I need help with my Accounting Cycle project

I need help with my Accounting Cycle project

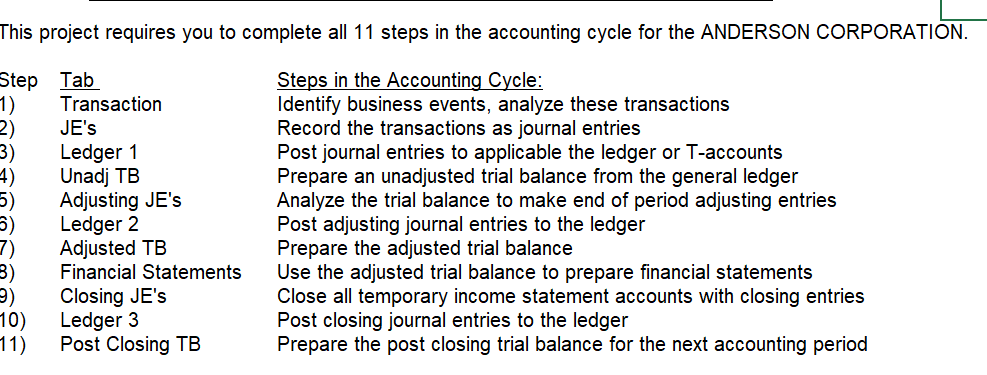

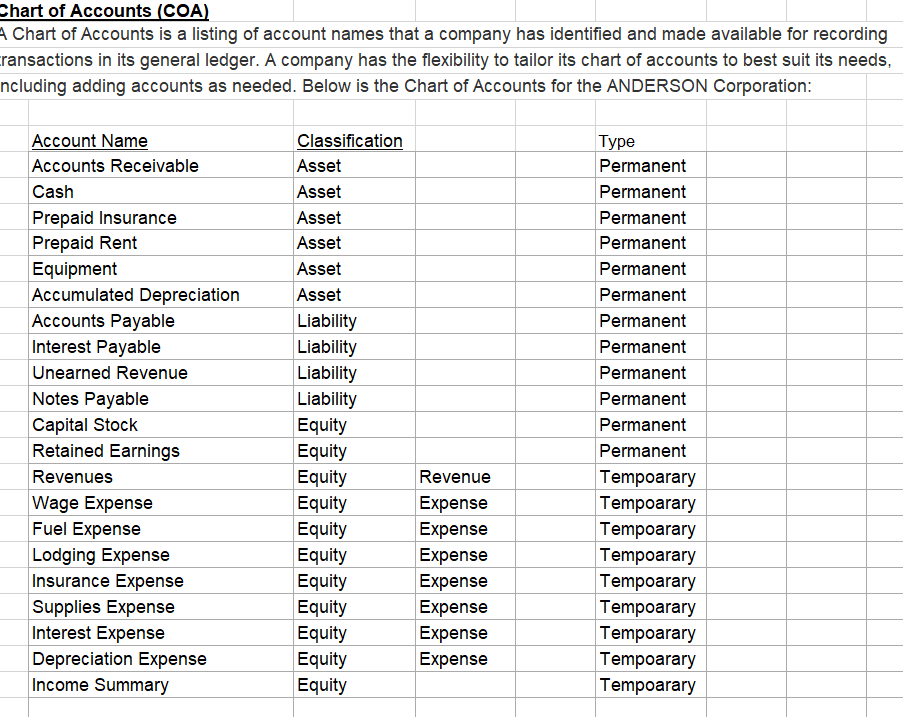

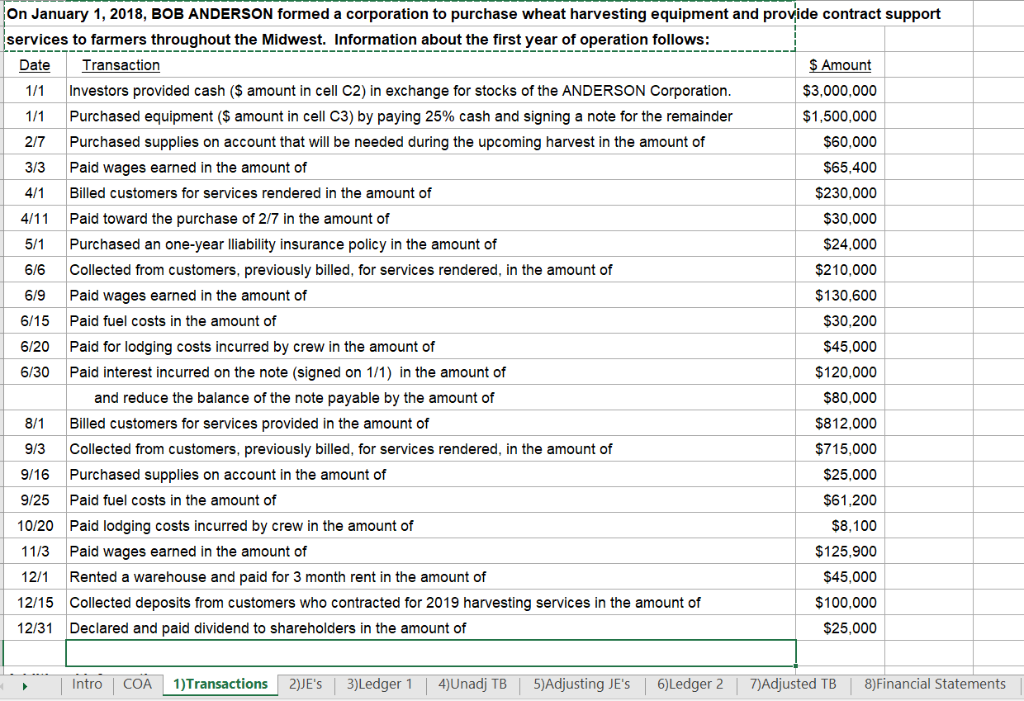

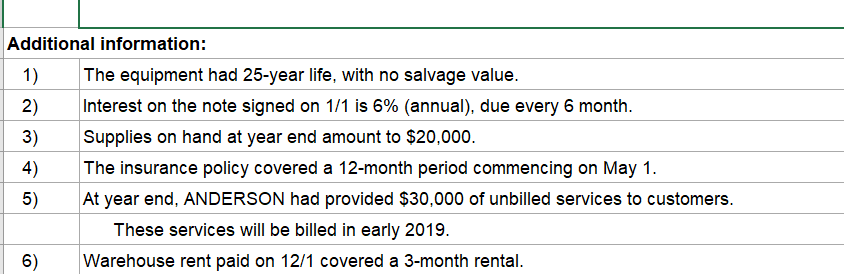

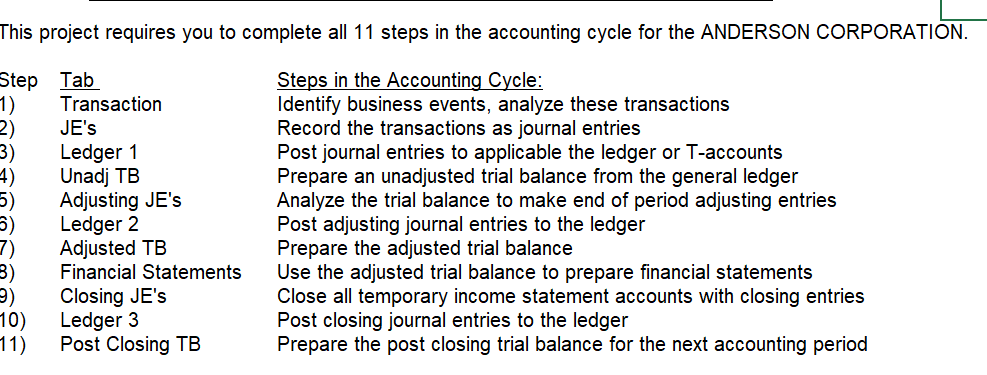

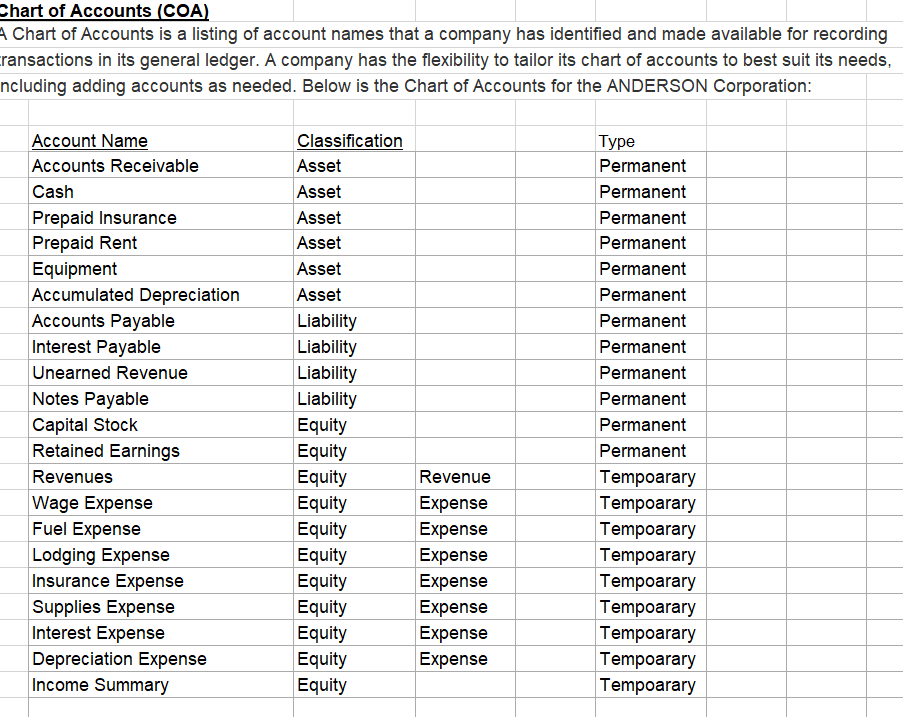

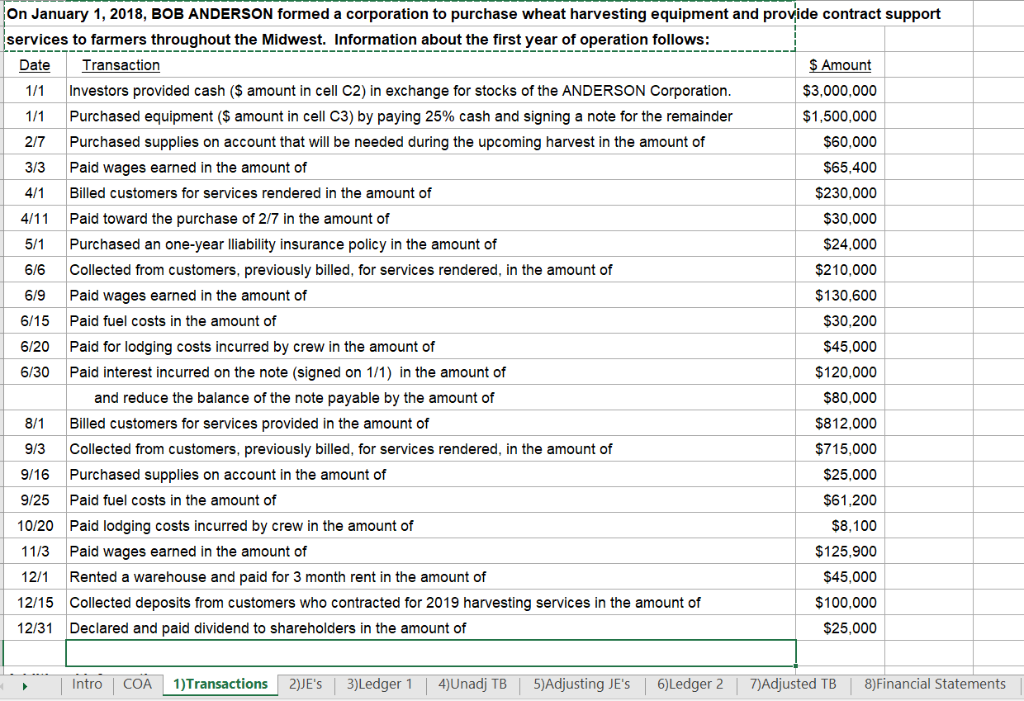

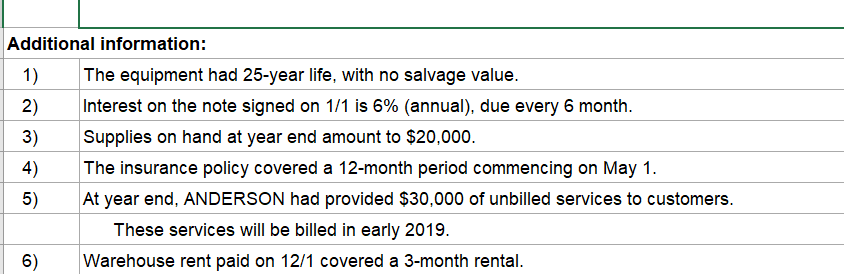

hart of Accounts (COA Chart of Accounts is a listing of account names that a company has identified and made available for recording ransactions in its general ledger. A company has the flexibility to tailor its chart of accounts to best suit its needs ncluding adding accounts as needed. Below is the Chart of Accounts for the ANDERSON Corporation Account Name Accounts Receivable Cash Prepaid Insurance Prepaid Rent Equipment Accumulated Depreciation Accounts Payable Interest Payable Unearned Revenue Notes Payable Capital Stock Retained Earnings Revenues Classification Asset Asset Asset Asset Asset Asset Liability Liability Liability Liability Equity Equity Equity Equity Equity Equity Equity Equity Equity Equity Equity Type Permanent Permanent Permanent Permanent Permanent Permanent Permanent Permanent Permanent Permanent Permanent Permanent Tempoarary Tempoarary Tempoarary Tempoarary Tempoarary Tempoarary Tempoarary Tempoarary Tempoarary age Expense Fuel Expense Lodging Expense Insurance Expense Supplies Expense Interest Expense Depreciation Expense Income Summary Revenue Expense Expense Expense Expense Expense Expense Expense On January 1, 2018, BOB ANDERSON formed a corporation to purchase wheat harvesting equipment and provide contract support services to farmers throughout the Midwest. Information about the first year of operation follows: Date Transaction 1/1 Investors provided cash (S amount in cell C2) in exchange for stocks of the ANDERSON Corporation 1/1 Purchased equipment ($ amount in cell C3) by paying 25% cash and signing a note for the remainder 2/7 Purchased supplies on account that will be needed during the upcoming harvest in the amount of 3/3 Paid wages earned in the amount of 4/1 Billed customers for services rendered in the amount of 4/11 Paid toward the purchase of 2/7 in the amount of 5/1 Purchased an one-year lliability insurance policy in the amount of 6/6 Collected from customers, previously billed, for services rendered, in the amount of 6/9 Paid wages earned in the amount of 6/15 Paid fuel costs in the amount of 6/20 Paid for lodging costs incurred by crew in the amount of 6/30 Paid interest incurred on the note (signed on 1/1) in the amount of $Amount $3,000,000 $1,500,000 $60,000 $65,400 $230,000 $30,000 $24,000 $210,000 $130,600 $30,200 $45,000 $120,000 $80,000 $812,000 $715,000 $25,000 $61,200 $8,100 $125,900 $45,000 $100,000 $25,000 and reduce the balance of the note payable by the amount of 8/1 Billed customers for services provided in the amount of 9/3 Collected from customers, previously billed, for services rendered, in the amount of 9/16 Purchased supplies on account in the amount of 9/25 Paid fuel costs in the amount of 10/20 Paid lodging costs incurred by crew in the amount of 11/3 Paid wages earned in the amount of 121 Rented a warehouse and paid for 3 month rent in the amount of 12/15 Collected deposits from customers who contracted for 2019 harvesting services in the amount of 12/31 Declared and paid dividend to shareholders in the amount of Intro COA 1)Transactions 2)JE's 3)Ledger14)Unadj TB 5)Adjusting JE's6)Ledger 2 7)Adjusted TB 8)Financial Statements Additional information: 1) The equipment had 25-year life, with no salvage value. Interest on the note signed on 1 /1 is 6% (annual), due every 6 month. 3) Supplies on hand at year end amount to $20,000. 4) The insurance policy covered a 12-month period commencing on May 1 5) At year end, ANDERSON had provided $30,000 of unbilled services to customers. These services will be billed in early 2019 Warehouse rent paid on 12/1 covered a 3-month rental 6)

I need help with my Accounting Cycle project

I need help with my Accounting Cycle project