I need help with how doing this business plan on goventureceo simulation/customers plan. This is for ice-cream shop.

Please help me with how should i do better and how do i know what we sale.

see pic

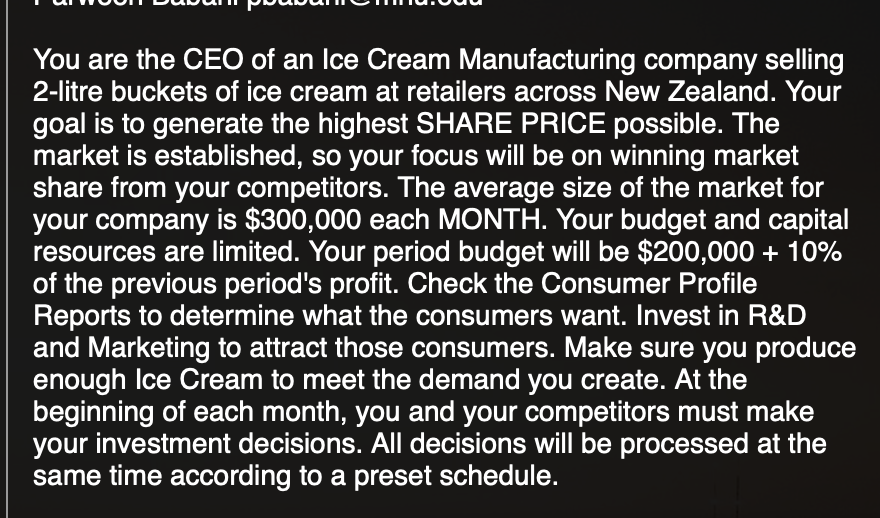

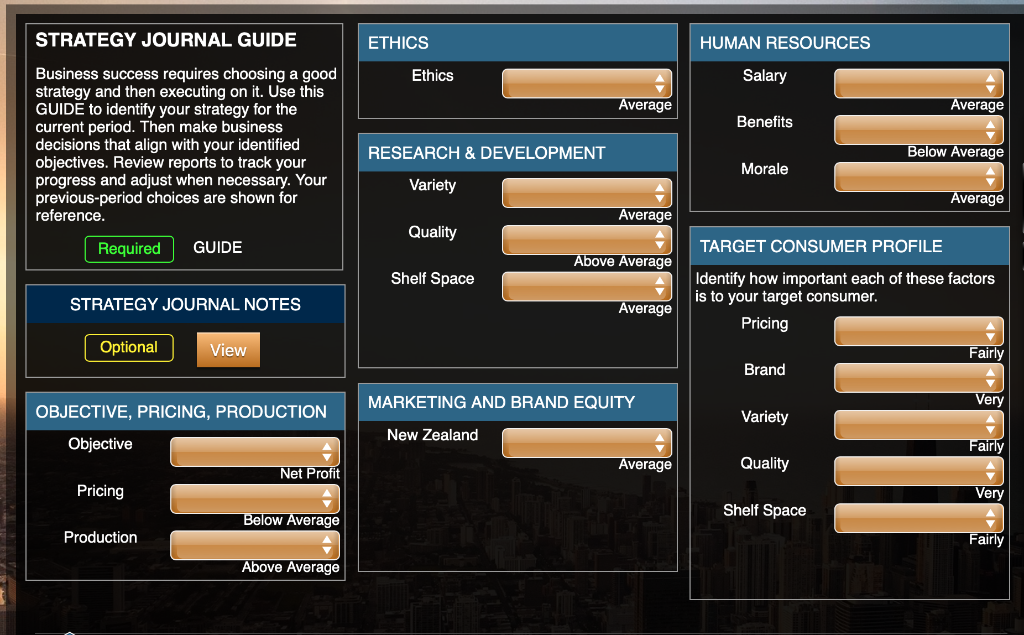

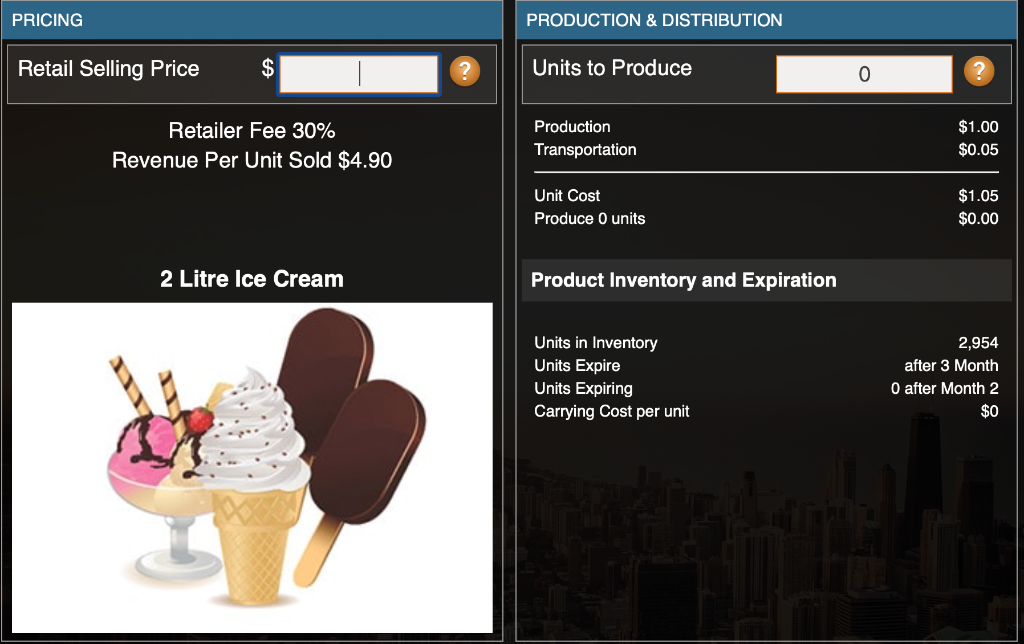

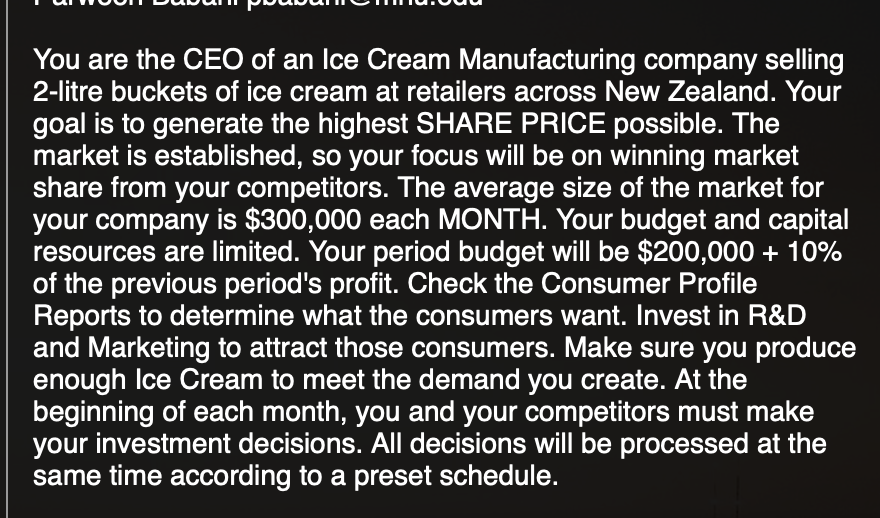

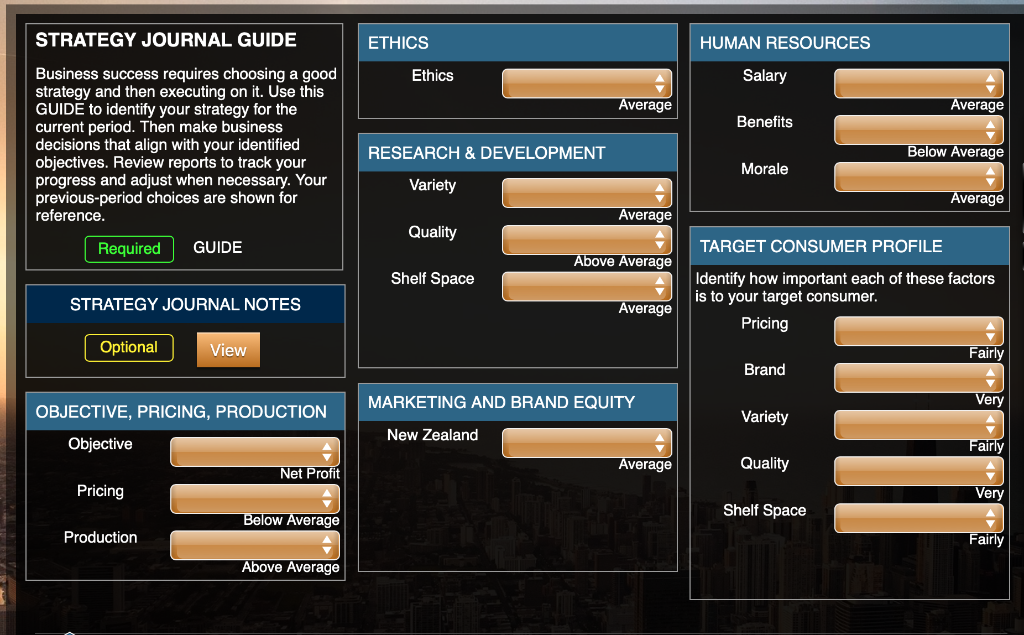

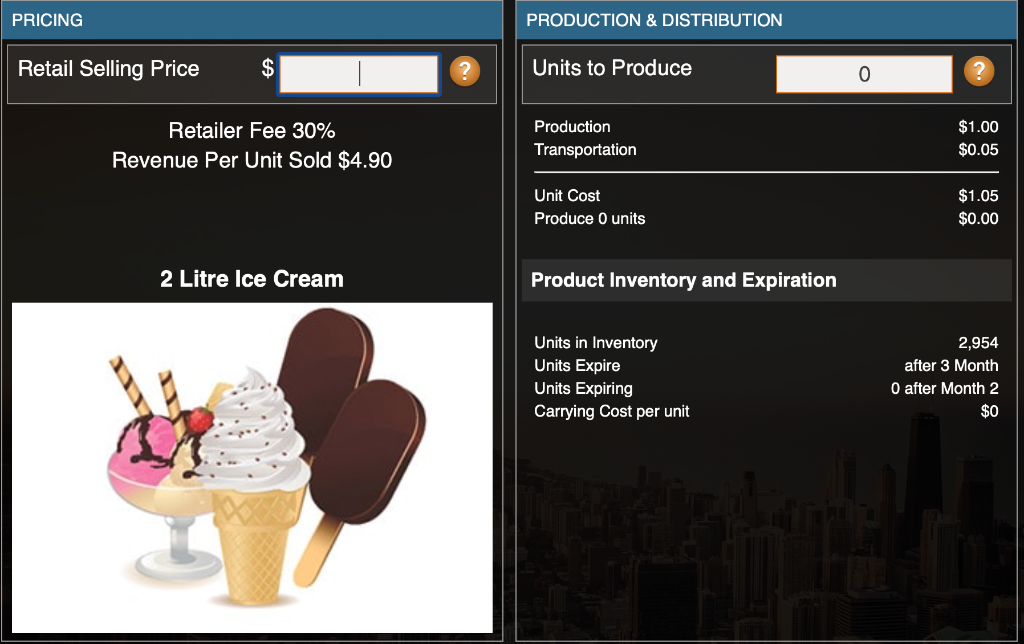

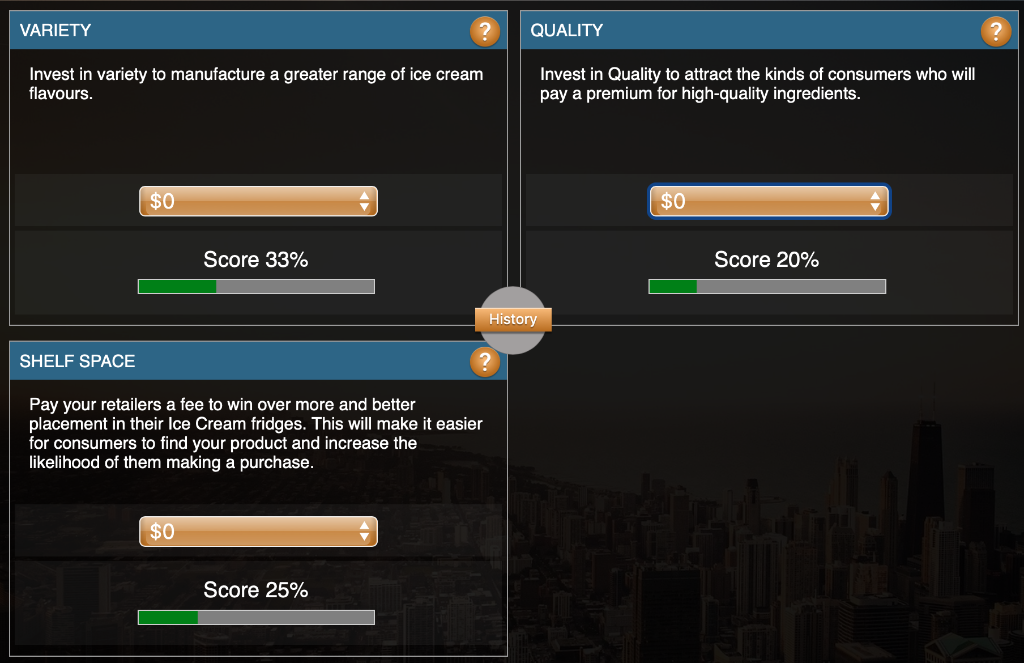

You are the CEO of an Ice Cream Manufacturing company selling 2-litre buckets of ice cream at retailers across New Zealand. Your goal is to generate the highest SHARE PRICE possible. The market is established, so your focus will be on winning market share from your competitors. The average size of the market for your company is $300,000 each MONTH. Your budget and capital resources are limited. Your period budget will be $200,000 + 10% of the previous period's profit. Check the Consumer Profile Reports to determine what the consumers want. Invest in R&D and Marketing to attract those consumers. Make sure you produce enough Ice Cream to meet the demand you create. At the beginning of each month, you and your competitors must make your investment decisions. All decisions will be processed at the same time according to a preset schedule. STRATEGY JOURNAL GUIDE ETHICS HUMAN RESOURCES Ethics Salary Average Average Benefits Business success requires choosing a good strategy and then executing on it. Use this GUIDE to identify your strategy for the current period. Then make business decisions that align with your identified objectives. Review reports to track your progress and adjust when necessary. Your previous-period choices are shown for reference. RESEARCH & DEVELOPMENT Below Average Morale Variety Average Average Quality Required GUIDE TARGET CONSUMER PROFILE Above Average Shelf Space Identify how important each of these factors is to your target consumer. STRATEGY JOURNAL NOTES Average Pricing Optional View Fairly Brand MARKETING AND BRAND EQUITY Very OBJECTIVE, PRICING, PRODUCTION Variety New Zealand Objective Fairly Average Quality Net Profit Pricing Very Shelf Space Below Average Production Fairly Above Average PRICING PRODUCTION & DISTRIBUTION Retail Selling Price $ Units to Produce 0 Retailer Fee 30% Production $1.00 $0.05 Transportation Revenue Per Unit Sold $4.90 Unit Cost $1.05 $0.00 Produce 0 units 2 Litre Ice Cream Product Inventory and Expiration 2,954 after 3 Month Units in Inventory Units Expire Units Expiring Carrying Cost per unit O after Month 2 $0 VARIETY QUALITY Invest in variety to manufacture a greater range of ice cream flavours. Invest in Quality to attract the kinds of consumers who will pay a premium for high-quality ingredients. $0 $0 Score 33% Score 20% History SHELF SPACE Pay your retailers a fee to win over more and better placement in their Ice Cream fridges. This will make it easier for consumers to find your product and increase the likelihood of them making a purchase. $0 Score 25% You are the CEO of an Ice Cream Manufacturing company selling 2-litre buckets of ice cream at retailers across New Zealand. Your goal is to generate the highest SHARE PRICE possible. The market is established, so your focus will be on winning market share from your competitors. The average size of the market for your company is $300,000 each MONTH. Your budget and capital resources are limited. Your period budget will be $200,000 + 10% of the previous period's profit. Check the Consumer Profile Reports to determine what the consumers want. Invest in R&D and Marketing to attract those consumers. Make sure you produce enough Ice Cream to meet the demand you create. At the beginning of each month, you and your competitors must make your investment decisions. All decisions will be processed at the same time according to a preset schedule. STRATEGY JOURNAL GUIDE ETHICS HUMAN RESOURCES Ethics Salary Average Average Benefits Business success requires choosing a good strategy and then executing on it. Use this GUIDE to identify your strategy for the current period. Then make business decisions that align with your identified objectives. Review reports to track your progress and adjust when necessary. Your previous-period choices are shown for reference. RESEARCH & DEVELOPMENT Below Average Morale Variety Average Average Quality Required GUIDE TARGET CONSUMER PROFILE Above Average Shelf Space Identify how important each of these factors is to your target consumer. STRATEGY JOURNAL NOTES Average Pricing Optional View Fairly Brand MARKETING AND BRAND EQUITY Very OBJECTIVE, PRICING, PRODUCTION Variety New Zealand Objective Fairly Average Quality Net Profit Pricing Very Shelf Space Below Average Production Fairly Above Average PRICING PRODUCTION & DISTRIBUTION Retail Selling Price $ Units to Produce 0 Retailer Fee 30% Production $1.00 $0.05 Transportation Revenue Per Unit Sold $4.90 Unit Cost $1.05 $0.00 Produce 0 units 2 Litre Ice Cream Product Inventory and Expiration 2,954 after 3 Month Units in Inventory Units Expire Units Expiring Carrying Cost per unit O after Month 2 $0 VARIETY QUALITY Invest in variety to manufacture a greater range of ice cream flavours. Invest in Quality to attract the kinds of consumers who will pay a premium for high-quality ingredients. $0 $0 Score 33% Score 20% History SHELF SPACE Pay your retailers a fee to win over more and better placement in their Ice Cream fridges. This will make it easier for consumers to find your product and increase the likelihood of them making a purchase. $0 Score 25%