Question

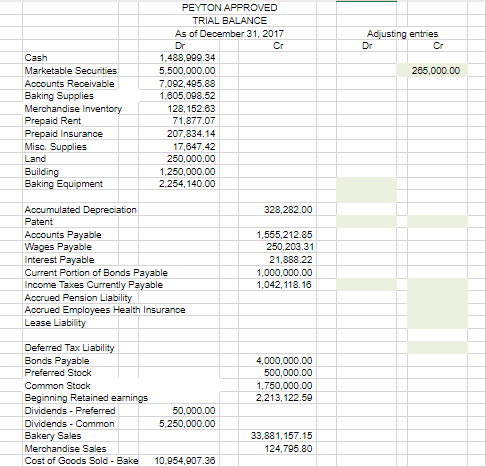

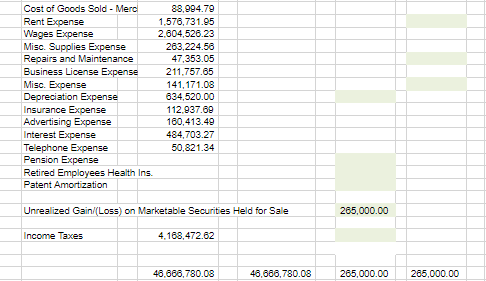

I need help with each adjusting entry and an explanation of how to find each one: ACC 309 Final Project Scenario Peyton Approved Overview Imagine

I need help with each adjusting entry and an explanation of how to find each one:

ACC 309 Final Project Scenario

Peyton Approved Overview

Imagine that you are working as a financial accountant for Peyton Approved, and you have been charged with revising its financial information. The company has experienced tremendous growth in the past three years, and it is now a well-known bakery chain for pet products. They have become a publicly traded company and have several locations that they deliver to regionally.

Peyton Approved Financial Information Comprehensive income items

Marketable securities on the balance sheet at a cost of $5,500,000 are available-for-sale

Market value at the balance sheet date is $5,235,000

Prepare the adjusting entry to record the unrealized loss and include in comprehensive income

Tax information and implications

$1,500 in meal and entertainment expenses show as a permanent difference for tax. Prepare the necessary adjusting entry. The company uses straight line depreciation for book and MACRS depreciation for the tax return

MACRS depreciation was $209,301 higher than book.

Prepare the adjusting entry for the deferred tax.

There have been recent tax structure changes that could impact the company. Peyton Approved has been a C Corp since the beginning of these changes. Peyton provides for taxes at 25% of pretax income (20% Federal, 5% state).

Hints:

$1,500 in meal and entertainment expenses show as a permanent difference for tax where the book expense is higher than the tax expense. Prepare the necessary adjusting entry. This entry requires you to record the current tax expense because of this permanent difference. Remember to apply the tax rate to the $1,500 difference.

The company uses straight line depreciation for book and MACRS depreciation for the tax return. MACRS depreciation was $209,301 higher than book. Prepare the adjusting entry for the deferred tax. Reclassify this amount from Taxes Currently Payable. Remember to apply the tax rate to the $209,301 difference.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started