Answered step by step

Verified Expert Solution

Question

1 Approved Answer

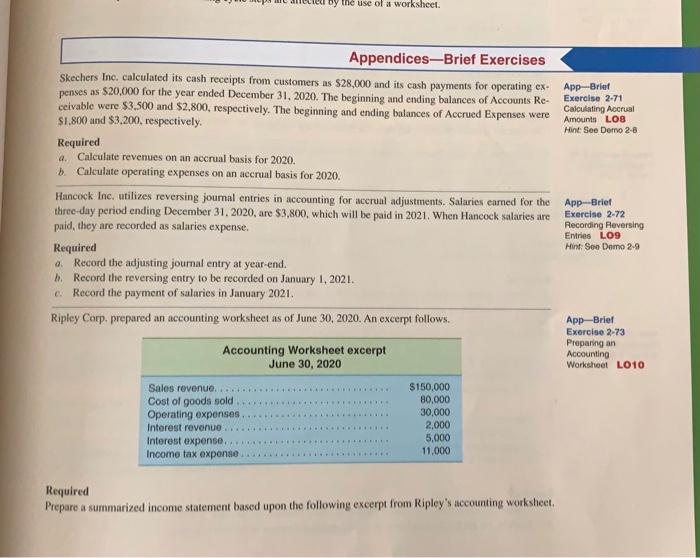

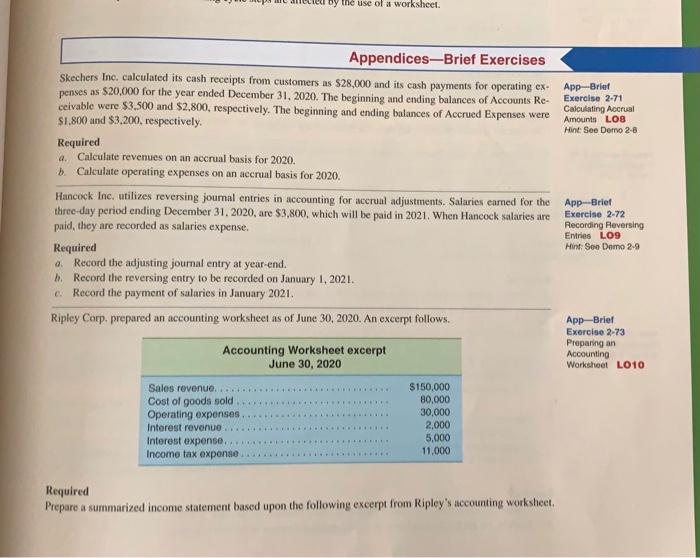

I need help with 2.71. Just a and b the use of a worksheet. Appendices-Brief Exercises Skechers Inc. calculated its cash receipts from customers as

I need help with 2.71. Just a and b

the use of a worksheet. Appendices-Brief Exercises Skechers Inc. calculated its cash receipts from customers as $28,000 and its cash payments for operating ex- App-Brief penses as $20,000 for the year ended December 31, 2020. The beginning and ending balances of Accounts Re- Exercise 2-71 ceivable were $3.500 and $2,800, respectively. The beginning and ending balances of Accrued Expenses were Calculating Accrual $1.800 and $3.200, respectively. Amounts LOS Hint See Demo 2-8 Required a. Calculate revenues on an accrual basis for 2020. 1. Calculate operating expenses on an accrual basis for 2020. Hancock Inc. utilizes reversing journal entries in accounting for necrual adjustments. Salaries earned for the App Brief three-day period ending December 31, 2020, are $3,800, which will be paid in 2021. When Hancock salaries are Exercise 2-72 paid, they are recorded as salaries expense. Recording Reversing Entries LO9 Required Hint: See Demo 2-9 a. Record the adjusting journal entry at year-end. h. Record the reversing entry to be recorded on January 1, 2021. c. Record the payment of salaries in January 2021. Ripley Corp. prepared an accounting worksheet as of June 30, 2020. An excerpt follows. AppBrief Exercise 2-73 Preparing an Accounting Worksheet excerpt Accounting June 30, 2020 Worksheet L010 Sales revenue... Cost of goods sold Operating expenses Interest revenuo Interest expenso. Income tax expense $150,000 80,000 30,000 2,000 5,000 11,000 Required Prepare a summarized income statement based upon the following excerpt from Ripley's accounting worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started