I need help understanding

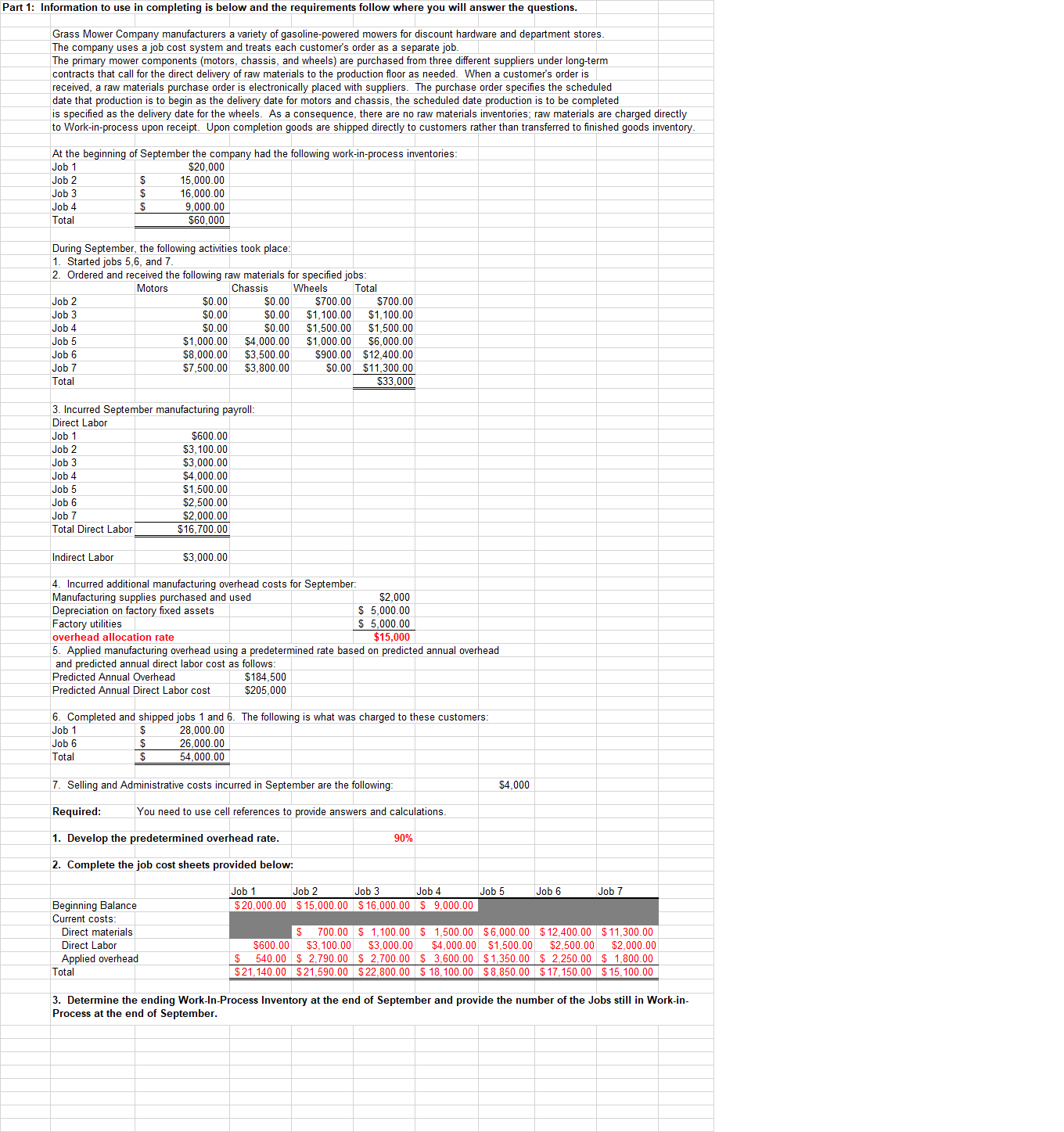

Part 1: Information to use in completing is below and the requirements follow where you will answer the questions. Grass Mower Company manufacturers a variety of gasoline-powered mowers for discount hardware and department stores. The company uses ajob cost system and treats each customers order as a separate job. The primary mower components (motors, chassis, and wheels) are purchased from three different suppliers under long-term contracts that call for the direct delivery of raw materials to the production oor as needed. When a customers order is received, a raw materials purchase order is electronically placed With suppliers. The purchase order species the scheduled date that production is to begin as the delivery date for motors and chassis, the scheduled date production is to be completed is specied as the delivery date for the wheels. As a consequence, there are no raw materials inventories; raw materials are charged directly to Worksinsprocess upon receipt. Upon completion goods are shipped directly to customers rather than transferred to nished goods inventory. At the beginning of September the company had the followmg worksinrprocess inventories: Job 1 $20,000 Job 2 $ 15,000.00 Job 3 $ 16,000.00 Job 4 $ 9,000.00 Total $60,000 During September, the following activities took place: 1. Started jobs 5,6, and 7. 2. Ordered and received the followmg raw materials for speCied jobs: Motors Chassis Wheels Total Job 2 $0.00 $0.00 $700.00 $700.00 Job 3 $0.00 $0.00 $1,100.00 $1,100.00 Job 4 $0.00 $0.00 $1,500.00 $1,500.00 Job 5 $1,000.00 $4,000.00 $1,000.00 $6,000.00 Job 6 $8,000.00 $3,500.00 $900.00 $12,400.00 Job 7 $7,500.00 $3,800.00 $0.00 $11,300.00 Total $33,000 3. Incurred September manufacturing payroll: Direct Labor Job 1 $600.00 Job 2 $3,100.00 Job 3 $3,000.00 Job 4 $4,000.00 Job 5 $1,500.00 Job 6 $2,500.00 Job 7 $2,000.00 Total Direct Labor Indirect Labor $3,000.00 4. Incurred additional manufacturing overhead costs for September: Manufacturing supplies purchased and used $2,000 Depreciation on factory xed assets $ 5,000.00 Factory utilities $ 5,000.00 overhead allocation rate $15,000 5. Applied manufacturing overhead using a predetermined rate based on predicted annual overhead and predicted annual direct labor cost as follows: Predicted Annual Overhead $184,500 Predicted Annual Direct Labor cost $205,000 6. Completed and shipped jobs 1 and B. The followmg is what was charged to these customers: Joh1 $ 28,000.00 Job 6 $ 26,000.00 Total $ 7. Selling and Administrative costs incurred in September are the following: $4,000 Required: You need to use cell references to provide answers and calculations. 1. Develop the predetermined overhead rate. 90% 2. Complete the job cost sheets provided below: Job 1 Job2 Job 3 Job 4 Job 5 Job 6 Job 7 Beginning Balance $20,000.00 $15,000.00 $16,000.00 $ 9,000.00 Currentcosts: Direct materials $ 700.00 $ 1,100.00 $ 1,500.00 $6,000.00 $12,400.00 $11,300.00 Direct Labor $600.00 $3,100.00 $3,000.00 $4,000.00 $1,500.00 $2,500.00 $2,000.00 Applied overhead $ 540.00 $ 2,790.00 $ 2,700.00 $ 3,600.00 $1,350.00 $ 2,250.00 $ 1,800.00 Total $21,140.00 $21,590.00 $22,800.00 $18,100.00 $8,850.00 $17,150.00 $15,100.00 3. Determine the ending Workrlanrocess Inventory at the end of September and provide the number of the Jobs still in Workrin. Process at the end of September