Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with my HW assignment with all parts. Any help would be appreicated! Advanced Accounting Part 2B Fall 2017 The assignment must be

I need help with my HW assignment with all parts. Any help would be appreicated!

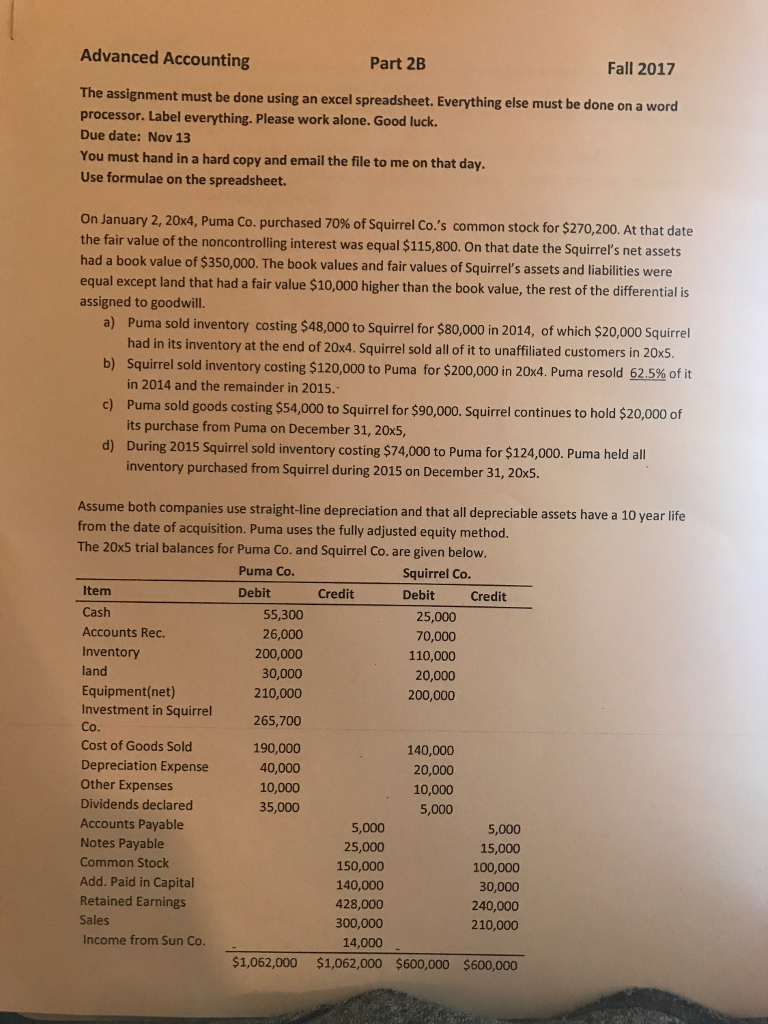

Advanced Accounting Part 2B Fall 2017 The assignment must be done using an excel spreadsheet. Everything processor. Label everything. Please work alone. Good luck. Due date: Nov 13 You must hand in a hard copy and email the file to me on that day. Use formulae on the spreadsheet. else must be done on a word On January 2, 20x4, Puma Co. the fair value of the noncontrolling interest was equal $115,800. On that date the Squirrel's net assets had a book value of $350,000. The book values and fair values of Squirrel's asset equal except land that had a fair value $10,000 higher than the book value, the rest of the differential is assigned to goodwill purchased 70% of Squirrel Co.'s common stock for $270,200. At that date a) Puma sold inventory costing $48,000 to Squirrel for $80,000 in 2014, of which $20,000 Squirrel had b) c) d) in its inventory at the end of 20x4. Squirrel sold all of it to unaffiliated customers in 20x5 Squirrel sold inventory costing $120,000 to Puma for $200,000 in 20x4, Puma resold 62.5% of it in 2014 and the remainder in 2015 Puma sold goods costing $54,000 to Squirrel for $90,000. Squirrel continues to hold $20,000 of its purchase from Puma on December 31, 20x5, During 2015 Squirrel sold inventory costing $74,000 to Puma for $124,000. Puma held all inventory purchased from Squirrel during 2015 on December 31, 20x5. Assume both companies use straight-line depreciation and that all depreciable assets have a 10 y from the date of acquisition. Puma uses the fully adjusted equity method. The 20x5 trial balances for Puma Co. and Squirrel Co. are given below ear life Puma Co. Debit Squirrel Co Debit Credit Item Cash Accounts Rec. Inventory land Equipment(net) Investment in Squirrel Co Cost of Goods Sold Depreciation Expense Other Expenses Dividends declared Accounts Payable Notes Payable Common Stock Add. Paid in Capital Retained Earnings Sales Income from Sun Co Credit 55,300 26,000 200,000 30,000 210,000 265,700 190,000 40,000 10,000 35,000 25,000 70,000 110,000 20,000 200,000 140,000 20,000 10,000 5,000 5,000 25,000 150,000 140,000 428,000 300,000 14,000 5,000 15,000 100,000 30,000 240,000 210,000 $1,062,000 $1,062,000 $600,000 $600,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started