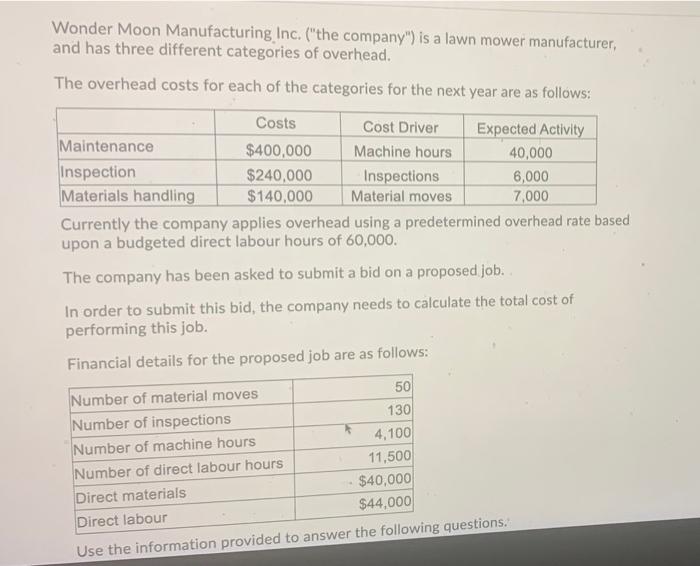

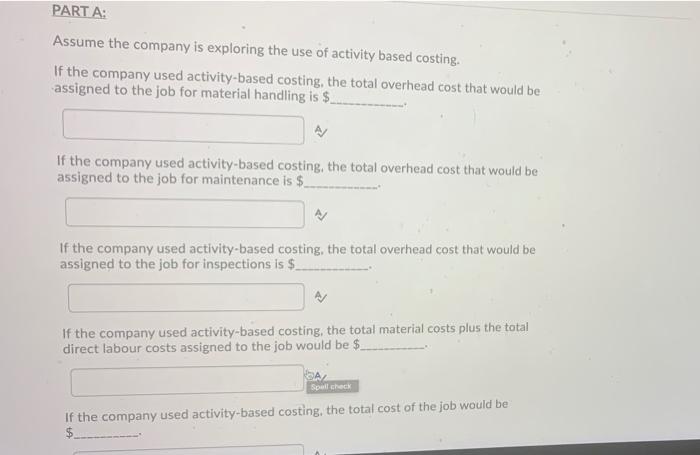

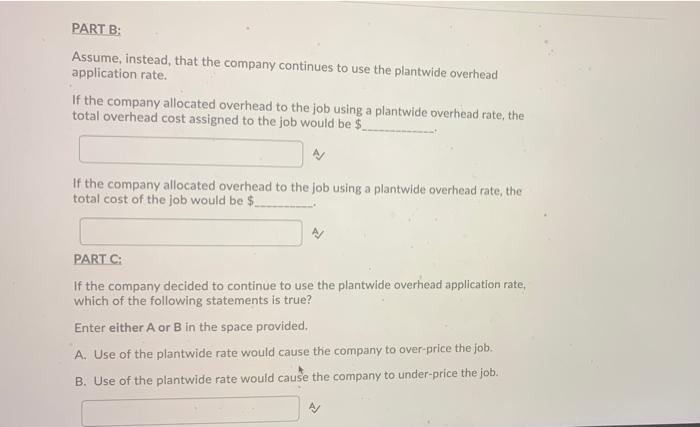

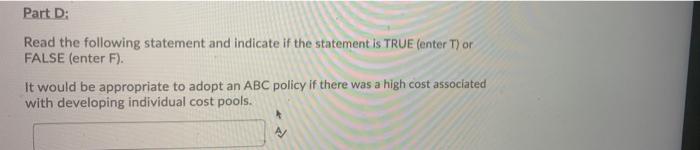

Wonder Moon Manufacturing Inc. ("the company") is a lawn mower manufacturer, and has three different categories of overhead. The overhead costs for each of the categories for the next year are as follows: Costs Cost Driver Expected Activity Maintenance $400,000 Machine hours 40,000 Inspection $240,000 Inspections 6,000 Materials handling $140,000 Material moves 7,000 Currently the company applies overhead using a predetermined overhead rate based upon a budgeted direct labour hours of 60,000. The company has been asked to submit a bid on a proposed job. In order to submit this bid, the company needs to calculate the total cost of performing this job. Financial details for the proposed job are as follows: 50 Number of material moves 130 Number of inspections 4,100 Number of machine hours 11,500 Number of direct labour hours $40,000 Direct materials $44,000 Direct labour Use the information provided to answer the following questions. PART A: Assume the company is exploring the use of activity based costing. If the company used activity-based costing, the total overhead cost that would be assigned to the job for material handling is $ A/ If the company used activity-based costing, the total overhead cost that would be assigned to the job for maintenance is $_ If the company used activity-based costing, the total overhead cost that would be assigned to the job for inspections is $ If the company used activity-based costing, the total material costs plus the total direct labour costs assigned to the job would be $ Spellcheck If the company used activity-based costing, the total cost of the job would be $ PART B: Assume, instead, that the company continues to use the plantwide overhead application rate. If the company allocated overhead to the job using a plantwide overhead rate, the total overhead cost assigned to the job would be $ If the company allocated overhead to the job using a plantwide overhead rate, the total cost of the job would be $ PART C: If the company decided to continue to use the plantwide overhead application rate, which of the following statements is true? Enter either A or B in the space provided. A. Use of the plantwide rate would cause the company to over-price the job. B. Use of the plantwide rate would cause the company to under-price the job. Part D: Read the following statement and indicate if the statement is TRUE (enter T) or FALSE (enter F). It would be appropriate to adopt an ABC policy if there was a high cost associated with developing individual cost pools