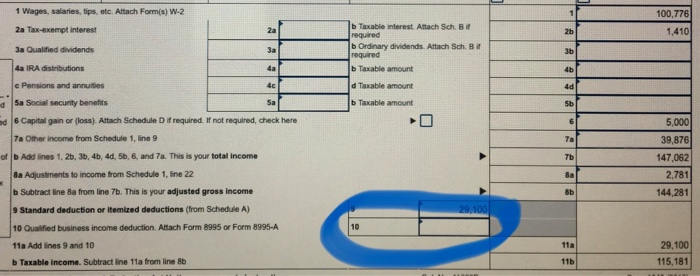

I need help with line 10 Form 1040 please

2019 Qualified business Income Deduction

thank you!

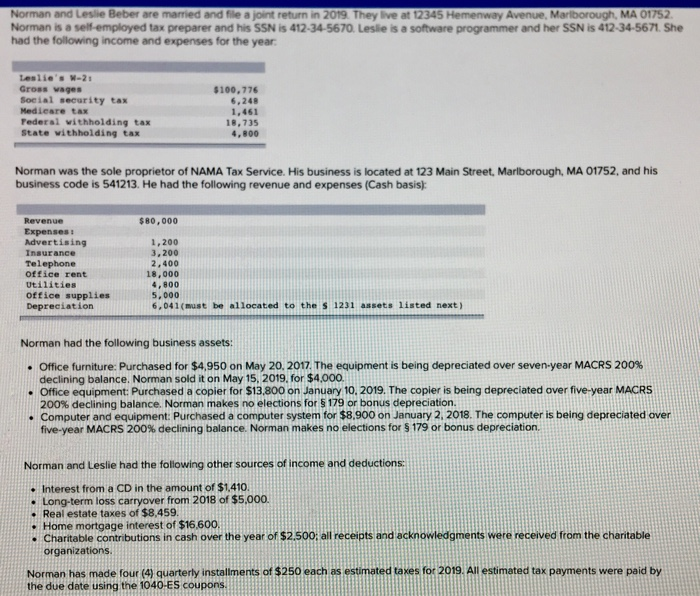

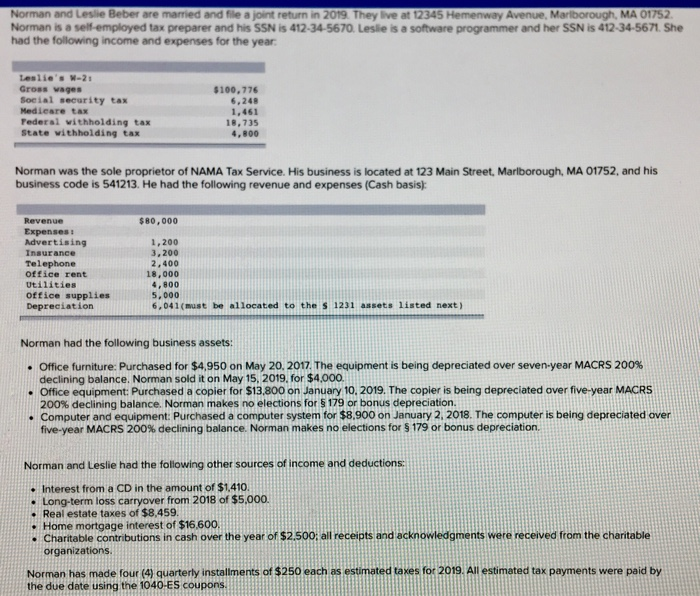

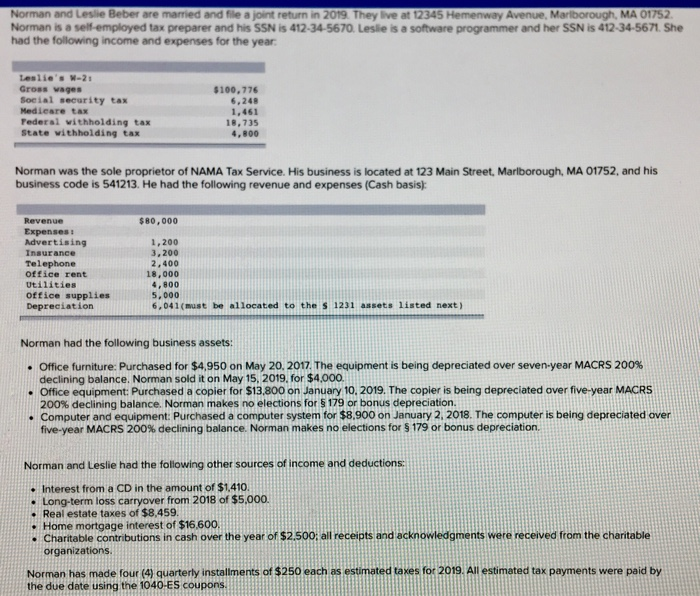

Norman and Leslie Beber are married and file a joint return in 2019. They live at 12345 Hemenway Avenue, Marlborough, MA 01752 Norman is a self-employed tax preparer and his SSN is 412-34-5670. Leslie is a software programmer and her SSN is 412-34-5671. She had the following income and expenses for the year Leslie's W-25 Gross wages Social security tax Medicare tax Federal withholding tax State withholding tax $100,776 6,240 1.461 18,735 Norman was the sole proprietor of NAMA Tax Service. His business is located at 123 Main Street, Marlborough, MA 01752. and his business code is 541213. He had the following revenue and expenses (Cash basis: $80,000 Revenue Expenses Advertising Insurance Telephone office rent Utilities office supplies Depreciation 1,200 3.200 2.400 18,000 4,800 5,000 6,041(must be allocated to the S 1231 assets listed next) Norman had the following business assets: Office furniture: Purchased for $4,950 on May 20, 2017. The equipment is being depreciated over seven-year MACRS 200% declining balance. Norman sold it on May 15, 2019, for $4,000. Office equipment: Purchased a copier for $13,800 on January 10, 2019. The copler is being depreciated over five-year MACRS 200% declining balance. Norman makes no elections for $179 or bonus depreciation. Computer and equipment: Purchased a computer system for $8.900 on January 2, 2018. The computer is being depreciated aver five-year MACRS 200% declining balance. Norman makes no elections for $ 179 or bonus depreciation Norman and Leslie had the following other sources of income and deductions Interest from a CD in the amount of $1.410. Long-term loss carryover from 2018 of $5,000. Real estate taxes of $8,459. Home mortgage interest of $16.600. Charitable contributions in cash over the year of $2,500: all receipts and acknowledgments were received from the charitable organizations. Norman has made four (4) quarterly installments of $250 each as estimated taxes for 2019. All estimated tax payments were paid by the due date using the 1040-ES coupons. 1 Wages, salaries, tips, etc. Attach Form(s) W-2 100,776 1.410 2a Tax-exempt interest 3a Qualified dividends 1b Taxable interest. Attach Sch. Bir required b Ordinary dividends. Attach Sch. BI required Taxable amount 3b 4a IRA distributions c Pensions and annuities d Taxable amount b Taxable amount 50 1 5 Sa Social security benefits ad 6 Capital gain or loss). Attach Schedule Dif required. If not required, check here 7a Other income from Schedule 1, line 9 of Add lines 1, 2, 3, 4, 4, 5, 6, and 7a. This is your total income 8a Adjustments to income from Schedule 1. line 22 Subtract line 8a from line 7b. This is your adjusted gross income 9 Standard deduction or itemized deductions (from Schedule A) 10 Qualified business income deduction. Attach Form 8995 or Form 8995-A 11a Add lines 9 and 10 b Taxable income. Subtract line 11a from line 8b ,000 39,876 147,062 2,781 144,281 29.100 11a 29,100 115,181 116