? Why or why not? b. Is your dividend yield different? Why or why not? 3. Your portfolio consists of 100 shares of CSH and 50 shares of EJH, which you just bought at $20 and $30 per share, respectively a. What fraction of your portfolio is invested in CSH? In EJH? b. If CSH increases to $23 and EJH decreases to $29, what is the return on your portfolio? 4. You have just purchased a share of stock for S20. The company is expected to pay a dividend of $0.50 per share in exactly one year. If you want to earn a 10% return on your investment, what price do you need if you expect to sell the share immediately after it pays the dividendStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started