Answered step by step

Verified Expert Solution

Question

1 Approved Answer

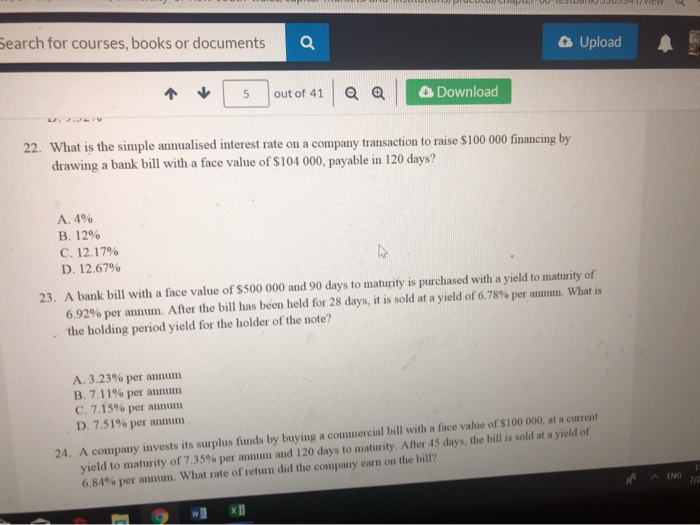

i need help with 13 24 pls Search for courses, books or documents 6 Upload 5 out of 41 QQ Download 22. What is the

i need help with 13 24 pls

Search for courses, books or documents 6 Upload 5 out of 41 QQ Download 22. What is the simple annualised interest rate on a company transaction to raise $100 000 financing by drawing a bank bill with a face value of $104 000, payable in 120 days? A. 4% B. 12% C.12.17% D. 12.67% 23. A bank bill with a face value of $500 000 and 90 days to maturity is purchased with a yield to maturity of 6.92% per annum. After the bill has been held for 28 days, it is sold at a yield of 6.78% per annum. What is the holding period yield for the holder of the note? A. 3.23% per annum B. 7.11% per annum C. 7.15% per annum D. 7.51% per annum 24. A company invests its surplus funds by buying a commercial bill with a face value of S100 000. at a current yield to maturity of 7.35% per annum and 120 days to maturity. After 45 days, the bill is sold at a yield of 6.8496 per annum. What rate of return did the company earn on the bill? AAENGT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started