Answered step by step

Verified Expert Solution

Question

1 Approved Answer

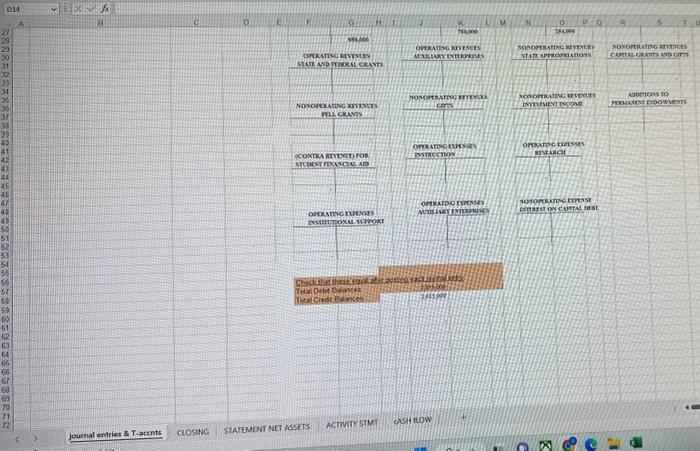

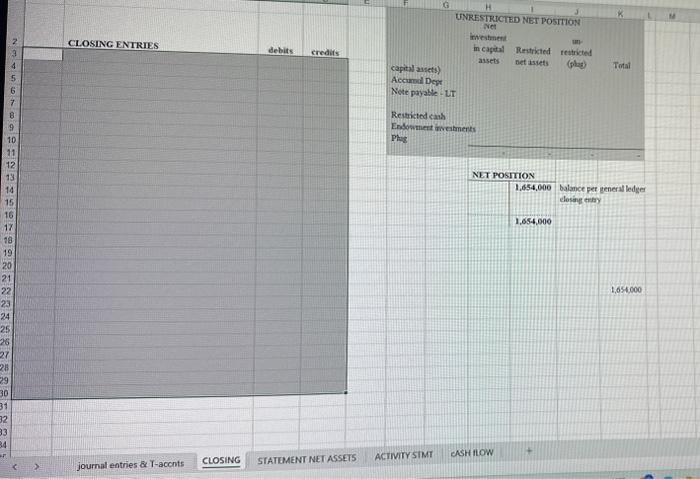

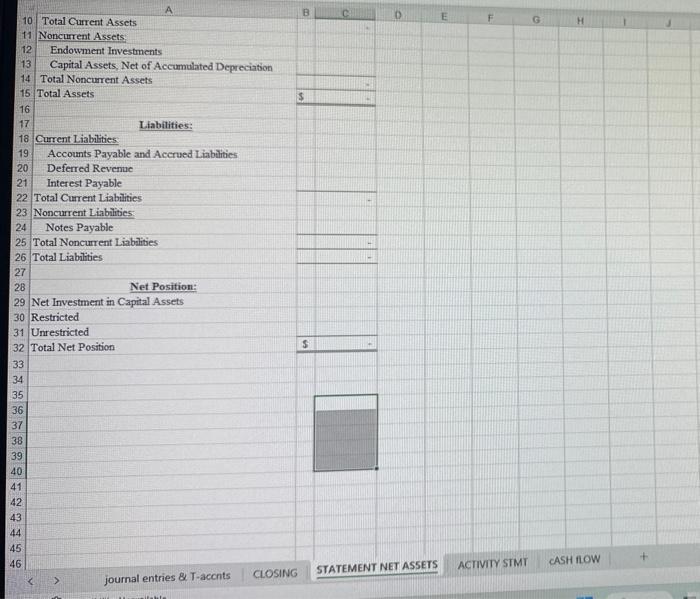

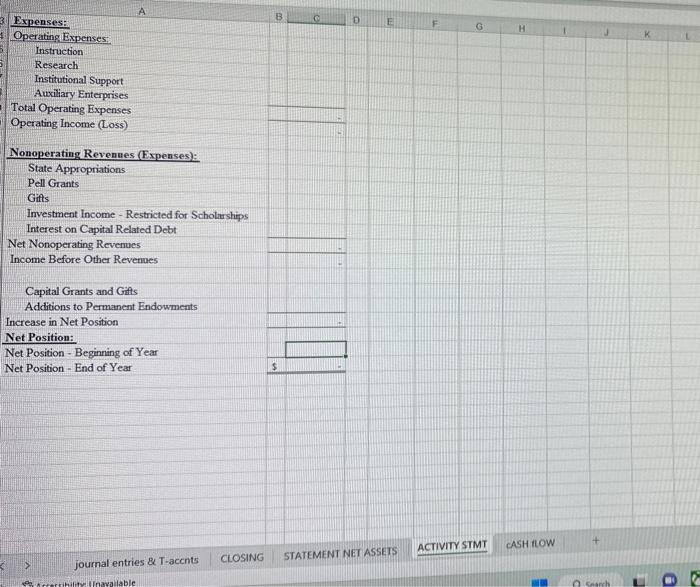

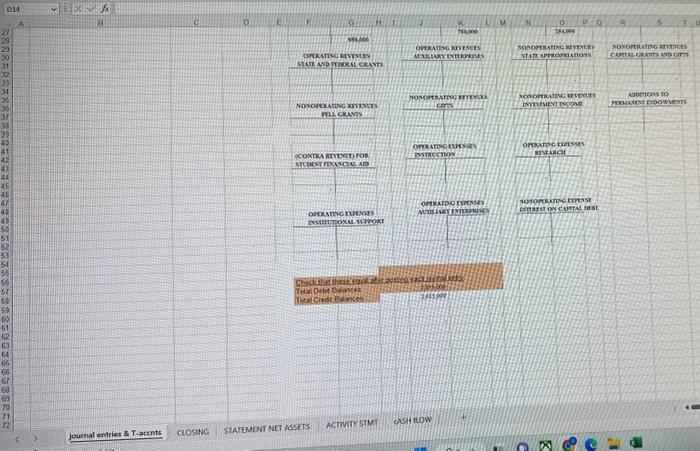

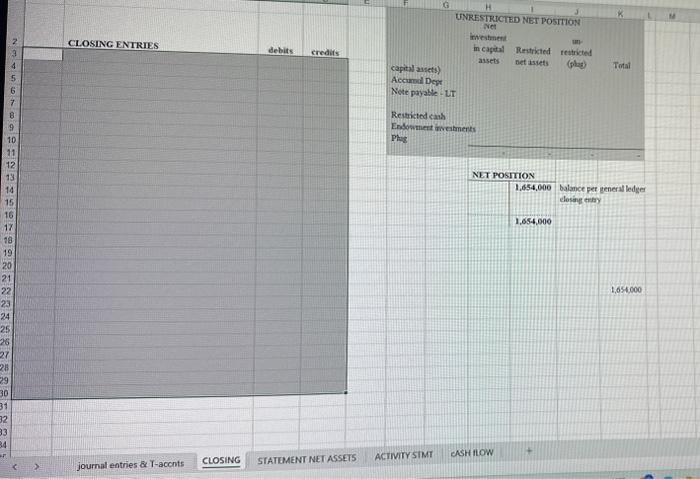

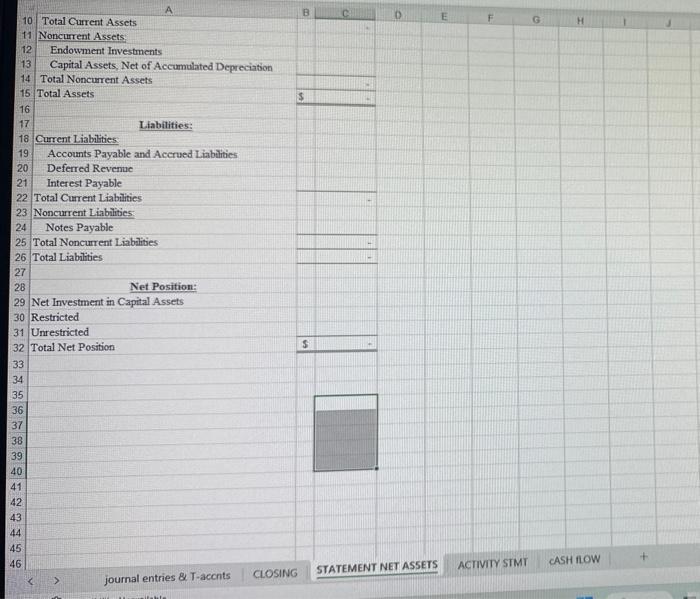

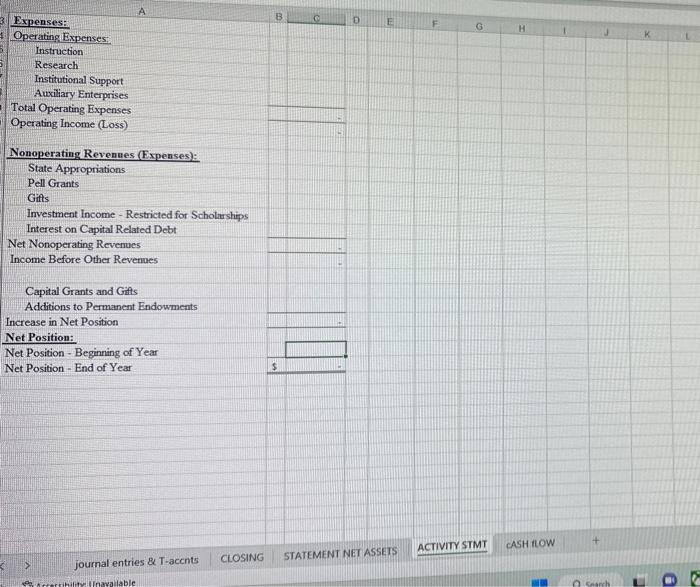

I need help with Journal Entries & T-Accounts, Closing Entries, Statement Net Assets, Activity Statement, and Cash Flow 11-9. The Great Lakes Maritime Institute is

I need help with Journal Entries & T-Accounts, Closing Entries, Statement Net Assets, Activity Statement, and Cash Flow

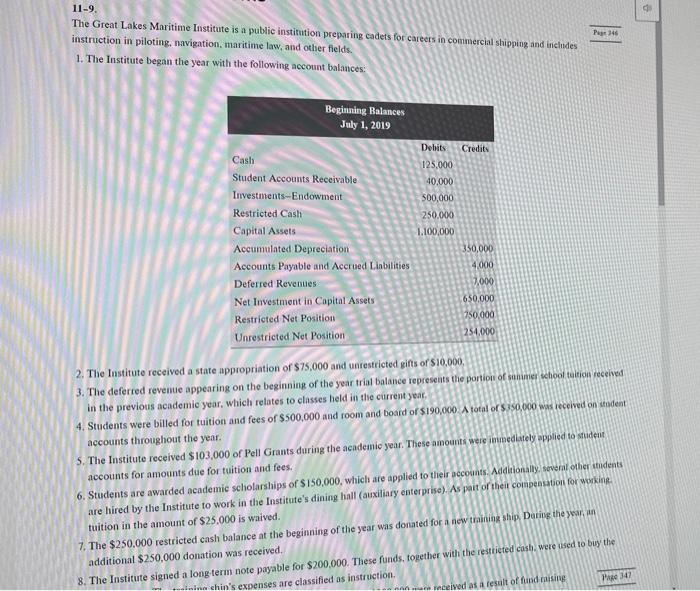

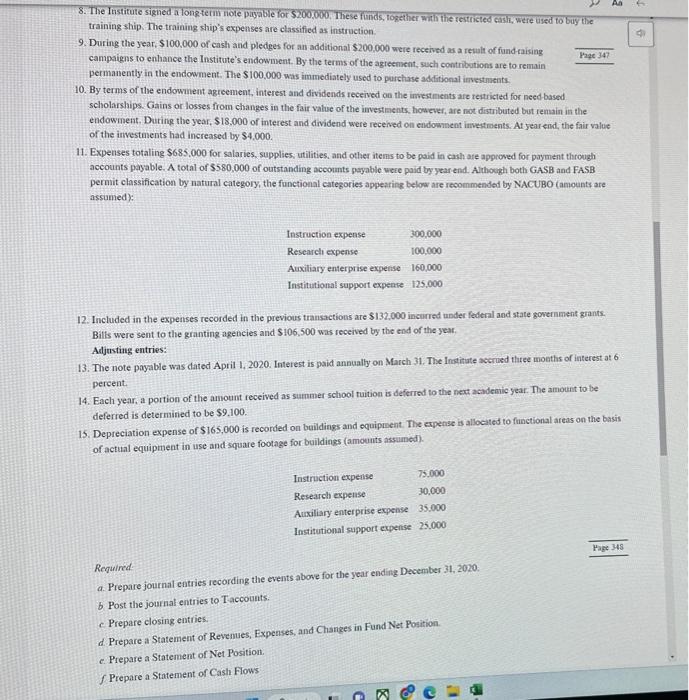

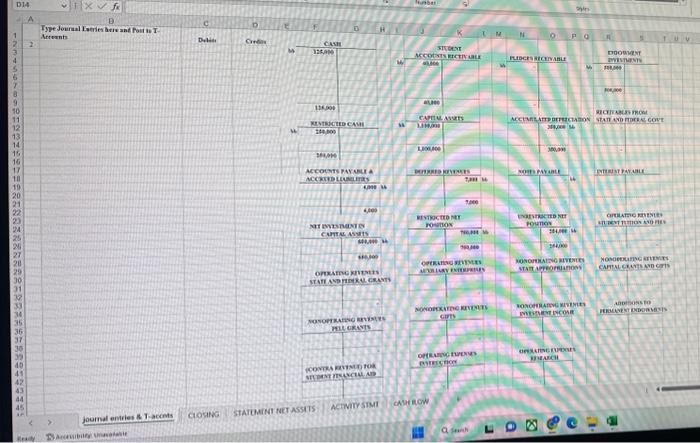

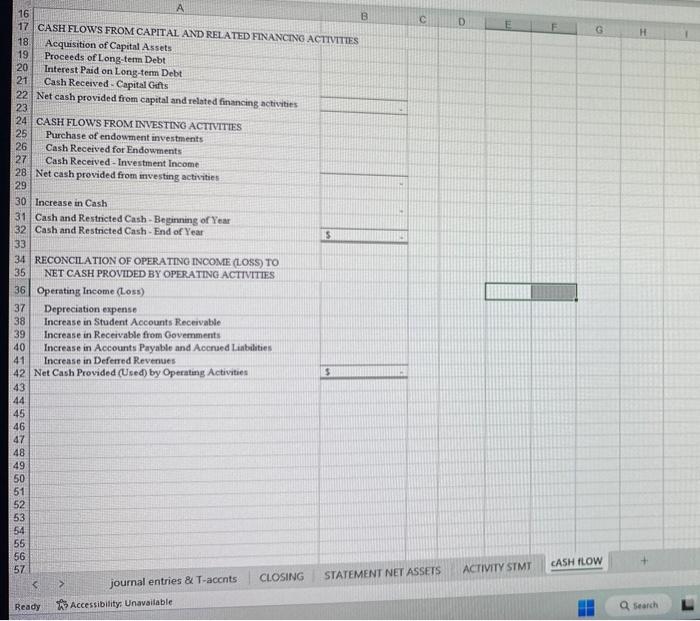

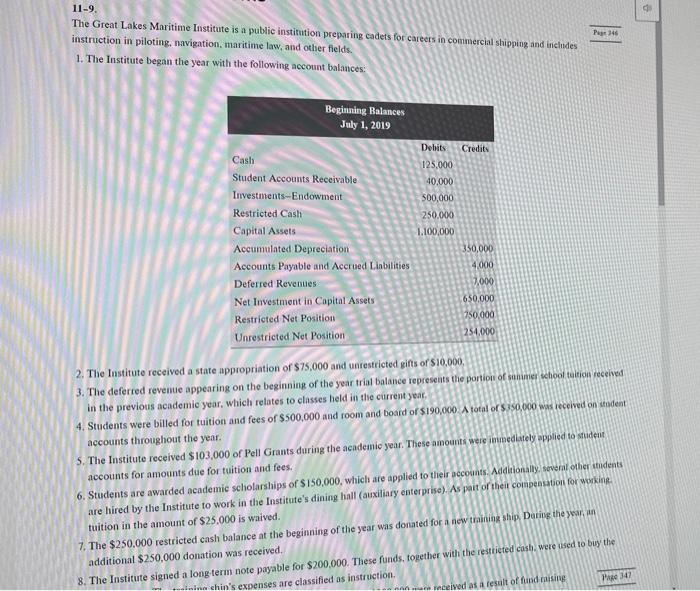

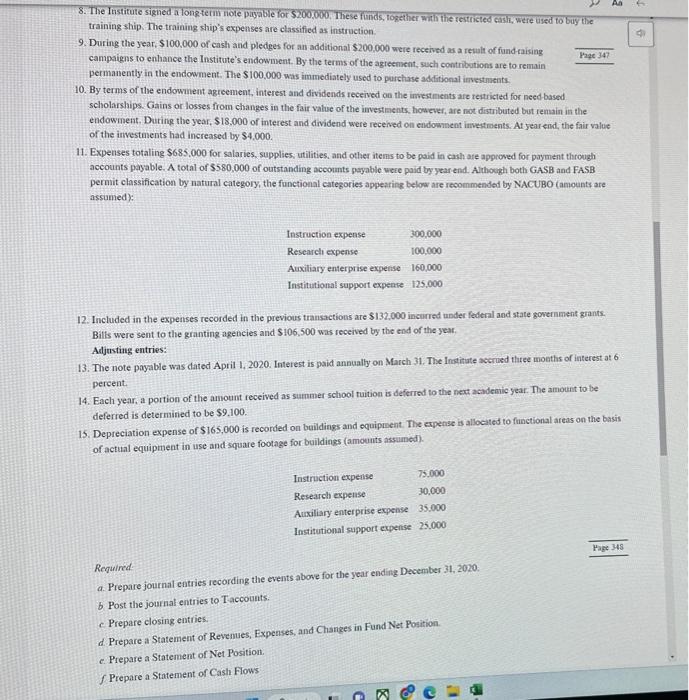

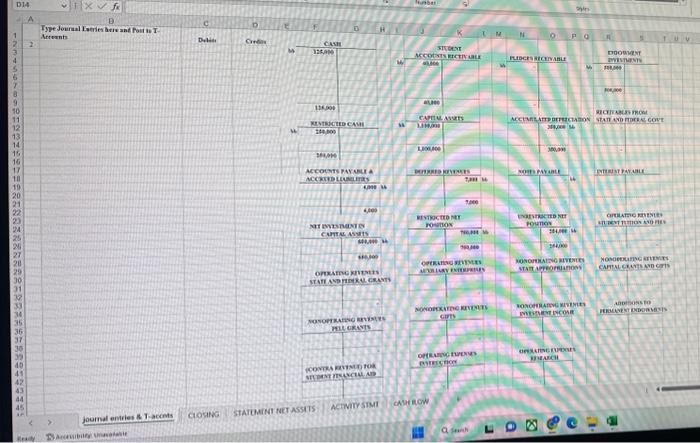

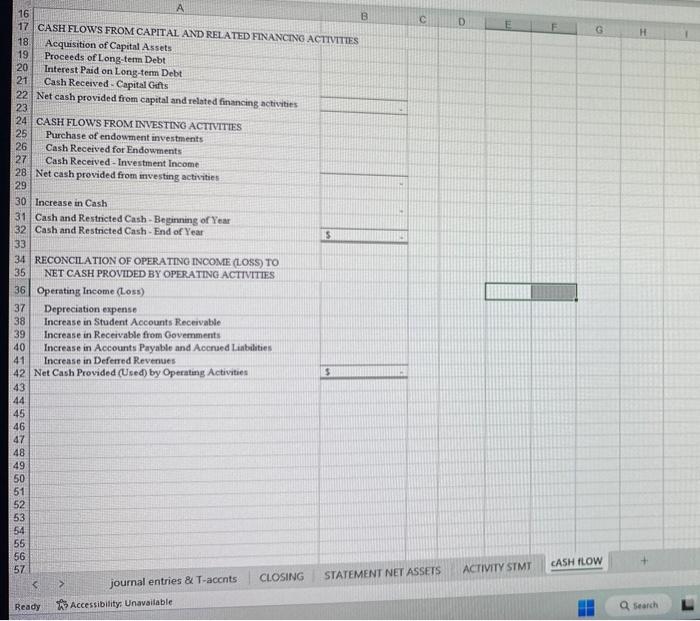

11-9. The Great Lakes Maritime Institute is a public institution preparing cadets for careers in commercial shipping and theludes instruction in piloting, navigation, maritime law, and other fields. 1. The Institute began the year with the following account balances: 2. The Institute received a state appropriation of $75,000 and unrestricted gifs of $10,000. 3. The deferred revenue appearing on the beginning of the year trial balance represents thie portion of sanumer wehpol tution received in the previous academic year, which relates to classes held in the current year. 4. Students were billed for tuition and fees of $500,000 and room and board of $190,000 A total or $390,000 wis ieceived on chodent 5. The Institute recelved $103,000 of Pell Grants during the academic year. These amounts were immediately applied to shident accounts throughout the year. 6. Students are awarded academic scholarships of $150,000. Which are applied to their accouats. Addationally. soveral ohicr atudents accounts for amounts due for tuition and fees. are hired by the Institute to work in the Institute's dining hall (auxiliary enterprise). As pait of their congeaption formokkine. 7. The $250.000 restricted cash balance at the beginning of the year was donated for a new trainiag ship, Dutiug the year, in tuition in the amount of $25,000 is waived. additional $250,000 donation was received. These funds, together with the restrieted cast were used to bus the 9. During the year, $100,000 of cash and pledges for an additional $200,000 were received as a recult of fund-aising campaigns to enhance the Institute's endowment. By the terms of the agreenent, such contribetions are to remain permanently in the endowment. The $100,000 wis immediately usod to parchase additional ievestments. 10. By terms of the endowment agreement, interest and dividends received on the imestments are reitricted for need based scholarships. Gains or losses from changes in the fair value of the imvestaents, however, are not distributed but remain in the endowment, During the year, $18.000 of interest and dividend were received on endownent imestreents. At year end, the fair value of the imvestuents had increased by $4,000. 11. Expenses totaling $685,000 for salaries, supplies; utilities, and other items to be paid in cash are approved for payment through accounts payable. A total of $580,000 of outstanding accounts payable were poid byyear end. Alrhocgh both GasB and FASB permit classification by natural category, the functional categories appearing below are recommended by NACUBO (amounts are assumed) 12. Included in the expenses recorded in the previous transactions are $132,000 incurred under federal and state govermment grants. Bills were sent to the granting agencies and $106,500 was received by the end of the year. Adjusting entries: 13. The note payable was dated Aprii 1,2020. Interest is paid annually on March 31. The Inotitute accrusd three moeths of interest at 6 percent. 14. Each year, a portion of the amount received as summer school tuition is deferred to the next achdemic year. The amount to be deferred is determiried to be $9,100. 15. Depreciation expense of $165,000 is recorded on beildings and oquipment. The expense is allocited to functional areas on the basis of actual equipment in use and square footage for buildinss (amounts assumed). a. Prepare journal eatries recording the events above for the year ending December 31, 2020: Required b. Post the journal entries to Taccounts. c. Prepare closing entries. d. Prepare a Statement of Revenues, Expenses, and Changes in Fund Net Position. e. Prepare a Statement of Net Position. f Prepare a Statement of Cash Flows Did q=x>f CLOSING ENTRIES 1,64,000 journal entries \& T-aconts CLOSING STATEMENTNETASSETS ACTNITYSIMT EASHILOW \begin{tabular}{|l|l|l|} \hline 10 & Total Current Assets \\ 11 & Noncurrent Assets \\ \hline 12 & Endowment Investments \\ 13 & Capital Assets, Net of Accumulated Depreciation \\ 14 & Total Noncurrent Assets \\ 15 & Total Assets \\ 16 & \\ 17 & \\ 18 & Current Liabilities \\ \hline 19 & Accounts Payable and Acerued Liabilities \\ \hline 20 & Deferred Revenue \\ \hline 21 & Interest Payable \\ 22 & Total Current Liabilities \\ \hline 23 & Noncurrent Liablities \\ \hline 24 & Notes Payable \\ \hline 25 & Total Noncurrent Liablities \\ 26 & Total Liabilities \\ \hline 27 & \\ \hline 28 & \\ \hline 29 & Net Investment in Capital Assets \\ \hline 30 & Restricted \\ \hline 31 & Unrestricted \\ \hline 32 & Total Net Position \\ \hline 33 & \\ \hline 34 & \\ \hline 35 & \\ \hline 36 & \\ 37 & \\ \hline 36 & \\ 39 & \\ 40 & \\ \hline 14 & \\ \hline \end{tabular} Expenses: Operating Expenses: Instruction Research Institutional Support Auciliary Enterprises Total Operating Expenses Operating Income (Loss) Nonoperating Revenues (Expenses): State Appropriations Pell Grants Gifts Investment lncome - Restricted for Scholurships Interest on Capital Related Debt Net Nonoperating Reverues Income Before Other Revenues Capital Grants and Gifts Additions to Permanent Endowmeats Increase in Net Position Net Position: Net Position - Beginning of Year Net Position - End of Year journal entries \& T-accnts CLOSING STATEMENT NET ASSETS ACTIVITYSTMT CASH LLOW \begin{tabular}{|l|c} 16 & A \\ 17 & CASH FLOWS FROM CAPITAL AND RELATED FINANCNG ACTIVTTIES \end{tabular} Acquisition of Capital Assets Proceeds of Long-tem Debt Interest Paid on Long-tem Debt Cash Received - Capital Gifts Net cash provided from capital and related financing activities CASH FLOWS FROM INVESTLNG ACTTVITIES Purchase of endowment investments Cash Received for Endowments Cash Received - Investment Income Net cash provided from investing activities Increase in Cash Cash and Restricted Cash-Beginning of Year Cash and Restricted Cash - End of Year RECONCL ATION OF OPERATING INCOME (LOSS) TO NET CASH PROVIDED BY OPERATING ACTVITIES Operating Income (Loss) Depreciation expense Increase in Student Aocounts Receivable Increase in Receivable from Govemments Increase in Accounts Payable and Accned Liabbities Increase in Defenred Revenues Net Cash Provided (Used) by Operating Activities 3 43 11-9. The Great Lakes Maritime Institute is a public institution preparing cadets for careers in commercial shipping and theludes instruction in piloting, navigation, maritime law, and other fields. 1. The Institute began the year with the following account balances: 2. The Institute received a state appropriation of $75,000 and unrestricted gifs of $10,000. 3. The deferred revenue appearing on the beginning of the year trial balance represents thie portion of sanumer wehpol tution received in the previous academic year, which relates to classes held in the current year. 4. Students were billed for tuition and fees of $500,000 and room and board of $190,000 A total or $390,000 wis ieceived on chodent 5. The Institute recelved $103,000 of Pell Grants during the academic year. These amounts were immediately applied to shident accounts throughout the year. 6. Students are awarded academic scholarships of $150,000. Which are applied to their accouats. Addationally. soveral ohicr atudents accounts for amounts due for tuition and fees. are hired by the Institute to work in the Institute's dining hall (auxiliary enterprise). As pait of their congeaption formokkine. 7. The $250.000 restricted cash balance at the beginning of the year was donated for a new trainiag ship, Dutiug the year, in tuition in the amount of $25,000 is waived. additional $250,000 donation was received. These funds, together with the restrieted cast were used to bus the 9. During the year, $100,000 of cash and pledges for an additional $200,000 were received as a recult of fund-aising campaigns to enhance the Institute's endowment. By the terms of the agreenent, such contribetions are to remain permanently in the endowment. The $100,000 wis immediately usod to parchase additional ievestments. 10. By terms of the endowment agreement, interest and dividends received on the imestments are reitricted for need based scholarships. Gains or losses from changes in the fair value of the imvestaents, however, are not distributed but remain in the endowment, During the year, $18.000 of interest and dividend were received on endownent imestreents. At year end, the fair value of the imvestuents had increased by $4,000. 11. Expenses totaling $685,000 for salaries, supplies; utilities, and other items to be paid in cash are approved for payment through accounts payable. A total of $580,000 of outstanding accounts payable were poid byyear end. Alrhocgh both GasB and FASB permit classification by natural category, the functional categories appearing below are recommended by NACUBO (amounts are assumed) 12. Included in the expenses recorded in the previous transactions are $132,000 incurred under federal and state govermment grants. Bills were sent to the granting agencies and $106,500 was received by the end of the year. Adjusting entries: 13. The note payable was dated Aprii 1,2020. Interest is paid annually on March 31. The Inotitute accrusd three moeths of interest at 6 percent. 14. Each year, a portion of the amount received as summer school tuition is deferred to the next achdemic year. The amount to be deferred is determiried to be $9,100. 15. Depreciation expense of $165,000 is recorded on beildings and oquipment. The expense is allocited to functional areas on the basis of actual equipment in use and square footage for buildinss (amounts assumed). a. Prepare journal eatries recording the events above for the year ending December 31, 2020: Required b. Post the journal entries to Taccounts. c. Prepare closing entries. d. Prepare a Statement of Revenues, Expenses, and Changes in Fund Net Position. e. Prepare a Statement of Net Position. f Prepare a Statement of Cash Flows Did q=x>f CLOSING ENTRIES 1,64,000 journal entries \& T-aconts CLOSING STATEMENTNETASSETS ACTNITYSIMT EASHILOW \begin{tabular}{|l|l|l|} \hline 10 & Total Current Assets \\ 11 & Noncurrent Assets \\ \hline 12 & Endowment Investments \\ 13 & Capital Assets, Net of Accumulated Depreciation \\ 14 & Total Noncurrent Assets \\ 15 & Total Assets \\ 16 & \\ 17 & \\ 18 & Current Liabilities \\ \hline 19 & Accounts Payable and Acerued Liabilities \\ \hline 20 & Deferred Revenue \\ \hline 21 & Interest Payable \\ 22 & Total Current Liabilities \\ \hline 23 & Noncurrent Liablities \\ \hline 24 & Notes Payable \\ \hline 25 & Total Noncurrent Liablities \\ 26 & Total Liabilities \\ \hline 27 & \\ \hline 28 & \\ \hline 29 & Net Investment in Capital Assets \\ \hline 30 & Restricted \\ \hline 31 & Unrestricted \\ \hline 32 & Total Net Position \\ \hline 33 & \\ \hline 34 & \\ \hline 35 & \\ \hline 36 & \\ 37 & \\ \hline 36 & \\ 39 & \\ 40 & \\ \hline 14 & \\ \hline \end{tabular} Expenses: Operating Expenses: Instruction Research Institutional Support Auciliary Enterprises Total Operating Expenses Operating Income (Loss) Nonoperating Revenues (Expenses): State Appropriations Pell Grants Gifts Investment lncome - Restricted for Scholurships Interest on Capital Related Debt Net Nonoperating Reverues Income Before Other Revenues Capital Grants and Gifts Additions to Permanent Endowmeats Increase in Net Position Net Position: Net Position - Beginning of Year Net Position - End of Year journal entries \& T-accnts CLOSING STATEMENT NET ASSETS ACTIVITYSTMT CASH LLOW \begin{tabular}{|l|c} 16 & A \\ 17 & CASH FLOWS FROM CAPITAL AND RELATED FINANCNG ACTIVTTIES \end{tabular} Acquisition of Capital Assets Proceeds of Long-tem Debt Interest Paid on Long-tem Debt Cash Received - Capital Gifts Net cash provided from capital and related financing activities CASH FLOWS FROM INVESTLNG ACTTVITIES Purchase of endowment investments Cash Received for Endowments Cash Received - Investment Income Net cash provided from investing activities Increase in Cash Cash and Restricted Cash-Beginning of Year Cash and Restricted Cash - End of Year RECONCL ATION OF OPERATING INCOME (LOSS) TO NET CASH PROVIDED BY OPERATING ACTVITIES Operating Income (Loss) Depreciation expense Increase in Student Aocounts Receivable Increase in Receivable from Govemments Increase in Accounts Payable and Accned Liabbities Increase in Defenred Revenues Net Cash Provided (Used) by Operating Activities 3 43

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started