Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help to solve this Problem 12.2A Objectives 12-2, 12-3 Recording adjustments for accrued and prepaid expense items and unearned income. On July 1,

I need help to solve this

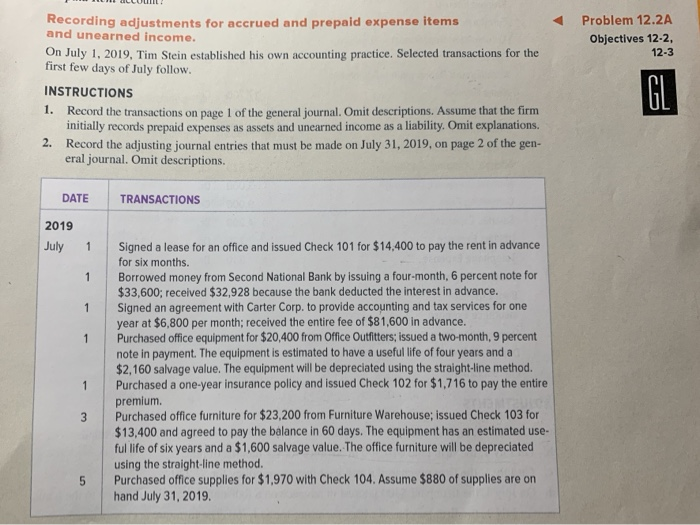

Problem 12.2A Objectives 12-2, 12-3 Recording adjustments for accrued and prepaid expense items and unearned income. On July 1, 2019, Tim Stein established his own accounting practice. Selected transactions for the first few days of July follow. INSTRUCTIONS 1. Record the transactions on page 1 of the general journal. Omit descriptions. Assume that the firm initially records prepaid expenses as assets and unearned income as a liability. Omit explanations. 2. Record the adjusting journal entries that must be made on July 31, 2019, on page 2 of the gen- eral journal. Omit descriptions. DATE TRANSACTIONS 2019 July 1 Signed a lease for an office and issued Check 101 for $14,400 to pay the rent in advance for six months. Borrowed money from Second National Bank by issuing a four-month, 6 percent note for $33,600; received $32,928 because the bank deducted the interest in advance. Signed an agreement with Carter Corp. to provide accounting and tax services for one year at $6,800 per month; received the entire fee of $81,600 in advance. Purchased office equipment for $20,400 from Office Outfitters, issued a two-month, 9 percent note in payment. The equipment is estimated to have a useful life of four years and a $2,160 salvage value. The equipment will be depreciated using the straight-line method. Purchased a one-year insurance policy and issued Check 102 for $1,716 to pay the entire premium Purchased office furniture for $23,200 from Furniture Warehouse; issued Check 103 for $13,400 and agreed to pay the balance in 60 days. The equipment has an estimated use. ful life of six years and a $1,600 salvage value. The office furniture will be depreciated using the straight-line method. Purchased office supplies for $1,970 with Check 104. Assume $880 of supplies are on hand July 31, 2019 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started