Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with number 1,2,4, and 7. Please explain steps. Thank You for your help. CHAPTER 7 THE CORELATION STRUCTURE OF SECURITY RETURNS 151

I need help with number 1,2,4, and 7. Please explain steps. Thank You for your help.

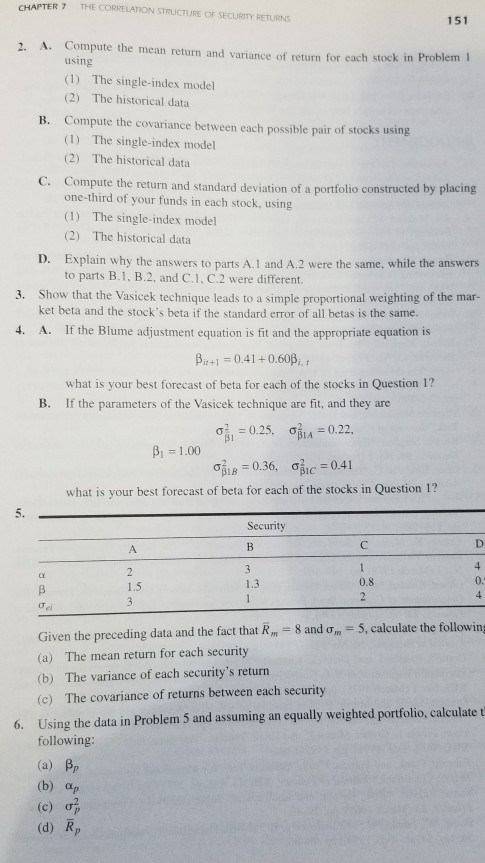

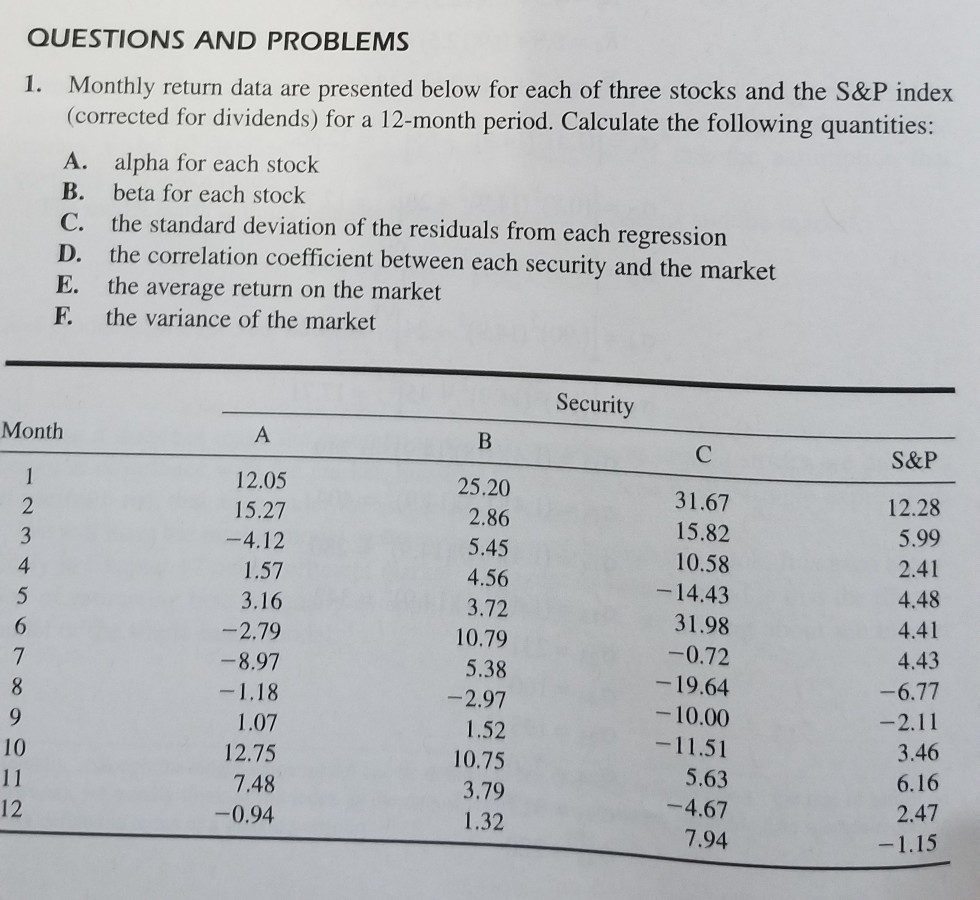

CHAPTER 7 THE CORELATION STRUCTURE OF SECURITY RETURNS 151 2. A. Compute the mean return and variance of return for cach stock in Problem using (1) The single-index model (2) The historical data Compute the covariance between each possible pair of stocks using (1) The single-index model (2) The historical data B. C. Compute the return and standard deviation of a portfolio constructed by placing one-third of your funds in each stock, using (1) The single-index model (2) The historical data D. Explain why the answers to parts A.1 and A.2 were the same, while the answers to parts B.1, B.2, and C.1, C.2 were different. 3. Show that the Vasicek technique leads to a simple proportional weighting of the mar- ket beta and the stock's beta if the standard error of all betas is the same. 4. A the Blume adjustment equation is fit and the appropriate equation is B1 0.41+0.60p, what is your best forecast of beta for each of the stocks in Question 1? B. If the parameters of the Vasicek technique are fit, and they are 2:0.25, Oli,-0.22, B1 - 1.00 21,-0.36, what is your best forecast of beta for each of the stocks in Question 1? ,c-0.41 Security 4. 1.3 Given the preceding data and the fact that Rm 8 and m-5, calculate the followin (a) The mean return for each security (b) The variance of each security's return (c) The covariance of returns between each security Using the data in Problem 5 and assuming an equally weighted portfolio, calculate t following: (a) B (b) ap (c) (d) R 6. CHAPTER 7 THE CORELATION STRUCTURE OF SECURITY RETURNS 151 2. A. Compute the mean return and variance of return for cach stock in Problem using (1) The single-index model (2) The historical data Compute the covariance between each possible pair of stocks using (1) The single-index model (2) The historical data B. C. Compute the return and standard deviation of a portfolio constructed by placing one-third of your funds in each stock, using (1) The single-index model (2) The historical data D. Explain why the answers to parts A.1 and A.2 were the same, while the answers to parts B.1, B.2, and C.1, C.2 were different. 3. Show that the Vasicek technique leads to a simple proportional weighting of the mar- ket beta and the stock's beta if the standard error of all betas is the same. 4. A the Blume adjustment equation is fit and the appropriate equation is B1 0.41+0.60p, what is your best forecast of beta for each of the stocks in Question 1? B. If the parameters of the Vasicek technique are fit, and they are 2:0.25, Oli,-0.22, B1 - 1.00 21,-0.36, what is your best forecast of beta for each of the stocks in Question 1? ,c-0.41 Security 4. 1.3 Given the preceding data and the fact that Rm 8 and m-5, calculate the followin (a) The mean return for each security (b) The variance of each security's return (c) The covariance of returns between each security Using the data in Problem 5 and assuming an equally weighted portfolio, calculate t following: (a) B (b) ap (c) (d) R 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started