I need help with #5 for the four basic financial statements.

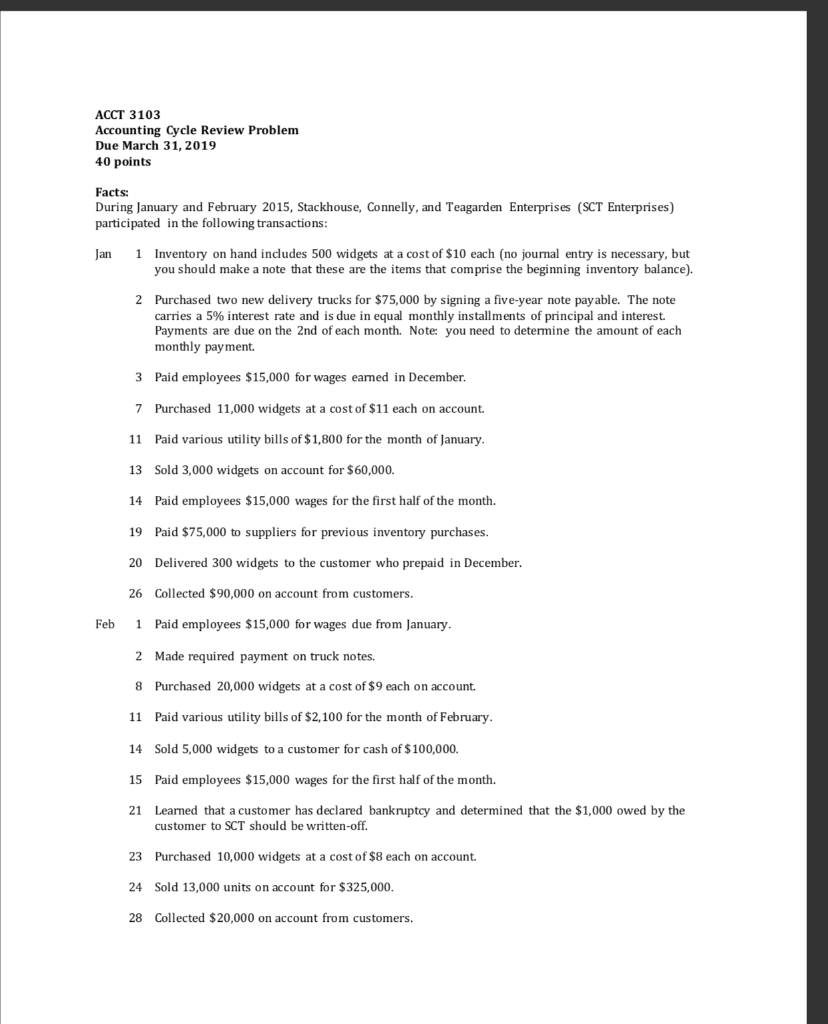

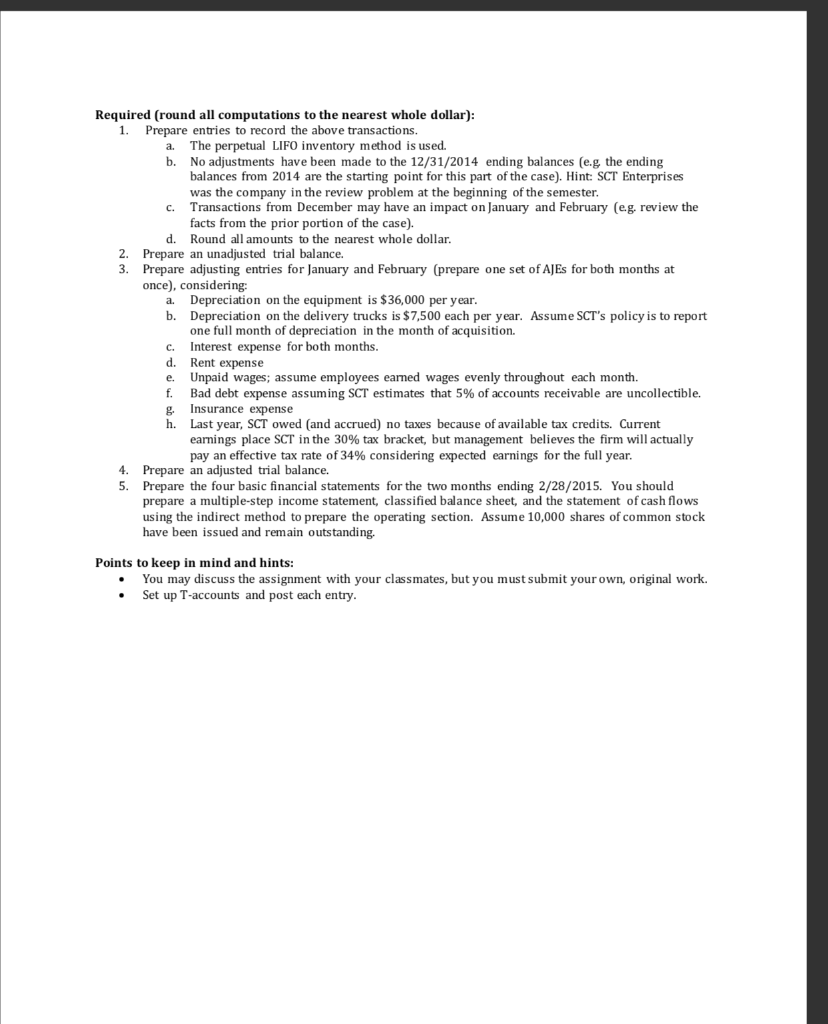

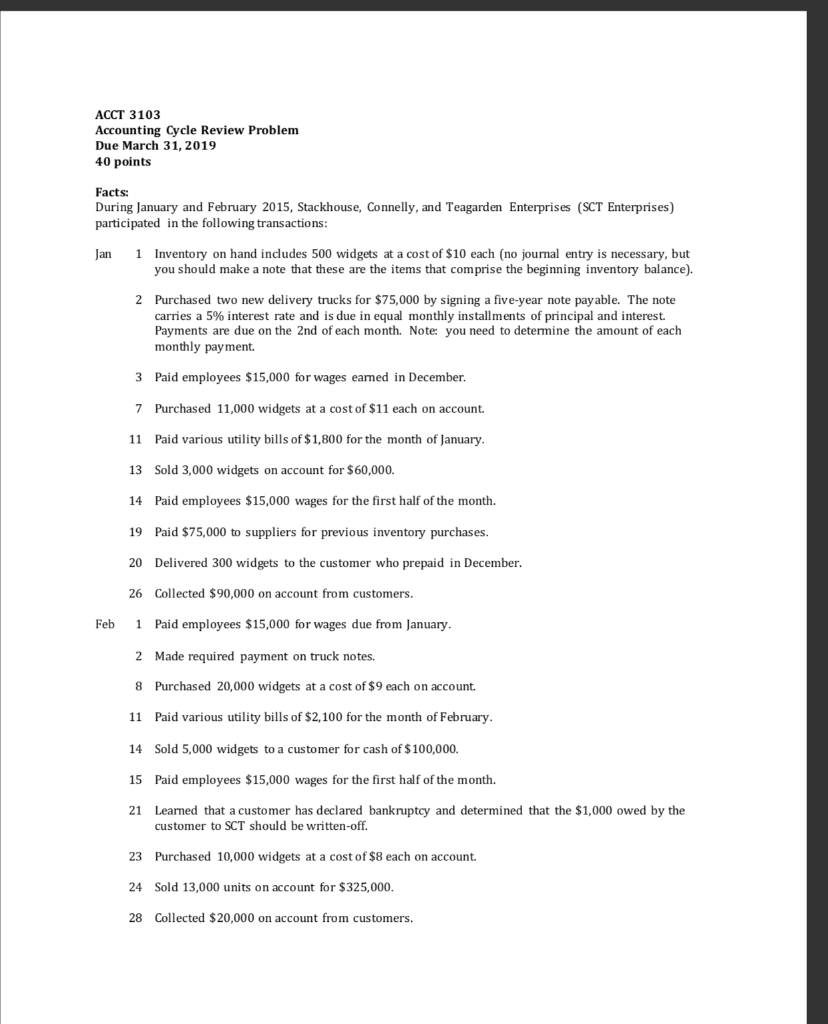

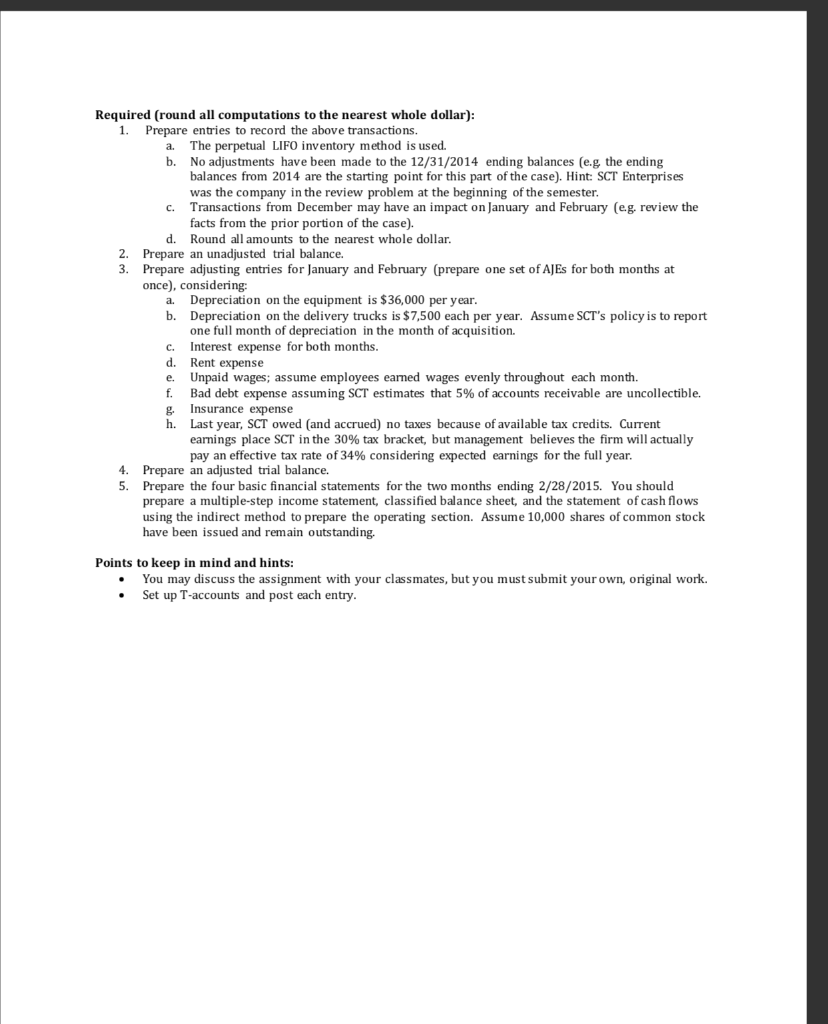

ACCT 3103 Accounting Cycle Review Problem Due March 31, 2019 40 points Facts: During January and February 2015, Stackhouse, Connelly, and Teagarden Enterprises (SCT Enterprises) participated in the following transactions Jan 1 Inventory on hand includes 500 widgets at a cost of $10 each (no journal entry is necessary, but you should make a note that these are the items that comprise the beginning inventory balance) 2 Purchased two new delivery trucks for $75,000 by signing a five-year note payable. The note carries a 5% interest rate and is due in equal monthly installments of principal and interest. Payments are due on the 2nd of each month. Note: you need to determine the amount of each monthly pay ment. 3 Paid employees $15,000 for wages earned in December 7 Purchased 11,000 widgets at a cost of $11 each on account. 11 Paid various utility bills of $1,800 for the month of January 13 Sold 3,000 widgets 14 Paid employees $15,000 wages for the first half of the month. 19 Paid $75,000 to suppliers for previous inventory purchases. 20 Delivered 300 widgets to the customer who prepaid in December. 26 Collected $90,000 on account from customers. on account for $60,000. Feb 1 Paid employees $15,000 for wages due from January 2 Made required payment on truck notes. 8 Purchased 20,000 widgets at a cost of $9 each on account. 11 Paid various utility bills of $2,100 for the month of February 14 Sold 5,000 widgets to a customer for cash of $100,000. 15 Paid employees $15,000 wages for the first half of the month. 21 Leaned that a customer has declared bankruptcy and determined that the $1,000 owed by the customer to SCT should be written-off 23 Purchased 10,000 widgets at a cost of $8 each on account. 24 Sold 13,000 units on account for $325,000 28 Collected $20,000 on account from customers Required (round all computations to the nearest whole dollar) 1. Prepare entries to record the above transactions a. The perpetual LIFO inventory method is used. b. No adjustments have been made to the 12/31/2014 ending balances (e.g, the ending balances from 2014 are the starting point for this part of the case). Hint: SCT Enterprises was the company in the review problem at the beginning of the semester C. Transactions from December may have an impact on January and February (e.g. review the facts from the prior portion of the case). d. Round all amounts to the nearest whole dollar 2. Prepare an unadjusted trial balance. 3. Prepare adjusting entries for January and February (prepare one set of AJEs for both months at once), considering: a. Depreciation on the equipment is $36,000 per year b. Depreciation on the delivery trucks is $7,500 each per year. Assume SCT's policy is to report one full month of depreciation in the month of acquisition. c. Interest expense for both months. d. Rent expense e. Unpaid wages; assume employees earned wages evenly throughout each month. f. Bad debt expense assuming SCT estimates that 5% of accounts receivable are uncollectible. g. Insurance expense h. Last year, SCT owed (and accrued) no taxes because of available tax credits. Current earnings place SCT in the 30% tax bracket, but management believes the firm will actually pay an effective tax rate of 34% considering expected earnings for the full year 4. Prepare an adjusted trial balance. 5. Prepare the four basic financial statements for the two months ending 2/28/2015. You should prepare a multiple-step income statement, classified balance sheet, and the statement of cash flows using the indirect method to prepare the operating section. Assume 10,000 shares of common stock have been issued and remain outstanding. Points to keep in mind and hints: You may discuss the assignment with your classmates, but you must submit your own, original work. Set up T-accounts and post each entry