I need help with c and D!!!

I need help with c and D!!!

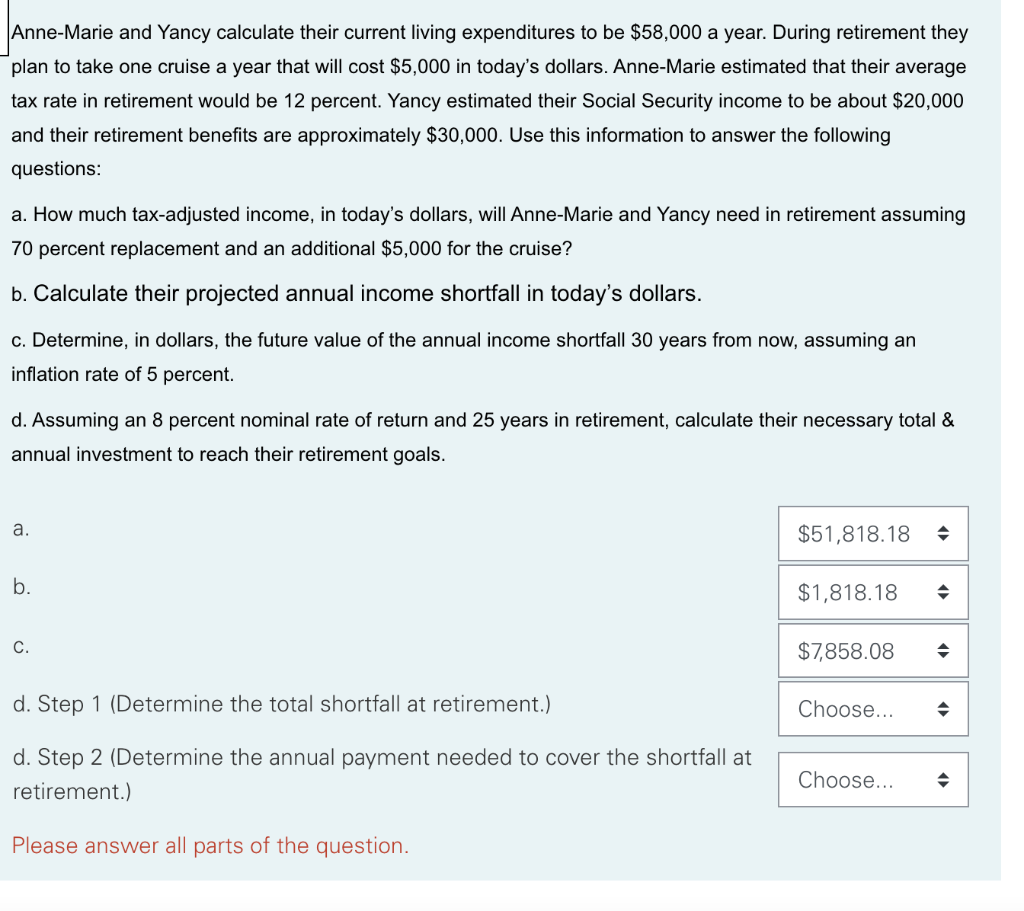

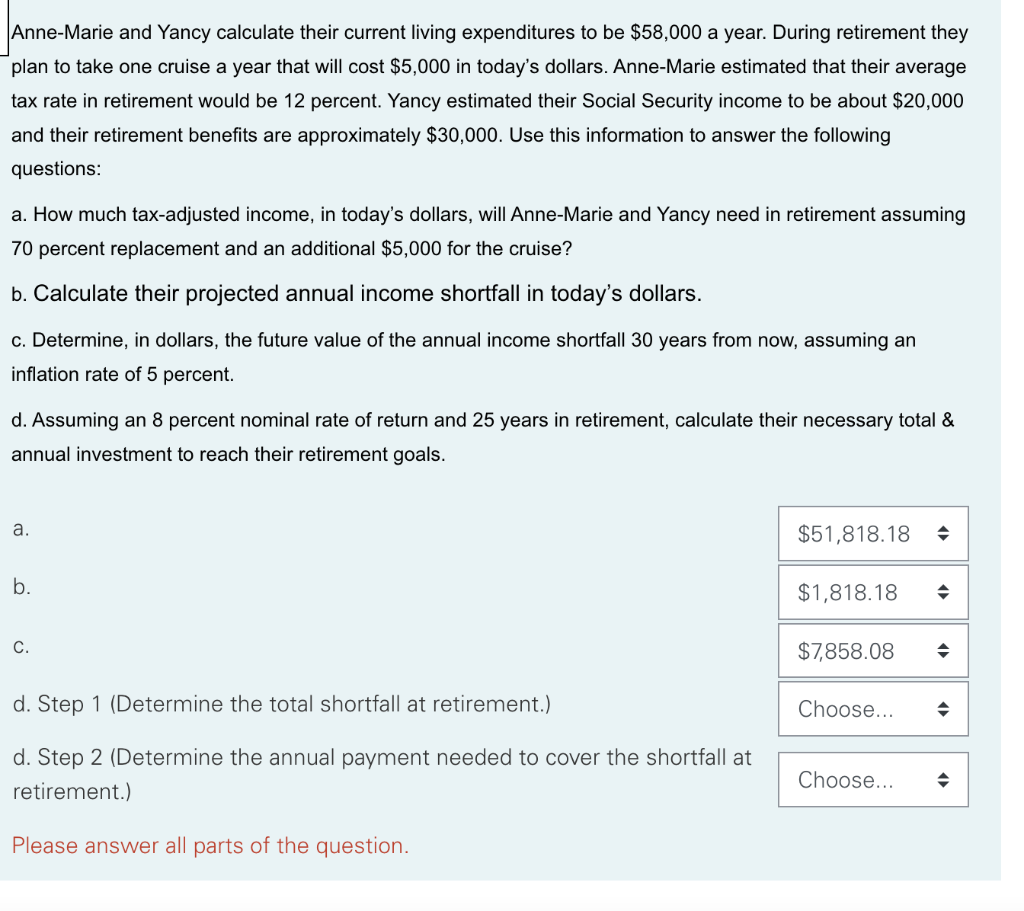

Anne-Marie and Yancy calculate their current living expenditures to be $58,000 a year. During retirement they plan to take one cruise a year that will cost $5,000 in today's dollars. Anne-Marie estimated that their average tax rate in retirement would be 12 percent. Yancy estimated their Social Security income to be about $20,000 and their retirement benefits are approximately $30,000. Use this information to answer the following questions: a. How much tax-adjusted income, in today's dollars, will Anne-Marie and Yancy need in retirement assuming 70 percent replacement and an additional $5,000 for the cruise? b. Calculate their projected annual income shortfall in today's dollars. c. Determine, in dollars, the future value of the annual income shortfall 30 years from now, assuming an inflation rate of 5 percent. d. Assuming an 8 percent nominal rate of return and 25 years in retirement, calculate their necessary total & annual investment to reach their retirement goals. a. $51,818.18 b. $1,818.18 C. $7,858.08 d. Step 1 (Determine the total shortfall at retirement.) Choose... d. Step 2 (Determine the annual payment needed to cover the shortfall at retirement.) Choose... Please answer all parts of the question. Anne-Marie and Yancy calculate their current living expenditures to be $58,000 a year. During retirement they plan to take one cruise a year that will cost $5,000 in today's dollars. Anne-Marie estimated that their average tax rate in retirement would be 12 percent. Yancy estimated their Social Security income to be about $20,000 and their retirement benefits are approximately $30,000. Use this information to answer the following questions: a. How much tax-adjusted income, in today's dollars, will Anne-Marie and Yancy need in retirement assuming 70 percent replacement and an additional $5,000 for the cruise? b. Calculate their projected annual income shortfall in today's dollars. c. Determine, in dollars, the future value of the annual income shortfall 30 years from now, assuming an inflation rate of 5 percent. d. Assuming an 8 percent nominal rate of return and 25 years in retirement, calculate their necessary total & annual investment to reach their retirement goals. a. $51,818.18 b. $1,818.18 C. $7,858.08 d. Step 1 (Determine the total shortfall at retirement.) Choose... d. Step 2 (Determine the annual payment needed to cover the shortfall at retirement.) Choose... Please answer all parts of the

I need help with c and D!!!

I need help with c and D!!!