Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I NEED HELP SOLVING THESE ISSUES You may answer or solve the problems using Excel of the traditional paper-and-pencil method. If you use the latter,

I NEED HELP SOLVING THESE ISSUES

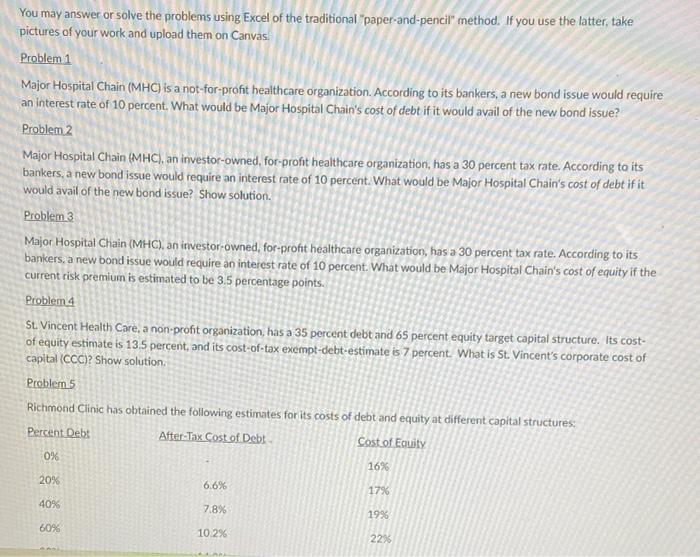

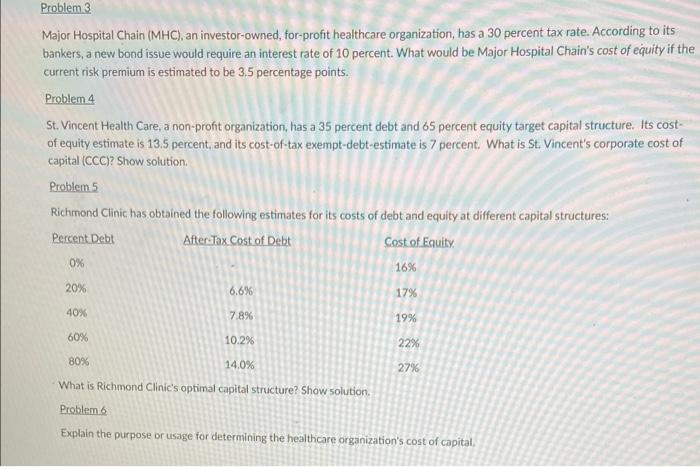

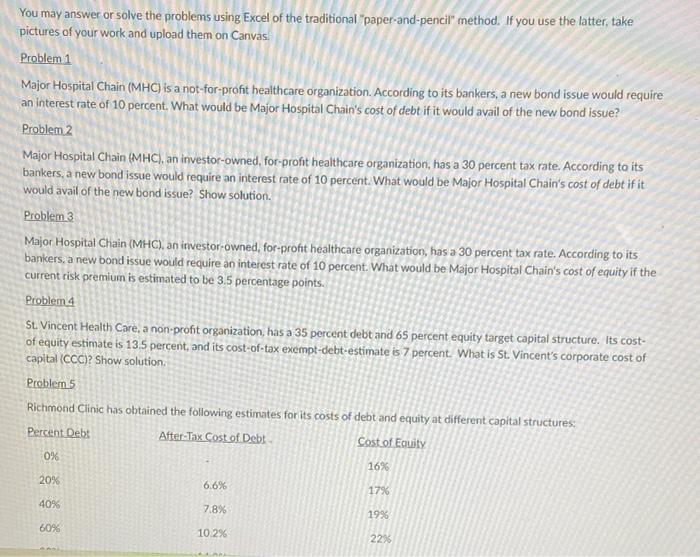

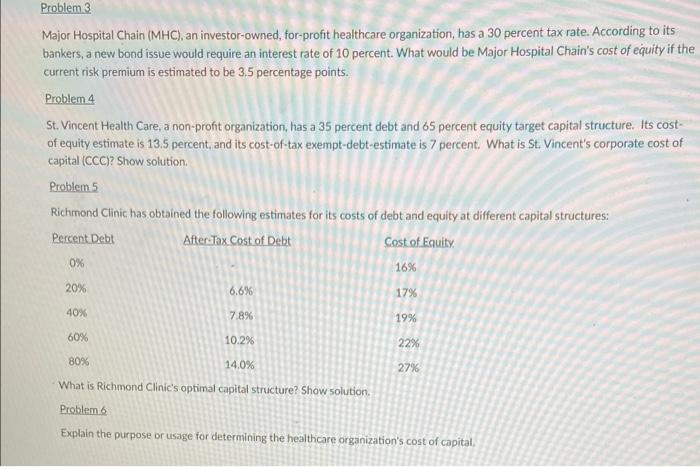

You may answer or solve the problems using Excel of the traditional "paper-and-pencil" method. If you use the latter, take pictures of your work and upload them on Canvas. Problem 1 Major Hospital Chain (MHC) is a not-for-profit healthcare organization. According to its bankers, a new bond issue would require an interest rate of 10 percent. What would be Major Hospital Chain's cost of debt if it would avail of the new bond issue? Problem 2 Major Hospital Chain (MHC), an investor-owned, for-profit healthcare organization, has a 30 percent tax rate. According to its bankers, a new bond issue would require an interest rate of 10 percent. What would be Major Hospital Chain's cost of debt if it would avail of the new bond issue? Show solution. Problem 3 Major Hospital Chain (MHC), an investor-owned, for-profit healthcare organization, has a 30 percent tax rate. According to its bankers, a new bond issue would require an interest rate of 10 percent. What would be Major Hospital Chain's cost of equity if the current risk premium is estimated to be 3.5 percentage points. Problem 4 St. Vincent Health Care, a non-profit organization has a 35 percent debt and 65 percent equity target capital structure. Its cost- of equity estimate is 13.5 percent, and its cost-of-tax exempt-debt-estimate is 7 percent. What is St. Vincent's corporate cost of capital (CCC)? Show solution Problem 5 Richmond Clinic has obtained the following estimates for its costs of debt and equity at different capital structures: After-Tax Cost of Debt Cost of Equity 0% Percent Debt 16% 20% 6.6% 17% 40% 7.8% 1996 60% 10.2% 223 a Problem 3 Major Hospital Chain (MHC), an investor-owned, for-profit healthcare organization, has a 30 percent tax rate. According to its bankers, a new bond issue would require an interest rate of 10 percent. What would be Major Hospital Chain's cost of equity if the current risk premium is estimated to be 3.5 percentage points. Problem 4 St. Vincent Health Care, a non-profit organization, has a 35 percent debt and 65 percent equity target capital structure. Its cost- of equity estimate is 13.5 percent, and its cost-of-tax exempt-debt-estimate is 7 percent. What is St. Vincent's corporate cost of capital (CCC)? Show solution Problem 5 Richmond Clinic has obtained the following estimates for its costs of debt and equity at different capital structures: Percent Debt After Tax Cost of Debt Cost of Equity 0% 16% 20% 6.6% 17% 40% 7.8% 19% 60% 10.2% 22% 80% 14.0% 27% What is Richmond Clinic's optimal capital structure? Show solution Problem 6 Explain the purpose or usage for determining the healthcare organization's cost of capital You may answer or solve the problems using Excel of the traditional "paper-and-pencil" method. If you use the latter, take pictures of your work and upload them on Canvas. Problem 1 Major Hospital Chain (MHC) is a not-for-profit healthcare organization. According to its bankers, a new bond issue would require an interest rate of 10 percent. What would be Major Hospital Chain's cost of debt if it would avail of the new bond issue? Problem 2 Major Hospital Chain (MHC), an investor-owned, for-profit healthcare organization, has a 30 percent tax rate. According to its bankers, a new bond issue would require an interest rate of 10 percent. What would be Major Hospital Chain's cost of debt if it would avail of the new bond issue? Show solution. Problem 3 Major Hospital Chain (MHC), an investor-owned, for-profit healthcare organization, has a 30 percent tax rate. According to its bankers, a new bond issue would require an interest rate of 10 percent. What would be Major Hospital Chain's cost of equity if the current risk premium is estimated to be 3.5 percentage points. Problem 4 St. Vincent Health Care, a non-profit organization has a 35 percent debt and 65 percent equity target capital structure. Its cost- of equity estimate is 13.5 percent, and its cost-of-tax exempt-debt-estimate is 7 percent. What is St. Vincent's corporate cost of capital (CCC)? Show solution Problem 5 Richmond Clinic has obtained the following estimates for its costs of debt and equity at different capital structures: After-Tax Cost of Debt Cost of Equity 0% Percent Debt 16% 20% 6.6% 17% 40% 7.8% 1996 60% 10.2% 223 a Problem 3 Major Hospital Chain (MHC), an investor-owned, for-profit healthcare organization, has a 30 percent tax rate. According to its bankers, a new bond issue would require an interest rate of 10 percent. What would be Major Hospital Chain's cost of equity if the current risk premium is estimated to be 3.5 percentage points. Problem 4 St. Vincent Health Care, a non-profit organization, has a 35 percent debt and 65 percent equity target capital structure. Its cost- of equity estimate is 13.5 percent, and its cost-of-tax exempt-debt-estimate is 7 percent. What is St. Vincent's corporate cost of capital (CCC)? Show solution Problem 5 Richmond Clinic has obtained the following estimates for its costs of debt and equity at different capital structures: Percent Debt After Tax Cost of Debt Cost of Equity 0% 16% 20% 6.6% 17% 40% 7.8% 19% 60% 10.2% 22% 80% 14.0% 27% What is Richmond Clinic's optimal capital structure? Show solution Problem 6 Explain the purpose or usage for determining the healthcare organization's cost of capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started