Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help such as solutions to all answers of this pratice problem,Thanks! Max Houck holds 700 shares of Boulder Gas and Light. He bought

I need help such as solutions to all answers of this pratice problem,Thanks!

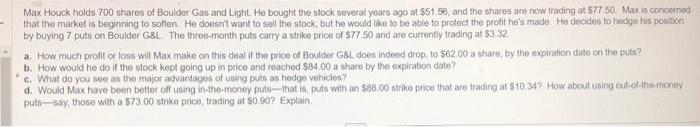

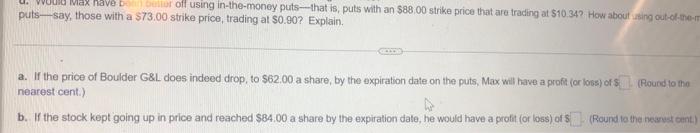

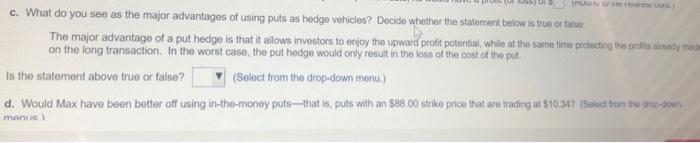

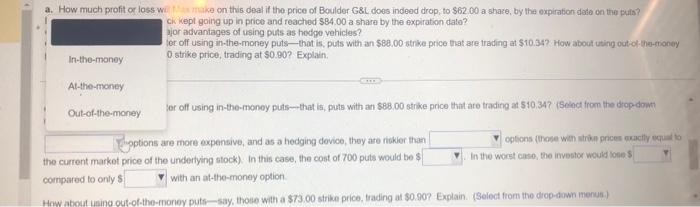

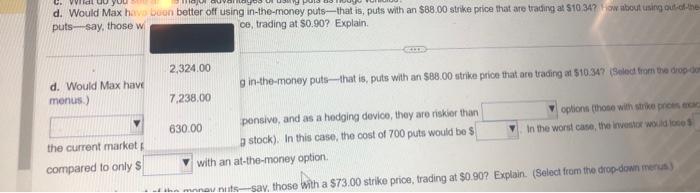

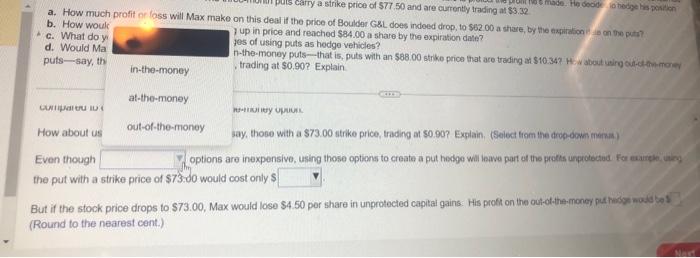

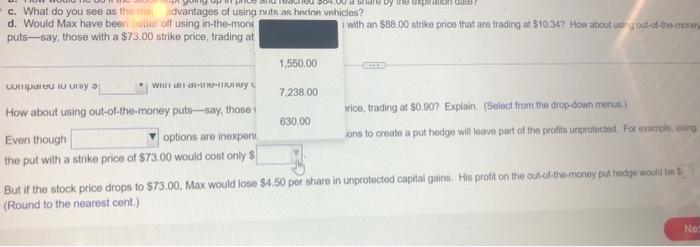

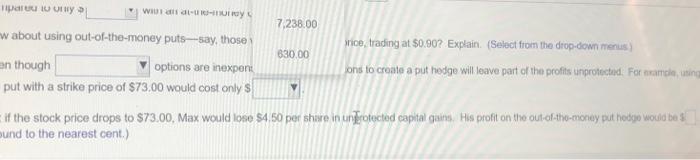

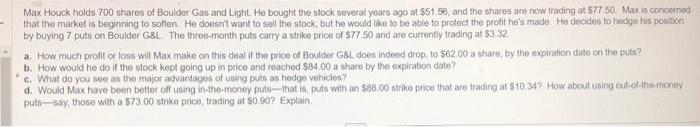

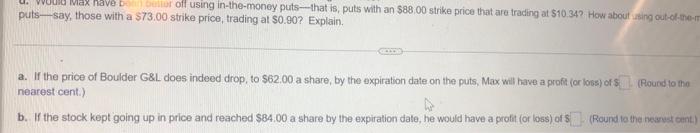

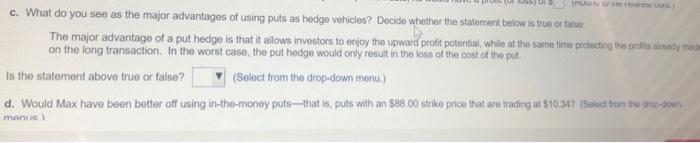

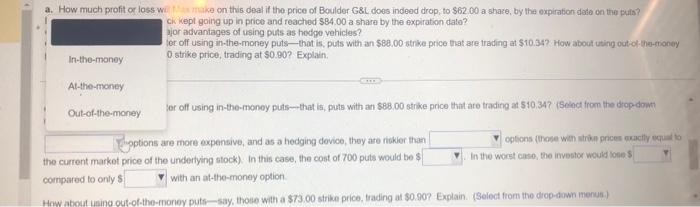

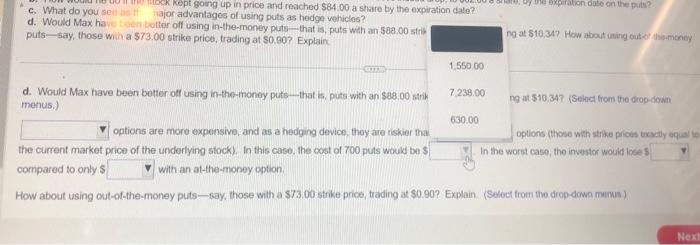

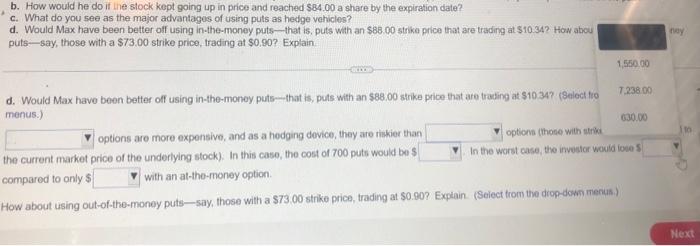

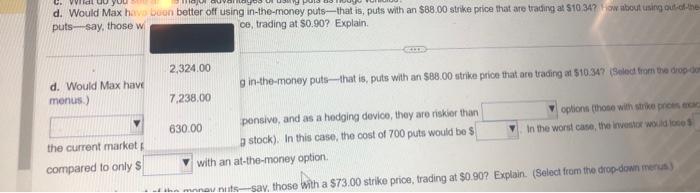

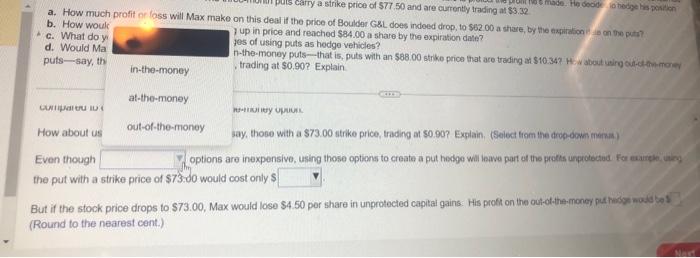

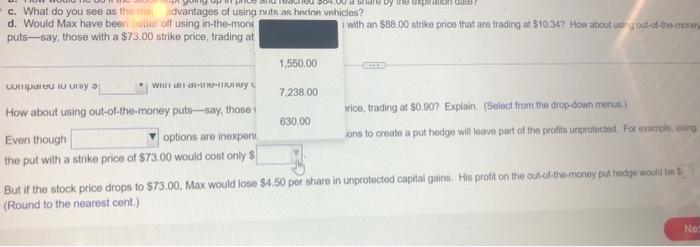

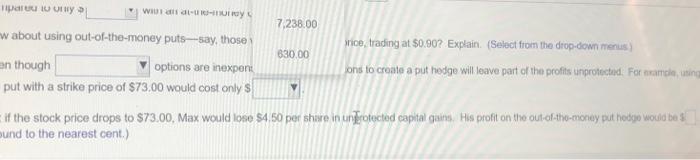

Max Houck holds 700 shares of Boulder Gas and Light. He bought the stock several years ago at $51. 58, and the shares are now trading at $77 50. Max is concerned that the market is beginning to soften. He doesn' want to sell the stock, but he would like to be able to protect the profit he's made. Ho docides to hedge his position by buying 7 puts on Boulder G8L. The three-month puts carry a strike price of $77.50 and are currentiy trading at $3.32 a. How much profit or loss will Max make on this deal if the price of Boulder G8L does indeod drop, to $62.00 a strare, by the expiration date on the puts? b. How would he do if the stock kept going up in price and reached $B4,00 a share by the expiration date? c. What do you see as the major advantages of using puts as hedge vehicles? d. Would Max have been better off ueing in the-monoy puts - that is, puts with an 888,00 strike price that are irading at $10.34? How about using out-of-the-money puts-5ay, those with a $73,00 strike price, trading at \$0.90? Explain puts-say, those with a $73.00 strike price, trading at $0.90 ? Explain. a. If the price of Boulder G\&L does indeed drop, to $62.00 a share, by the expiration date on the puts, Max will have a proft (or loss) of nearest cent.) b. If the stock kept going up in price and reached $84.00 a share by the expiration date, he would have a profit (or loss) of (Round to the nearset cent) c. What do you see as the major advantages of using puts as hedge vehicles? Decide whether the statement below is true or false. The major advantage of a put hedgo is that it allows irvestors to enjoy the upward profit potential, while at the sarne 1 ise protecting the prufis alrewy mas on the long transaction. In the worst case, the put hedge would only result in the loss of the cost of the put Is the statemont above true or false? (Seloct from the droprdown menu.) d. Would Max have been better off using in-tho-money puts--that is, puts with an $88,00 strike price that are trading at 51034 ? (Seirdt from ite atovedein manis 1 a. How much proft or loss wi ck kept going up in price and reactied $84.00 a share by the expiration date? jor alvantages of using puts as hedpo vehicles? ier off using in-the-money puts- that is, puts with an $88.00 strke price that are trading at $10.34 ? How about uting out-of the-erioney 0 strike price, trading at $0.90 ? Explain. jer off using in-the-money puts-that is, puts with an $88,00 strike price thit are trading at 510,34 ? iselect from the dropdowt lipptions are more expenaive, and as a hedging device, they ate riakier than cotions (thage with strik pnces axacfly aciue to the current market price of the undertying stock) in this case, the cost of 700 puts would be $ In the worst anse, the investor woukd lotes compared to only S with an at the-money option How ahout using out-of-the-rnoney putf-say, thote with a $73.00 strike price, trading at $0.90 ? Explain. (\$elect from the drep-dawn menus.) c. What do you see as the major advantages of ising puts as hedge vehicles? d. Would Max have been better oft using irfthe-money puts-that is, puts with an $88.00 strike 4? How about using out-of the-monay puts-say, those with a $73,00 strike price, trading at $0.90 ? Explain d. Would Max have been better off uting in-the-money puts - that is, puts with an $88.00 strike M7 lSeloct ficm the drop-down freruss.) options are more expensive, and as a hedging device, they are isker than options (those with stribe pices exactiy equal to the current market price of the undertying stock). In this case, the cost of 700 pusts would be 5 In the worst case, the imvestor wondd lase compared to onlys with an at-the-money option How about using out-of-the-money puts-say, those with a $73.00 strike price, trading at $0,90 ? Explain. (Select trom the drop-town merks.) up in price and reached $84.00 a share by the expiration date? d. Would Max hay hajor advartages of using puts as hedge vehicles? puts stay those win a $73.00 offil using in-the-money puts that is, puts with an 580.00 strl puts - say, those win a $73.00 strike price, trading at $0.90 ? Explain d. Would Max have been botter off using in-the-money puts-that is. puts with an $88.00 strik menus.) options are more expensive, and as a hodging device, thoy are riskier tha the current market price of the underlying stock). In this case. the cost of 700 puts wouk be 3 cornparod to onty $ with an at-the-money option. 9 at 510,34 ? How about ating outeo themchey ng at 510.34 ? (Select frem the drop-down options (those weth strke prices exxitly equal In the worst case, the investor would loget In the worst caso, the investor would loge s How about using out-of-the-money puts-say, those with a $73.00 strike price, trading at $0.90 ? Explain. (Select from the drop-down mairus ) b. How would he do if the stock kept going up in price and reached $84.00 a share by the expiration date? c. What do you see as the major advantages of using puts as hedge vahicles? d. Would Max have been better off using in-the-money puts-that is, puts with an $86.00 strike price that are trading at $10.34? How abou puts-say, those with a $73,00 strike price, trading at $0,90 ? Explain d. Would Max have been better off using in-the-money puts-ethat is, puts with an $88.00 strike price that are trading at $1034 ? (8elect fus manus:) options are more expensive, and as a hedging device, they are riskier than the current market price of the underlying stock): In this case, the cost of 700 puts would be 5 compared to only $ with an at-tho-money option. How about using out-of-the-money puts-5ay, those with a $73.00 strike price, trading at 50.90 ? Explain. (Seiect trom the drep-dcin menus.) a. How much profit ne loss will Max make on this deat if the price of Boulder G8L does indeed drop, to 562.00 a shase, by the exisiraich in as co the put?? b. How wouk c. What do y d. Would Ma puts-say, th ) up in price and reachod $84.00 a share by the expiration dale? jes of using puts as hodge vehicles? , trading at $0,90 ? Exptain Guipait tu iu i noitiaity upiun. How about us say, those with a $73.00 strike price, trading at $0.90 ? Exglain, (Select fiom the droe-ockn merim ) Even though options are inexpensive, using those options to create a put hodge will isave part uf the protis upprotectod for examele. ince the put with a strike price of $73.00 would cost only $ But if the stock price drops to $73.00, Max would lose $4.50 per share in unprotected capital gains: His proft on the out-othemoner put hedez husk se 3 . (Round to the nearest cent.) d. Would Max hiv buen better off using in-the-money puts-that is, puts with an $68.00 strike price that are trating at $1034 ? I ax about usine putiel the puts say, those w Ce, trading at $0.90 ? Explain. d. Would Max have 9 in-the-money puts-that is, puts with an $88.00 strike price that are vading at 516.34 ? iBelect fram eve drop ib montis.) pensive, and as a hodging dovice, they are riskier than g stock). In this case, the cost of 700 puts would be 8 oplicns (thoee with strike prets eray In the worst case, the truestor wy ild loee? the current market k with an at-the-money option. compared to only $ a. How much profit ne loss will Max make on this deat if the price of Boulder G8L does indeed drop, to 562.00 a shase, by the exisiraich in as co the put?? b. How wouk c. What do y d. Would Ma puts-say, th ) up in price and reachod $84.00 a share by the expiration dale? jes of using puts as hodge vehicles? , trading at $0,90 ? Exptain Guipait tu iu i noitiaity upiun. How about us say, those with a $73.00 strike price, trading at $0.90 ? Exglain, (Select fiom the droe-ockn merim ) Even though options are inexpensive, using those options to create a put hodge will isave part uf the protis upprotectod for examele. ince the put with a strike price of $73.00 would cost only $ But if the stock price drops to $73.00, Max would lose $4.50 per share in unprotected capital gains: His proft on the out-othemoner put hedez husk se 3 . (Round to the nearest cent.) c. What do you see as lhur haj dvantages of using nuts as hecine verhicles? d. Would Max have been viler oll using in-the-mont puts-say, those with a $73.00 strike price, trading at i with an $88,00 strike price that are trading at $1034 ? How about usin g pit-ot-he mone 1,550.00 cumplater io uring 9 7,238.00 How about using out-ol-the-money puts-say, those 630.00 xrice, trading at $0.90 ? Explain. (Seloct from the drop-down menus) Even though options are inexpent ons to create a put hedge will leave part of the prolits ungrotected For exarrabe, using the put with a strike price of $73.00 would cost only $ But if the stock price drops to $73.00. Max would lose $4.50 per share in unprotected capilal gains. His profit on the out-oftio-monay put hedge would bet (Round to the nearest cent) ipalted to tiry $ whs ais at-etnuiny 7,238.00 w about using out-of-the-money puts-say, those 1 Wice, trading at $0.90 ? Explain. (Select from the drop-down menus) options are inexper: ons to create a put hedge will leave part of the profits unprodected. For nxamcle, usin put with a strike price of $73.00 would cost only $ if the stock price drops to \$73.00, Max would lose \$4.50 per share in un Totected capial gains. His profit on the out-ar-the-money put hodgo wotid be 3 und to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started