Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with K-N please. Outstanding shares is 100,000. EBIT was $500,000 last year with earning expected to remain constant. Seven Scenarios 1 -

I need help with K-N please. Outstanding shares is 100,000. EBIT was $500,000 last year with earning expected to remain constant.

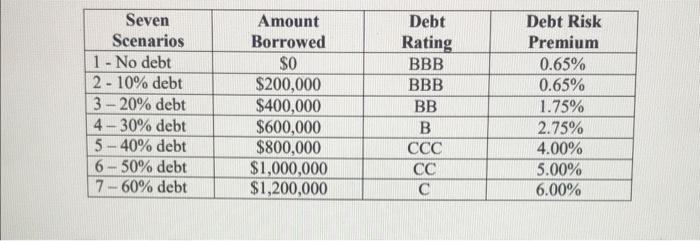

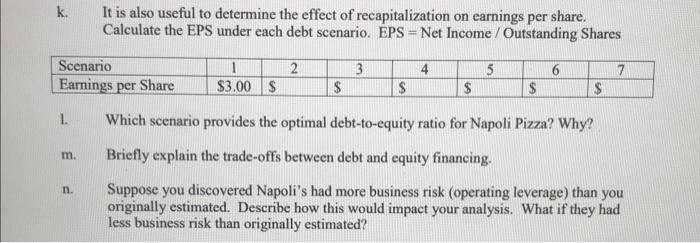

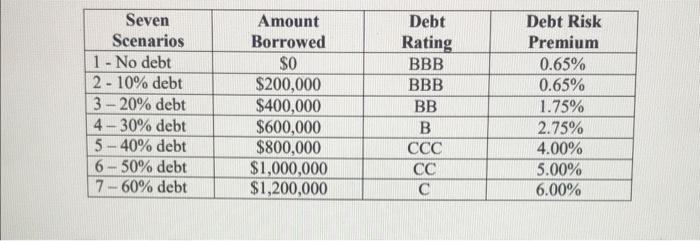

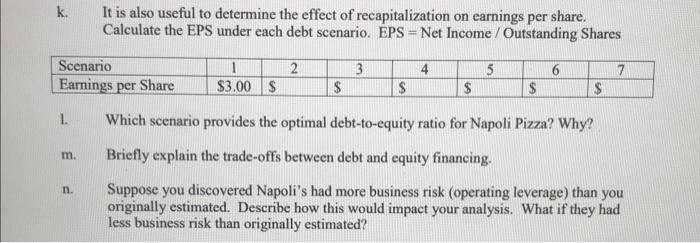

Seven Scenarios 1 - No debt 2 - 10% debt 3- 20% debt 4-30% debt 5 - 40% debt 6 - 50% debt 7- 60% debt Amount Borrowed SO $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 Debt Rating BBB BBB BB B CC Debt Risk Premium 0.65% 0.65% 1.75% 2.75% 4.00% 5.00% 6.00% k. It is also useful to determine the effect of recapitalization on earnings per share. Calculate the EPS under each debt scenario. EPS = Net Income / Outstanding Shares 3 Scenario Earnings per Share 2 4. 1 $3.00 $ 5 6 7 $ $ $ $ $ 1. Which scenario provides the optimal debt-to-equity ratio for Napoli Pizza? Why? m. Briefly explain the trade-offs between debt and equity financing. n. Suppose you discovered Napoli's had more business risk (operating leverage) than you originally estimated. Describe how this would impact your analysis. What if they had less business risk than originally estimated? Seven Scenarios 1 - No debt 2 - 10% debt 3- 20% debt 4-30% debt 5 - 40% debt 6 - 50% debt 7- 60% debt Amount Borrowed SO $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 Debt Rating BBB BBB BB B CC Debt Risk Premium 0.65% 0.65% 1.75% 2.75% 4.00% 5.00% 6.00% k. It is also useful to determine the effect of recapitalization on earnings per share. Calculate the EPS under each debt scenario. EPS = Net Income / Outstanding Shares 3 Scenario Earnings per Share 2 4. 1 $3.00 $ 5 6 7 $ $ $ $ $ 1. Which scenario provides the optimal debt-to-equity ratio for Napoli Pizza? Why? m. Briefly explain the trade-offs between debt and equity financing. n. Suppose you discovered Napoli's had more business risk (operating leverage) than you originally estimated. Describe how this would impact your analysis. What if they had less business risk than originally estimated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started