Answered step by step

Verified Expert Solution

Question

1 Approved Answer

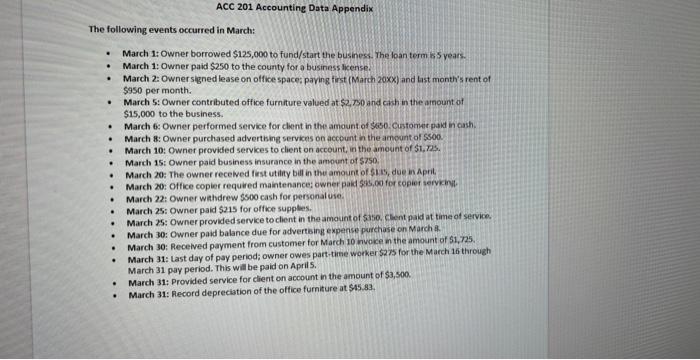

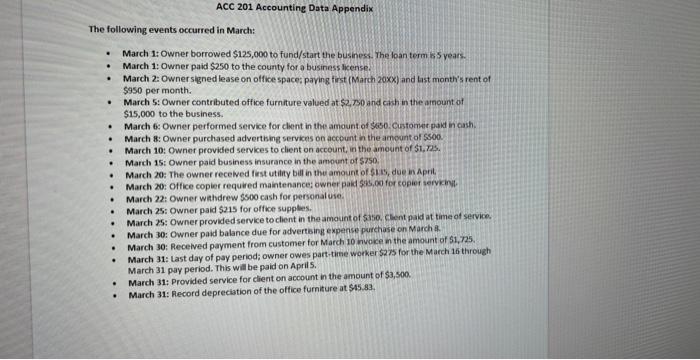

I need help with creating a General journal, Ledger accounts, trail balance and Statement of Stockholder Equity. thanks The following events occurred in March: -

I need help with creating a General journal, Ledger accounts, trail balance and Statement of Stockholder Equity. thanks

The following events occurred in March: - March 1: Owner borrowed $125,000 to fund/start the business. The loan term 155 years. - March 1: Owner paid $250 to the county for a business incense. - March 2: Owner signed lease on office space: paving tirst (March 20x(x) and last month's rent of $950 per month. - March 5: Owner contributed office furnture valued at $2,80 and cah in the arnount of $15,000 to the business. - March 6: Owner performed service for client in the amount of \$is0. Customet pakd in cash. - March 8: Owner purchased advertiing services on account in the ameunt of 5500. - March 10: Owner provided services to client on account, in the amount of $1,7.5. - March 15: Owner paid business insurance in the ampont of 5750 . - March 20: The owner received fist utitity bill in the amount of 5118 , due in Aprit. - March 20: Office copier required maintenance; owner paid sws,00 for copier servkina. - March 22: Owner watudrew $500 cash for personal une. - March 25: Owner paid $215 for office supples. - March 25: Owner provided service to client in the amount of sise. Clent paid at time of service. - March 30: Owner paid balance due for advertising expense purctiase on March a. - March 30: Recelved payment from customer for March 10 nvoice n the amount of 51,725. - March 31: Last day of pay period; owner owes part-tine woeker $275 for the March 16 through March 31 pay period. This will be paid on Aprils. - March 31: Provided service for client on account in the amount of $3,500. - March 31: Record depreciation of the office furniture at \$55.83. The following events occurred in March: - March 1: Owner borrowed $125,000 to fund/start the business. The loan term 155 years. - March 1: Owner paid $250 to the county for a business incense. - March 2: Owner signed lease on office space: paving tirst (March 20x(x) and last month's rent of $950 per month. - March 5: Owner contributed office furnture valued at $2,80 and cah in the arnount of $15,000 to the business. - March 6: Owner performed service for client in the amount of \$is0. Customet pakd in cash. - March 8: Owner purchased advertiing services on account in the ameunt of 5500. - March 10: Owner provided services to client on account, in the amount of $1,7.5. - March 15: Owner paid business insurance in the ampont of 5750 . - March 20: The owner received fist utitity bill in the amount of 5118 , due in Aprit. - March 20: Office copier required maintenance; owner paid sws,00 for copier servkina. - March 22: Owner watudrew $500 cash for personal une. - March 25: Owner paid $215 for office supples. - March 25: Owner provided service to client in the amount of sise. Clent paid at time of service. - March 30: Owner paid balance due for advertising expense purctiase on March a. - March 30: Recelved payment from customer for March 10 nvoice n the amount of 51,725. - March 31: Last day of pay period; owner owes part-tine woeker $275 for the March 16 through March 31 pay period. This will be paid on Aprils. - March 31: Provided service for client on account in the amount of $3,500. - March 31: Record depreciation of the office furniture at \$55.83

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started