I need help with 37-40. 37. The taxpayer, Michael, owns 500 common shares of X Company. The shares were purchased for $25,000. Ho sells all

Answered step by step

Verified Expert Solution

Question

47 users unlocked this solution today!

I need help with 37-40.

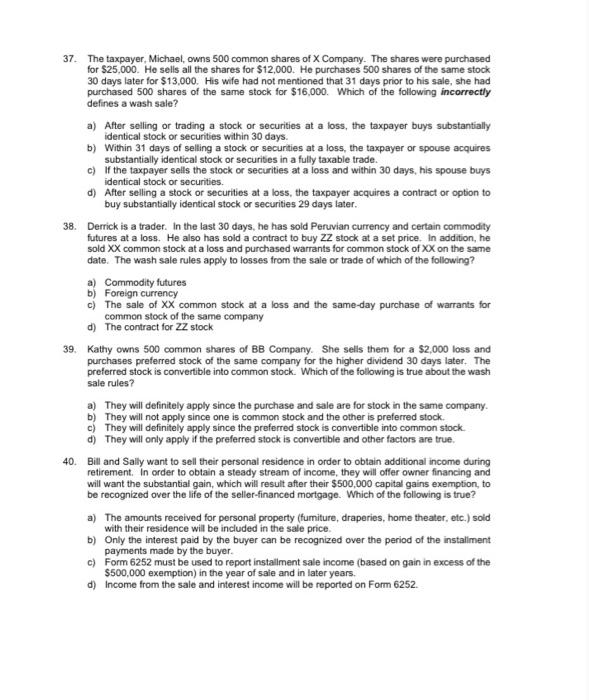

37. The taxpayer, Michael, owns 500 common shares of X Company. The shares were purchased for $25,000. Ho sells all the shares for $12,000. He purchases 500 shares of the same stock 30 days later for $13,000. His wife had not mentioned that 31 days prior to his sale, she had purchased 500 shares of the same stock for $16,000. Which of the following incorrectly defines a wash sale? a) After selling or trading a stock or securities at a loss, the taxpayer buys substantially identical stock or securities within 30 days. b) Within 31 days of selling a stock or securities at a loss, the taxpayer or spouse acquires substantially identical stock or securities in a fully taxable trade. c) If the taxpayer sells the stock or securities at a loss and within 30 days, his spouse buys identical stock or securities. d) After selling a stock or securities at a loss, the taxpayer acquires a contract or option to buy substantially identical stock or securities 29 days later. 38. Derrick is a trader. In the last 30 days, he has sold Peruvian currency and certain commodity futures at a loss. He also has sold a contract to buy ZZ stock at a set price. In addition, he sold XX common stock at a loss and purchased warrants for common stock of XX on the same date. The wash sale rules apply to losses from the sale or trade of which of the following? a) Commodity futures b) Foreign currency c) The sale of XX common stock at a loss and the same-day purchase of warrants for common stock of the same company d) The contract for ZZ stock 39. Kathy owns 500 common shares of BB Company. She sells them for a $2,000 loss and purchases preferred stock of the same company for the higher dividend 30 days later. The preferred stock is convertible into common stock. Which of the following is true about the wash sale rules? a) They will definitely apply since the purchase and sale are for stock in the same company. b) They will not apply since one is common stock and the other is preferred stock. c) They will definitely apply since the preferred stock is convertible into common stock d) They will only apply if the preferred stock is convertible and other factors are true. 40. Bill and Sally want to sell their personal residence in order to obtain additional income during retirement. In order to obtain a steady stream of income, they will offer owner financing and will want the substantial gain, which will result after their $500,000 capital gains exemption to be recognized over the life of the seller-financed mortgage. Which of the following is true? a) The amounts received for personal property (furniture, draperies, home theater, etc.) sold with their residence will be included in the sale price b) Only the interest paid by the buyer can be recognized over the period of the installment payments made by the buyer. c) Form 6252 must be used to report installment sale income (based on gain in excess of the $500,000 exemption) in the year of sale and in later years. d) Income from the sale and interest income will be reported on Form 6252. 37. The taxpayer, Michael, owns 500 common shares of X Company. The shares were purchased for $25,000. Ho sells all the shares for $12,000. He purchases 500 shares of the same stock 30 days later for $13,000. His wife had not mentioned that 31 days prior to his sale, she had purchased 500 shares of the same stock for $16,000. Which of the following incorrectly defines a wash sale? a) After selling or trading a stock or securities at a loss, the taxpayer buys substantially identical stock or securities within 30 days. b) Within 31 days of selling a stock or securities at a loss, the taxpayer or spouse acquires substantially identical stock or securities in a fully taxable trade. c) If the taxpayer sells the stock or securities at a loss and within 30 days, his spouse buys identical stock or securities. d) After selling a stock or securities at a loss, the taxpayer acquires a contract or option to buy substantially identical stock or securities 29 days later. 38. Derrick is a trader. In the last 30 days, he has sold Peruvian currency and certain commodity futures at a loss. He also has sold a contract to buy ZZ stock at a set price. In addition, he sold XX common stock at a loss and purchased warrants for common stock of XX on the same date. The wash sale rules apply to losses from the sale or trade of which of the following? a) Commodity futures b) Foreign currency c) The sale of XX common stock at a loss and the same-day purchase of warrants for common stock of the same company d) The contract for ZZ stock 39. Kathy owns 500 common shares of BB Company. She sells them for a $2,000 loss and purchases preferred stock of the same company for the higher dividend 30 days later. The preferred stock is convertible into common stock. Which of the following is true about the wash sale rules? a) They will definitely apply since the purchase and sale are for stock in the same company. b) They will not apply since one is common stock and the other is preferred stock. c) They will definitely apply since the preferred stock is convertible into common stock d) They will only apply if the preferred stock is convertible and other factors are true. 40. Bill and Sally want to sell their personal residence in order to obtain additional income during retirement. In order to obtain a steady stream of income, they will offer owner financing and will want the substantial gain, which will result after their $500,000 capital gains exemption to be recognized over the life of the seller-financed mortgage. Which of the following is true? a) The amounts received for personal property (furniture, draperies, home theater, etc.) sold with their residence will be included in the sale price b) Only the interest paid by the buyer can be recognized over the period of the installment payments made by the buyer. c) Form 6252 must be used to report installment sale income (based on gain in excess of the $500,000 exemption) in the year of sale and in later years. d) Income from the sale and interest income will be reported on Form 6252 Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards