Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with all requirements Verizon Manufacturing, Inc. purchased a new piece of manufacturing equipment at a total acquisition cost of $2,800,000 on January

I need help with all requirements

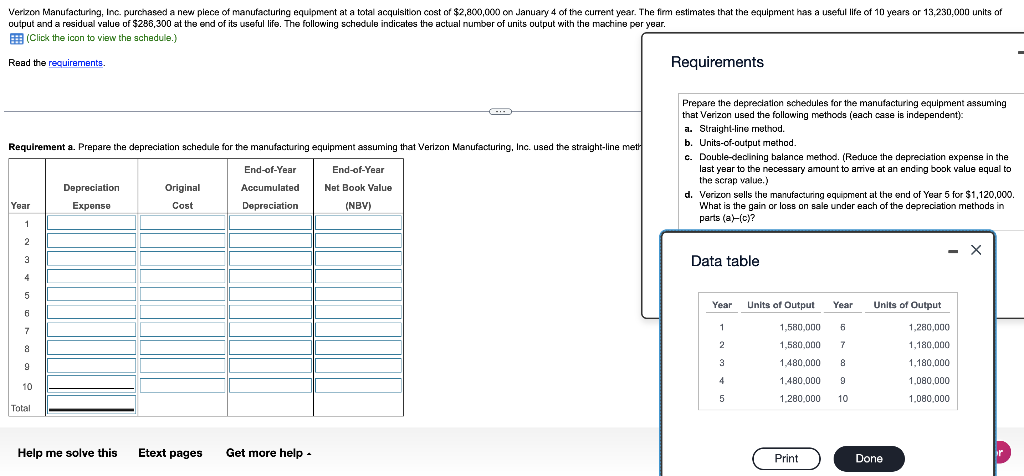

Verizon Manufacturing, Inc. purchased a new piece of manufacturing equipment at a total acquisition cost of $2,800,000 on January 4 of the current year. The fimm estimates that the equipment has a useful life of 10 years or 13,230.000 units of output and a residual value of $286,300 at the end of its useful life. The following schedule indicates the actual number of units output with the machine per year. (Click the icon to view the schedule.) Read the requirements. Requirements Requirement a. Prepare the depreciation schedule for the manufacturing equipment assuming that Verizon Manufacturing, Inc. used the straight-line metr a Prepare the depreciation schedules for the manufacturing equipment assuming that Verizon used the following methods (each case is independent): a. Straight-line method. b. Units-of-output method c. Double-declining balance method. (Reduce the depreciation expense in the last year to the necessary amount to arrive at an ending book value equal to the scrap value.) d. Verizon sells the manufacturing equipment at the end of Year 5 for $1,120,000. What is the gain or loss on sale under each of the depreciation methods in parts (a)-(c)? End-of-Year End-of-Year Original Net Book Value Depreciation Expenso Accumulated Depreciation Year Cost (NBV) 1 2 - X 3 Data table 4 5 5 Year Units of Output Year Units of Output 6 7 1 6 1,580,000 1,580,000 8 2 7 1,280,000 1,180,000 1,180,000 3 1,480,000 8 9 4 9 1,080.000 10 1.480.000 1.280.000 5 10 1.080.000 Total Help me solve this Etext pages Get more help or Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started