Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need Help with balance sheet A. B. QUESTION SET 3. Following is the end of year balance sheet for Sullivan Camping Outfitters, Inc. (SCO)

I need Help with balance sheet

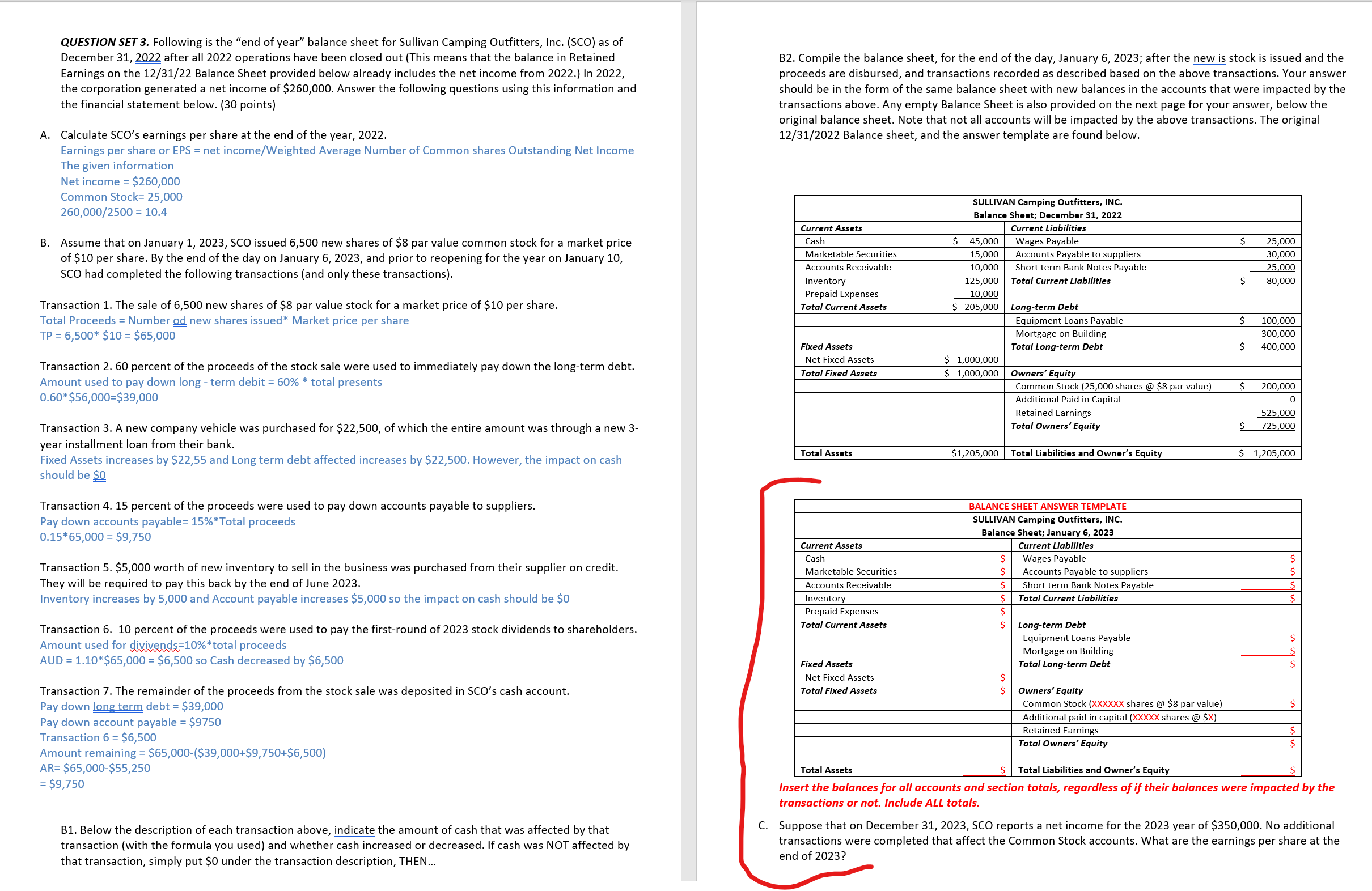

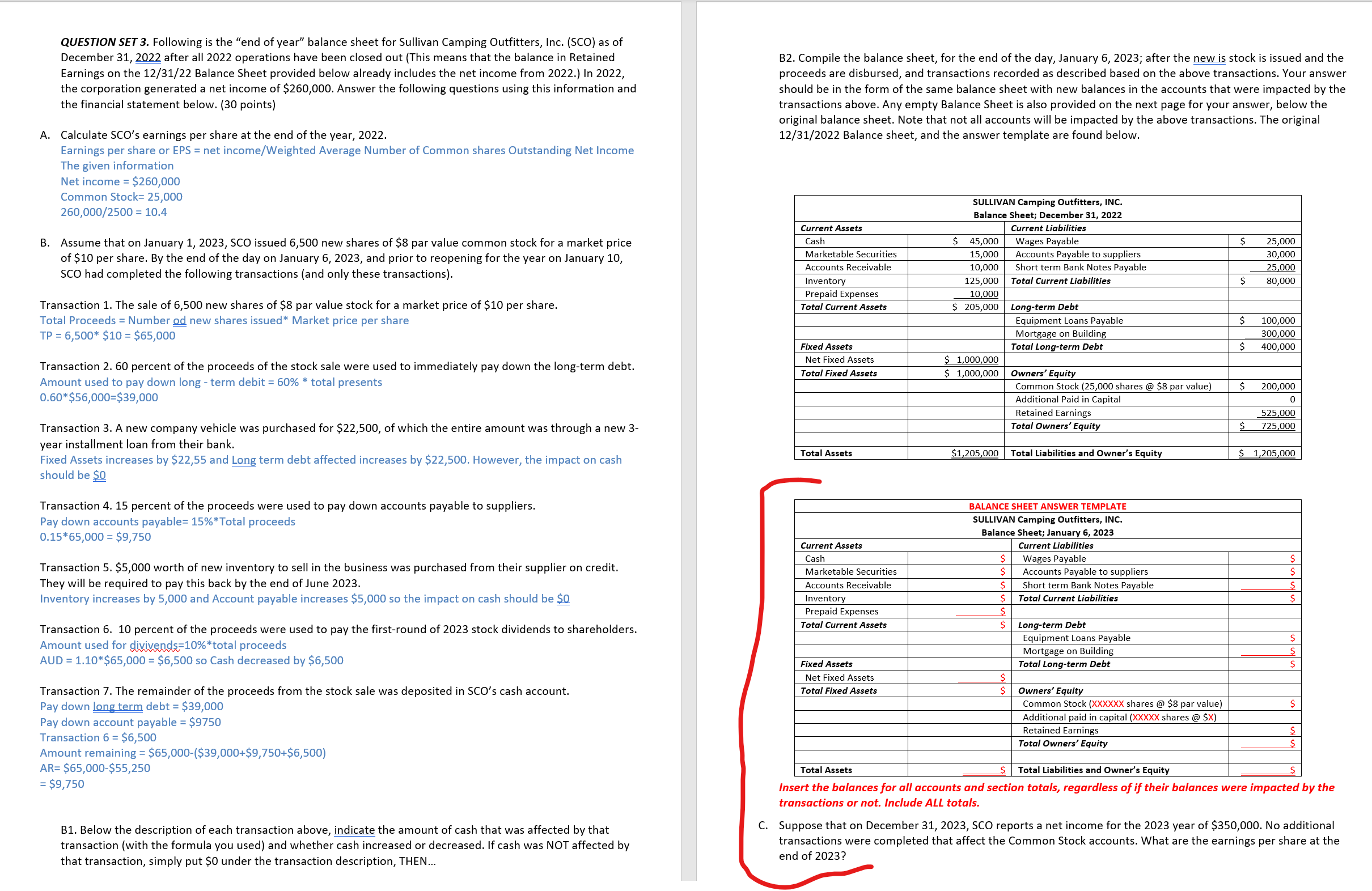

A. B. QUESTION SET 3. Following is the "end of year" balance sheet for Sullivan Camping Outfitters, Inc. (SCO) as of December 31, 2022 after all 2022 operations have been closed out (This means that the balance in Retained Earnings on the 12/31/22 Balance Sheet provided below already includes the net income from 2022.) In 2022, the corporation generated a net income of $260,000. Answer the following questions using this information and the financial statement below. (30 points) Calculate SCO's earnings per share at the end of the year, 2022. Earnings per share or EPS = net income/Weighted Average Number of Common shares Outstanding Net Income The given information Net income = $260,000 Common Stock= 25,000 260,000/2500 = 10.4 Assume that on January 1, 2023, SCO issued 6,500 new shares of $8 par value common stock for a market price of $10 per share. By the end of the day on January 6, 2023, and prior to reopening for the year on January 10, SCO had completed the following transactions (and only these transactions). B2. Compile the balance sheet, for the end of the day, January 6, 2023; after the new_js stock is issued and the proceeds are disbursed, and transactions recorded as described based on the above transactions. Your answer should be in the form of the same balance sheet with new balances in the accounts that were impacted by the transactions above. Any empty Balance Sheet is also provided on the next page for your answer, below the original balance sheet. Note that not all accounts will be impacted by the above transactions. The original 12/31/2022 Balance sheet, and the answer template are found below. SULLIVAN Camping Outfitters, INC. Balance Sheet; December 31, 2022 Current Assets Cash Marketable Securities Accounts Receivable Inventory Prepaid Expenses Total Current Assets Fixed Assets Net Fixed Assets Total Fixed Assets Total Assets Current Assets Cash Marketable Securities Accounts Receivable Inventory Prepaid Expenses Total Current Assets Fixed Assets Net Fixed Assets Total Fixed Assets Total Assets S 45,000 15,000 10,000 125,000 10 ooo 205,000 Transaction 1. The sale of 6,500 new shares of $8 par value stock for a market price of $10 per share. Total Proceeds = Number Qd new shares issued* Market price per share TP = $10 = $65,000 Transaction 2. 60 percent of the proceeds of the stock sale were used to immediately pay down the long-term debt. Amount used to pay down long - term debit = 60% * total presents Transaction 3. A new company vehicle was purchased for $22,500, of which the entire amount was through a new 3- year installment loan from their bank. Fixed Assets increases by $22,55 and term debt affected increases by $22,500. However, the impact on cash should be SO Transaction 4. 15 percent of the proceeds were used to pay down accounts payable to suppliers. Pay down accounts payable= 15%* Total proceeds = $9,750 Transaction 5. $5,000 worth of new inventory to sell in the business was purchased from their supplier on credit. They will be required to pay this back by the end of June 2023. Inventory increases by 5,000 and Account payable increases $5,000 so the impact on cash should be SO Transaction 6. 10 percent of the proceeds were used to pay the first-round of 2023 stock dividends to shareholders. Amount used for proceeds AUD = = $6,500 so Cash decreased by $6,500 Transaction 7. The remainder of the proceeds from the stock sale was deposited in SCO's cash account. Pay down debt = $39,000 Pay down account payable = $9750 Transaction 6 = $6,500 Amount remaining = = $9,750 Bl. Below the description of each transaction above, indicate the amount of cash that was affected by that transaction (with the formula you used) and whether cash increased or decreased. If cash was NOT affected by that transaction, simply put $0 under the transaction description, THEN . Current Liabilities Wages Payable Accounts Payable to suppliers Short term Bank Notes Payable Total Current Liabilities Long-term Debt Equipment Loans Payable Mortgage on Building Total Long-term Debt Owners' Equity Common Stock (25,000 shares @ $8 par value) Additional Paid in Capital Retained Earnings Total Owners' Equity S 25,000 30,000 25 ooo 80,000 100,000 300 ooo 400,000 200,000 525 ooo 725,000 Total Liabilities and Owner's Equity BALANCE SHEET ANSWER TEMPLATE SULLIVAN Camping Outfitters, INC. Balance Sheet; January 6, 2023 Current Liabilities Wages Payable Accounts Payable to suppliers Short term Bank Notes Payable Total Current Liabilities Long-term Debt Equipment Loans Payable Mortgage on Building Total Long-term Debt Owners' Equity Common Stock (XXXX)(X shares @ $8 par value) Additional paid in capital (XXXX)( shares @ $X) Retained Earnings Total Owners' Equity Total Liabilities and Owner's Equity s 1,205.000 C. Insert the balances for all accounts and section totals, regardless of if their balances were impacted by the transactions or not. Include ALL totals. Suppose that on December 31, 2023, SCO reports a net income for the 2023 year of $350,000. No additional transactions were completed that affect the Common Stock accounts. What are the earnings per share at the end of 2023?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started