Answered step by step

Verified Expert Solution

Question

1 Approved Answer

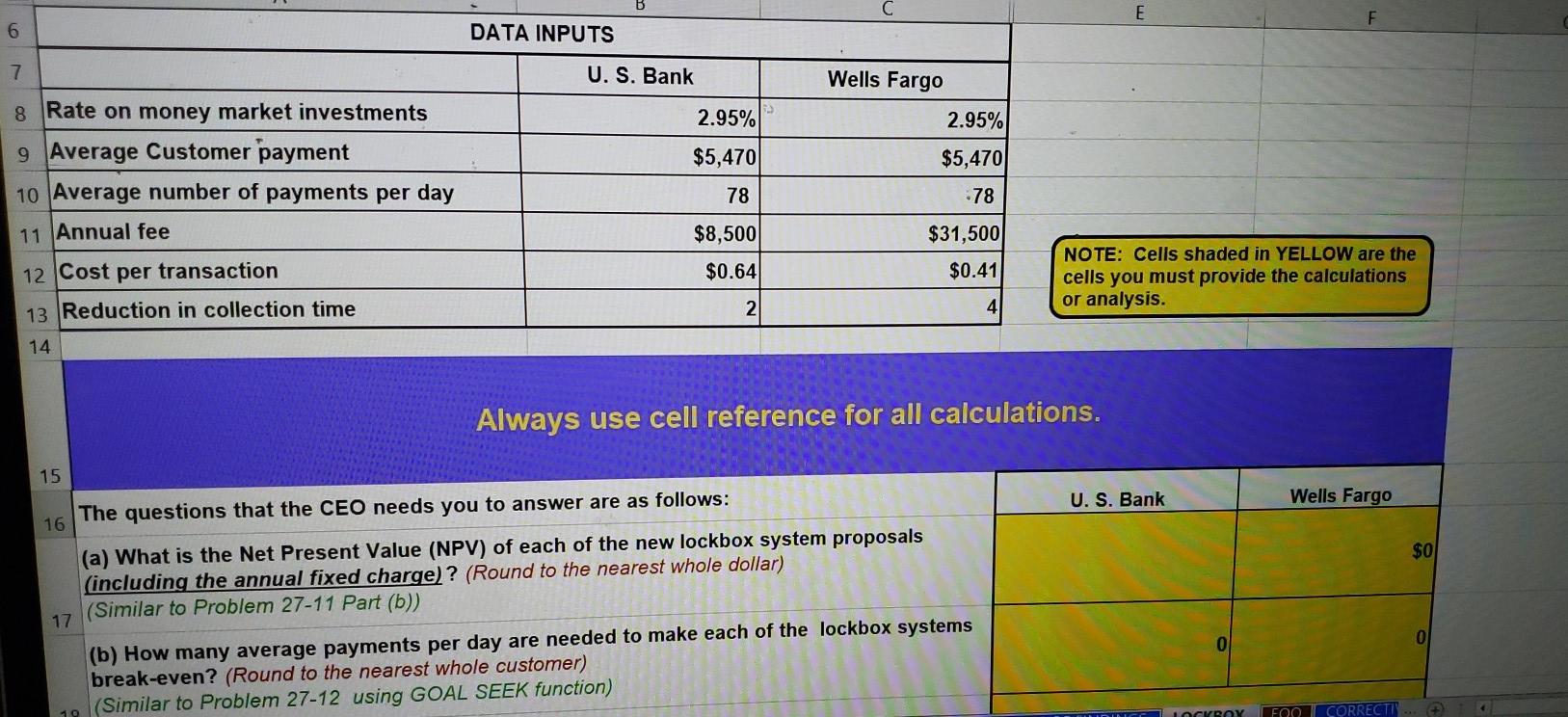

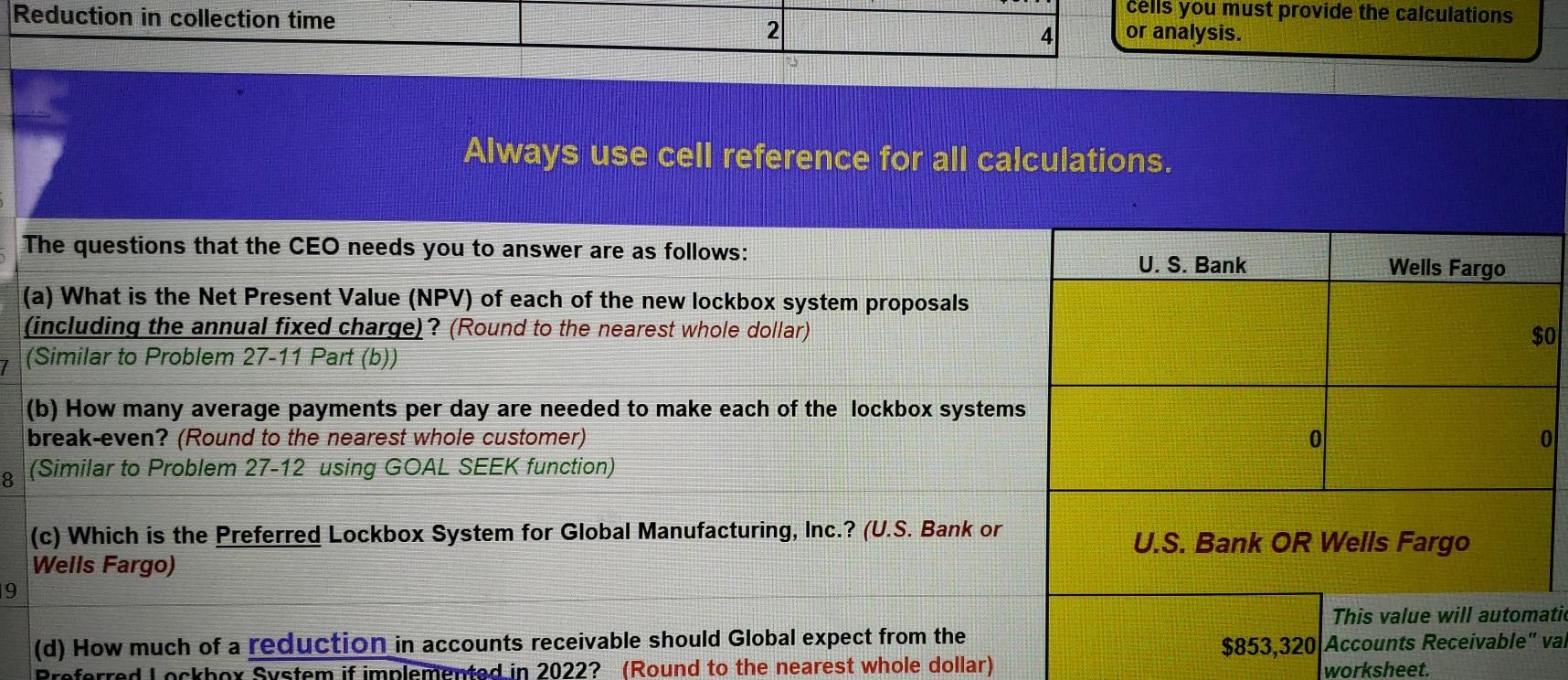

I need help with a, b, c. please show work and ill rate! E F 6 DATA INPUTS 7 U. S. Bank Wells Fargo 2.95%

I need help with a, b, c. please show work and ill rate!

E F 6 DATA INPUTS 7 U. S. Bank Wells Fargo 2.95% 2.95% $5,470 $5,470 78 -78 8 Rate on money market investments 9 Average Customer payment 10 Average number of payments per day 11 Annual fee 12 Cost per transaction 13 Reduction in collection time $31,500 $8,500 $0.64 $0.41 NOTE: Cells shaded in YELLOW are the cells you must provide the calculations or analysis. 2 4 14 Always use cell reference for all calculations. 15 U.S. Bank Wells Fargo $0 16 The questions that the CEO needs you to answer are as follows: (a) What is the Net Present Value (NPV) of each of the new lockbox system proposals (including the annual fixed charge)? (Round to the nearest whole dollar) 17 (Similar to Problem 27-11 Part (b)) (b) How many average payments per day are needed to make each of the lockbox systems break-even? (Round to the nearest whole customer) (Similar to Problem 27-12 using GOAL SEEK function) 0 LOVROY FOO CORRECTUS Reduction in collection time 2 cells you must provide the calculations or analysis. 4 Always use cell reference for all calculations. The questions that the CEO needs you to answer are as follows: U.S. Bank Wells Fargo (a) What is the Net Present Value (NPV) of each of the new lockbox system proposals (including the annual fixed charge)? (Round to the nearest whole dollar) (Similar to Problem 27-11 Part (b)) $0 (b) How many average payments per day are needed to make each of the lockbox systems break-even? (Round to the nearest whole customer) (Similar to Problem 27-12 using GOAL SEEK function) 0 0 (c) Which is the Preferred Lockbox System for Global Manufacturing, Inc.? (U.S. Bank or Wells Fargo) 19 U.S. Bank OR Wells Fargo (d) How much of a reduction in accounts receivable should Global expect from the Preferred Lockhoy System if imnlemented in 2022? (Round to the nearest whole dollar) This value will automatic $853,320 Accounts Receivable" val worksheet. E F 6 DATA INPUTS 7 U. S. Bank Wells Fargo 2.95% 2.95% $5,470 $5,470 78 -78 8 Rate on money market investments 9 Average Customer payment 10 Average number of payments per day 11 Annual fee 12 Cost per transaction 13 Reduction in collection time $31,500 $8,500 $0.64 $0.41 NOTE: Cells shaded in YELLOW are the cells you must provide the calculations or analysis. 2 4 14 Always use cell reference for all calculations. 15 U.S. Bank Wells Fargo $0 16 The questions that the CEO needs you to answer are as follows: (a) What is the Net Present Value (NPV) of each of the new lockbox system proposals (including the annual fixed charge)? (Round to the nearest whole dollar) 17 (Similar to Problem 27-11 Part (b)) (b) How many average payments per day are needed to make each of the lockbox systems break-even? (Round to the nearest whole customer) (Similar to Problem 27-12 using GOAL SEEK function) 0 LOVROY FOO CORRECTUS Reduction in collection time 2 cells you must provide the calculations or analysis. 4 Always use cell reference for all calculations. The questions that the CEO needs you to answer are as follows: U.S. Bank Wells Fargo (a) What is the Net Present Value (NPV) of each of the new lockbox system proposals (including the annual fixed charge)? (Round to the nearest whole dollar) (Similar to Problem 27-11 Part (b)) $0 (b) How many average payments per day are needed to make each of the lockbox systems break-even? (Round to the nearest whole customer) (Similar to Problem 27-12 using GOAL SEEK function) 0 0 (c) Which is the Preferred Lockbox System for Global Manufacturing, Inc.? (U.S. Bank or Wells Fargo) 19 U.S. Bank OR Wells Fargo (d) How much of a reduction in accounts receivable should Global expect from the Preferred Lockhoy System if imnlemented in 2022? (Round to the nearest whole dollar) This value will automatic $853,320 Accounts Receivable" val worksheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started