Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with how to solve this questions please. 1 Caspian Sea Drinks is considering the purchase of a plum juicer - the PJX5.

I need help with how to solve this questions please.

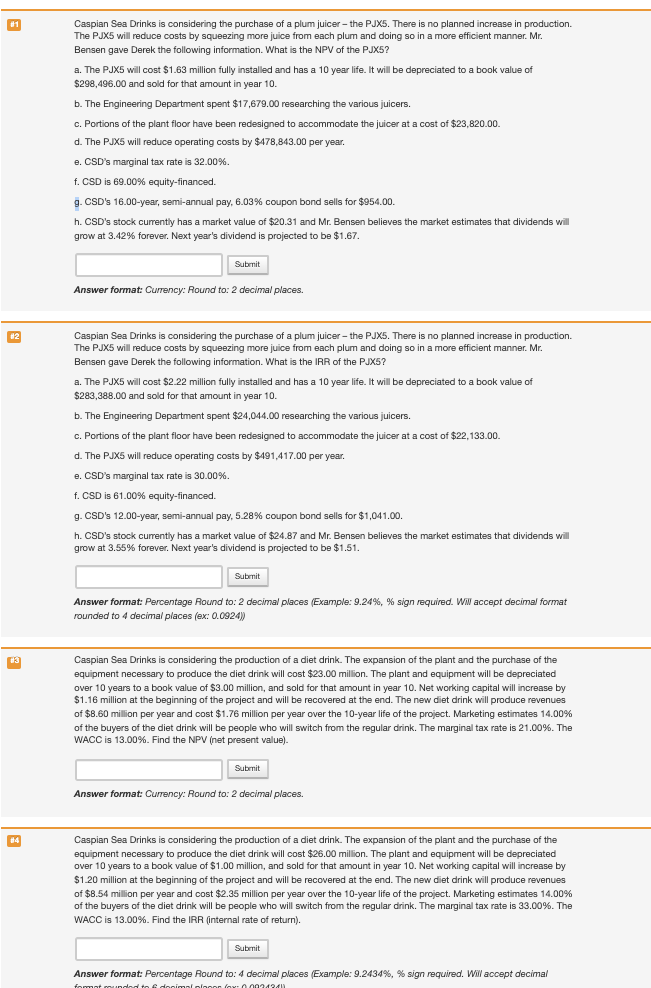

1 Caspian Sea Drinks is considering the purchase of a plum juicer - the PJX5. There is no planned increase in production. The PJX5 will reduce costs by squeezing more juice from each plum and doing so in a more efficient manner. Mr. Bensen gave Derek the following information. What is the NPV of the PjX5? a. The PJX5 will cost $1.63 million fully installed and has a 10 year life. It will be depreciated to a book value of $298,496.00 and sold for that amount in year 10. b. The Engineering Department spent $17,679.00 researching the various juicers. c. Portions of the plant floor have been redesigned to accommodate the juicer at a cost of $23,820.00. d. The PJX5 will reduce operating costs by $478,843.00 per year. e. CSD's marginal tax rate is 32.00%. f. CSD is 69.00% equity-financed. g, % . g. CSD's 16.00-year, semi-annual pay, 6.03% coupon bond sells for $954.00. h. CSD's stock currently has a market value of $20.31 and Mr. Bensen believes the market estimates that dividends will grow at 3.42% forever. Next year's dividend is projected to be $1.67. Submit Answer format: Currency: Round to: 2 decimal places. #2 Caspian Sea Drinks is considering the purchase of a plum juicer - the PJX5. There is no planned increase in production. The PJX5 will reduce costs by squeezing more juice from each plum and doing so in a more efficient manner. Mr. Bensen gave Derek the following information. What is the IRR of the PJX5? a. The PJX5 will cost $2.22 million fully installed and has a 10 year life. It will be depreciated to a book value of $283,388.00 and sold for that amount in year 10. b. The Engineering Department spent $24,044.00 researching the various juicers. c. Portions of the plant floor have been redesigned to accommodate the juicer at a cost of $22,133.00 d. The PJX5 will reduce operating costs by $491,417.00 per year. e. CSD's marginal tax rate is 30.00%. f. CSD is 61.00% equity-financed. g. CSD's 12.00-year, semi-annual pay, 5.28% coupon bond sells for $1,041.00. h. CSD's stock currently has a market value of $24.87 and Mr. Bensen believes the market estimates that dividends will grow at 3.55% forever. Next year's dividend is projected to be $1.51. Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. WW accept decimal format rounded to 4 decimal places (ex: 0.0924)) 03 Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $23.00 million. The plant and equipment will be depreciated over 10 years to a book value of $3.00 million, and sold for that amount in year 10. Net working capital will increase by $1.16 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $8.60 million per year and cost $1.76 million per year over the 10-year life of the project. Marketing estimates 14.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 21.00%. The WACC is 13.00%. Find the NPV (net present value). Subrnit Answer format: Currency: Round to: 2 decimal places. : 84 Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $26.00 million. The plant and equipment will be depreciated over 10 years to a book value of $1.00 million, and sold for that amount in year 10. Net working capital will increase by $1.20 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $8.54 million per year and cost $2.35 million per year over the 10-year life of the project. Marketing estimates 14.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 33.00%. The WACC is 13.00%. Find the IRR (internal rate of return). Submit Answer format: Percentage Round to: 4 decimal places (Example: 9.2434%, % sign required. Will accept decimal fomatended to decimal oor ov249411Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started