I need help to make sure I did it right we were supposed to use the indirect method. I want to know if I'm missing anything.

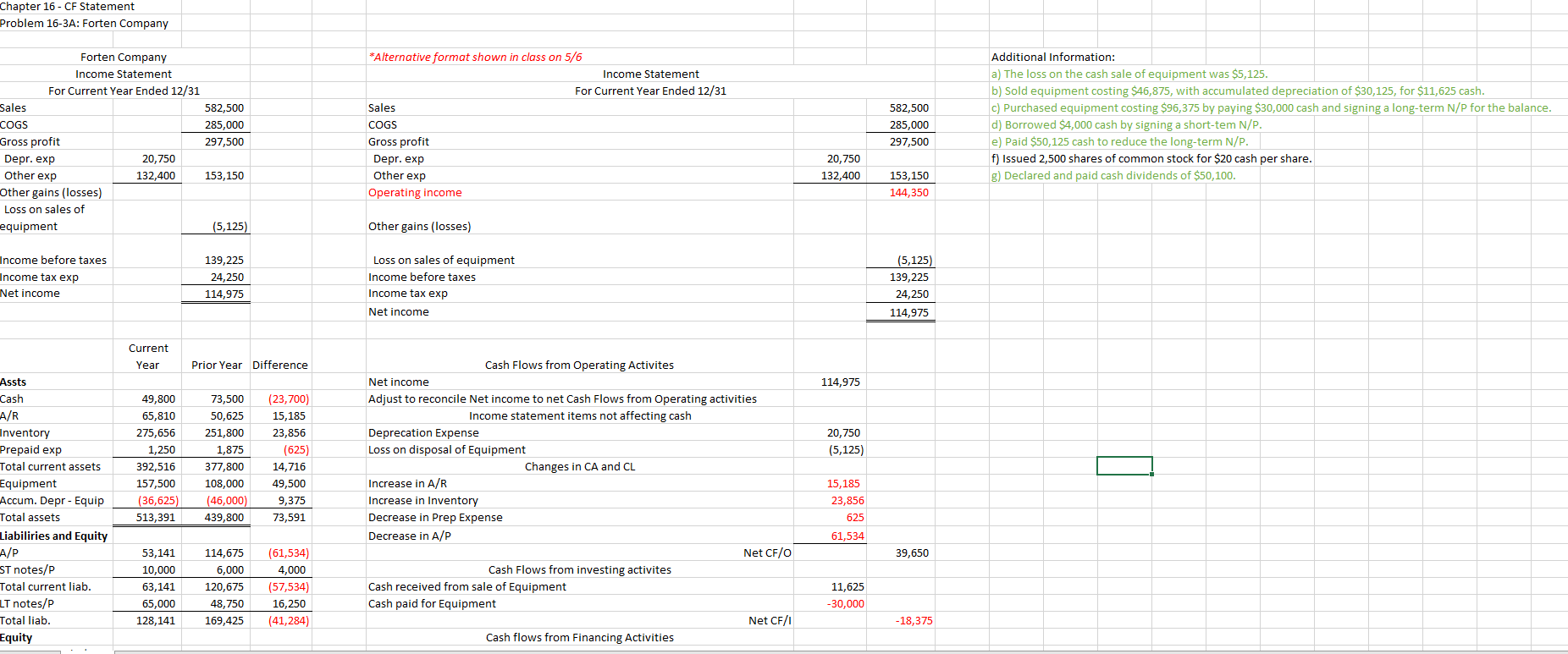

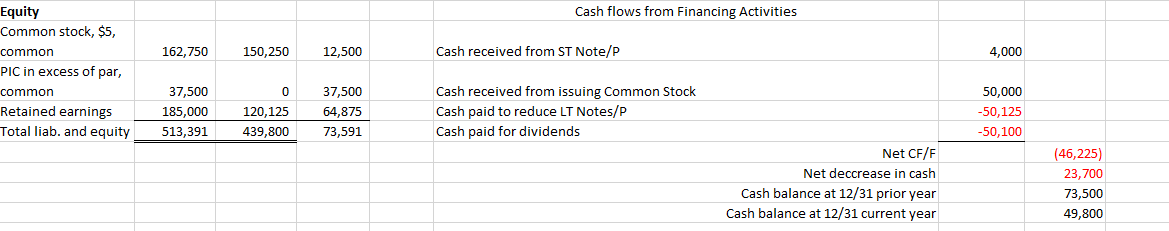

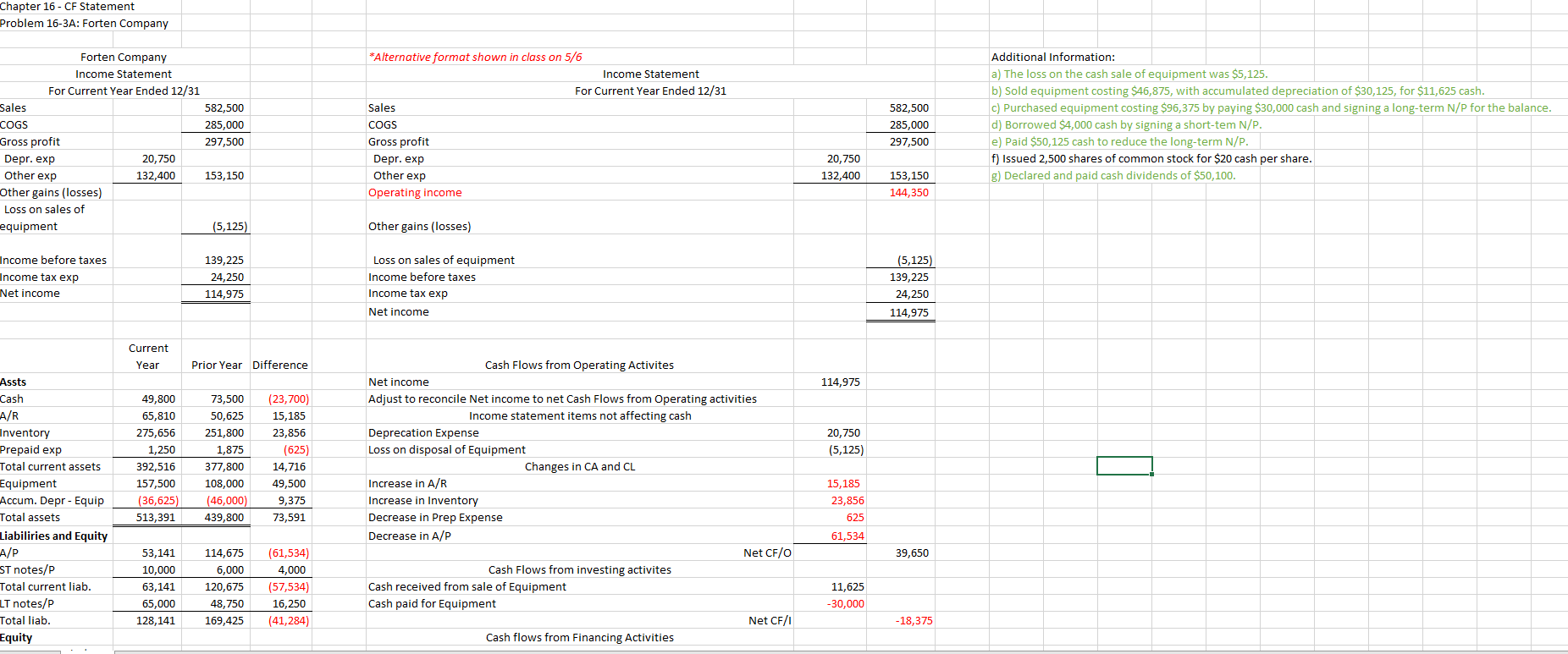

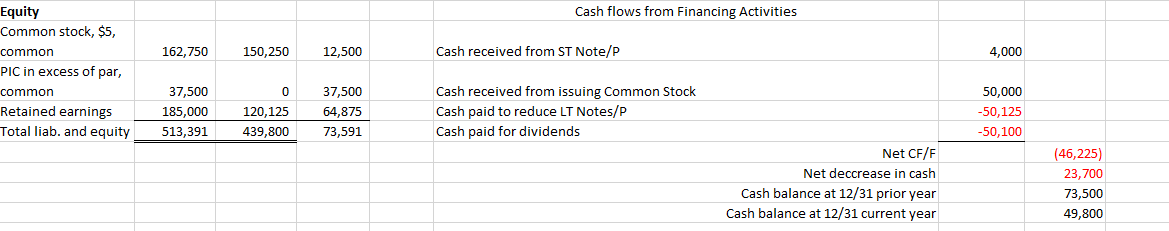

Chapter 16 - CF Statement Problem 16-3A: Forten Company Forten Company Income Statement For Current Year Ended 12/31 Sales 582,500 COGS 285,000 Gross profit 297,500 Depr. exp 20,750 Other exp 132,400 153,150 Other gains (losses) Loss on sales of equipment (5,125) *Alternative format shown in class on 5/6 Income Statement For Current Year Ended 12/31 Sales COGS Gross profit Depr. exp Other exp Operating income 582,500 285,000 297,500 Additional Information: a) The loss on the cash sale of equipment was $5,125. b) Sold equipment costing $46,875, with accumulated depreciation of $30,125, for $11,625 cash. c) Purchased equipment costing $96,375 by paying $30,000 cash and signing a long-term N/P for the balance. d) Borrowed $4,000 cash by signing a short-tem N/P. e) Paid $50,125 cash to reduce the long-term N/P. f) Issued 2,500 shares of common stock for $20 cash per share. g) Declared and paid cash dividends of $50,100. 20,750 132,400 153,150 144,350 Other gains (losses) Income before taxes Income tax exp Net income 139,225 24,250 114,975 Loss on sales of equipment Income before taxes Income tax exp Net income (5,125) 139,225 24,250 114,975 Current Year Prior Year Difference 114,975 20,750 (5,125) Assts Cash A/R Inventory Prepaid exp Total current assets Equipment Accum. Depr - Equip Total assets Liabiliries and Equity A/P ST notes/P Total current liab. LT notes/P Total liab. Equity 49,800 65,810 275,656 1,250 392,516 157,500 (36,625) 513,391 73,500 50,625 251,800 1,875 377,800 108,000 (46,000) 439,800 (23,700) 15,185 23,856 (625) 14,716 49,500 9,375 73,591 Cash Flows from Operating Activites Net income Adjust to reconcile Net income to net Cash Flows from Operating activities Income statement items not affecting cash Deprecation Expense Loss on disposal of Equipment Changes in CA and CL Increase in A/R Increase in Inventory Decrease in Prep Expense Decrease in A/P Net CF/0 Cash Flows from investing activites Cash received from sale of Equipment Cash paid for Equipment Net CF/1 Cash flows from Financing Activities 15,185 23,856 625 61,534 (61,534) 39,650 4,000 53,141 10,000 63,141 65,000 128,141 114,675 6,000 120,675 48,750 169,425 (57,534) 16,250 (41,284) 11,625 -30,000 -18,375 Cash flows from Financing Activities 162,750 150,250 12,500 Cash received from ST Note/P 4,000 Equity Common stock, $5, common PIC in excess of par, common Retained earnings Total liab. and equity 37,500 185,000 513,391 120,125 439,800 37,500 64,875 73,591 Cash received from issuing Common Stock Cash paid to reduce LT Notes/P Cash paid for dividends 50,000 -50,125 -50,100 Net CF/F Net deccrease in cash Cash balance at 12/31 prior year Cash balance at 12/31 current year (46,225) 23,700 73,500 49,800