Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with my homework Q7. On 1 May 2018, Dress in Style receiveda $2000 advance payment from a customer ftor the design and

I need help with my homework

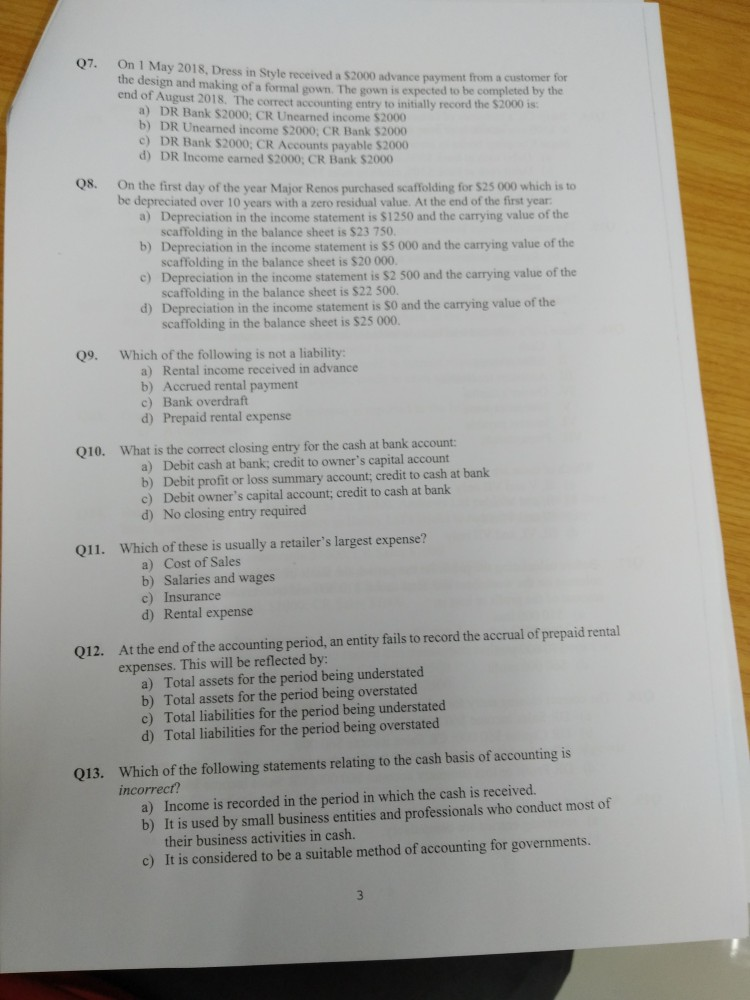

Q7. On 1 May 2018, Dress in Style receiveda $2000 advance payment from a customer ftor the design and making of a formal gown. The gowm is expected to be completed by the end of / a) DR Ba b) DR Unea c) DR Bank $2000 $2000; CR Bank $2000 d) DR Income earned $2000: CR Bank $2000 t 2018. The correct accounting entry to initially record the $2000 is: $2000; CR Unearned income $2000 00 Q8. On the first day of the year Major Renos purchased scaffolding for $25 000 which is to be depreciated over 10 years with a zero residual value. At the end of the first year a) Depreciation in the income statement is $1250 and the carrying value of the scaffolding in the balance sheet is $23 750. b) Depreciation in the income statement is $5 000 and the carrying value of the scaffolding in the balance sheet is $20 000 c) Depreciation scaffolding in the balance sheet is $22 500. d) Depreciation scaffolding in the balance sheet is $25 000 the income statement is $2 500 and the carrying value of the the income statement is and the carrying value of the Which of the following is not a liability: a) Rental income received in advance b) Accrued rental payment c) Bank overdraft d) Prepaid rental expense Q9. What is the correct closing entry for the cash at bank account a) Debit cash at bank; credit b) Debit profit or loss summary aceount, credit to cash at bank c) Debit owner's capital account; credit to cash at bank d) No closing entry required Q10. owner's capital account Which of these is usually a retailer's largest expense? a) Cost of Sales b) Salaries and wages c) Insurance d) Rental expense Q11. At the end of the accounting period, an entity fails to record the accrual of prepaid rental expenses. This will be reflected by: a) Total assets for the period being understated b) Total assets for the period being overstated c) Total liabilities for the period being understated d) Total liabilities for the period being overstated Q12 Which of the following statements relating to the cash basis of accounting is incorrect? a) Income is recorded in the period in which the cash is received. b) It is used by small business entities and professionals who conduct most of their business activities in cash. c) It is considered to be a suitable method of accounting for governments. Q13

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started