Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help Video Excel Online Structured AV CAPH, pofonok Consider the following information for the stocks, Stocks and the return on the westocks are

i need help

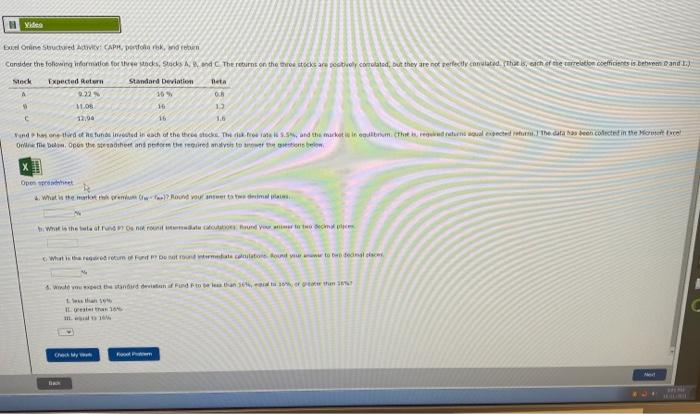

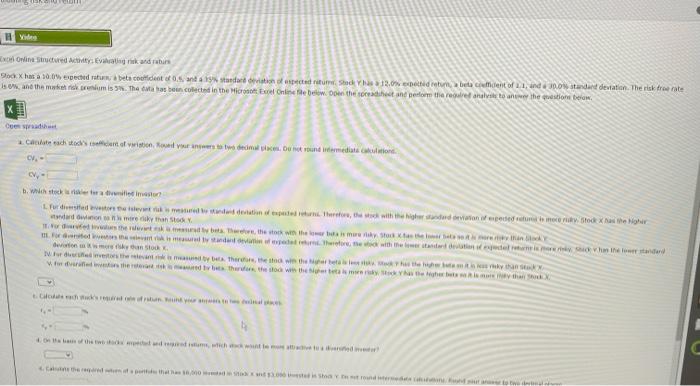

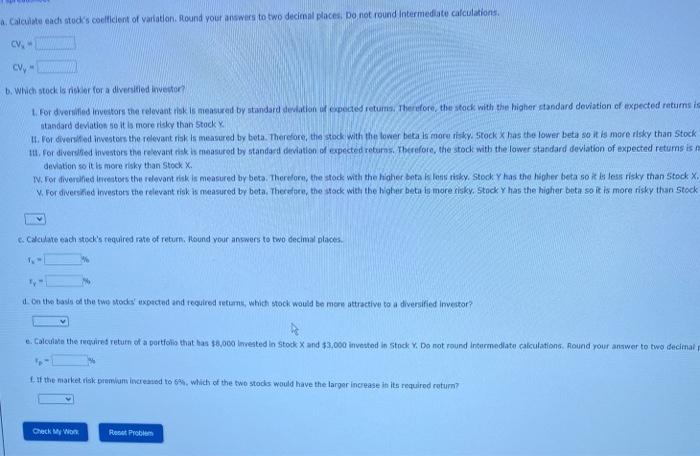

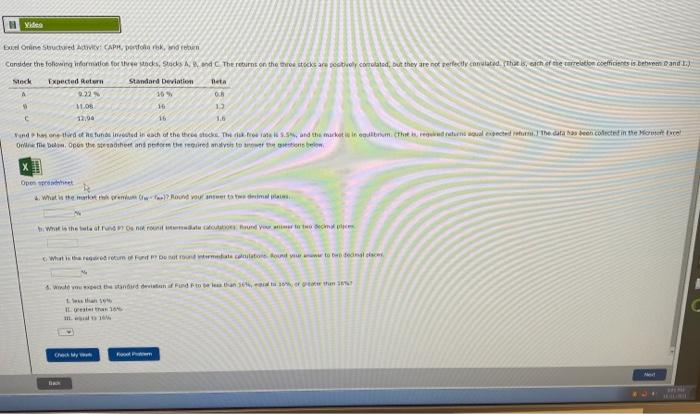

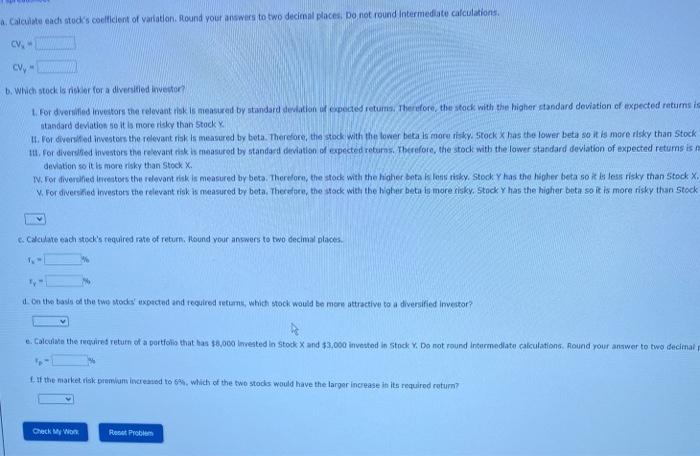

Video Excel Online Structured AV CAPH, pofonok Consider the following information for the stocks, Stocks and the return on the westocks are pretvoly correlated, but they are not perfectly emulated that is, aith of the correlation coefficients is behin Pand) Stock Expected Return Standard deviation Det 0.22 169 08 11.08 16 13 12,00 16 1.6 and has one todos funded in th of the three deck The dr. and the market in comunalected for the database. Collection the Moon wie. Open the other and to be a way to resto Open What is the more woordvoerder What is the best round of them What is thereum Decalon Rouw tot el Widerstand titan Fund to be worn La IL 6 Online Structured My Chang and rebre SEX has a 100% pected to be code and a standardition spectrum Stockh 12.04 Detrobelcent of 100 tandard deviation. The risk trate is own the markmis. The atas ben collected in the Microsoft Excel Online Sebelow. Our the set and perform the required anlike to the stone Coenih 2. Cabe each dam olision Rouest dedmallu hot round meditation CV- CV- b. With this Ludised on the deviner Therefore, with the idealnie State Noir womedy than stock is the best the stock with more Stock model. Therefore the wide with the dan kan stock Ford may be there the human for the better to win the North the bath them wicht that is hard. a. Calculate endi studi's coefficient of variation. Round your answers to two decimal places. Do not found Intermediate calculations CV, CV b. Which stocks ner for a diversified investor L. For diversified Investors the relevant tok is measured by standard deviation of expected returns. Therefore, the stock with the higher standard deviation of expected returns i standard deviation so it is more risky than Stock II. For diversified investors the relevant risk is measured by beta. Therefore, the stock with the lower beta is more risky. Stock X has the lower beta so it is more risky than Stock III. for diversified investors there want risk is measured by standard deviation of expected returns. Therefore, the stock with the lower standard deviation of expected retums is deviation so it is more risky than Stock X. W. For diversified investors the relevant risk is measured by beta. Therefore, the stock with the higher bata is on risky. Stock Y has the higher beta so it is less risky than Stock X. V. For diversified Investors the relevant risk a measured by bota. Therefore, the stock with the higher beta to more risky. Stock y has the higher beta so it is more risky than stock e. Calculate cach stock's required rate of return, Hound your answers to two decimal places d. On the basis of the two Modes' expected and required returns, which stock would be more attractive to a diversified Investor? 6. Calculate the resired return of a portfolio that has 18,000 invested in stock X and $3,000 invested in stock . Do not round Intermediate calculations, Round your answer to two decimal 1.1f the market visk Drumban increased to 6%, which of the two stocks would have the larger increase in its required retur? Check My Won Res Problem Video Excel Online Structured AV CAPH, pofonok Consider the following information for the stocks, Stocks and the return on the westocks are pretvoly correlated, but they are not perfectly emulated that is, aith of the correlation coefficients is behin Pand) Stock Expected Return Standard deviation Det 0.22 169 08 11.08 16 13 12,00 16 1.6 and has one todos funded in th of the three deck The dr. and the market in comunalected for the database. Collection the Moon wie. Open the other and to be a way to resto Open What is the more woordvoerder What is the best round of them What is thereum Decalon Rouw tot el Widerstand titan Fund to be worn La IL 6 Online Structured My Chang and rebre SEX has a 100% pected to be code and a standardition spectrum Stockh 12.04 Detrobelcent of 100 tandard deviation. The risk trate is own the markmis. The atas ben collected in the Microsoft Excel Online Sebelow. Our the set and perform the required anlike to the stone Coenih 2. Cabe each dam olision Rouest dedmallu hot round meditation CV- CV- b. With this Ludised on the deviner Therefore, with the idealnie State Noir womedy than stock is the best the stock with more Stock model. Therefore the wide with the dan kan stock Ford may be there the human for the better to win the North the bath them wicht that is hard. a. Calculate endi studi's coefficient of variation. Round your answers to two decimal places. Do not found Intermediate calculations CV, CV b. Which stocks ner for a diversified investor L. For diversified Investors the relevant tok is measured by standard deviation of expected returns. Therefore, the stock with the higher standard deviation of expected returns i standard deviation so it is more risky than Stock II. For diversified investors the relevant risk is measured by beta. Therefore, the stock with the lower beta is more risky. Stock X has the lower beta so it is more risky than Stock III. for diversified investors there want risk is measured by standard deviation of expected returns. Therefore, the stock with the lower standard deviation of expected retums is deviation so it is more risky than Stock X. W. For diversified investors the relevant risk is measured by beta. Therefore, the stock with the higher bata is on risky. Stock Y has the higher beta so it is less risky than Stock X. V. For diversified Investors the relevant risk a measured by bota. Therefore, the stock with the higher beta to more risky. Stock y has the higher beta so it is more risky than stock e. Calculate cach stock's required rate of return, Hound your answers to two decimal places d. On the basis of the two Modes' expected and required returns, which stock would be more attractive to a diversified Investor? 6. Calculate the resired return of a portfolio that has 18,000 invested in stock X and $3,000 invested in stock . Do not round Intermediate calculations, Round your answer to two decimal 1.1f the market visk Drumban increased to 6%, which of the two stocks would have the larger increase in its required retur? Check My Won Res

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started