I need help understanding the problem with solution?

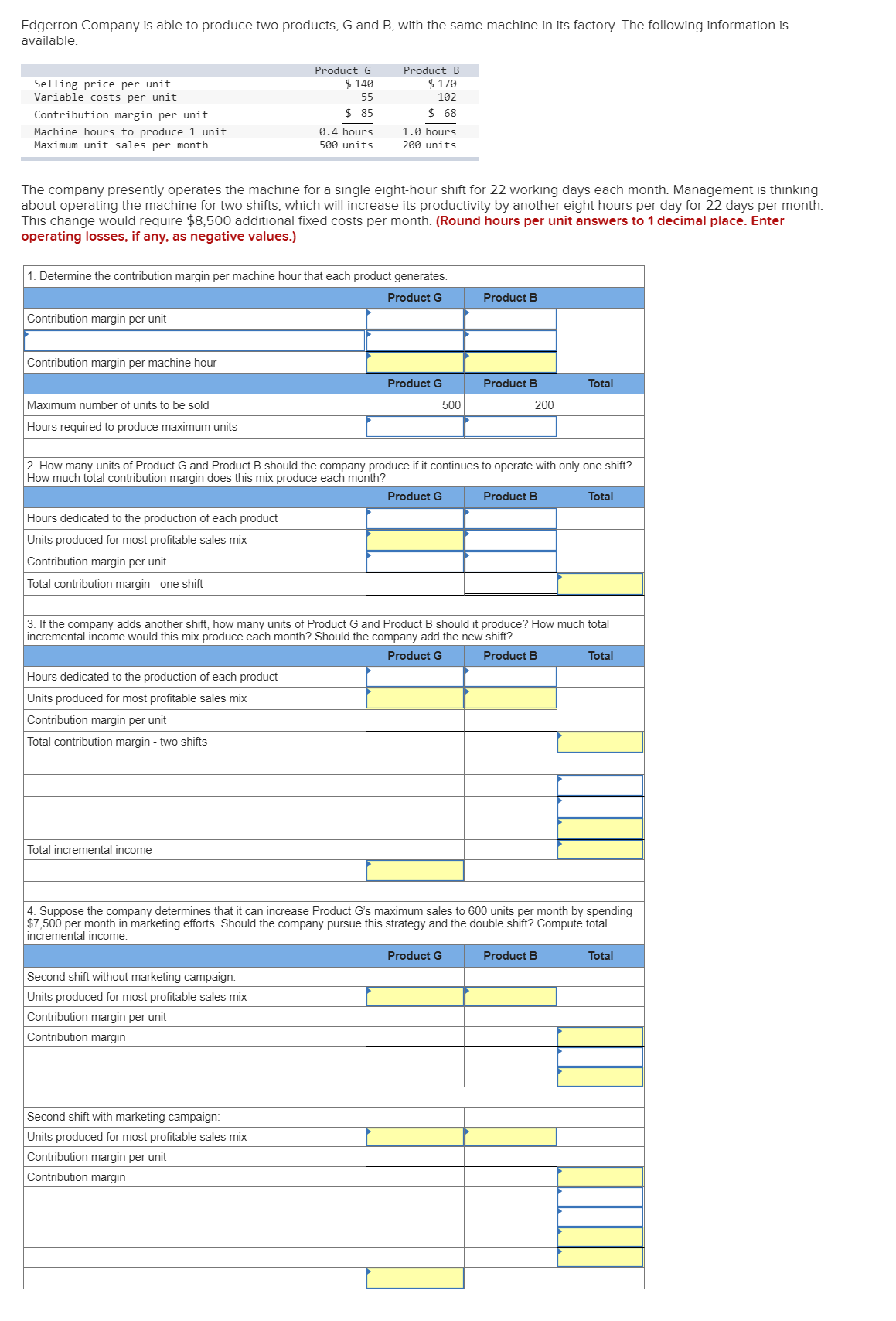

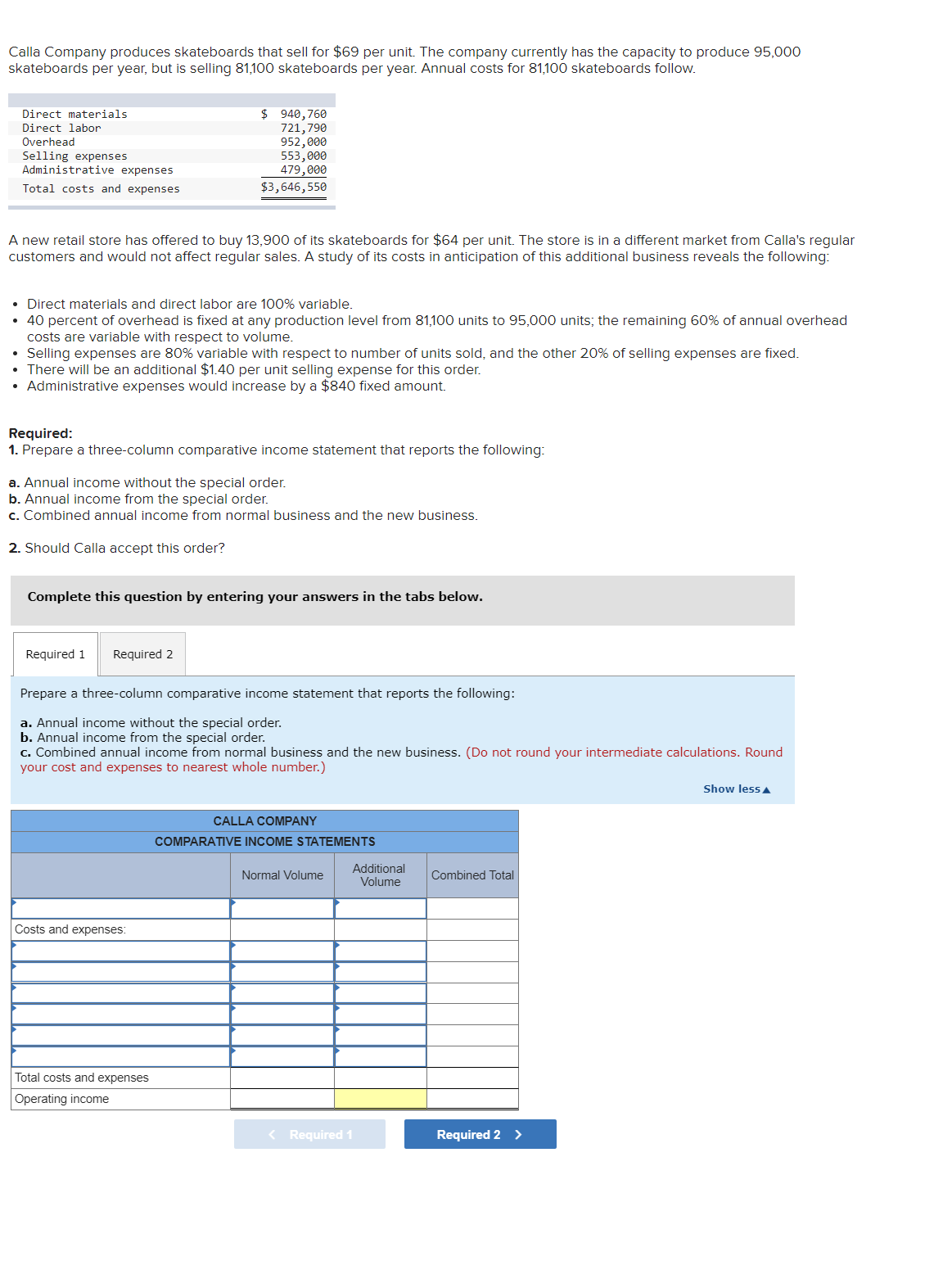

Edgerrori Company is able to produce two products, G and B, with the same machine in its factory. The following information is available. Product G Product B Selling price per' unit :t 14.9 $ 179 Variable costs per unit 55 192 Contribution margin per unit $ 55 $ 55 Machine hours to produce 1 unit: 8.4 hours 1.8 hours Maximum unit sales per month 568 units 286 units The company presently operates the machine for a single eightehour shitt for 22 working days each month. Management is thinking about operating the machine for two shifts, which will increase its productivity by another eight hours per day for 22 days per month. This change would require $8,500 additional xed costs per month. (Round hours per unit answers to 1 decimal place. Enter operating losses, if any, as negative values.) 1. Determine the contribution margin per machine hourthat each product generates. Contribution margin per unit Contribution margin per machine hour Maximum number of units to be sold Hours requiredtn produce maximum unis 2. How many unis of Product G and Product B should the company produce it it oontinues to operate with only one shitt'? How much total contribution margin does this mix produoe each month? Hours dedimted to the production of each product Unis produoed for most protable sales mix Contribution margin per unit Total contribution margin - one shift 3. It the company adds another Shl' how many units of Product 6 and Product B should it produce" How much total incremental income would this mix produce each month? Should the company add the new shitt? Hours dedicated to the production oi each product Unis produced for most protable sales mix Contn bution margin per unit Total contribution margin , two shits H Total incremental income 4. Suppose the company determines that it can increase Product G's maximum sales tn 600 unis per month by spending $7,500 per month in marketing efforts. Should the company pursue this strategy and the double shift"! Compute total incremental income Second shift vnthout marketing campaign: Unis produoed for most protable sales mix I Contn bution margin per unit Contn bution margin Second shift With marketing campaign Unis produoed for most protable sales mix Contn bution margin per unit Contribution margin Calla Company produces skateboards that sell for $69 per unit. The company currently has the capacity to produce 95,000 skateboards per year. but is selling 81.100 skateboards per year. Annual costs for 81.100 skateboards follow. Dir-act materials $ 948,769 Direct labor 721,796 Over-head 952,889 Selling expenses 553,806 Administrative expenses 479,880 Total costs and expenses $3,646,559 A new retail store has offered to buy 13,900 of its skateboards for $64 per unit The store is in a different market from Calla's regular customers and would not affect regular sales A study of its costs in anticipation ofthis additional business reveals the tollowmg: - Direct materials and direct labor are 100% variable. - 40 percent of overhead is fixed at any production level from 81,100 units to 95,000 units; the remaining 60% ofanhual overhead costs are variable with respect to volume. - Selling expenses are 80% variable with respect to number of units sold, and the other 20% of selling expenses are fixed. - There will be an additional $1.40 per unit selling expense forthis order. - Administrative expenses would increase by a $840 xed amount. Required: 1. Prepare a threescolumn comparative income statement that reports the following: a. Annual income withoutthe special order. b. Annual income from the special order 1:. Combined annual income from normal business and the new business. 2. Should Cal 6 accept this order? Complete this question by entering you- answers in the labs below. Required 1 Required 2 Prepare a threescolumn comparative income statement that reports the following: a. Annual income without the special order. I). Annual income from the special order. c. Combined annual inoome from normal business and the new business. (Do not round your intermediate calculations. Round your cost and expenses to nearest whole number.) Sllmir IessA cams and expenses: -- Total costs and expenses Operating income Calla Company produces skateboards that sell for $69 per unit. The company currently has the capacity to produce 95,000 skateboards per year. but is selling 81.100 skateboards per year. Annual costs for 31.100 skateboards follow. Direct materials E 948,763 Direct labor 721,798 Overhead 952,806 Selling expenses 553,888 Administrative expenses 1179,1566 Total costs and expenses $3,646,558 A new retail store has offered to buy 13,900 of its skateboards for $64 per unit The store is in a different market from Calla's regular customers and would not affect regular sales. A study of its costs in anticipation ofthis additional business reveals the tollowrng: - Direct materials and direct labor are 100% variable. - 40 percent of overhead Is fixed at any production level from 81,100 units to 95,000 units; the remaining 60% of annual overhead costs are variable with respect to volume. - Selling expenses are 80% variable with respect to number of units sold, and the other 20% of selling expenses are fixed. - There will be an additional $1.40 per urlit selling expense for this order. - Administrative expenses would increase by a $840 xed amount. Required: 1. Prepare a threercolumh comparative Income statement that reports the following: a. Annual income withoutthe special order. b. Annual Income from the special order c. Combined annual income from normal business and the new business. 2. Should Cal a accept this order? Complete this qugtion by entering your answers in the tabs below. Required 1 Required 2 Should (Ella accept 'iis order? Should Calla acmpt order? _