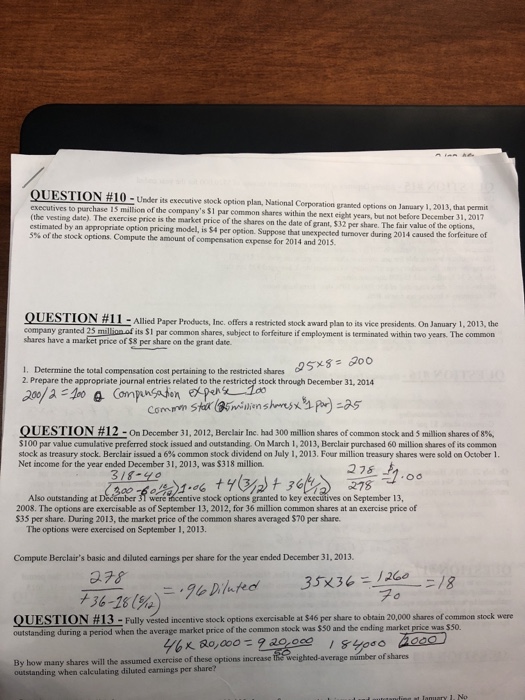

I need help with 10

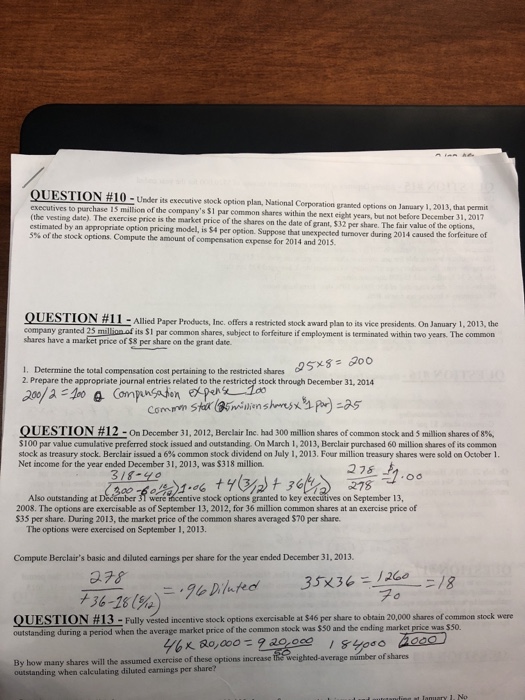

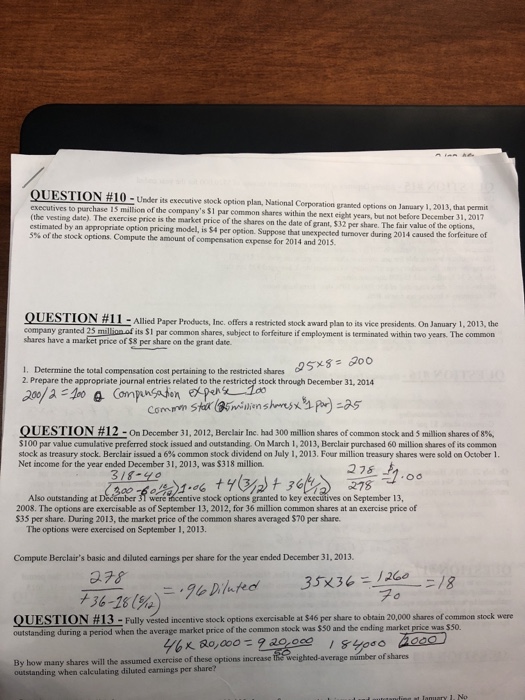

O ST I N # 10-under its executive Skok option plan Natina Corporation granted pei to parchase 15 million of the company's S1 par common shares within the mext eight years, but not before December 31, 2017 s onianuary ?2013,thu pent date). The exercise price is the market price of the shares on the date of grant, $32 per share. The fair value of the options (the vesting estimated by an appropriate option pricing model, is $4 per option. 5% of the stock options. Compute the amount of compensation expense for 2014 ng 2014 caused the forfeiture of and 2015 OU ESTI ON 1 -Allied Paper Products, Inc. offers a restricted stock award plan to its vice presidents. On January 1. 2013, the company granted 25 million of its $1 par common shares, subject to forfeiture if employment is terminated within two years. The common shares have a market price of $8 per share on the grant date 1. Determine the total compensation cost pertaining to the restricted shares 2 Prepare the appropriate journal entries related to the restricted stock through December 31, 2014 QUESTION #12 -on December 31, 2012, Berclair Inc, had 300 millin shares of common stock and S million shares of 8%, $100 par value cumulative preferred stock issued and outstanding. On March 1, 2013, Berclair purchased 60 million shares of its common stock as treasury stock. Berclair issued a 6% common stock dividend on July 1,2013. Four mallion treasury shares were sold on October 1 Net income for the year ended December 31, 2013, was $318 million. 3/8-4 278 Also outstanding at December 31 were micentive stock options granted to key executives on September 13, 2008. The options are exercisable as of September 13, 2012, for 36 million common shares at an exercise price of $33 per share. During 2013, the market price of the common shares averaged $70 per share. The options were exercised on September 1, 2013. Compute Berclair's basic and diluted earnings per share for the year ended December 31, 2013. QUESTION #13 Fully vested incentive stock options exercisable at $46 per share to obtain 20,000 shares of common stock were a period when the average market price of the common stock was $50 and the ending market price was $50. By how many shares will the assumed exercise of these options increase outstanding when caleulating diluted earnings per share the weighted-average mumber of shares