I need help with #10 and #11 on the first picture.

This is ALL the information given, thank you.

This is the Data

this is the data

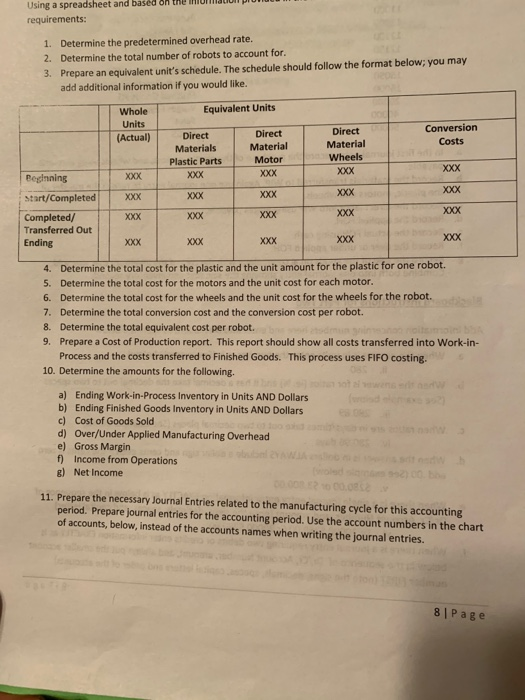

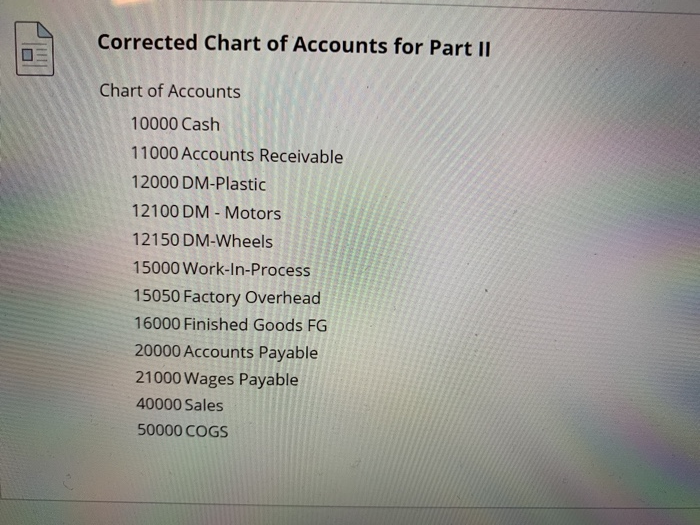

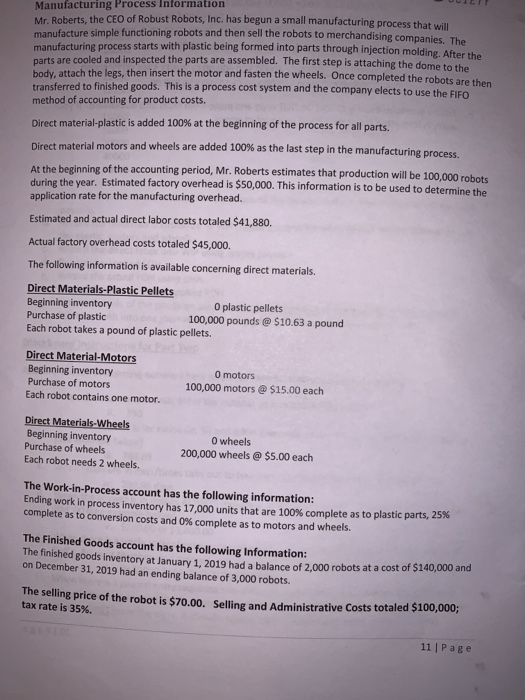

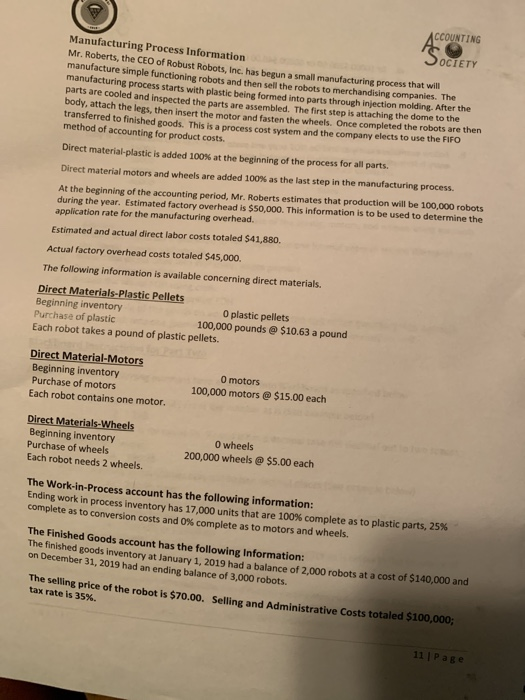

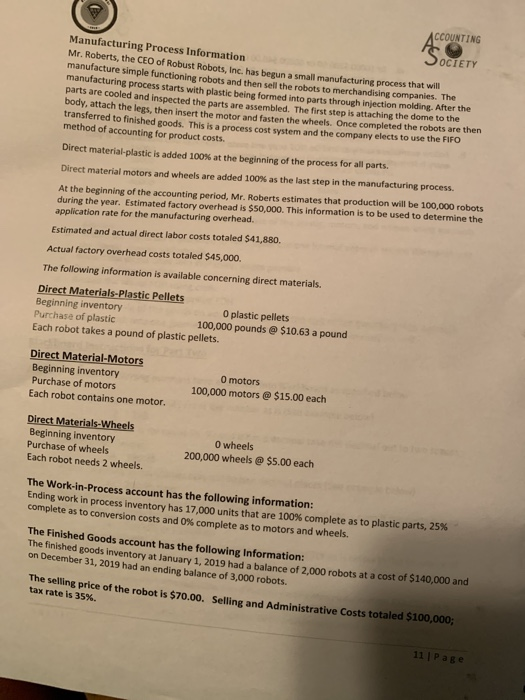

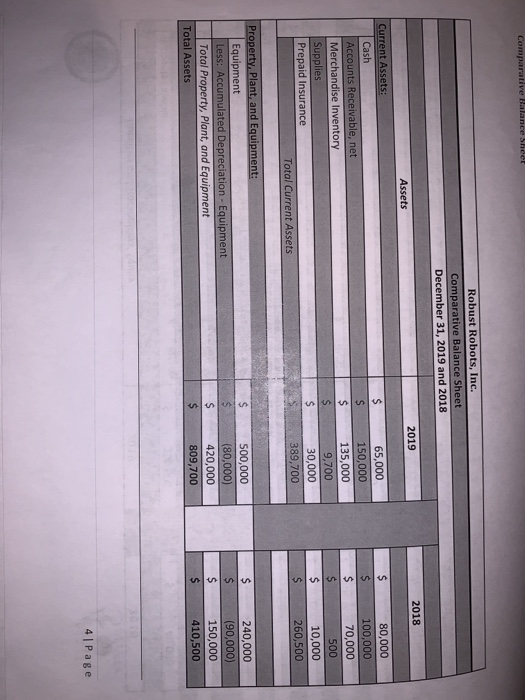

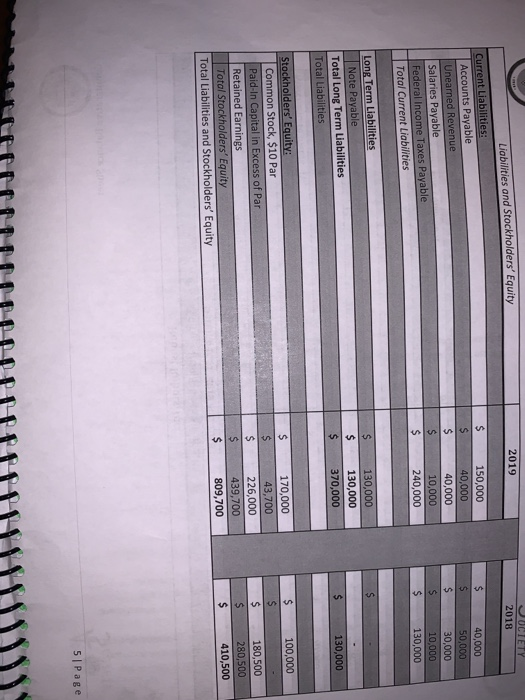

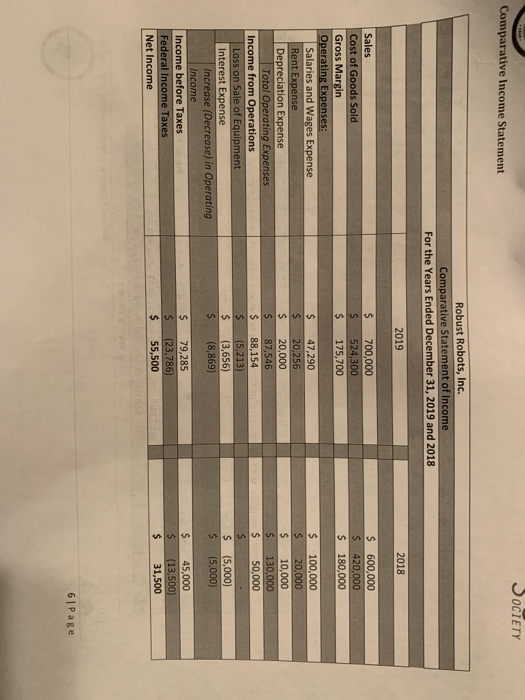

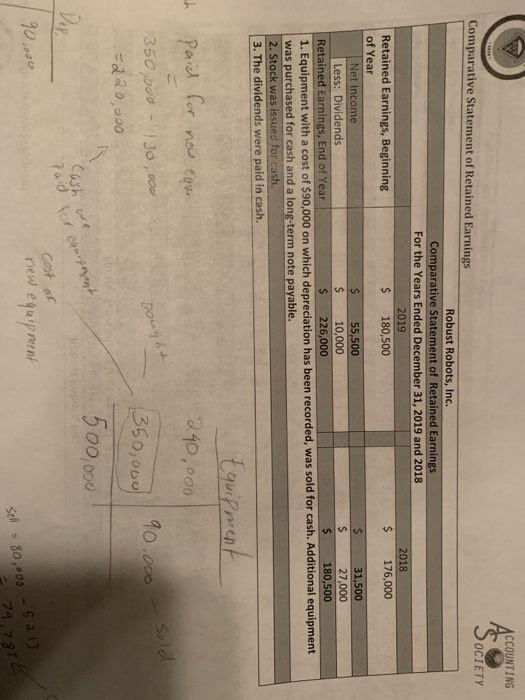

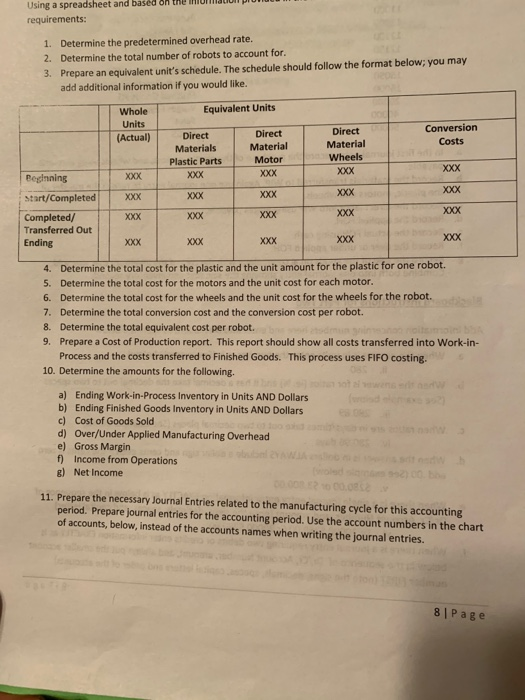

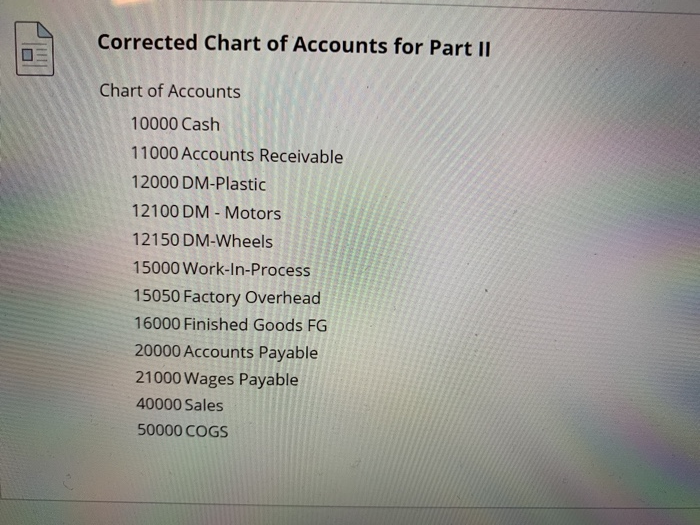

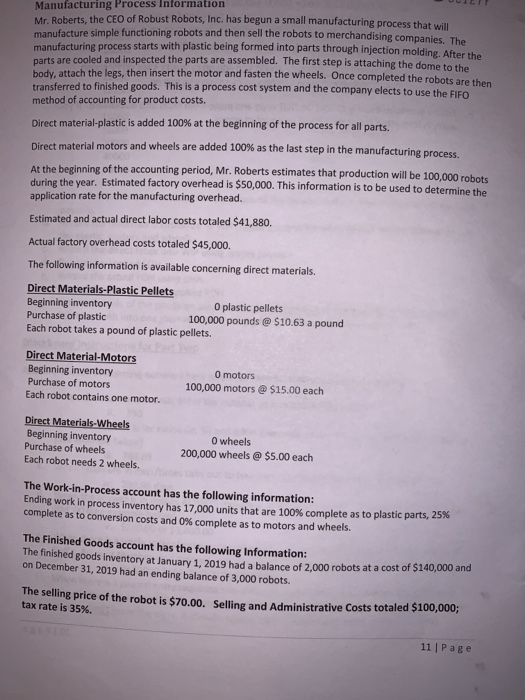

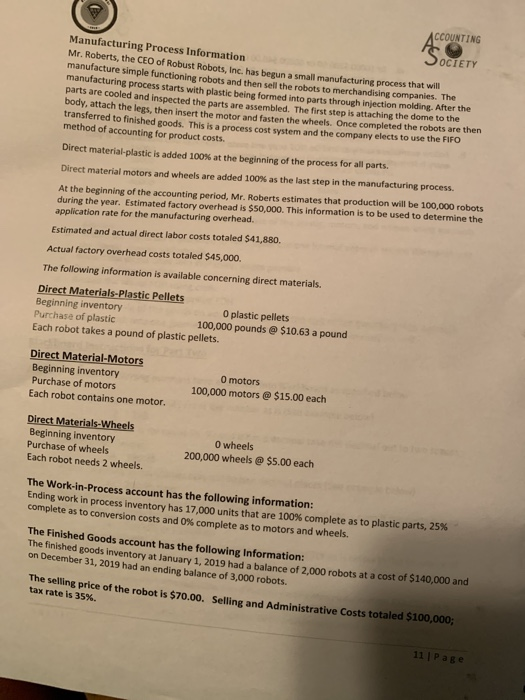

IT PUNDIT Using a spreadsheet and based on the requirements: 1. Determine the predetermined overhead rate. 2. Determine the total number of robots to account for. 3. Prepare an equivalent unit's schedule. The schedule should follow the format below; you may add additional information if you would like. Whole Equivalent Units Units (Actual) Conversion Costs Direct Materials Plastic Parts XXX Direct Material Motor XXX Direct Material Wheels XXX XXX Beginning Start/Completed XX XXX XXX XXX XXX XXX XXX XXX XXX XXX Completed/ Transferred Out Ending XXX XXX XXX xxx XXX 4. Determine the total cost for the plastic and the unit amount for the plastic for one robot. 5. Determine the total cost for the motors and the unit cost for each motor. 6. Determine the total cost for the wheels and the unit cost for the wheels for the robot. 7. Determine the total conversion cost and the conversion cost per robot. 8. Determine the total equivalent cost per robot. 9. Prepare a Cost of Production report. This report should show all costs transferred into Work-in- Process and the costs transferred to Finished Goods. This process uses FIFO costing. 10. Determine the amounts for the following. wensen a) Ending Work-in-Process Inventory in Units AND Dollars b) Ending Finished Goods Inventory in Units AND Dollars c) Cost of Goods Sold d) Over/Under Applied Manufacturing Overhead e) Gross Margin f) Income from Operations g) Net Income 11. Prepare the necessary Journal Entries related to the manufacturing cycle for this accounting period. Prepare journal entries for the accounting period. Use the account numbers in the chart of accounts, below, instead of the accounts names when writing the journal entries. 8 Page Corrected Chart of Accounts for Part II Chart of Accounts 10000 Cash 11000 Accounts Receivable 12000 DM-Plastic 12100 DM - Motors 12150 DM-Wheels 15000 Work-In-Process 15050 Factory Overhead 16000 Finished Goods FG 20000 Accounts Payable 21000 Wages Payable 40000 Sales 50000 COGS Manufacturing Process Information Mr. Roberts, the CEO of Robust Robots, Inc. has begun a small manufacturing process that will manufacture simple functioning robots and then sell the robots to merchandising companies The manufacturing process starts with plastic being formed into parts through injection molding. After the narts are cooled and inspected the parts are assembled. The first step is attaching the dome to the hody.attach the legs, then insert the motor and fasten the wheels. Once completed the robots are then transferred to finished goods. This is a process cost system and the company elects to use the FIE method of accounting for product costs. Direct material-plastic is added 100% at the beginning of the process for all parts. Direct material motors and wheels are added 100% as the last step in the manufacturing process At the beginning of the accounting period, Mr. Roberts estimates that production will be 100,000 robots during the year. Estimated factory overhead is $50,000. This information is to be used to determine the application rate for the manufacturing overhead. Estimated and actual direct labor costs totaled $41,880. Actual factory overhead costs totaled $45,000. The following information is available concerning direct materials. Direct Materials-Plastic Pellets Beginning inventory O plastic pellets Purchase of plastic 100,000 pounds @ $10.63 a pound Each robot takes a pound of plastic pellets. Direct Material-Motors Beginning inventory Purchase of motors Each robot contains one motor. O motors 100,000 motors @ $15.00 each Direct Materials-Wheels Beginning inventory Purchase of wheels Each robot needs 2 wheels. O wheels 200,000 wheels @ $5.00 each The Work-in-process account has the following information: Ending work in process inventory has 17,000 units that are 100% complete as to plastic parts, 25% complete as to conversion costs and 0% complete as to motors and wheels. The Finished Goods account has the following Information: The finished goods Inventory at January 1, 2019 had a balance of 2.000 robots at a cost of $140,000 and on December 31, 2019 had an ending balance of 3,000 robots. ne selling price of the robot is $70.00. Selline and Administrative Costs totaled $100,000; tax rate is 35%. 11 | Page ACCOUNTING Manufacturing Process Information SOCIETY Mr. Roberts, the CEO of Robust Robots, Inc. has begun a small manufacturing process that will manufacture simple functioning robots and then sell the robots to merchandising companies. The manufacturing process starts with plastic being formed into parts through injection molding. After the parts are cooled and inspected the parts are assembled. The first step is attaching the dome to the body, attach the legs, then insert the motor and faster the wheels. Once completed the robots are then transferred to finished goods. This is a process cost system and the company elects to use the FIFO method of accounting for product costs. Direct material-plastic is added 100% at the beginning of the process for all parts. Direct material motors and wheels are added 100% as the last step in the manufacturing process. At the beginning of the accounting period, Mr. Roberts estimates that production will be 100,000 robots during the year. Estimated factory overhead is $50,000. This information is to be used to determine the application rate for the manufacturing overhead. Estimated and actual direct labor costs totaled $41,880. Actual factory overhead costs totaled $45,000 The following information is available concerning direct materials. Direct Materials-Plastic Pellets Beginning inventory O plastic pellets Purchase of plastic 100,000 pounds @ $10.63 a pound Each robot takes a pound of plastic pellets. Direct Material Motors Beginning inventory Purchase of motors Each robot contains one motor. O motors 100,000 motors @ $15.00 each Direct Materials-Wheels Beginning inventory Purchase of wheels Each robot needs 2 wheels. O wheels 200,000 wheels @ $5.00 each The Work-in-Process account has the following information: Ending work in process inventory has 17,000 units that are 100% complete as to plastic parts, 25% complete as to conversion costs and 0% complete as to motors and wheels. The Finished Goods account has the following Information: The finished goods inventory at January 1, 2019 had a balance of 2,000 robots at a cost of $140,000 and on December 31, 2019 had an ending balance of 3,000 robots. The selling price of the robot is $70.00. Selling and Administrative Costs totaled $100,000 tax rate is 35%. 11 | Page Comparative Balance Sheet Robust Robots, Inc. Comparative Balance Sheet December 31, 2019 and 2018 2019 2018 $ $ Assets Current Assets: Cash Accounts Receivable, net Merchandise Inventory Supplies Prepaid Insurance Total Current Assets $ $ $ $ $ 65,000 150,000 135,000 9,700 30,000 389,700 nun 80,000 100,000 70,000 500 10,000 260,500 $ Property, plant, and Equipment: Equipment Less: Accumulated Depreciation - Equipment Total Property, Plant, and Equipment Total Assets 500,000 (80,000) 420,000 809,700 $ $ $ $ 240,000 (90,000) 150,000 410,500 4 Page 2019 OCIETY 2018 Liabilities and Stockholders' Equity Current Liabilities: Accounts Payable Unearned Revenue Salaries Payable Federal Income Taxes Payable Total Current Liabilities $ $ $ $ $ 150,000 40,000 40,000 10,000 240,000 $ $ $ $ $ 40,000 50,000 30,000 10,000 130,000 Long Term Liabilities Note Payable Total Long Term Liabilities Total Liabilities $ $ $ 130,000 130,000 370,000 $ 130,000 100,000 $ $ $ Stockholders' Equity: Common Stock, $10 Par Paid-In Capital in Excess of Par Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 170,000 43,700 226,000 439,700 809,700 $ $ $ $ $ 180,500 280,500 410,500 5 Page SOCIETY Comparative Income Statement Robust Robots, Inc. Comparative Statement of income For the Years Ended December 31, 2019 and 2018 2019 2018 $ $ $ 700,000 524,300 175,700 $ 600,000 $ 420,000 $ 180,000 Sales Cost of Goods Sold Gross Margin Operating Expenses: Salaries and Wages Expense Rent Expense Depreciation Expense Total Operating Expenses Income from Operations Loss on Sale of Equipment Interest Expense Increase (Decrease) in Operating Income Income before Taxes Federal Income Taxes Net Income $ $ $ $ $ $ $ $ 47,290 20,256 20,000 87,546 88,154 (5,213) (3,656) (8,869) $ $ $ $ $ 100,000 20,000 10,000 130,000 50,000 $ $ (5,000) (5,000) $ 79,285 (23,786) 55,500 $ $ $ 45,000 (13,500) 31,500 $ 6 Page ACCOUNTING Comparative Statement of Retained Earnings SOCIETY Robust Robots, Inc. Comparative Statement of Retained Earnings For the Years Ended December 31, 2019 and 2018 2019 2018 Retained Earnings, Beginning $ 180,500 $ 176,000 of Year Net Income $ 55,500 $ 31,500 Less: Dividends $ 10,000 $ 27,000 Retained Earnings, End of Year $ 226,000 $ 180,500 1. Equipment with a cost of $90,000 on which depreciation has been recorded, was sold for cash. Additional equipment was purchased for cash and a long-term note payable. 2. Stock was issued for cash. 3. The dividends were paid in cash. Equipment 240,000 paid for new eque 30,000 sold Dought 90.000 350,000 - -220,000 350,oool 500,000 Cash we for equipment paid Cost of new equipment sell = 80,000 - 52 13 79,787 IT PUNDIT Using a spreadsheet and based on the requirements: 1. Determine the predetermined overhead rate. 2. Determine the total number of robots to account for. 3. Prepare an equivalent unit's schedule. The schedule should follow the format below; you may add additional information if you would like. Whole Equivalent Units Units (Actual) Conversion Costs Direct Materials Plastic Parts XXX Direct Material Motor XXX Direct Material Wheels XXX XXX Beginning Start/Completed XX XXX XXX XXX XXX XXX XXX XXX XXX XXX Completed/ Transferred Out Ending XXX XXX XXX xxx XXX 4. Determine the total cost for the plastic and the unit amount for the plastic for one robot. 5. Determine the total cost for the motors and the unit cost for each motor. 6. Determine the total cost for the wheels and the unit cost for the wheels for the robot. 7. Determine the total conversion cost and the conversion cost per robot. 8. Determine the total equivalent cost per robot. 9. Prepare a Cost of Production report. This report should show all costs transferred into Work-in- Process and the costs transferred to Finished Goods. This process uses FIFO costing. 10. Determine the amounts for the following. wensen a) Ending Work-in-Process Inventory in Units AND Dollars b) Ending Finished Goods Inventory in Units AND Dollars c) Cost of Goods Sold d) Over/Under Applied Manufacturing Overhead e) Gross Margin f) Income from Operations g) Net Income 11. Prepare the necessary Journal Entries related to the manufacturing cycle for this accounting period. Prepare journal entries for the accounting period. Use the account numbers in the chart of accounts, below, instead of the accounts names when writing the journal entries. 8 Page Corrected Chart of Accounts for Part II Chart of Accounts 10000 Cash 11000 Accounts Receivable 12000 DM-Plastic 12100 DM - Motors 12150 DM-Wheels 15000 Work-In-Process 15050 Factory Overhead 16000 Finished Goods FG 20000 Accounts Payable 21000 Wages Payable 40000 Sales 50000 COGS Manufacturing Process Information Mr. Roberts, the CEO of Robust Robots, Inc. has begun a small manufacturing process that will manufacture simple functioning robots and then sell the robots to merchandising companies The manufacturing process starts with plastic being formed into parts through injection molding. After the narts are cooled and inspected the parts are assembled. The first step is attaching the dome to the hody.attach the legs, then insert the motor and fasten the wheels. Once completed the robots are then transferred to finished goods. This is a process cost system and the company elects to use the FIE method of accounting for product costs. Direct material-plastic is added 100% at the beginning of the process for all parts. Direct material motors and wheels are added 100% as the last step in the manufacturing process At the beginning of the accounting period, Mr. Roberts estimates that production will be 100,000 robots during the year. Estimated factory overhead is $50,000. This information is to be used to determine the application rate for the manufacturing overhead. Estimated and actual direct labor costs totaled $41,880. Actual factory overhead costs totaled $45,000. The following information is available concerning direct materials. Direct Materials-Plastic Pellets Beginning inventory O plastic pellets Purchase of plastic 100,000 pounds @ $10.63 a pound Each robot takes a pound of plastic pellets. Direct Material-Motors Beginning inventory Purchase of motors Each robot contains one motor. O motors 100,000 motors @ $15.00 each Direct Materials-Wheels Beginning inventory Purchase of wheels Each robot needs 2 wheels. O wheels 200,000 wheels @ $5.00 each The Work-in-process account has the following information: Ending work in process inventory has 17,000 units that are 100% complete as to plastic parts, 25% complete as to conversion costs and 0% complete as to motors and wheels. The Finished Goods account has the following Information: The finished goods Inventory at January 1, 2019 had a balance of 2.000 robots at a cost of $140,000 and on December 31, 2019 had an ending balance of 3,000 robots. ne selling price of the robot is $70.00. Selline and Administrative Costs totaled $100,000; tax rate is 35%. 11 | Page ACCOUNTING Manufacturing Process Information SOCIETY Mr. Roberts, the CEO of Robust Robots, Inc. has begun a small manufacturing process that will manufacture simple functioning robots and then sell the robots to merchandising companies. The manufacturing process starts with plastic being formed into parts through injection molding. After the parts are cooled and inspected the parts are assembled. The first step is attaching the dome to the body, attach the legs, then insert the motor and faster the wheels. Once completed the robots are then transferred to finished goods. This is a process cost system and the company elects to use the FIFO method of accounting for product costs. Direct material-plastic is added 100% at the beginning of the process for all parts. Direct material motors and wheels are added 100% as the last step in the manufacturing process. At the beginning of the accounting period, Mr. Roberts estimates that production will be 100,000 robots during the year. Estimated factory overhead is $50,000. This information is to be used to determine the application rate for the manufacturing overhead. Estimated and actual direct labor costs totaled $41,880. Actual factory overhead costs totaled $45,000 The following information is available concerning direct materials. Direct Materials-Plastic Pellets Beginning inventory O plastic pellets Purchase of plastic 100,000 pounds @ $10.63 a pound Each robot takes a pound of plastic pellets. Direct Material Motors Beginning inventory Purchase of motors Each robot contains one motor. O motors 100,000 motors @ $15.00 each Direct Materials-Wheels Beginning inventory Purchase of wheels Each robot needs 2 wheels. O wheels 200,000 wheels @ $5.00 each The Work-in-Process account has the following information: Ending work in process inventory has 17,000 units that are 100% complete as to plastic parts, 25% complete as to conversion costs and 0% complete as to motors and wheels. The Finished Goods account has the following Information: The finished goods inventory at January 1, 2019 had a balance of 2,000 robots at a cost of $140,000 and on December 31, 2019 had an ending balance of 3,000 robots. The selling price of the robot is $70.00. Selling and Administrative Costs totaled $100,000 tax rate is 35%. 11 | Page Comparative Balance Sheet Robust Robots, Inc. Comparative Balance Sheet December 31, 2019 and 2018 2019 2018 $ $ Assets Current Assets: Cash Accounts Receivable, net Merchandise Inventory Supplies Prepaid Insurance Total Current Assets $ $ $ $ $ 65,000 150,000 135,000 9,700 30,000 389,700 nun 80,000 100,000 70,000 500 10,000 260,500 $ Property, plant, and Equipment: Equipment Less: Accumulated Depreciation - Equipment Total Property, Plant, and Equipment Total Assets 500,000 (80,000) 420,000 809,700 $ $ $ $ 240,000 (90,000) 150,000 410,500 4 Page 2019 OCIETY 2018 Liabilities and Stockholders' Equity Current Liabilities: Accounts Payable Unearned Revenue Salaries Payable Federal Income Taxes Payable Total Current Liabilities $ $ $ $ $ 150,000 40,000 40,000 10,000 240,000 $ $ $ $ $ 40,000 50,000 30,000 10,000 130,000 Long Term Liabilities Note Payable Total Long Term Liabilities Total Liabilities $ $ $ 130,000 130,000 370,000 $ 130,000 100,000 $ $ $ Stockholders' Equity: Common Stock, $10 Par Paid-In Capital in Excess of Par Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 170,000 43,700 226,000 439,700 809,700 $ $ $ $ $ 180,500 280,500 410,500 5 Page SOCIETY Comparative Income Statement Robust Robots, Inc. Comparative Statement of income For the Years Ended December 31, 2019 and 2018 2019 2018 $ $ $ 700,000 524,300 175,700 $ 600,000 $ 420,000 $ 180,000 Sales Cost of Goods Sold Gross Margin Operating Expenses: Salaries and Wages Expense Rent Expense Depreciation Expense Total Operating Expenses Income from Operations Loss on Sale of Equipment Interest Expense Increase (Decrease) in Operating Income Income before Taxes Federal Income Taxes Net Income $ $ $ $ $ $ $ $ 47,290 20,256 20,000 87,546 88,154 (5,213) (3,656) (8,869) $ $ $ $ $ 100,000 20,000 10,000 130,000 50,000 $ $ (5,000) (5,000) $ 79,285 (23,786) 55,500 $ $ $ 45,000 (13,500) 31,500 $ 6 Page ACCOUNTING Comparative Statement of Retained Earnings SOCIETY Robust Robots, Inc. Comparative Statement of Retained Earnings For the Years Ended December 31, 2019 and 2018 2019 2018 Retained Earnings, Beginning $ 180,500 $ 176,000 of Year Net Income $ 55,500 $ 31,500 Less: Dividends $ 10,000 $ 27,000 Retained Earnings, End of Year $ 226,000 $ 180,500 1. Equipment with a cost of $90,000 on which depreciation has been recorded, was sold for cash. Additional equipment was purchased for cash and a long-term note payable. 2. Stock was issued for cash. 3. The dividends were paid in cash. Equipment 240,000 paid for new eque 30,000 sold Dought 90.000 350,000 - -220,000 350,oool 500,000 Cash we for equipment paid Cost of new equipment sell = 80,000 - 52 13 79,787