Answered step by step

Verified Expert Solution

Question

1 Approved Answer

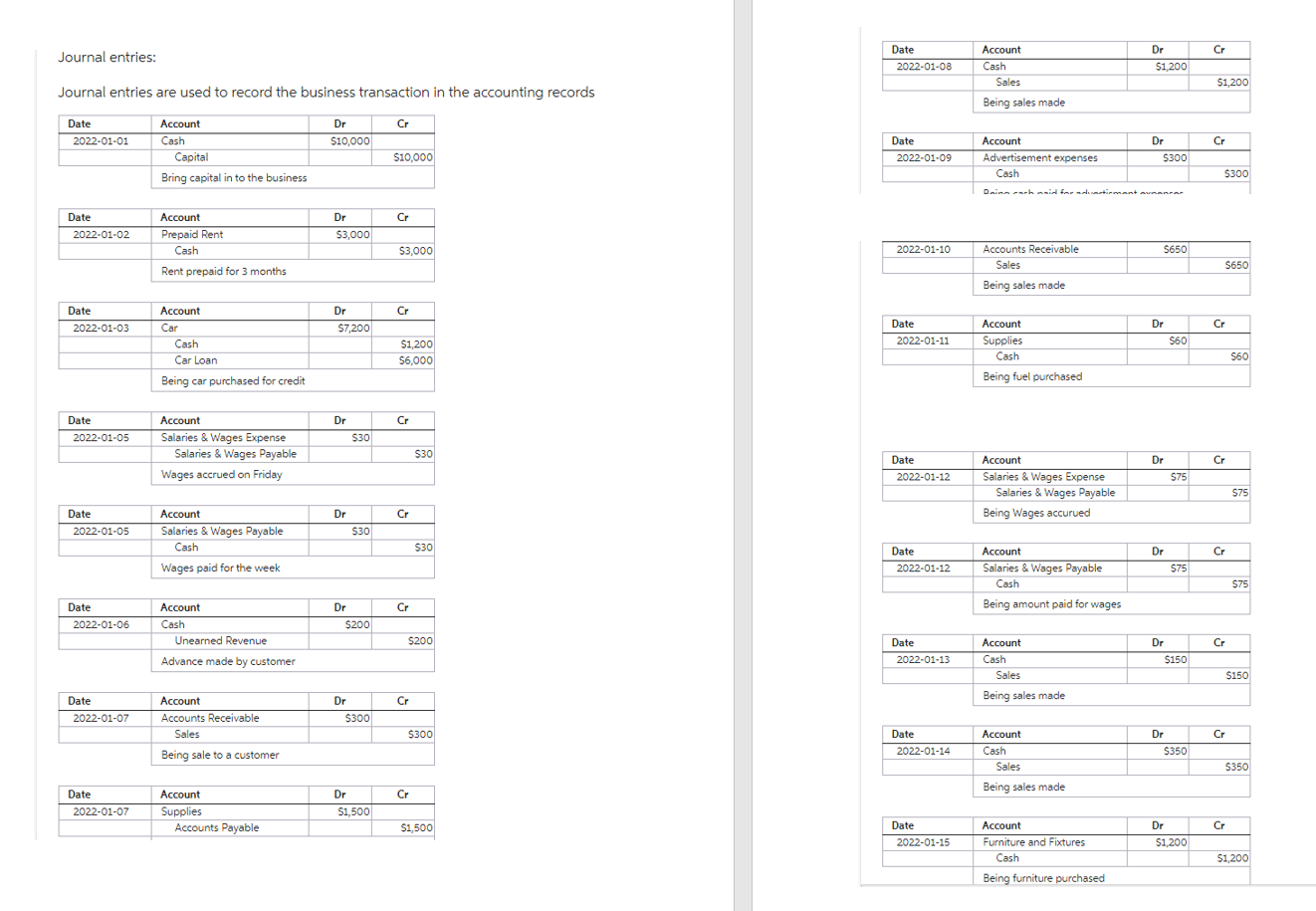

I need help with closing entries using the following information please. Journal entries: Journal entries are used to record the business transaction in the accounting

I need help with closing entries using the following information please.

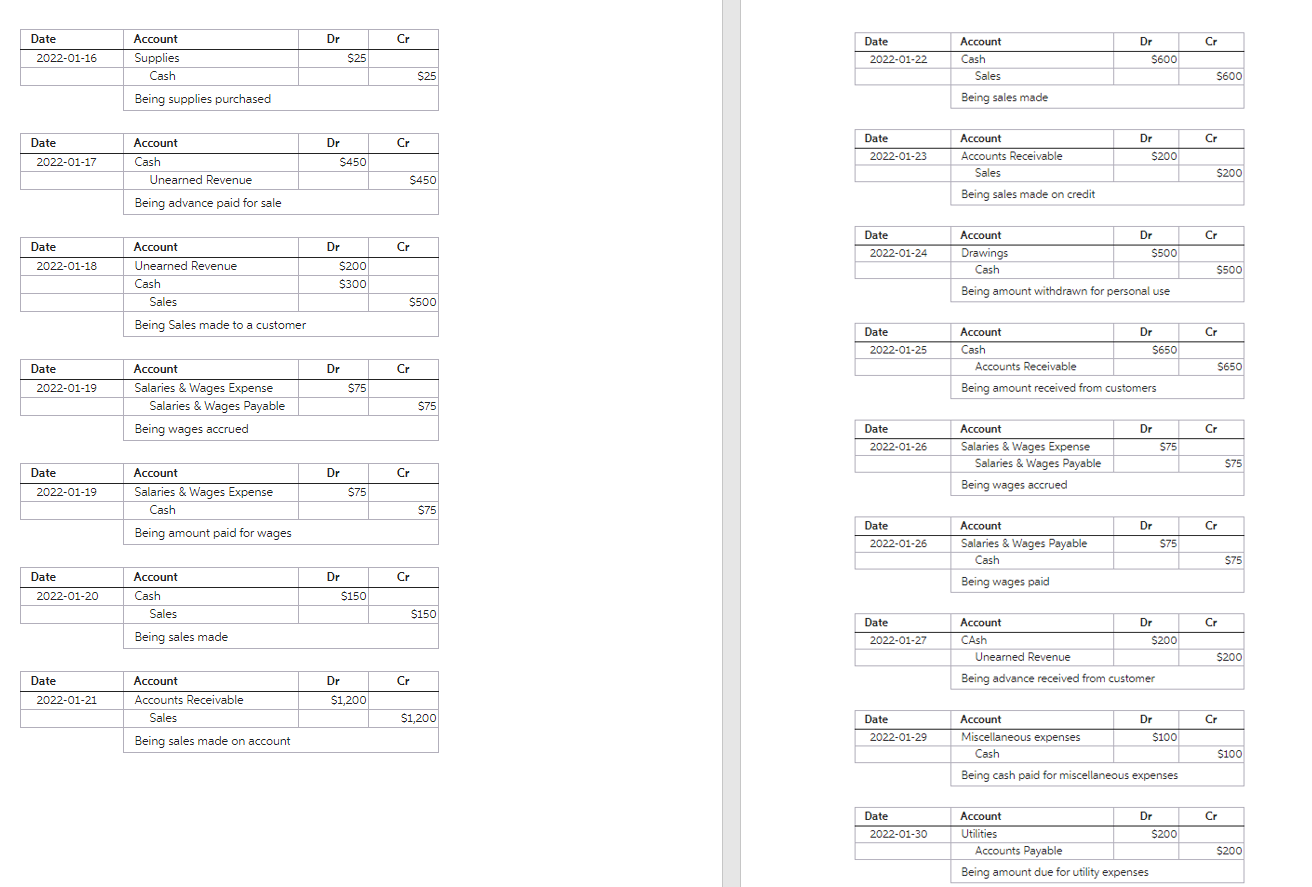

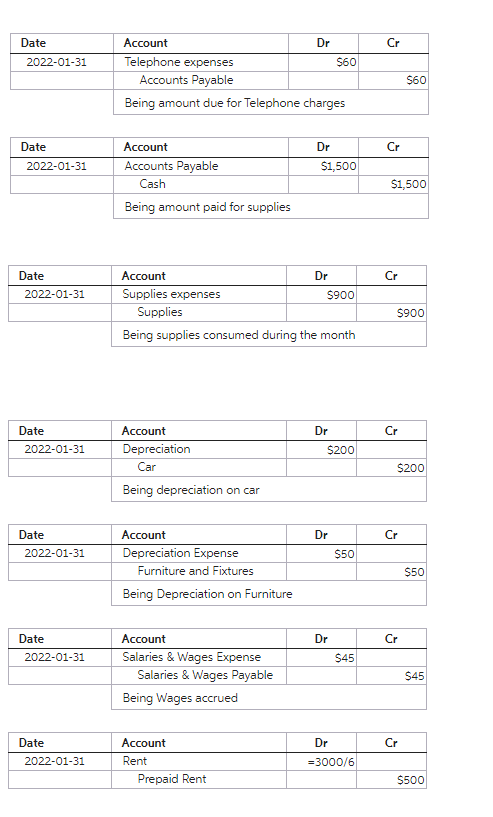

Journal entries: Journal entries are used to record the business transaction in the accounting records \begin{tabular}{|c|c|c|c|} \hline Date & Account & Dr & Cr \\ \hline \multirow[t]{3}{*}{20220116} & Supplies & $25 & \\ \hline & Cash & & $25 \\ \hline & \multicolumn{3}{|c|}{ Being supplies purchased } \\ \hline \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & Cr \\ \hline 20220122 & Cash & $600 & \\ \hline & Sales & & $600 \\ \hline & Being sales made & & \\ \cline { 2 - 4 } & & \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & Cr \\ \hline 20220117 & Cash & $450 & \\ \hline & Unearned Revenue & & $450 \\ \hline & Being advance paid for sale \\ \cline { 2 - 3 } \end{tabular} \begin{tabular}{|l|l|c|c|} \hline Date & Account & Dr & Cr \\ \hline 20220123 & Accounts Receivable & $200 & \\ \hline & Sales & & $200 \\ \hline & Being sales made on credit \\ \cline { 2 - 3 } & \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & Cr \\ \hline 20220118 & Unearned Revenue & $200 & \\ \hline & Cash & $300 & \\ \hline & Sales & & $500 \\ \hline & Being Sales made to a customer & & \\ \cline { 2 - 4 } \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account & Dr & Cr \\ \hline \multirow[t]{3}{*}{20220124} & Drawings & $500 & \\ \hline & Cash & & $500 \\ \hline & Being am & nal use & \\ \hline \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & \multicolumn{1}{|c|}{ Cr } \\ \hline 2022-01-19 & Salaries \& Wages Expense & $75 & \\ \hline & Salaries \& Wages Payable & & \\ \hline & Being wages accrued & \\ \cline { 2 - 4 } & \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account & Dr & Cr \\ \hline \multirow[t]{3}{*}{ 2022-01-25 } & Cash & $650 & \\ \hline & Accounts Receivable & & $650 \\ \hline & Being amount received f & ners & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account & Dr & Cr \\ \hline 2022-01-19 & Salaries \& Wages Expense & $75 & \\ \hline & Cash & & $75 \\ \hline & \multicolumn{3}{|l|}{ Being amount paid for wages } \\ \hline \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & \multicolumn{1}{|c|}{ Cr } \\ \hline 20220126 & Salaries \& Wages Expense & $75 & \\ \hline & Salaries \& Wages Payable & & $75 \\ \hline & Being wages accrued & & \\ \cline { 2 - 4 } & \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & \multicolumn{1}{|c|}{Cr} \\ \hline 20220120 & Cash & $150 & \\ \hline & Sales & & $150 \\ \hline & Being sales made & & \\ \cline { 2 - 4 } & \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & \multicolumn{1}{|c|}{ Cr } \\ \hline 20220126 & Salaries \& Wages Payable & $75 & \\ \hline & Cash & & $75 \\ \hline & Being wages paid & & \\ \cline { 2 - 3 } & \end{tabular} \begin{tabular}{|l|l|c|c|} \hline Date & Account & Dr & Cr \\ \hline 20220121 & Accounts Receivable & $1,200 & \\ \hline & Sales & & $1,200 \\ \hline & Being sales made on account \\ \cline { 2 - 3 } \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account & Dr & Cr \\ \hline 20220127 & CAsh & $200 & \\ \hline & Unearned Revenue & & $200 \\ \hline \end{tabular} \begin{tabular}{|l|l|c|c|} \hline Date & Account & Dr & Cr \\ \hline 20220129 & Miscellaneous expenses & $100 & \\ \hline \multicolumn{3}{|c|}{ Cash } & $100 \\ \hline & Being cash paid for miscellaneous expenses \\ \hline \end{tabular} \begin{tabular}{|l|l|c|c|} \hline Date & Account & Dr & Cr \\ \hline 20220130 & Utilities & $200 & \\ \hline & Accounts Payable & & $200 \\ \hline \multicolumn{2}{|c|}{ Being amount due for utility expenses } \\ \cline { 2 - 3 } \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & \multicolumn{1}{c|}{ Cr } \\ \hline 2022-01-31 & Telephone expenses & $60 & \\ \hline & Accounts Payable & & $60 \\ \hline & Being amount due for Telephone charges \\ \cline { 2 - 4 } \end{tabular} \begin{tabular}{|l|l|c|c|} \hline Date & Account & Dr & Cr \\ \hline 20220131 & Accounts Payable & $1,500 & \\ \hline & Cash & & $1,500 \\ \hline & Being amount paid for supplies \\ \cline { 2 - 3 } \end{tabular} \begin{tabular}{|l|l|c|c|} \hline Date & Account & Dr & Cr \\ \hline 20220131 & Supplies expenses & $900 & \\ \hline & Supplies & & $900 \\ \hline & \multicolumn{2}{|c|}{ Being supplies consumed during the month } \\ \cline { 2 - 4 } \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & Cr \\ \hline 20220131 & Depreciation & $200 & \\ \hline & Car & & $200 \\ \hline & Being depreciation on car \\ \cline { 2 - 3 } & \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & \multicolumn{1}{c|}{ Cr } \\ \hline 20220131 & Depreciation Expense & $50 & \\ \hline & Furniture and Fixtures & & \\ \hline & Being Depreciation on Furniture \\ \cline { 2 - 4 } \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & \multicolumn{1}{c|}{ Cr } \\ \hline 20220131 & Salaries \& Wages Expense & $45 & \\ \hline & Salaries \& Wages Payable & & \\ \hline & Being Wages accrued & & \\ \cline { 2 - 4 } & \end{tabular} \begin{tabular}{|l|l|c|c|} \hline Date & Account & Dr & Cr \\ \hline 20220131 & Rent & =3000/6 & \\ \hline & Prepaid Rent & & $500 \\ \hline \end{tabular}

Journal entries: Journal entries are used to record the business transaction in the accounting records \begin{tabular}{|c|c|c|c|} \hline Date & Account & Dr & Cr \\ \hline \multirow[t]{3}{*}{20220116} & Supplies & $25 & \\ \hline & Cash & & $25 \\ \hline & \multicolumn{3}{|c|}{ Being supplies purchased } \\ \hline \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & Cr \\ \hline 20220122 & Cash & $600 & \\ \hline & Sales & & $600 \\ \hline & Being sales made & & \\ \cline { 2 - 4 } & & \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & Cr \\ \hline 20220117 & Cash & $450 & \\ \hline & Unearned Revenue & & $450 \\ \hline & Being advance paid for sale \\ \cline { 2 - 3 } \end{tabular} \begin{tabular}{|l|l|c|c|} \hline Date & Account & Dr & Cr \\ \hline 20220123 & Accounts Receivable & $200 & \\ \hline & Sales & & $200 \\ \hline & Being sales made on credit \\ \cline { 2 - 3 } & \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & Cr \\ \hline 20220118 & Unearned Revenue & $200 & \\ \hline & Cash & $300 & \\ \hline & Sales & & $500 \\ \hline & Being Sales made to a customer & & \\ \cline { 2 - 4 } \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account & Dr & Cr \\ \hline \multirow[t]{3}{*}{20220124} & Drawings & $500 & \\ \hline & Cash & & $500 \\ \hline & Being am & nal use & \\ \hline \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & \multicolumn{1}{|c|}{ Cr } \\ \hline 2022-01-19 & Salaries \& Wages Expense & $75 & \\ \hline & Salaries \& Wages Payable & & \\ \hline & Being wages accrued & \\ \cline { 2 - 4 } & \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account & Dr & Cr \\ \hline \multirow[t]{3}{*}{ 2022-01-25 } & Cash & $650 & \\ \hline & Accounts Receivable & & $650 \\ \hline & Being amount received f & ners & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account & Dr & Cr \\ \hline 2022-01-19 & Salaries \& Wages Expense & $75 & \\ \hline & Cash & & $75 \\ \hline & \multicolumn{3}{|l|}{ Being amount paid for wages } \\ \hline \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & \multicolumn{1}{|c|}{ Cr } \\ \hline 20220126 & Salaries \& Wages Expense & $75 & \\ \hline & Salaries \& Wages Payable & & $75 \\ \hline & Being wages accrued & & \\ \cline { 2 - 4 } & \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & \multicolumn{1}{|c|}{Cr} \\ \hline 20220120 & Cash & $150 & \\ \hline & Sales & & $150 \\ \hline & Being sales made & & \\ \cline { 2 - 4 } & \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & \multicolumn{1}{|c|}{ Cr } \\ \hline 20220126 & Salaries \& Wages Payable & $75 & \\ \hline & Cash & & $75 \\ \hline & Being wages paid & & \\ \cline { 2 - 3 } & \end{tabular} \begin{tabular}{|l|l|c|c|} \hline Date & Account & Dr & Cr \\ \hline 20220121 & Accounts Receivable & $1,200 & \\ \hline & Sales & & $1,200 \\ \hline & Being sales made on account \\ \cline { 2 - 3 } \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account & Dr & Cr \\ \hline 20220127 & CAsh & $200 & \\ \hline & Unearned Revenue & & $200 \\ \hline \end{tabular} \begin{tabular}{|l|l|c|c|} \hline Date & Account & Dr & Cr \\ \hline 20220129 & Miscellaneous expenses & $100 & \\ \hline \multicolumn{3}{|c|}{ Cash } & $100 \\ \hline & Being cash paid for miscellaneous expenses \\ \hline \end{tabular} \begin{tabular}{|l|l|c|c|} \hline Date & Account & Dr & Cr \\ \hline 20220130 & Utilities & $200 & \\ \hline & Accounts Payable & & $200 \\ \hline \multicolumn{2}{|c|}{ Being amount due for utility expenses } \\ \cline { 2 - 3 } \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & \multicolumn{1}{c|}{ Cr } \\ \hline 2022-01-31 & Telephone expenses & $60 & \\ \hline & Accounts Payable & & $60 \\ \hline & Being amount due for Telephone charges \\ \cline { 2 - 4 } \end{tabular} \begin{tabular}{|l|l|c|c|} \hline Date & Account & Dr & Cr \\ \hline 20220131 & Accounts Payable & $1,500 & \\ \hline & Cash & & $1,500 \\ \hline & Being amount paid for supplies \\ \cline { 2 - 3 } \end{tabular} \begin{tabular}{|l|l|c|c|} \hline Date & Account & Dr & Cr \\ \hline 20220131 & Supplies expenses & $900 & \\ \hline & Supplies & & $900 \\ \hline & \multicolumn{2}{|c|}{ Being supplies consumed during the month } \\ \cline { 2 - 4 } \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & Cr \\ \hline 20220131 & Depreciation & $200 & \\ \hline & Car & & $200 \\ \hline & Being depreciation on car \\ \cline { 2 - 3 } & \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & \multicolumn{1}{c|}{ Cr } \\ \hline 20220131 & Depreciation Expense & $50 & \\ \hline & Furniture and Fixtures & & \\ \hline & Being Depreciation on Furniture \\ \cline { 2 - 4 } \end{tabular} \begin{tabular}{|l|l|r|r|} \hline Date & Account & Dr & \multicolumn{1}{c|}{ Cr } \\ \hline 20220131 & Salaries \& Wages Expense & $45 & \\ \hline & Salaries \& Wages Payable & & \\ \hline & Being Wages accrued & & \\ \cline { 2 - 4 } & \end{tabular} \begin{tabular}{|l|l|c|c|} \hline Date & Account & Dr & Cr \\ \hline 20220131 & Rent & =3000/6 & \\ \hline & Prepaid Rent & & $500 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started