Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help solving these problems can you walk me through a break down on how you get the answers to each one of these

I need help solving these problems

can you walk me through a break down on how you get the answers to each one of these

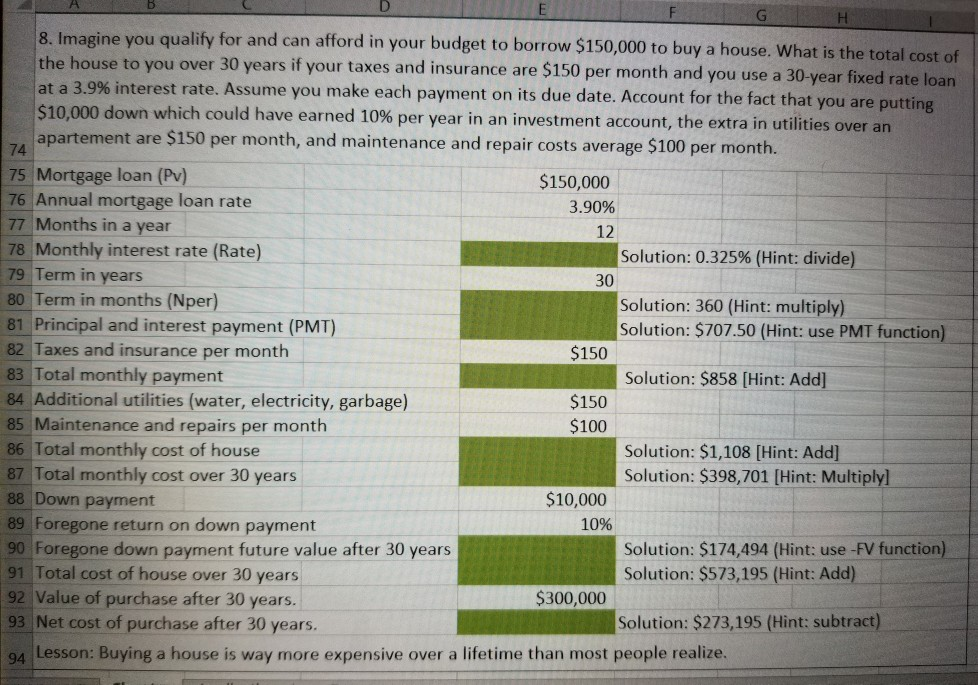

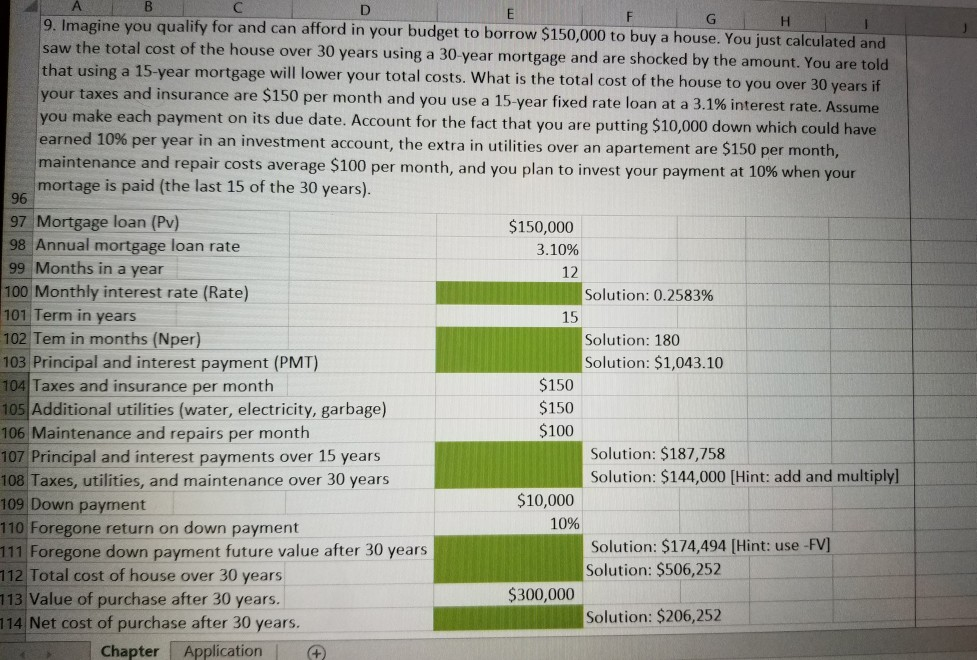

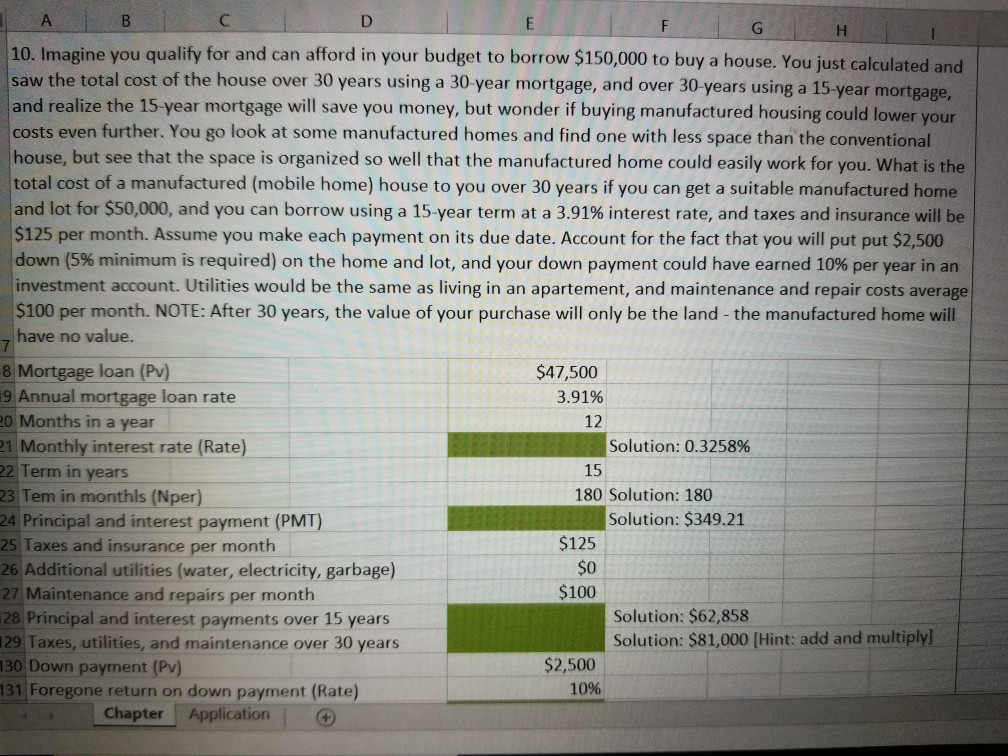

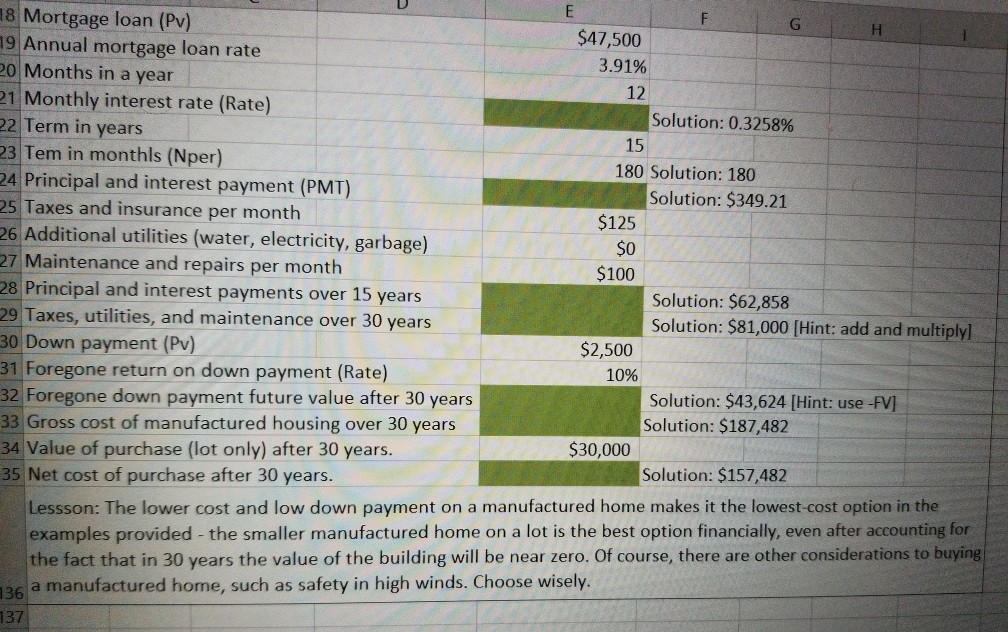

H 8. Imagine you qualify for and can afford in your budget to borrow $150,000 to buy a house. What is the total cost of the house to you over 30 years if your taxes and insurance are $150 per month and you use a 30-year fixed rate loan at a 3.9% interest rate. Assume you make each payment on its due date. Account for the fact that you are putting $10,000 down which could have earned 10 % per year in an investment account, the extra in utilities over an apartement are $150 per month, and maintenance and repair costs average $100 per month. 74 75 Mortgage loan (Pv) 76 Annual mortgage loan rate 77 Months in a year $150,000 3.90% 12 78 Monthly interest rate (Rate) Solution: 0.325% (Hint: divide) 79 Term in years 80 Term in months (Nper) 81 Principal and interest payment (PMT) 82 Taxes and insurance per month 83 Total monthly payment 84 Additional utilities (water, electricity, garbage) 85 Maintenance and repairs per month 86 Total monthly cost of house 87 Total monthly cost over 30 years 88 Down payment 30 Solution: 360 (Hint: multiply) Solution: $707.50 (Hint: use PMT function) $150 Solution: $858 [Hint: Add] $150 $100 Solution: $1,108 [Hint: Add] Solution: $398,701 [Hint: Multiply] $10,000 89 Foregone return on down payment 10% Solution: $174,494 (Hint: use -FV function) 90 Foregone down payment future value after 30 years 91 Total cost of house over 30 years 92 Value of purchase after 30 years. 93 Net cost of purchase after 30 years. Solution: $573,195 (Hint: Add) $300,000 Solution: $273,195 (Hint: subtract) 94 Lesson: Buying a house is way more expensive over a lifetime than most people realize. B 9. Imagine you qualify for and can afford in your budget to borrow $150,000 to buy a house. You just calculated and G H saw the total cost of the house over 30 years using a 30-year mortgage and are shocked by the amount. You are told that using a 15-year mortgage will lower your total costs. What is the total cost of the house to you over 30 years if your taxes and insurance are $150 per month and you use a 15-year fixed rate loan at a 3.1 % interest rate. Assume you make each payment on its due date. Account for the fact that you are putting $10,000 down which could have earned 10 % per year in an investment account, the extra in utilities over an apartement are $150 per month, maintenance and repair costs average $100 per month, and you plan to invest your payment at 10 % when your mortage is paid (the last 15 of the 30 years). 96 97 Mortgage loan (Pv) 98 Annual mortgage loan rate 99 Months in a year 100 Monthly interest rate (Rate) 101 Term in years 102 Tem in months (Nper) 103 Principal and interest payment (PMT) 104 Taxes and insurance per month $150,000 3.10% 12 Solution: 0.2583% 15 Solution: 180 Solution: $1,043.10 $150 105 Additional utilities (water, electricity, garbage) 106 Maintenance and repairs per month 107 Principal and interest payments over 15 years 108 Taxes, utilities, and maintenance over 30 years 109 Down payment $150 $100 Solution: $187,758 Solution: $144,000 [Hint: add and multiply] $10,000 10% 110 Foregone return on down payment 111 Foregone down payment future value after 30 years 112 Total cost of house over 30 years 113 Value of purchase after 30 years. 114 Net cost of purchase after 30 years. Solution: $174,494 [Hint: use -FV] Solution: $506,252 $300,000 Solution: $206,252 Chapter Application A C B E G H 10. Imagine you qualify for and can afford in your budget to borrow $150,000 to buy a house. You just calculated and saw the total cost of the house over 30 years using a 30-year mortgage, and over 30-years using a 15-year mortgage, and realize the 15-year mortgage will save you money, but wonder if buying manufactured housing could lower your costs even further. You go look at some manufactured homes and find one with less space than the conventional house, but see that the space is organized so well that the manufactured home could easily work for you. What is the total cost of a manufactured (mobile home) house to you over 30 years if you can get a suitable manufactured home and lot for $50,000, and you can borrow using a 15-year term at a 3.91% interest rate, and taxes and insurance will be $125 per month. Assume you make each payment on its due date. Account for the fact that you will put put $2,500 down (5% minimum is required) on the home and lot, and your down payment could have earned 10% per year in an investment account. Utilities would be the same as living in an apartement, and maintenance and repair costs average $100 per month. NOTE: After 30 years, the value of your purchase will only be the land - the manufactured home will have no value. 7 8 Mortgage loan (Pv) 9 Annual mortgage loan rate 20 Months in a year 21 Monthly interest rate (Rate) 22 Term in years 23 Tem in monthls (Nper) 24 Principal and interest payment (PMT) 25 Taxes and insurance per month $47,500 3.91% 12 Solution: 0.3258% 15 180 Solution: 180 Solution: $349.21 $125 26 Additional utilities (water, electricity, garbage) 27 Maintenance and repairs per month 28 Principal and interest payments over 15 years 129 Taxes, utilities, and maintenance over 30 years 130 Down payment (Pv) 131 Foregone return on down payment (Rate) $0 $100 Solution: $62,858 Solution: $81,000 [Hint: add and multiply] $2,500 10% Chapter Application E G 18 Mortgage loan (Pv) H $47,500 19 Annual mortgage loan rate 20 Months in a year 21 Monthly interest rate (Rate) 22 Term in years 3.91% 12 Solution: 0.3258% 15 23 Tem in monthls (Nper) 24 Principal and interest payment (PMT) 25 Taxes and insurance per month 26 Additional utilities (water, electricity, garbage) 27 Maintenance and repairs per month 28 Principal and interest payments over 15 years 29 Taxes, utilities, and maintenance over 30 years 30 Down payment (Pv) 31 Foregone return on down payment (Rate) 32 Foregone down payment future value after 30 years 33 Gross cost of manufactured housing over 30 years 34 Value of purchase (lot only) after 30 years. 35 Net cost of purchase after 30 years. 180 Solution: 180 Solution: $349.21 $125 $0 $100 Solution: $62,858 Solution: $81,000 [Hint: add and multiply] $2,500 10% Solution: $43,624 [Hint: use -FV] Solution: $187,482 $30,000 Solution: $157,482 Lessson: The lower cost and low down payment on a manufactured home makes it the lowest-cost option in the examples provided the smaller manufactured home on a lot is the best option financially, even after accounting for the fact that in 30 years the value of the building will be near zero. Of course, there are other considerations to buying 126 a manufactured home, such as safety in high winds. Choose wisely 137Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started