I need help with a Cumulative Comprehension Problem: Echo Systems.

I have done the Journal Entrees, but need help with the Trial balance, income statement and statement of changes and balance sheet for the October entries and in the second part the same with a Nov, but I think Nov the changes have to be for two months I have attached the whole problem for A and B it's all one project.

Thank you in advance

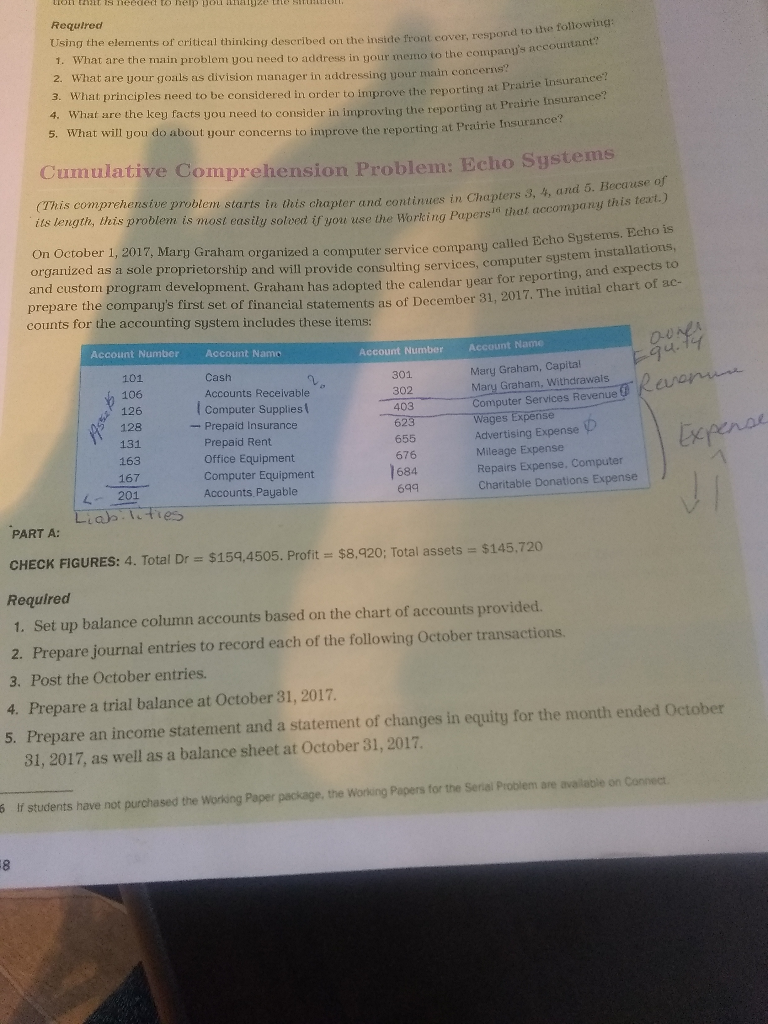

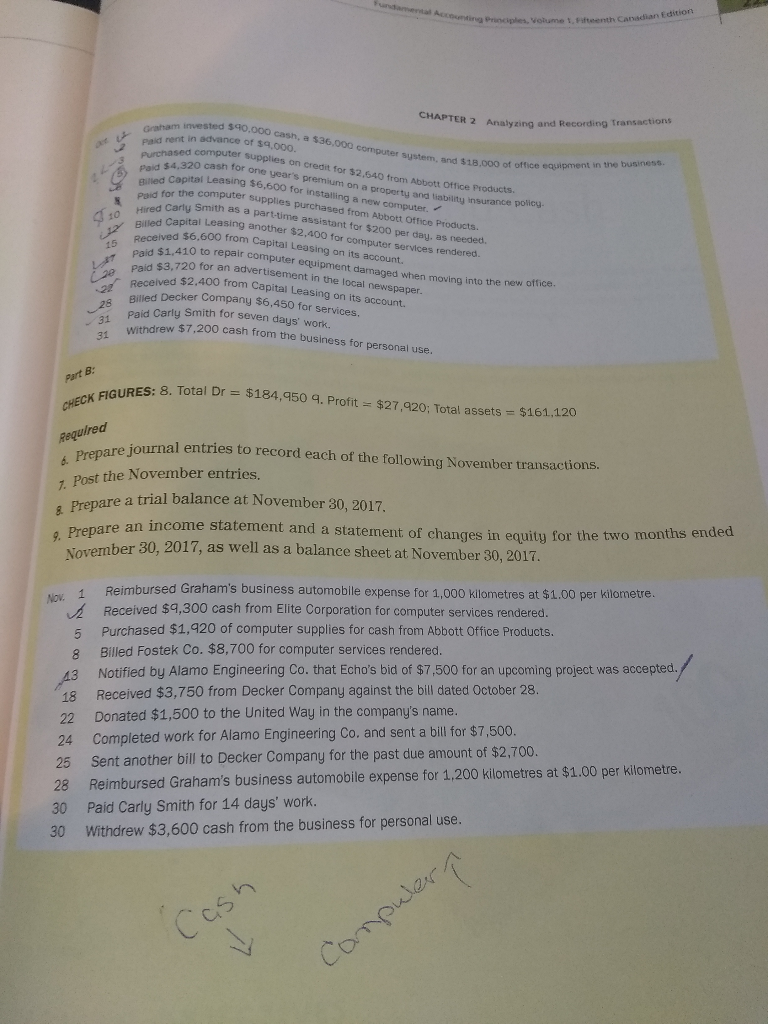

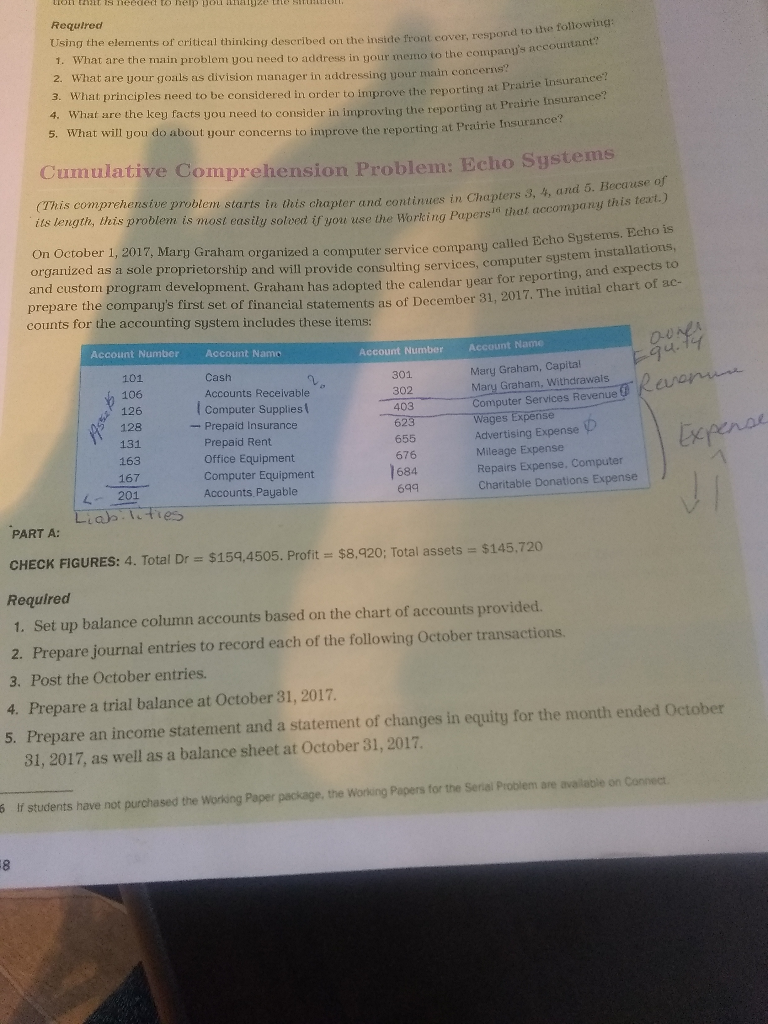

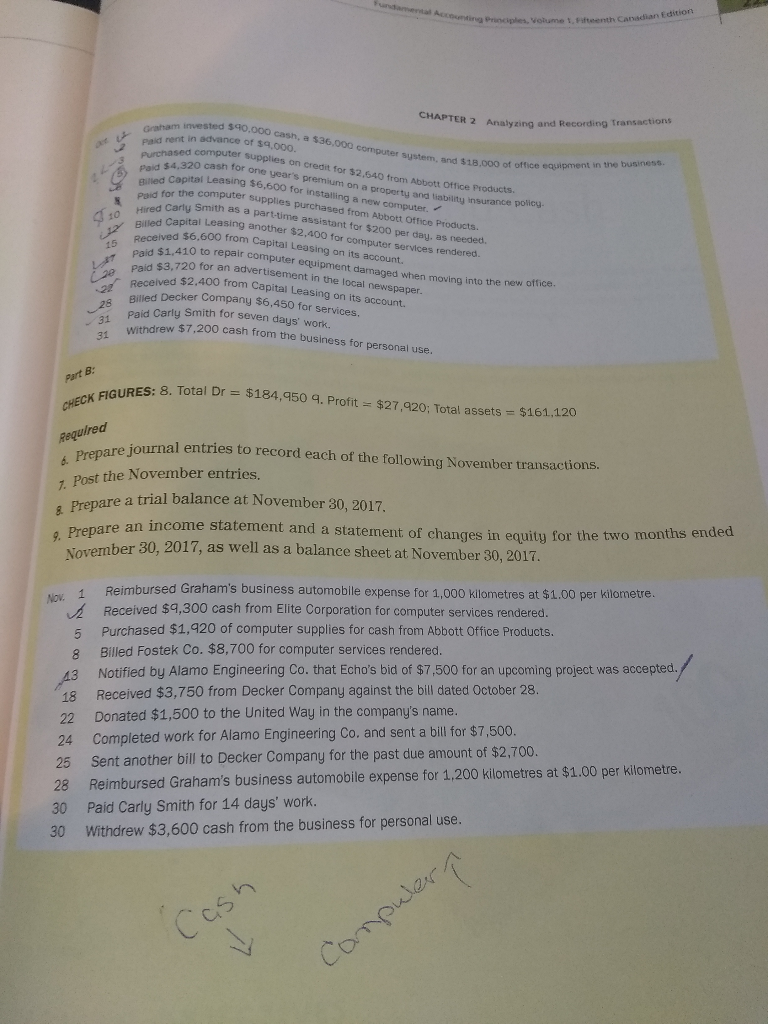

Requlred Using the elements of critical thinking described on the inside front cover, re 1. What are the main problem you need to address in your meio to the companys 2. What are your goals as division manager in addressing your main concers 3. What principles need to be considered in order to improve the reporting a 4. What are the key facts you need to consider in improving the reporting at 5. What will you do about your concerns to improve the reporting at o the following: spon t Prairie Insurance? Cumulative Comprehension Problem: Echo Systems 3, 4, and 6. Because o that accompany this text.) (This comprehenstve problem starts in this chapter and continues in Chapters its length, theis problem is most easily solced if you use the Working Pupers On October 1, 2017, Mary Graham organized a computer service company organized as a sole proprietorship and will provide consulting services, c called Echo Systems. Echo is mputer system insta tlstorm program development. Graham has adopted the calendar uear for reporting, and expects to prepare the company's first set of financial statements as of December 31, 2017. The initial ehart of a counts for the accounting system includes these items Account Number Accoumt Namo Cash Accounts Recelvable Computer Supplies Account Nar Account Number 101 106 126 128 131 163 167 Mary Graham, Capital Mary Graham, Withdrawals Computer Services Revenue 302 403 623 655 676 684 699 - Prepaid Insurance Advertising Expense Mileage Expense Repairs Expense, Computer Charitable Donations Expense Prepaid Rent Office Equipment Computer Equipment Accounts Payable 4 201 ttes PART A: CHECK FIGURES: 4. Total Dr $159,4505. Profit $8,920; Total assets $145,720 Required 1. Set up balance column accounts based on the chart of accounts provided 2. Prepare journal entries to record each of the following October transactions 3. Post the October entries. 4. Prepare a trial balance at October 31, 2017 5. Prepare an income statement and a statement of changes in equity for the month ended October 31, 2017, as well as a balance sheet at October 31, 2017 students have not purchased the Working Paper package, the working Papers for the Senai Problem an lalable on Connect. 8 2 Analyzing and Recording Transactions ted 340.000 cash, a $36,000 computer systerm Graham invested rent in advance of s.o0 Pad aed computer supplies on cs rent in advance of sq,000. supplies on credit for $2,640 from Abbott Office and 18,000 of office equipment in the business. s Purchased cash for one year's premium on a property and Leasing $6,600 for installing a new computer Products tiability insurance policy- for the computer supplies Carly Smith as a partime ailed Capital Leasing another $2,400 for from Abbott Office for $200 per day. as computer assistant fo Received $6.600 from Capital Leg 15 1.410 to repair computer on i r equipment damaged when moving into the new office 3.720 for an advertisement in the local Received $2.400 from Capital Leasing on its account. t in the local newspaper. 22 Biled Decker Company $6,450 for services. Paid Carly Smith for seven days' work 28 - rew $7,200 cash from the business for personal use. part B: s: 8. Total Dr $184950 q. Profit $27.920; Total assets = $161,120 are journal entries to record each of the following November transactions. 7. Post the November entries. & Prepare a a trial balance at November 30, 2017. an income statement and a statement of changes in equity for the two mont he ber 30, 2017, as well as a balance sheet at November 30, 2017. 1 Reimbursed Graham's business automobile expense for 1,000 klometres at $1.00 per kilometre. Received $9,300 cash from Elite Corporation for computer services rendered. 5 Purchased $1,920 of computer supplies for cash from Abbott Office Products Notified by Alamo Engineering Co. that Echo's bid of $7,500 for an upcoming project was accepted. Received $3,750 from Decker Company against the bill dated October 28. Donated $1,500 to the United Way in the company's name. Completed work for Alamo Engineering Co. and sent a bill for $7,500. Sent another bill to Decker Company for the past due amount of $2,700. Billed Fostek Co. $8,700 for computer services rendered. 8 3 18 22 24 25 28 Reimbursed Graham's business automobile expense for 1,200 kilometres at $1.00 per kilometre. 30 Paid Carly Smith for 14 days' work. 30 Withdrew $3,600 cash from the business for personal use. Requlred Using the elements of critical thinking described on the inside front cover, re 1. What are the main problem you need to address in your meio to the companys 2. What are your goals as division manager in addressing your main concers 3. What principles need to be considered in order to improve the reporting a 4. What are the key facts you need to consider in improving the reporting at 5. What will you do about your concerns to improve the reporting at o the following: spon t Prairie Insurance? Cumulative Comprehension Problem: Echo Systems 3, 4, and 6. Because o that accompany this text.) (This comprehenstve problem starts in this chapter and continues in Chapters its length, theis problem is most easily solced if you use the Working Pupers On October 1, 2017, Mary Graham organized a computer service company organized as a sole proprietorship and will provide consulting services, c called Echo Systems. Echo is mputer system insta tlstorm program development. Graham has adopted the calendar uear for reporting, and expects to prepare the company's first set of financial statements as of December 31, 2017. The initial ehart of a counts for the accounting system includes these items Account Number Accoumt Namo Cash Accounts Recelvable Computer Supplies Account Nar Account Number 101 106 126 128 131 163 167 Mary Graham, Capital Mary Graham, Withdrawals Computer Services Revenue 302 403 623 655 676 684 699 - Prepaid Insurance Advertising Expense Mileage Expense Repairs Expense, Computer Charitable Donations Expense Prepaid Rent Office Equipment Computer Equipment Accounts Payable 4 201 ttes PART A: CHECK FIGURES: 4. Total Dr $159,4505. Profit $8,920; Total assets $145,720 Required 1. Set up balance column accounts based on the chart of accounts provided 2. Prepare journal entries to record each of the following October transactions 3. Post the October entries. 4. Prepare a trial balance at October 31, 2017 5. Prepare an income statement and a statement of changes in equity for the month ended October 31, 2017, as well as a balance sheet at October 31, 2017 students have not purchased the Working Paper package, the working Papers for the Senai Problem an lalable on Connect. 8 2 Analyzing and Recording Transactions ted 340.000 cash, a $36,000 computer systerm Graham invested rent in advance of s.o0 Pad aed computer supplies on cs rent in advance of sq,000. supplies on credit for $2,640 from Abbott Office and 18,000 of office equipment in the business. s Purchased cash for one year's premium on a property and Leasing $6,600 for installing a new computer Products tiability insurance policy- for the computer supplies Carly Smith as a partime ailed Capital Leasing another $2,400 for from Abbott Office for $200 per day. as computer assistant fo Received $6.600 from Capital Leg 15 1.410 to repair computer on i r equipment damaged when moving into the new office 3.720 for an advertisement in the local Received $2.400 from Capital Leasing on its account. t in the local newspaper. 22 Biled Decker Company $6,450 for services. Paid Carly Smith for seven days' work 28 - rew $7,200 cash from the business for personal use. part B: s: 8. Total Dr $184950 q. Profit $27.920; Total assets = $161,120 are journal entries to record each of the following November transactions. 7. Post the November entries. & Prepare a a trial balance at November 30, 2017. an income statement and a statement of changes in equity for the two mont he ber 30, 2017, as well as a balance sheet at November 30, 2017. 1 Reimbursed Graham's business automobile expense for 1,000 klometres at $1.00 per kilometre. Received $9,300 cash from Elite Corporation for computer services rendered. 5 Purchased $1,920 of computer supplies for cash from Abbott Office Products Notified by Alamo Engineering Co. that Echo's bid of $7,500 for an upcoming project was accepted. Received $3,750 from Decker Company against the bill dated October 28. Donated $1,500 to the United Way in the company's name. Completed work for Alamo Engineering Co. and sent a bill for $7,500. Sent another bill to Decker Company for the past due amount of $2,700. Billed Fostek Co. $8,700 for computer services rendered. 8 3 18 22 24 25 28 Reimbursed Graham's business automobile expense for 1,200 kilometres at $1.00 per kilometre. 30 Paid Carly Smith for 14 days' work. 30 Withdrew $3,600 cash from the business for personal use