Answered step by step

Verified Expert Solution

Question

1 Approved Answer

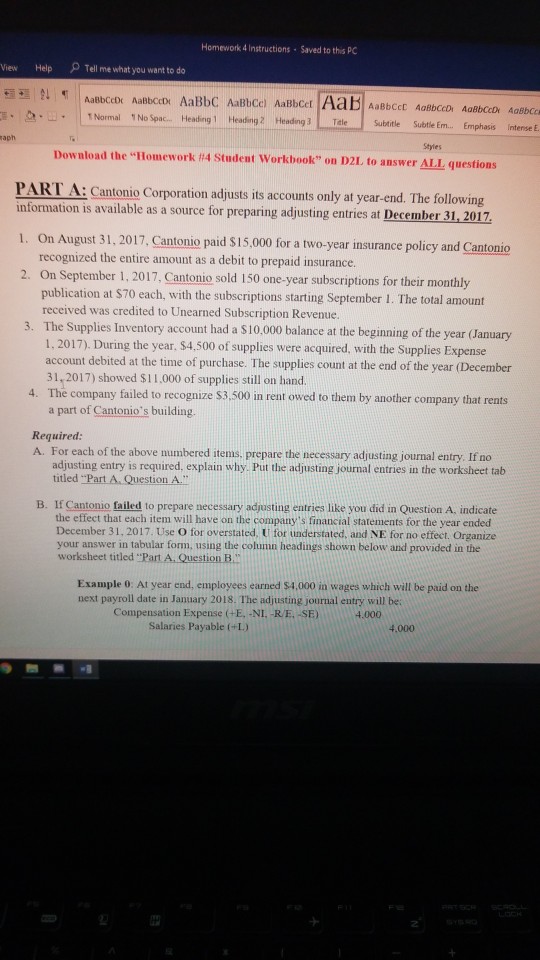

I need help understanding adjusting here are the 4 i have in my homework Homework 4 Instructions Saved to this PC View Help Tell me

I need help understanding adjusting here are the 4 i have in my homework

Homework 4 Instructions Saved to this PC View Help Tell me what you want to do 1Normal 1 No Spac.. Heading 1 Heading HengTSubileSubrle Em.. aph Styles Download the Homework #4 student workbook" on D21, to answer ALL questions PART A:Cantonio Corporation adjusts its accounts only at year-end. The following information is available as a source for 1. On August 31, 2017, Cantonio paid $15,000 for a two-year insurance policy and Cantonio 2. On September 1, 2017, preparing adjusting entries at December 31,2017 recognized the entire amount as a debit to prepaid insurance. Cantonio sold 150 one-year subscriptions for their monthly publication at $70 each, with the subscriptions starting received was credited to Unearned Subscription Revenue The Supplies Inventory account had a S10.000 balance at the beginning of the year (January 1, 2017). During the year, $4,500 of supplies were acquired, with the Supplies Expense account debited at the time of purchase. The supplies count at the end of the year (December 31,2017) showed $11,000 of supplies still on hand The company failed to recognize S3,500 in rent owed to them by another company that rents a part of Cantonio's building September 1. The total amount 3. 4. Required A. For each of the above numbered items. prepare the necessary adjusting journal entry. If no adjusting entry is required, explain why. Put the adjusting journal entries in the worksheet tab titled "Part A. Question A. B. If Carton lo failed to prepare necessary adjusting entries like you did in Question A, indicate the effect that each item will have on the company's financial statements for the year ended December 31, 2017. Use O for overstated, UU for understated, and NE for no effect. Organize your answer in tabular form, using the column headings shown below and provided in the worksheet titled Part A. Question B. Example 0 At year end, employees earned $4.000 in wages which will be paid on the next payroll date in January 2018. The adjusting journal entry will bes Compensation Expense (+E, -NI, -R/E. -SE) 4.000 Salaries Payable (+L) 4.000 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started