Question

I need help with my accounting homework. I need to determine the depreciation of an asset, but I don't know what the salvage value is.

I need help with my accounting homework. I need to determine the depreciation of an asset, but I don't know what the salvage value is. Can anyone help me figure out how to calculate the salvage value? Below is the information provided.

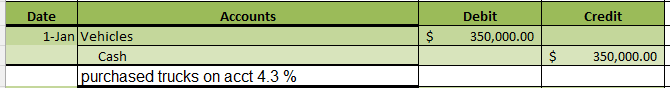

January 1: Purchased a fleet of vehicles for $350,000 via a loan from the bank. The trucks have a useful life of six years. The loan is for six years with an interest rate of 4.3%. The company already owned $200,000 of vehicles prior to this purchase with an accumulated depreciation of $80,000.

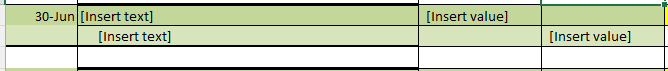

June 30: Book the depreciation for the first half of the year on the vehicles you purchased January 1.

\begin{tabular}{r|l|l|l|} \hline \multicolumn{1}{c|}{ Date } & \multicolumn{1}{|c|}{ Accounts } & Debit & \multicolumn{1}{c|}{ Credit } \\ \hline \multirow{2}{*}{ 1-Jan } & Vehicles & $350,000.00 & \\ \cline { 2 - 5 } & Cash & & $350,000.00 \\ \hline \multirow{2}{*}{} & purchased trucks on acct 4.3\% & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 30-Jun & {[ Insert text] } & [Insert value] & \\ \cline { 2 - 5 } & {[ Insert text] } & & [Insert value] \\ \hline & & & \\ \hline \end{tabular}

\begin{tabular}{r|l|l|l|} \hline \multicolumn{1}{c|}{ Date } & \multicolumn{1}{|c|}{ Accounts } & Debit & \multicolumn{1}{c|}{ Credit } \\ \hline \multirow{2}{*}{ 1-Jan } & Vehicles & $350,000.00 & \\ \cline { 2 - 5 } & Cash & & $350,000.00 \\ \hline \multirow{2}{*}{} & purchased trucks on acct 4.3\% & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 30-Jun & {[ Insert text] } & [Insert value] & \\ \cline { 2 - 5 } & {[ Insert text] } & & [Insert value] \\ \hline & & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started