Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with my homework. Thank you 0 Capital structure decisions refer to the: (I point) a dividend yield of the firm's stock b.

I need help with my homework.

Thank you

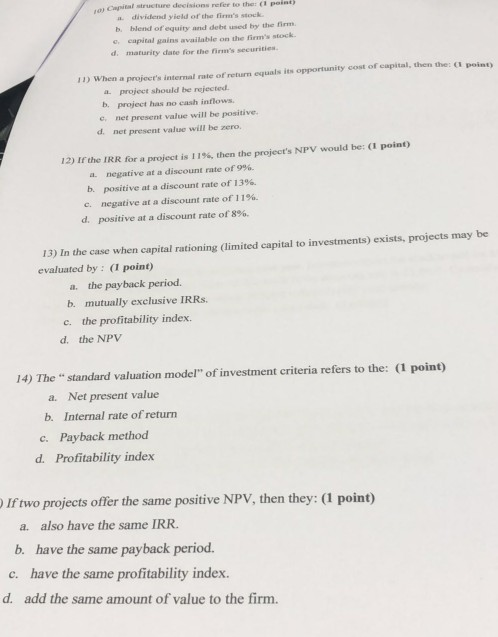

0 Capital structure decisions refer to the: (I point) a dividend yield of the firm's stock b. blend of equity and debt used by the firm. e capital gains available on the firm's stock. d. maturity date for the firm's securities. 1) When a project's internal rate of return equals its opportunity cost of capital, then the: (I poinn a. project should be rejected. b. project has no cash inflows. . net present value will be positive. d. net present value will be zero. 12) If the IRR for a project is 119%, then the project's NPV would be: (I point) a. negative at a discount rate of 9%. b. positive at a discount rate of 13%. c. negative at a discount rate of 11%. d. positive at a discount rate of 8%. 13) In the case when capital rationing (limited capital to investments) exists, projects may be evaluated by : (1 point) a. the payback period. b. mutually exclusive IRRS. the profitability index. c. d. the NPV 14) The "standard valuation model" of investment criteria refers to the: (1 point) a. Net present value b. Internal rate of return c. Payback method d. Profitability index D If two projects offer the same positive NPV, then they: (1 point) also have the same IRR. a. b. have the same payback period. c. have the same profitability index. d. add the same amount of value to the firmStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started