Question

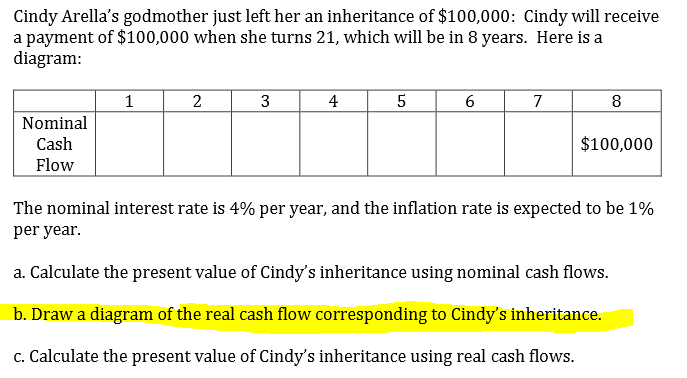

I need help understanding what the question in B is asking. This is the table that I came up with, but I don't know if

I need help understanding what the question in B is asking. This is the table that I came up with, but I don't know if the table is diagramming "real cash flow".

| 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

| Nominal | $73,069.02 | $75,991.78 | $79,031.45 | $82,192.71 | $85,480.42 | $8,899.64 | $92,455.62 | $96,153.85 | $100,000 |

| 73069.02*1.04 | 73069.02*(1.04)^2 | 73069.02*(1.04)^3 | 73069.02*(1.04)^4 | 73069.02*(1.04)^5 | 73069.02*(1.04)^6 | 73069.02*(1.04)^7 |

Maybe the ordering of the questions is throwing me off??? I found the answer to c (below) and I think I may be able to make a similar table based off of the answer in c....

c) Calculate the present value of Cindys inheritance using real cash flows

= 1 + real rate = (1 + .04) / (1 + .01)

= 1 + real rate = (1.04) / (1.01)

= 1 + real rate = 1.0297

real rate = .0297 or 2.97%

Present value in real cash flow = future value / (1 + real rate)time

PV = 100,000 / (1.0297)8 = $79,125.10

| 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

| Real | $79,125.10 | $100,000 |

Am I on the right track?

Cindy Arella's godmother just left her an inheritance of $100,000: Cindy will receive a payment of $100,000 when she turns 21, which will be in 8 years. Here is a diagram: 1 2 3 4 5 6 7 8 Nominal Cash Flow $100,000 The nominal interest rate is 4% per year, and the inflation rate is expected to be 1% per year. a. Calculate the present value of Cindy's inheritance using nominal cash flows. b. Draw a diagram of the real cash flow corresponding to Cindy's inheritance. c. Calculate the present value of Cindy's inheritance using real cash flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started