Answered step by step

Verified Expert Solution

Question

1 Approved Answer

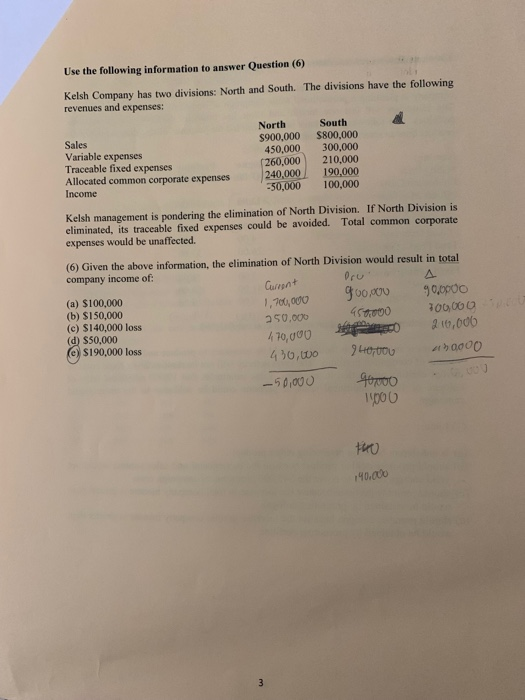

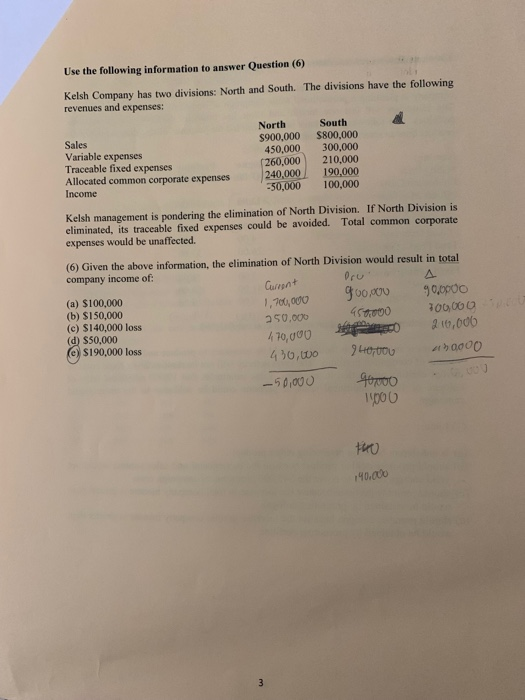

i need help Use the following information to answer Question (6) Kelsh Company has two divisions: North and South. The divisions have the following revenues

i need help

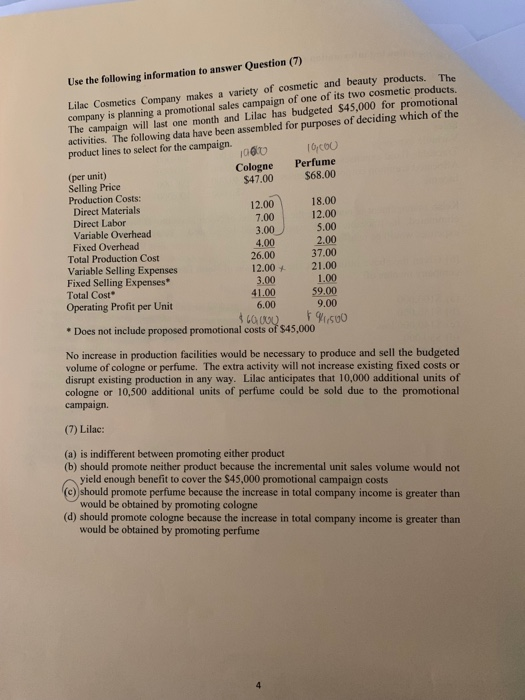

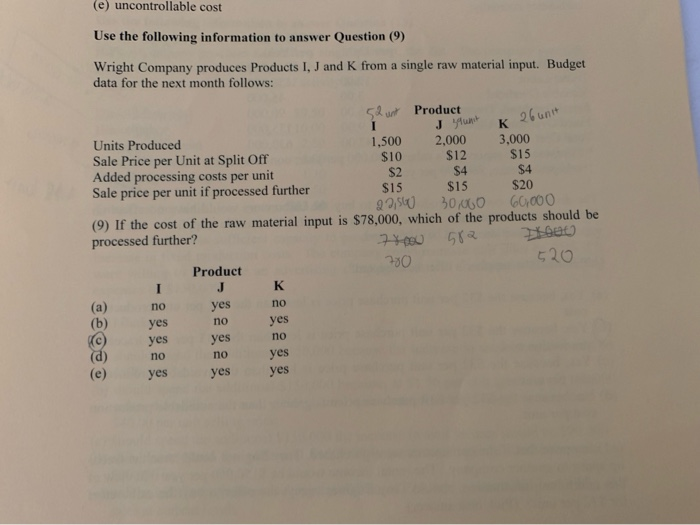

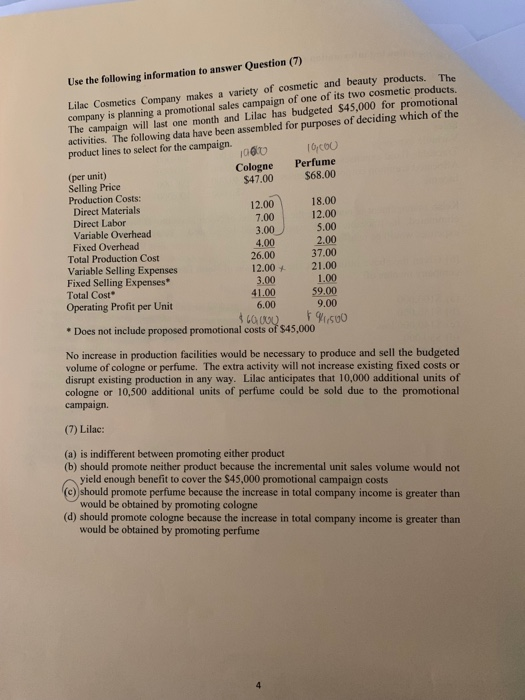

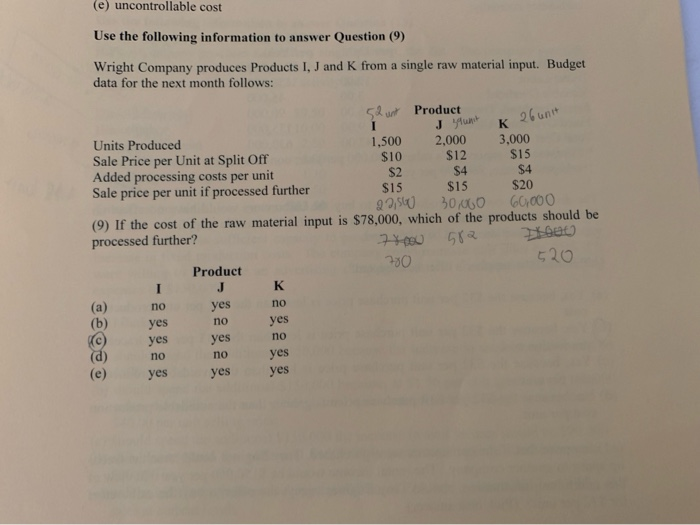

Use the following information to answer Question (6) Kelsh Company has two divisions: North and South. The divisions have the following revenues and expenses: South $800,000 300,000 210,000 190,000 100,000 North $900,000 450,000 (260,000 240,000 50,000 Sales Variable expenses Traceable fixed expenses Allocated common corporate expenses Income Kelsh management is pondering the elimination of North Division. If North Division is eliminated, its traceable fixed expenses could be avoided. Total common corporate expenses would be unaffected. (6) Given the above information, the elimination of North Division would result in total company income of: A Cureent 1,70,000 goou (a) $100,000 (b) $150,000 (c) $140,000 loss (d) $50,000 (e) $190,000 loss 300000 250,000 2 16,000 4 70,000 430,w0 -50,000 r40.a00 3 Use the following information to answer Question (7) Lilac Cosmetics Company makes a variety of cosmetic and beauty products. The company is planning a promotional sales campaign of one of its two cosmetic products The campaign will last one month and Lilac has budgeted $45,000 for promotional activities. The following data have been assembled for purposes of deciding which of the product lines to select for the campaign. 10ycou Perfume $68.00 Cologne $47.00 (per unit) Selling Price Production Costs: Direct Materials Direct Labor Variable Overhead Fixed Overhead 18.00 12.00 5.00 12.00 7.00 3.00 2.00 37.00 21.00 4.00 26.00 Total Production Cost Variable Selling Expenses Fixed Selling Expenses Total Cost Operating Profit per Unit 12.00 3.00 41.00 1.00 59.00 9.00 F 9500 Does not include proposed promotional costs of $45,000 6.00 $ co cow No increase in production facilities would be necessary to produce and sell the budgeted volume of cologne or perfume. The extra activity will not increase existing fixed costs or disrupt existing production in any way. Lilac anticipates that 10,000 additional units of cologne or 10,500 additional units of perfume could be sold due to the promotional campaign. (7) Lilac: (a) is indifferent between promoting either product (b) should promote neither product because the incremental unit sales volume would not yield enough benefit to cover the $45,000 promotional campaign costs (e)should promote perfume because the increase in total company income is greater than would be obtained by promoting cologne (d) should promote cologne because the increase in total company income is greater than would be obtained by promoting perfume 4 (e) uncontrollable cost Use the following information to answer Question (9) Wright Company produces Products I, J and K from a single raw material input. Budget data for the next month follows: 5& wt Product J yfun 2,000 $12 $4 $15 K 26un 3,000 $15 $4 unt Units Produced 1,500 $10 Sale Price per Unit at Split Off Added processing costs per unit Sale price per unit if processed further $2 $15 $20 Ooslca 30/000 G0h.000 (9) If the cost of the raw material input is $78,000, which of the products should be processed further? 520 Product (a) (b) no yes no yes no yes yes yes no (d) no no yes yes yes yes KO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started