I need help with Exercise 10-9. Thank you

Use the information from 10-8 to answer 10-9.

Use the information from 10-8 to answer 10-9.

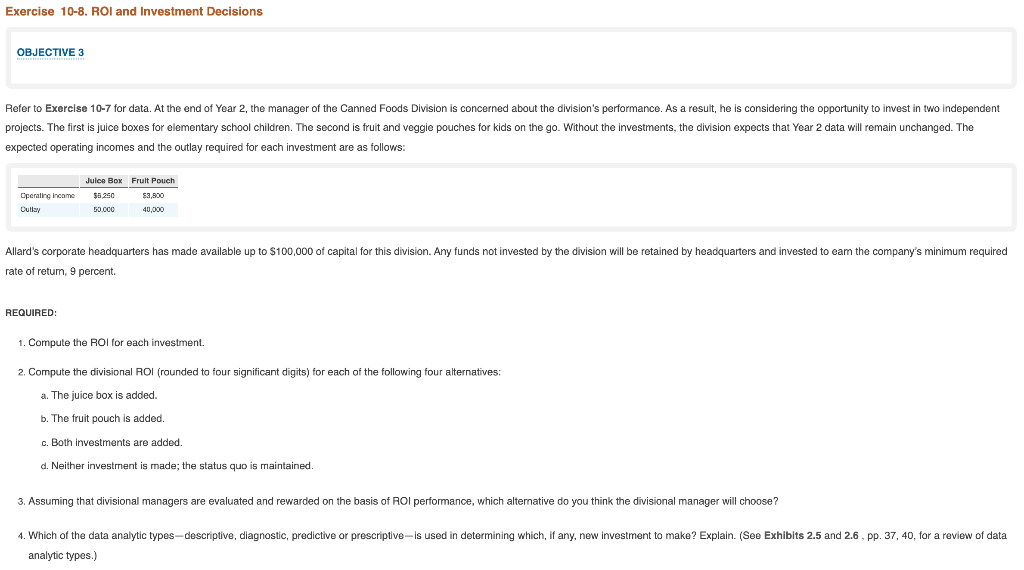

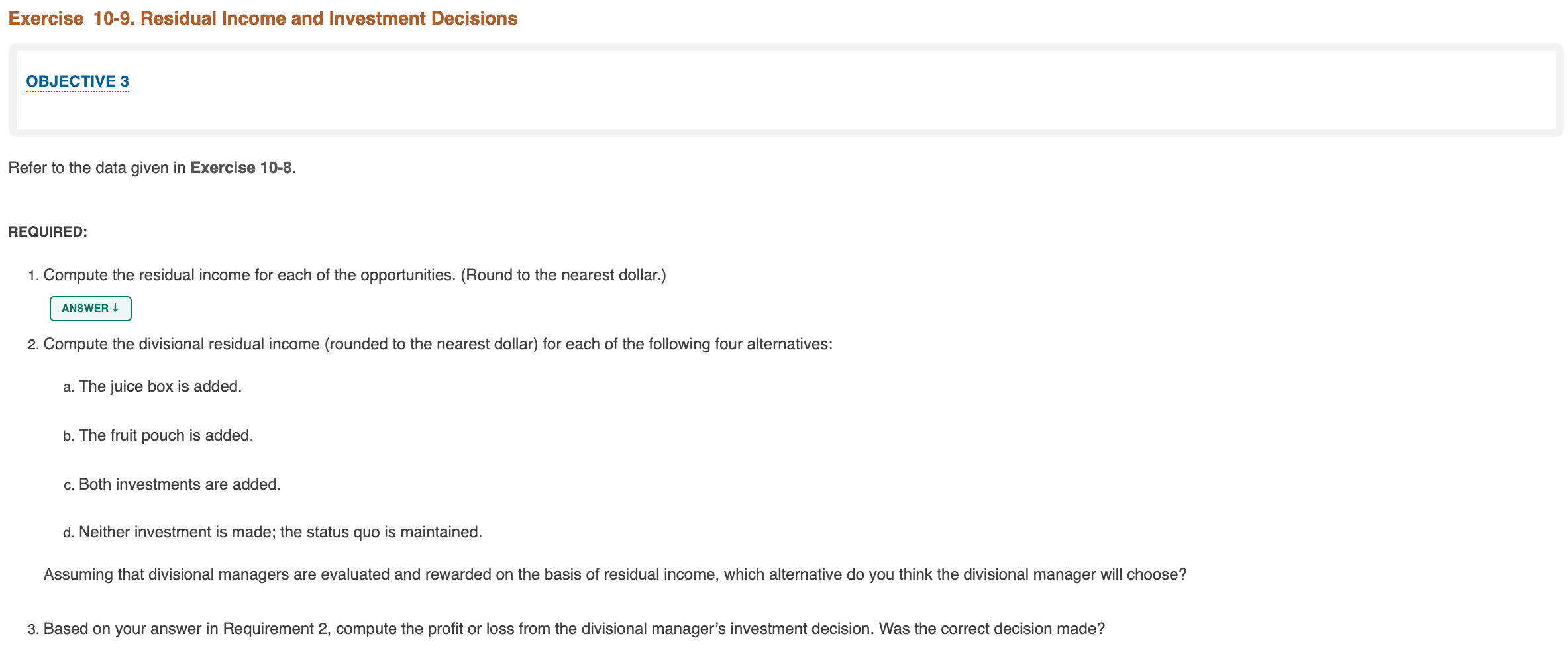

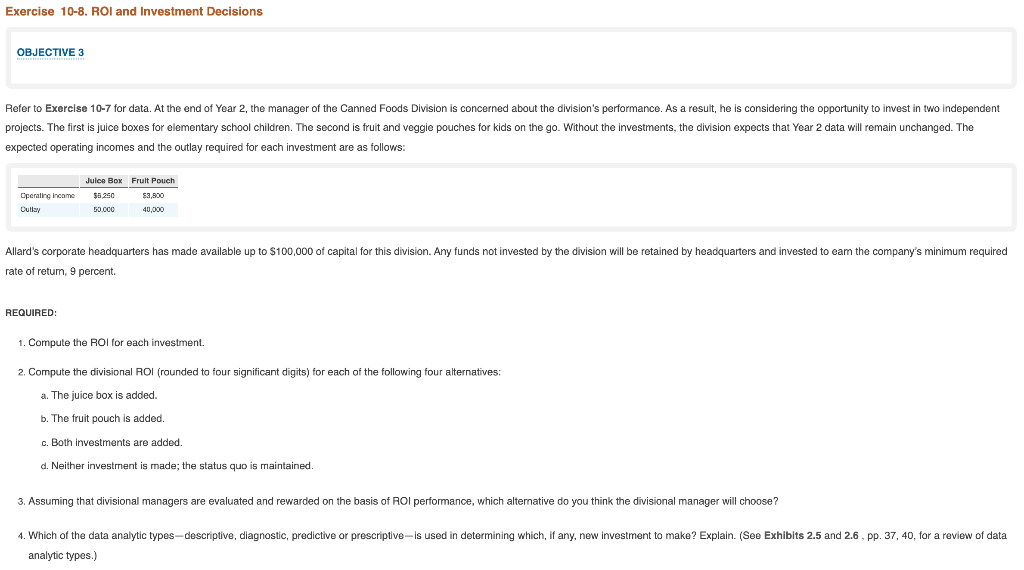

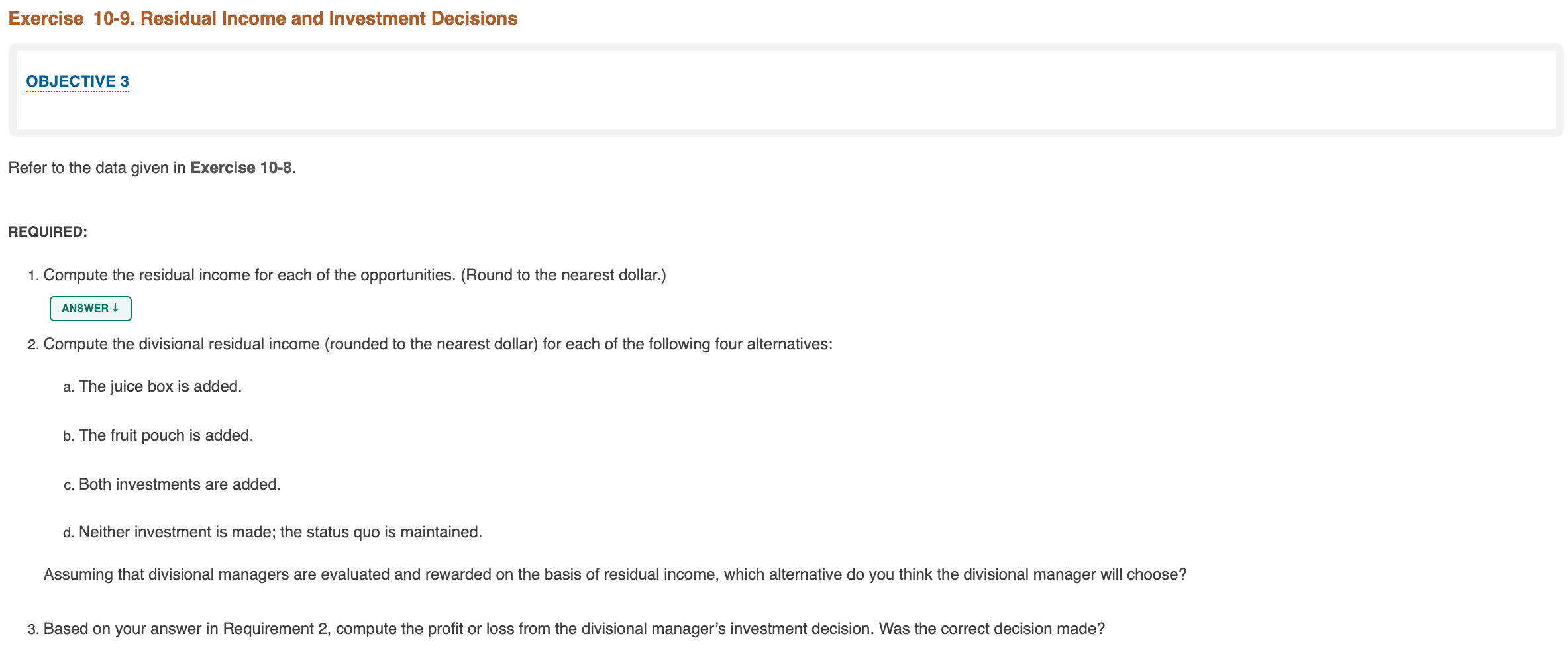

Exercise 10-9. Residual Income and Investment Decisions OBJECTIVE 3 Refer to the data given in Exercise 10-8. REQUIRED: 1. Compute the residual income for each of the opportunities. (Round to the nearest dollar.) ANSWER 2. Compute the divisional residual income (rounded to the nearest dollar) for each of the following four alternatives: a. The juice box is added. b. The fruit pouch is added. c. Both investments are added. d. Neither investment is made; the status quo is maintained. Assuming that divisional managers are evaluated and rewarded on the basis of residual income, which alternative do you think the divisional manager will choose? 3. Based on your answer in Requirement 2, compute the profit or loss from the divisional manager's investment decision. Was the correct decision made? Exercise 10-8. ROI and Investment Decisions OBJECTIVE 3 Refer to Exercise 10-7 for data. At the end of Year 2, the manager of the Canned Foods Division is concerned about the division's performance. As a result, he is considering the opportunity to invest in two independent projects. The first is juice boxes for elementary school children. The second is fruit and veggie pouches for kids on the go. Without the investments, the division expects that Year 2 data will remain unchanged. The expected operating incomes and the outlay required for each investment are as follows: Operating Income Outlay Juice Box Fruit Pouch $5.250 $9,800 50.000 40.000 Allard's corporate headquarters has made available up to $100,000 of capital for this division. Any funds not invested by the division will be retained by headquarters and invested to eam the company's minimum required rate of retum percent REQUIRED: 1. Compute the ROI for each investment 2. Compute the divisional ROI (rounded to four significant digits) for each of the following four alternatives: a. The juice box is added. b. The fruit pouch is added. c. Both investments are added. d. Neither investment is made; the status quo is maintained. 3. Assuming that divisional managers are evaluated and rewarded on the basis of ROI performance, which alternative do you think the divisional manager will choose? 4. Which of the data analytic types-descriptive, diagnostic, predictive or prescriptive-- is used in determining which, if any, new investment to make? Explain. (See Exhibits 2.5 and 2.6, pp. 37, 40, for a review of data analytic types.) Exercise 10-9. Residual Income and Investment Decisions OBJECTIVE 3 Refer to the data given in Exercise 10-8. REQUIRED: 1. Compute the residual income for each of the opportunities. (Round to the nearest dollar.) ANSWER 2. Compute the divisional residual income (rounded to the nearest dollar) for each of the following four alternatives: a. The juice box is added. b. The fruit pouch is added. c. Both investments are added. d. Neither investment is made; the status quo is maintained. Assuming that divisional managers are evaluated and rewarded on the basis of residual income, which alternative do you think the divisional manager will choose? 3. Based on your answer in Requirement 2, compute the profit or loss from the divisional manager's investment decision. Was the correct decision made? Exercise 10-8. ROI and Investment Decisions OBJECTIVE 3 Refer to Exercise 10-7 for data. At the end of Year 2, the manager of the Canned Foods Division is concerned about the division's performance. As a result, he is considering the opportunity to invest in two independent projects. The first is juice boxes for elementary school children. The second is fruit and veggie pouches for kids on the go. Without the investments, the division expects that Year 2 data will remain unchanged. The expected operating incomes and the outlay required for each investment are as follows: Operating Income Outlay Juice Box Fruit Pouch $5.250 $9,800 50.000 40.000 Allard's corporate headquarters has made available up to $100,000 of capital for this division. Any funds not invested by the division will be retained by headquarters and invested to eam the company's minimum required rate of retum percent REQUIRED: 1. Compute the ROI for each investment 2. Compute the divisional ROI (rounded to four significant digits) for each of the following four alternatives: a. The juice box is added. b. The fruit pouch is added. c. Both investments are added. d. Neither investment is made; the status quo is maintained. 3. Assuming that divisional managers are evaluated and rewarded on the basis of ROI performance, which alternative do you think the divisional manager will choose? 4. Which of the data analytic types-descriptive, diagnostic, predictive or prescriptive-- is used in determining which, if any, new investment to make? Explain. (See Exhibits 2.5 and 2.6, pp. 37, 40, for a review of data analytic types.)

Use the information from 10-8 to answer 10-9.

Use the information from 10-8 to answer 10-9.