Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help with an equation for unrealized holding loss on security investments net of tax Reporting a companive Income Statement con 410.000, and med

i need help with an equation for unrealized holding loss on security investments net of tax

i need help with an equation for unrealized holding loss on security investments net of tax

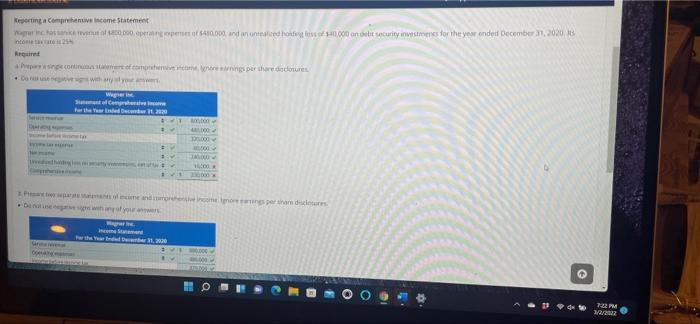

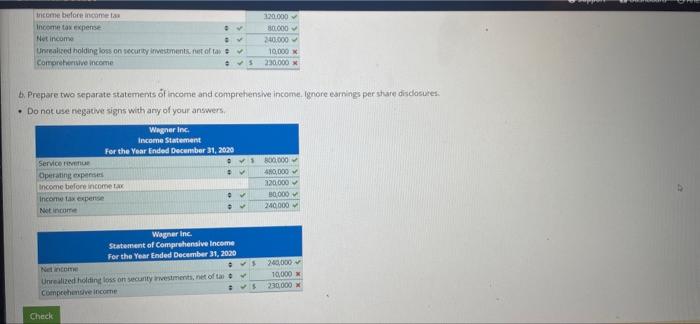

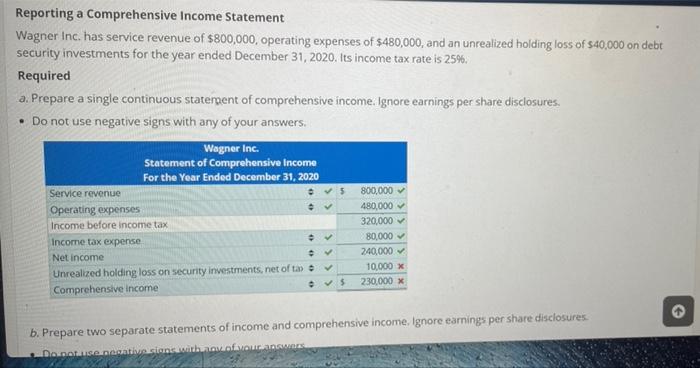

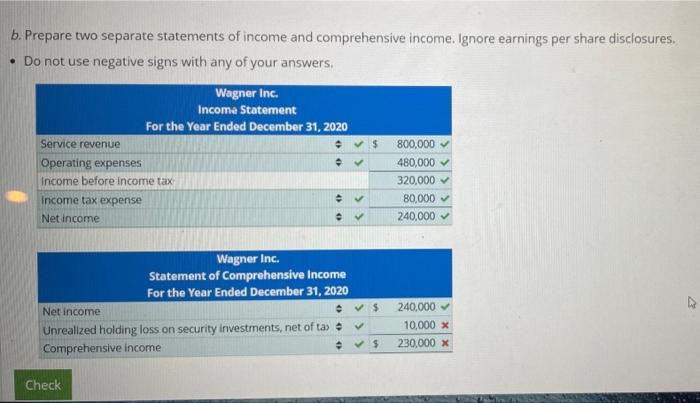

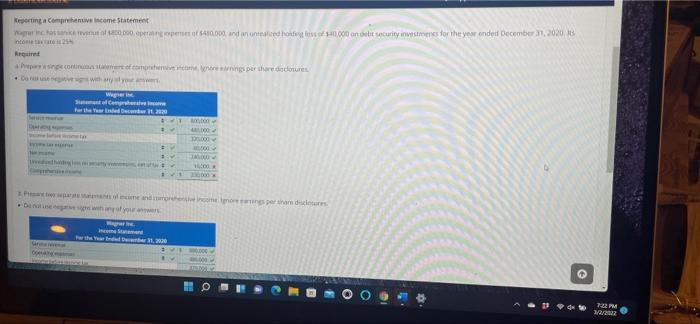

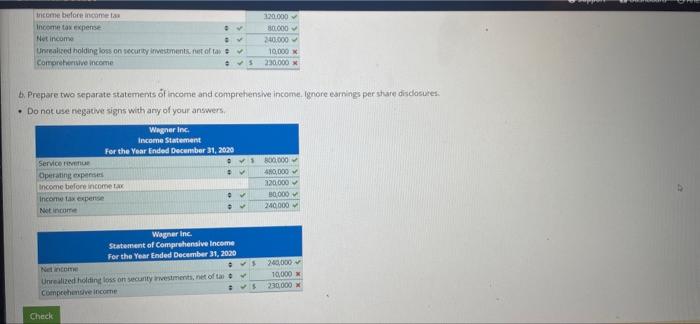

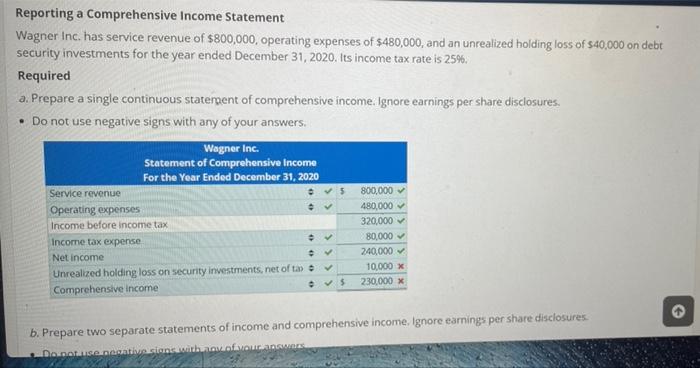

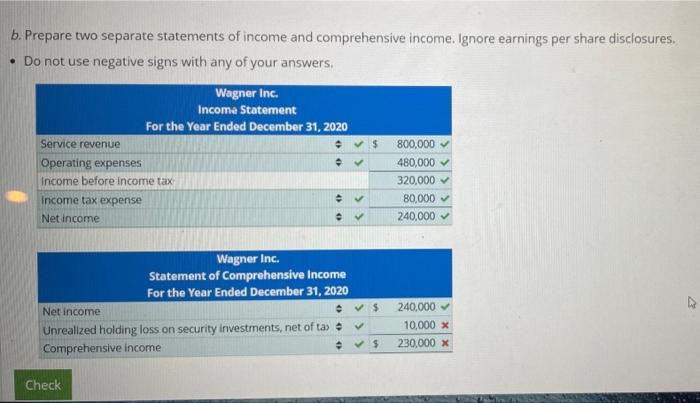

Reporting a companive Income Statement con 410.000, and med hotels 20.00 art curity investments for the yew ended December 2008 peccato come one per dare dores Do you Wegne For the red Dec 12 1.000 000 Don eine anderen you want 722 PM 12/2002 income before income Income tax expense Net income Unrealized holding loss on security Investments.net Comprehensive income 120.000 B000 0.000 10,000 $ 230.000 x b. Prepare two separate statements of income and comprehensive income, ignore earnings per share disclosures. Do not use negative signs with any of your answers Wagner Inc Income Statement For the Year Ended December 31, 2020 Service 800.000 Operating expenses 40,000 Income before income 220.000 Income tax expense 30.000 Netin . 240,000 Wagner Inc Statement of Comprehensive Income For the Year Ended December 31, 2020 Neinco Unrealized holding loss on security investments, net ofta Comprehensive income 240.000 10.000 230,000 X Check Reporting a comprehensive Income Statement Wagner Inc. has service revenue of $800,000, operating expenses of $480,000, and an unrealized holding loss of $40,000 on debt security investments for the year ended December 31, 2020. Its income tax rate is 25%. Required a. Prepare a single continuous statement of comprehensive income, Ignore earnings per share disclosures. . Do not use negative signs with any of your answers Wagner Inc. Statement of Comprehensive Income For the Year Ended December 31, 2020 Service revenue 5 800,000 Operating expenses 480,000 Income before income tax 320,000 Income tax expense 80,000 240,000 Net income 10,000 X Unrealized holding loss on security investments, net ofta 5 230,000 X Comprehensive income b. Prepare two separate statements of income and comprehensive income. Ignore earnings per share disclosures Do Show ADW b. Prepare two separate statements of income and comprehensive income. Ignore earnings per share disclosures Do not use negative signs with any of your answers. Wagner Inc. Income Statement For the Year Ended December 31, 2020 Service revenue $ 800,000 Operating expenses 480,000 Income before income tax 320,000 Income tax expense 80,000 240,000 Net income e Wagner Inc. Statement of Comprehensive Income For the Year Ended December 31, 2020 Net income e s Unrealized holding loss on security investments, net ofta Comprehensive income 5 240,000 10,000 x 230,000 x e Check

Reporting a companive Income Statement con 410.000, and med hotels 20.00 art curity investments for the yew ended December 2008 peccato come one per dare dores Do you Wegne For the red Dec 12 1.000 000 Don eine anderen you want 722 PM 12/2002 income before income Income tax expense Net income Unrealized holding loss on security Investments.net Comprehensive income 120.000 B000 0.000 10,000 $ 230.000 x b. Prepare two separate statements of income and comprehensive income, ignore earnings per share disclosures. Do not use negative signs with any of your answers Wagner Inc Income Statement For the Year Ended December 31, 2020 Service 800.000 Operating expenses 40,000 Income before income 220.000 Income tax expense 30.000 Netin . 240,000 Wagner Inc Statement of Comprehensive Income For the Year Ended December 31, 2020 Neinco Unrealized holding loss on security investments, net ofta Comprehensive income 240.000 10.000 230,000 X Check Reporting a comprehensive Income Statement Wagner Inc. has service revenue of $800,000, operating expenses of $480,000, and an unrealized holding loss of $40,000 on debt security investments for the year ended December 31, 2020. Its income tax rate is 25%. Required a. Prepare a single continuous statement of comprehensive income, Ignore earnings per share disclosures. . Do not use negative signs with any of your answers Wagner Inc. Statement of Comprehensive Income For the Year Ended December 31, 2020 Service revenue 5 800,000 Operating expenses 480,000 Income before income tax 320,000 Income tax expense 80,000 240,000 Net income 10,000 X Unrealized holding loss on security investments, net ofta 5 230,000 X Comprehensive income b. Prepare two separate statements of income and comprehensive income. Ignore earnings per share disclosures Do Show ADW b. Prepare two separate statements of income and comprehensive income. Ignore earnings per share disclosures Do not use negative signs with any of your answers. Wagner Inc. Income Statement For the Year Ended December 31, 2020 Service revenue $ 800,000 Operating expenses 480,000 Income before income tax 320,000 Income tax expense 80,000 240,000 Net income e Wagner Inc. Statement of Comprehensive Income For the Year Ended December 31, 2020 Net income e s Unrealized holding loss on security investments, net ofta Comprehensive income 5 240,000 10,000 x 230,000 x e Check

i need help with an equation for unrealized holding loss on security investments net of tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started