Answered step by step

Verified Expert Solution

Question

1 Approved Answer

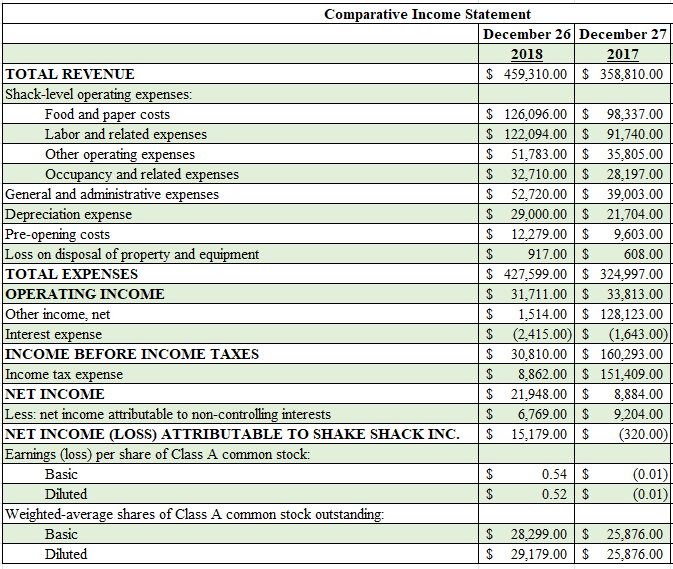

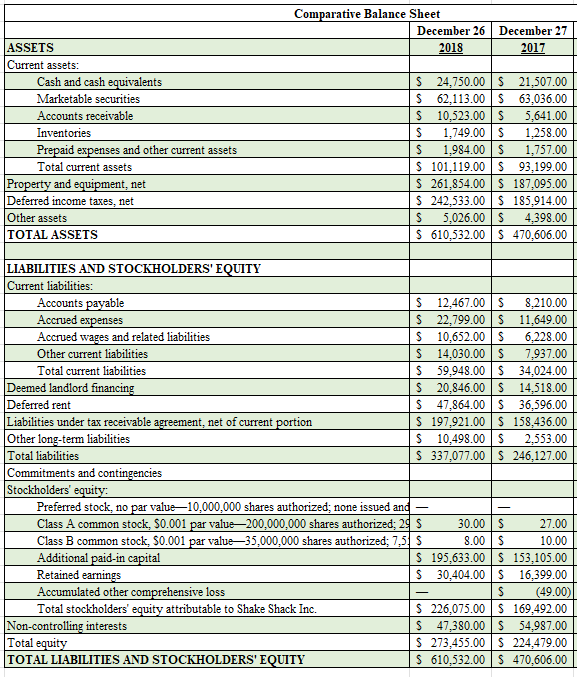

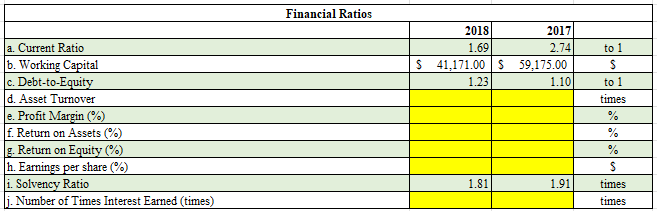

I need help with my financial ratios for 2017 and 2018 d, e, f, g, h, and j (highlighted in neon yellow). Please show me

I need help with my financial ratios for 2017 and 2018 d, e, f, g, h, and j (highlighted in neon yellow). Please show me what I'm supposed to use for each.

Thank you.

\begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Comparative Income Statement } \\ \hline & \begin{tabular}{|l|} December 26 \\ \end{tabular} & December 27 \\ \hline & 2018 & 2017 \\ \hline TOTAL REVENUE & $459,310.00 & $358,810.00 \\ \hline \multicolumn{3}{|l|}{ Shack-level operating expenses: } \\ \hline Food and paper costs & $126,096.00 & $98,337.00 \\ \hline Labor and related expenses & $122,094.00 & $91,740.00 \\ \hline Other operating expenses & $51,783.00 & $35,805.00 \\ \hline Occupancy and related expenses & $32,710.00 & $28,197.00 \\ \hline General and administrative expenses & $52,720.00 & $39,003.00 \\ \hline Depreciation expense & $29,000.00 & $21,704.00 \\ \hline Pre-opening costs & $12,279.00 & 9,603.00 \\ \hline Loss on disposal of property and equipment & 917.00 & 608.00 \\ \hline TOTAL EXPENSES & $427,599.00 & $324,997.00 \\ \hline OPERATING INCOME & $31,711.00 & $33,813.00 \\ \hline Other income, net & 1,514.00 & $128,123.00 \\ \hline Interest expense & $(2,415.00) & (1,643.00) \\ \hline INCOME BEFORE INCOME TAXES & $30,810.00 & $160,293.00 \\ \hline Income tax expense & 8,862.00 & $151,409.00 \\ \hline NET INCOME & $21,948.00 & 8,884.00 \\ \hline Less: net income attributable to non-controlling interests & 6,769.00 & 9,204.00 \\ \hline NET INCOME (LOSS) ATTRIBUTABLE TO SHAKE SHACK INC. & $15,179.00 & (320.00) \\ \hline \multicolumn{3}{|l|}{ Earnings (loss) per share of Class A common stock: } \\ \hline Basic & 0.54 & (0.01) \\ \hline Diluted & 0.52 & (0.01) \\ \hline \multicolumn{3}{|l|}{ Weighted-average shares of Class A common stock outstanding: } \\ \hline Basic & $28,299.00 & $25,876.00 \\ \hline Diluted & $29,179.00 & $25,876.00 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Comparative Balance Sheet } \\ \hline & December 26 & December 27 \\ \hline ASSETS & 2018 & 2017 \\ \hline \multicolumn{3}{|l|}{ Current assets: } \\ \hline Cash and cash equivalents & \$ 24,750.00 & \$ 21,507.00 \\ \hline Marketable securities & $62,113.00 & $63,036.00 \\ \hline Accounts receivable & \begin{tabular}{|lr|} $ & 10,523.00 \\ \end{tabular} & 5,641.00 \\ \hline Inventories & 1,749.00 & 1,258.00 \\ \hline Prepaid expenses and other current assets & 1,984.00 & 1,757.00 \\ \hline Total current assets & \$ 101,119.00 & \$ 93,199.00 \\ \hline Property and equipment, net & S 261,854.00 & S 187,095.00 \\ \hline Deferred income taxes, net & $242,533.00 & S 185,914.00 \\ \hline Other assets & 5,026.00 & 4,398.00 \\ \hline TOTAL ASSETS & $610,532.00 & $470,606.00 \\ \hline \multicolumn{3}{|l|}{ LIABILITIES AND STOCKHOLDERS' EQUITY } \\ \hline \multicolumn{3}{|l|}{ Current liabilities: } \\ \hline Accounts payable & S 12,467.00 & 8,210.00 \\ \hline Accrued expenses & \begin{tabular}{|ll|} $ & 22,799.00 \\ \end{tabular} & \$ 11,649.00 \\ \hline Accrued wages and related liabilities & S 10,652.00 & 6,228.00 \\ \hline Other current liabilities & S 14,030.00 & 7,937.00 \\ \hline Total current liabilities & \begin{tabular}{|lr|} $ & 59,948.00 \\ \end{tabular} & $34,024.00 \\ \hline Deemed landlord financing & S 20,846.00 & $14,518.00 \\ \hline Deferred rent & \begin{tabular}{ll} & 47,864.00 \\ \end{tabular} & $36,596.00 \\ \hline Liabilities under tax receivable agreement, net of current portion & \$ 197,921.00 & \$ 158,436.00 \\ \hline Other long-term liabilities & \begin{tabular}{ll} & 10,498.00 \\ \end{tabular} & 2,553.00 \\ \hline Total liabilities & S 337,077.00 & $246,127.00 \\ \hline \multicolumn{3}{|l|}{ Commitments and contingencies } \\ \hline \multicolumn{3}{|l|}{ Stockholders' equity: } \\ \hline Preferred stock, no par value- 10,000,000 shares authorized; none issued and & - & - \\ \hline Class A common stock, $0.001 par value 200,000,000 shares authorized; 29 & 30.00 & 27.00 \\ \hline Class B common stock, $0.001 par value 35,000,000 shares authorized; 7,5 . & 8.00 & 10.00 \\ \hline Additional paid-in capital & S 195,633.00 & \$ 153,105.00 \\ \hline Retained earnings & $30,404.00 & S 16,399.00 \\ \hline Accumulated other comprehensive loss & - & (49.00) \\ \hline Total stockholders' equity attributable to Shake Shack Inc. & S 226,075.00 & \$ 169,492.00 \\ \hline Non-controlling interests & S 47,380.00 & S 54,987.00 \\ \hline Total equity & S 273,455.00 & S 224,479.00 \\ \hline TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY & $610,532.00 & \$ 470,606.00 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Financial Ratios } \\ \hline & 2018 & 2017 & \\ \hline a. Current Ratio & 1.69 & 2.74 & to 1 \\ \hline b. Working Capital & \begin{tabular}{|ll|} S & 41,171.00 \\ \end{tabular} & \begin{tabular}{|lr|} $ & 59,175.00 \\ \end{tabular} & s \\ \hline c. Debt-to-Equity & 1.23 & 1.10 & to 1 \\ \hline d. Asset Turnover & & & times \\ \hline e. Profit Margin (\%) & & & % \\ \hline f. Return on Assets (\%) & & & % \\ \hline \begin{tabular}{|l|} g. Return on Equity (%) \\ \end{tabular} & & & % \\ \hline h. Earnings per share (%) & & & s \\ \hline i. Solvency Ratio & 1.81 & 1.91 & times \\ \hline j. Number of Times Interest Earned (times) & & & times \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Comparative Income Statement } \\ \hline & \begin{tabular}{|l|} December 26 \\ \end{tabular} & December 27 \\ \hline & 2018 & 2017 \\ \hline TOTAL REVENUE & $459,310.00 & $358,810.00 \\ \hline \multicolumn{3}{|l|}{ Shack-level operating expenses: } \\ \hline Food and paper costs & $126,096.00 & $98,337.00 \\ \hline Labor and related expenses & $122,094.00 & $91,740.00 \\ \hline Other operating expenses & $51,783.00 & $35,805.00 \\ \hline Occupancy and related expenses & $32,710.00 & $28,197.00 \\ \hline General and administrative expenses & $52,720.00 & $39,003.00 \\ \hline Depreciation expense & $29,000.00 & $21,704.00 \\ \hline Pre-opening costs & $12,279.00 & 9,603.00 \\ \hline Loss on disposal of property and equipment & 917.00 & 608.00 \\ \hline TOTAL EXPENSES & $427,599.00 & $324,997.00 \\ \hline OPERATING INCOME & $31,711.00 & $33,813.00 \\ \hline Other income, net & 1,514.00 & $128,123.00 \\ \hline Interest expense & $(2,415.00) & (1,643.00) \\ \hline INCOME BEFORE INCOME TAXES & $30,810.00 & $160,293.00 \\ \hline Income tax expense & 8,862.00 & $151,409.00 \\ \hline NET INCOME & $21,948.00 & 8,884.00 \\ \hline Less: net income attributable to non-controlling interests & 6,769.00 & 9,204.00 \\ \hline NET INCOME (LOSS) ATTRIBUTABLE TO SHAKE SHACK INC. & $15,179.00 & (320.00) \\ \hline \multicolumn{3}{|l|}{ Earnings (loss) per share of Class A common stock: } \\ \hline Basic & 0.54 & (0.01) \\ \hline Diluted & 0.52 & (0.01) \\ \hline \multicolumn{3}{|l|}{ Weighted-average shares of Class A common stock outstanding: } \\ \hline Basic & $28,299.00 & $25,876.00 \\ \hline Diluted & $29,179.00 & $25,876.00 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Comparative Balance Sheet } \\ \hline & December 26 & December 27 \\ \hline ASSETS & 2018 & 2017 \\ \hline \multicolumn{3}{|l|}{ Current assets: } \\ \hline Cash and cash equivalents & \$ 24,750.00 & \$ 21,507.00 \\ \hline Marketable securities & $62,113.00 & $63,036.00 \\ \hline Accounts receivable & \begin{tabular}{|lr|} $ & 10,523.00 \\ \end{tabular} & 5,641.00 \\ \hline Inventories & 1,749.00 & 1,258.00 \\ \hline Prepaid expenses and other current assets & 1,984.00 & 1,757.00 \\ \hline Total current assets & \$ 101,119.00 & \$ 93,199.00 \\ \hline Property and equipment, net & S 261,854.00 & S 187,095.00 \\ \hline Deferred income taxes, net & $242,533.00 & S 185,914.00 \\ \hline Other assets & 5,026.00 & 4,398.00 \\ \hline TOTAL ASSETS & $610,532.00 & $470,606.00 \\ \hline \multicolumn{3}{|l|}{ LIABILITIES AND STOCKHOLDERS' EQUITY } \\ \hline \multicolumn{3}{|l|}{ Current liabilities: } \\ \hline Accounts payable & S 12,467.00 & 8,210.00 \\ \hline Accrued expenses & \begin{tabular}{|ll|} $ & 22,799.00 \\ \end{tabular} & \$ 11,649.00 \\ \hline Accrued wages and related liabilities & S 10,652.00 & 6,228.00 \\ \hline Other current liabilities & S 14,030.00 & 7,937.00 \\ \hline Total current liabilities & \begin{tabular}{|lr|} $ & 59,948.00 \\ \end{tabular} & $34,024.00 \\ \hline Deemed landlord financing & S 20,846.00 & $14,518.00 \\ \hline Deferred rent & \begin{tabular}{ll} & 47,864.00 \\ \end{tabular} & $36,596.00 \\ \hline Liabilities under tax receivable agreement, net of current portion & \$ 197,921.00 & \$ 158,436.00 \\ \hline Other long-term liabilities & \begin{tabular}{ll} & 10,498.00 \\ \end{tabular} & 2,553.00 \\ \hline Total liabilities & S 337,077.00 & $246,127.00 \\ \hline \multicolumn{3}{|l|}{ Commitments and contingencies } \\ \hline \multicolumn{3}{|l|}{ Stockholders' equity: } \\ \hline Preferred stock, no par value- 10,000,000 shares authorized; none issued and & - & - \\ \hline Class A common stock, $0.001 par value 200,000,000 shares authorized; 29 & 30.00 & 27.00 \\ \hline Class B common stock, $0.001 par value 35,000,000 shares authorized; 7,5 . & 8.00 & 10.00 \\ \hline Additional paid-in capital & S 195,633.00 & \$ 153,105.00 \\ \hline Retained earnings & $30,404.00 & S 16,399.00 \\ \hline Accumulated other comprehensive loss & - & (49.00) \\ \hline Total stockholders' equity attributable to Shake Shack Inc. & S 226,075.00 & \$ 169,492.00 \\ \hline Non-controlling interests & S 47,380.00 & S 54,987.00 \\ \hline Total equity & S 273,455.00 & S 224,479.00 \\ \hline TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY & $610,532.00 & \$ 470,606.00 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Financial Ratios } \\ \hline & 2018 & 2017 & \\ \hline a. Current Ratio & 1.69 & 2.74 & to 1 \\ \hline b. Working Capital & \begin{tabular}{|ll|} S & 41,171.00 \\ \end{tabular} & \begin{tabular}{|lr|} $ & 59,175.00 \\ \end{tabular} & s \\ \hline c. Debt-to-Equity & 1.23 & 1.10 & to 1 \\ \hline d. Asset Turnover & & & times \\ \hline e. Profit Margin (\%) & & & % \\ \hline f. Return on Assets (\%) & & & % \\ \hline \begin{tabular}{|l|} g. Return on Equity (%) \\ \end{tabular} & & & % \\ \hline h. Earnings per share (%) & & & s \\ \hline i. Solvency Ratio & 1.81 & 1.91 & times \\ \hline j. Number of Times Interest Earned (times) & & & times \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started