Answered step by step

Verified Expert Solution

Question

1 Approved Answer

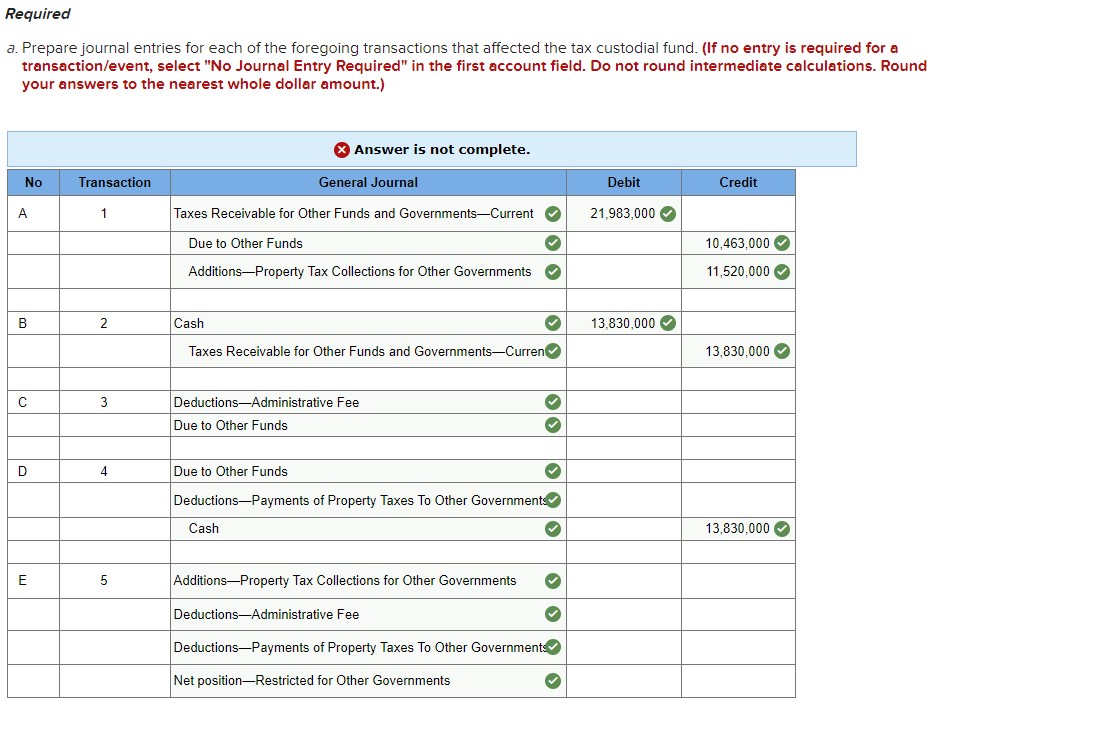

** I need help with C, D, E (3,4, 5). The General Journal Accounts are correct. I'm having problems figuring out the debit and credit

** I need help with C, D, E (3,4, 5). The General Journal Accounts are correct. I'm having problems figuring out the debit and credit

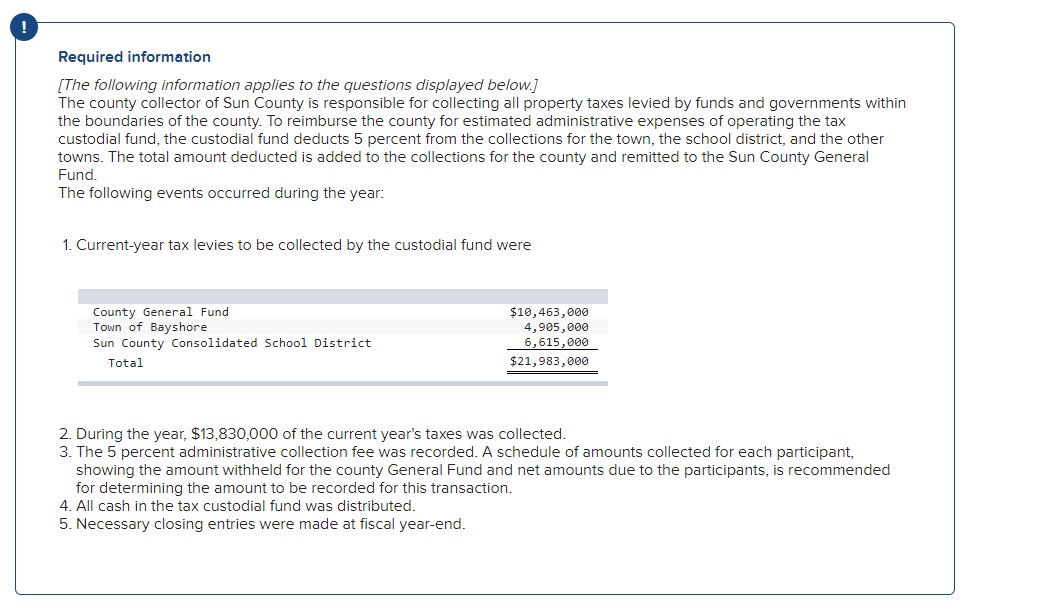

Required information [The following information applies to the questions displayed below.] The county collector of Sun County is responsible for collecting all property taxes levied by funds and governments within the boundaries of the county. To reimburse the county for estimated administrative expenses of operating the tax custodial fund, the custodial fund deducts 5 percent from the collections for the town, the school district, and the other towns. The total amount deducted is added to the collections for the county and remitted to the Sun County General Fund. The following events occurred during the year: 1. Current-year tax levies to be collected by the custodial fund were 2. During the year, $13,830,000 of the current year's taxes was collected. 3. The 5 percent administrative collection fee was recorded. A schedule of amounts collected for each participant, showing the amount witheld for the county General Fund and net amounts due to the participants, is recommended for determining the amount to be recorded for this transaction. 4. All cash in the tax custodial fund was distributed. 5. Necessary closing entries were made at fiscal year-end. 3. Prepare journal entries for each of the foregoing transactions that affected the tax custodial fund. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.)

Required information [The following information applies to the questions displayed below.] The county collector of Sun County is responsible for collecting all property taxes levied by funds and governments within the boundaries of the county. To reimburse the county for estimated administrative expenses of operating the tax custodial fund, the custodial fund deducts 5 percent from the collections for the town, the school district, and the other towns. The total amount deducted is added to the collections for the county and remitted to the Sun County General Fund. The following events occurred during the year: 1. Current-year tax levies to be collected by the custodial fund were 2. During the year, $13,830,000 of the current year's taxes was collected. 3. The 5 percent administrative collection fee was recorded. A schedule of amounts collected for each participant, showing the amount witheld for the county General Fund and net amounts due to the participants, is recommended for determining the amount to be recorded for this transaction. 4. All cash in the tax custodial fund was distributed. 5. Necessary closing entries were made at fiscal year-end. 3. Prepare journal entries for each of the foregoing transactions that affected the tax custodial fund. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started