Question: I need help with 5-13 under the required GAAP in USA Required 5-13 5.journal entries 6.post adjusted entries 7.prepare adjusted trial balance 8.prepare income statement

Required 5-13

5.journal entries 6.post adjusted entries 7.prepare adjusted trial balance 8.prepare income statement 9.prepare statement of owners equity 10.prepare balance sheet 11.journalize closing entries 12. post closing entries to ledger 13.prepare a post closing trial balance

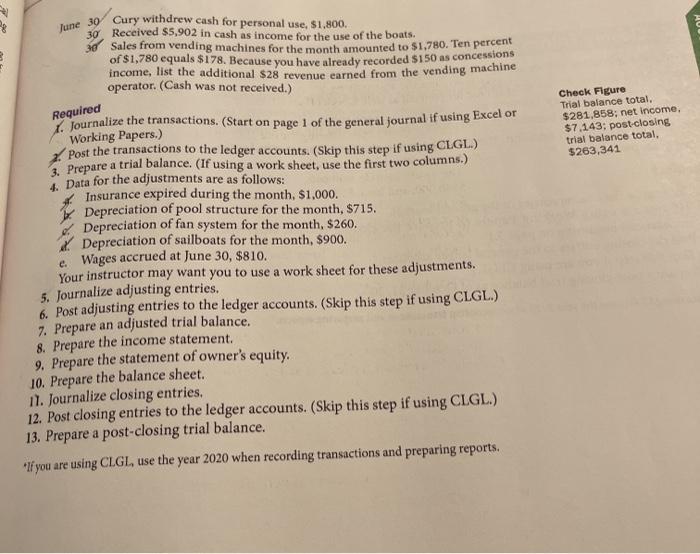

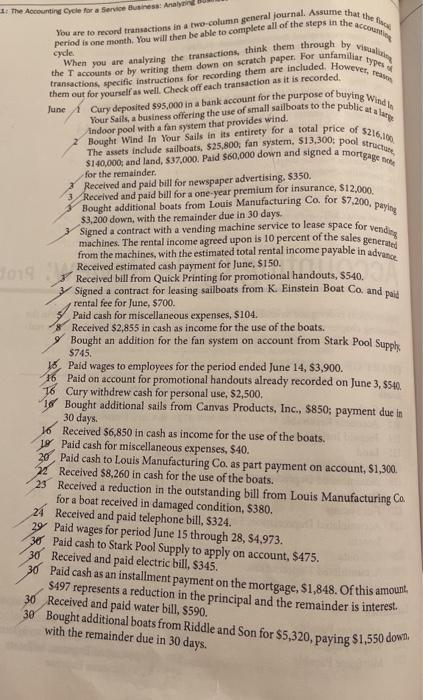

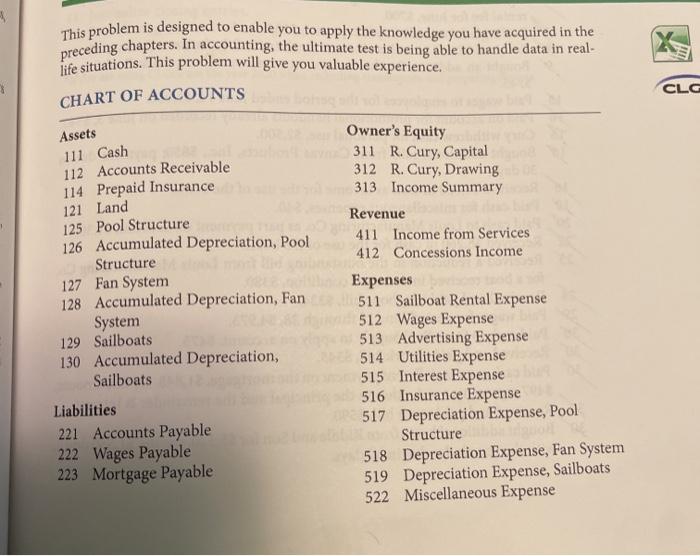

June 30 Cury withdrew cash for personal use, $1,800. 30 Received $5,902 in cash as income for the use of the boats. 30 Sales from vending machines for the month amounted to $1.780. Ten percent income, list the additional $28 revenue earned from the vending machine of $1,780 equals $178. Because you have already recorded $150 as concessions operator. (Cash was not received.) Required Check Figure Trial balance total, $281.858, net income. $7.143: post-closing trial balance total $263,341 1. Journalize the transactions. (Start on page 1 of the general journal if using Excel or 2. Post the transactions to the ledger accounts. (Skip this step if using CLGL) 3. Prepare a trial balance. (If using a work sheet, use the first two columns.) 4. Data for the adjustments are as follows: Insurance expired during the month, $1.000, Depreciation of pool structure for the month, $715. Depreciation of fan system for the month, $260. 2 Depreciation of sailboats for the month, $900. e Wages accrued at June 30, $810. Your instructor may want you to use a work sheet for these adjustments. 5. Journalize adjusting entries. 6. Post adjusting entries to the ledger accounts. (Skip this step if using CLGL.) 7. Prepare an adjusted trial balance. 8. Prepare the income statement. 9. Prepare the statement of owner's equity. 10. Prepare the balance sheet. 17. Journalize closing entries. 12. Post closing entries to the ledger accounts. (Skip this step if using CLGL.) 13. Prepare a post-closing trial balance. "If you are using CLGL, use the year 2020 when recording transactions and preparing reports. ac 1The Accounting Cycle for a Service Business Analynn You are to record transactions in a two-column general journal. Assume that this period is one month. You will then be able to complete all of the steps in the cycle the T accounts or by writing them down on scratch paper. For unfamiliar types When you are analyzing the transactions, think them through by Visa transactions, specific instructions for recording them are included. However, them off transaction as it is June 1 Cury deposited $95,000 in a bank account for the purpose of buying Wit Your Sails, a business offering the use of small sailboats to the publicat Indoor pool with a fan system that provides wind. Bought Wind In Your Sails in its entirety for a total price of $216, The assets include sailboats, $25,800; fan system, $13,300: pool structure, $140,000, and land, S37,000. Paid $60,000 down and signed a mortgage for the remainder. Received and paid bill for newspaper advertising. $350. 3 Received and paid bill for a one-year premium for insurance, $12.000. Bought additional boats from Louis Manufacturing Co. for $7,200. paying $3.200 down, with the remainder due in 30 days Signed a contract with a vending machine service to lease space for vendin machines. The rental income agreed upon is 10 percent of the sales generale from the machines, with the estimated total rental income payable in advance Joey Received et frated and printing for promotional handouts, 6540. Signed a contract for leasing sailboats from K. Einstein Boat Co and paid rental fee for June, $700. Paid cash for miscellaneous expenses, $104. Received $2,855 in cash as income for the use of the boats. Bought an addition for the fan system on account from Stark Pool Supphe $745, Paid wages to employees for the period ended June 14, S3,900. 16 Paid on account for promotional handouts already recorded on June 3, 5540 16 Cury withdrew cash for personal use, $2,500. 16 Bought additional sails from Canvas Products, Inc., $850; payment due in 30 days. Received $6,850 in cash as income for the use of the boats. 19 Paid cash for miscellaneous expenses, $40. 20 Paid cash to Louis Manufacturing Co. as part payment on account, $1,300. 24 Received $8,260 in cash for the use of the boats. 25 Received a reduction in the outstanding bill from Louis Manufacturing Co. for a boat received in damaged condition, $380. 24 Received and paid telephone bill, 5324. 29 Paid wages for period June 15 through 28, S4,973. 30 Paid cash to Stark Pool Supply to apply on account, $475. 30 Received and paid electric bill, $345. 30 Paid cash as an installment payment on the mortgage, $1,848. Of this amount S497 represents a reduction in the principal and the remainder is interest. 30 Received and paid water bill, S590. 30 Bought additional boats from Riddle and Son for $5,320, paying $1,550 dowti with the remainder due in 30 days. X CLC Assets 111 Cash This problem is designed to enable you to apply the knowledge you have acquired in the life situations. This problem will give you valuable experience. preceding chapters. In accounting, the ultimate test is being able to handle data in real- CHART OF ACCOUNTS Owner's Equity 311 R. Cury, Capital 112 Accounts Receivable 312 R. Cury, Drawing 114 Prepaid Insurance 313 Income Summary 121 Land Revenue 125 Pool Structure 126 Accumulated Depreciation, Pool 411 Income from Services Structure 412 Concessions Income 127 Fan System Expenses 128 Accumulated Depreciation, Fan 511 Sailboat Rental Expense System 512 Wages Expense 129 Sailboats 513 Advertising Expense 130 Accumulated Depreciation, 514 Utilities Expense Sailboats 515 Interest Expense Liabilities 516 Insurance Expense 221 Accounts Payable 517 Depreciation Expense, Pool Structure 222 Wages Payable 518 Depreciation Expense, Fan System 223 Mortgage Payable 519 Depreciation Expense, Sailboats 522 Miscellaneous Expense June 30 Cury withdrew cash for personal use, $1,800. 30 Received $5,902 in cash as income for the use of the boats. 30 Sales from vending machines for the month amounted to $1.780. Ten percent income, list the additional $28 revenue earned from the vending machine of $1,780 equals $178. Because you have already recorded $150 as concessions operator. (Cash was not received.) Required Check Figure Trial balance total, $281.858, net income. $7.143: post-closing trial balance total $263,341 1. Journalize the transactions. (Start on page 1 of the general journal if using Excel or 2. Post the transactions to the ledger accounts. (Skip this step if using CLGL) 3. Prepare a trial balance. (If using a work sheet, use the first two columns.) 4. Data for the adjustments are as follows: Insurance expired during the month, $1.000, Depreciation of pool structure for the month, $715. Depreciation of fan system for the month, $260. 2 Depreciation of sailboats for the month, $900. e Wages accrued at June 30, $810. Your instructor may want you to use a work sheet for these adjustments. 5. Journalize adjusting entries. 6. Post adjusting entries to the ledger accounts. (Skip this step if using CLGL.) 7. Prepare an adjusted trial balance. 8. Prepare the income statement. 9. Prepare the statement of owner's equity. 10. Prepare the balance sheet. 17. Journalize closing entries. 12. Post closing entries to the ledger accounts. (Skip this step if using CLGL.) 13. Prepare a post-closing trial balance. "If you are using CLGL, use the year 2020 when recording transactions and preparing reports. ac 1The Accounting Cycle for a Service Business Analynn You are to record transactions in a two-column general journal. Assume that this period is one month. You will then be able to complete all of the steps in the cycle the T accounts or by writing them down on scratch paper. For unfamiliar types When you are analyzing the transactions, think them through by Visa transactions, specific instructions for recording them are included. However, them off transaction as it is June 1 Cury deposited $95,000 in a bank account for the purpose of buying Wit Your Sails, a business offering the use of small sailboats to the publicat Indoor pool with a fan system that provides wind. Bought Wind In Your Sails in its entirety for a total price of $216, The assets include sailboats, $25,800; fan system, $13,300: pool structure, $140,000, and land, S37,000. Paid $60,000 down and signed a mortgage for the remainder. Received and paid bill for newspaper advertising. $350. 3 Received and paid bill for a one-year premium for insurance, $12.000. Bought additional boats from Louis Manufacturing Co. for $7,200. paying $3.200 down, with the remainder due in 30 days Signed a contract with a vending machine service to lease space for vendin machines. The rental income agreed upon is 10 percent of the sales generale from the machines, with the estimated total rental income payable in advance Joey Received et frated and printing for promotional handouts, 6540. Signed a contract for leasing sailboats from K. Einstein Boat Co and paid rental fee for June, $700. Paid cash for miscellaneous expenses, $104. Received $2,855 in cash as income for the use of the boats. Bought an addition for the fan system on account from Stark Pool Supphe $745, Paid wages to employees for the period ended June 14, S3,900. 16 Paid on account for promotional handouts already recorded on June 3, 5540 16 Cury withdrew cash for personal use, $2,500. 16 Bought additional sails from Canvas Products, Inc., $850; payment due in 30 days. Received $6,850 in cash as income for the use of the boats. 19 Paid cash for miscellaneous expenses, $40. 20 Paid cash to Louis Manufacturing Co. as part payment on account, $1,300. 24 Received $8,260 in cash for the use of the boats. 25 Received a reduction in the outstanding bill from Louis Manufacturing Co. for a boat received in damaged condition, $380. 24 Received and paid telephone bill, 5324. 29 Paid wages for period June 15 through 28, S4,973. 30 Paid cash to Stark Pool Supply to apply on account, $475. 30 Received and paid electric bill, $345. 30 Paid cash as an installment payment on the mortgage, $1,848. Of this amount S497 represents a reduction in the principal and the remainder is interest. 30 Received and paid water bill, S590. 30 Bought additional boats from Riddle and Son for $5,320, paying $1,550 dowti with the remainder due in 30 days. X CLC Assets 111 Cash This problem is designed to enable you to apply the knowledge you have acquired in the life situations. This problem will give you valuable experience. preceding chapters. In accounting, the ultimate test is being able to handle data in real- CHART OF ACCOUNTS Owner's Equity 311 R. Cury, Capital 112 Accounts Receivable 312 R. Cury, Drawing 114 Prepaid Insurance 313 Income Summary 121 Land Revenue 125 Pool Structure 126 Accumulated Depreciation, Pool 411 Income from Services Structure 412 Concessions Income 127 Fan System Expenses 128 Accumulated Depreciation, Fan 511 Sailboat Rental Expense System 512 Wages Expense 129 Sailboats 513 Advertising Expense 130 Accumulated Depreciation, 514 Utilities Expense Sailboats 515 Interest Expense Liabilities 516 Insurance Expense 221 Accounts Payable 517 Depreciation Expense, Pool Structure 222 Wages Payable 518 Depreciation Expense, Fan System 223 Mortgage Payable 519 Depreciation Expense, Sailboats 522 Miscellaneous Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts