Answered step by step

Verified Expert Solution

Question

1 Approved Answer

-I need help with number 5 specifically, but help with all journal entries and their closing entries for the year would be great! 5.) Pay

-I need help with number 5 specifically, but help with all journal entries and their closing entries for the year would be great!

5.) "Pay utilities of $4,000 from 2020 (prior year).

-I also need help recording the closing entry for expenses, *note* there is NO account titled "income summary" to close it out to; how should I calculate the year-end revenue?

Thank you! :)

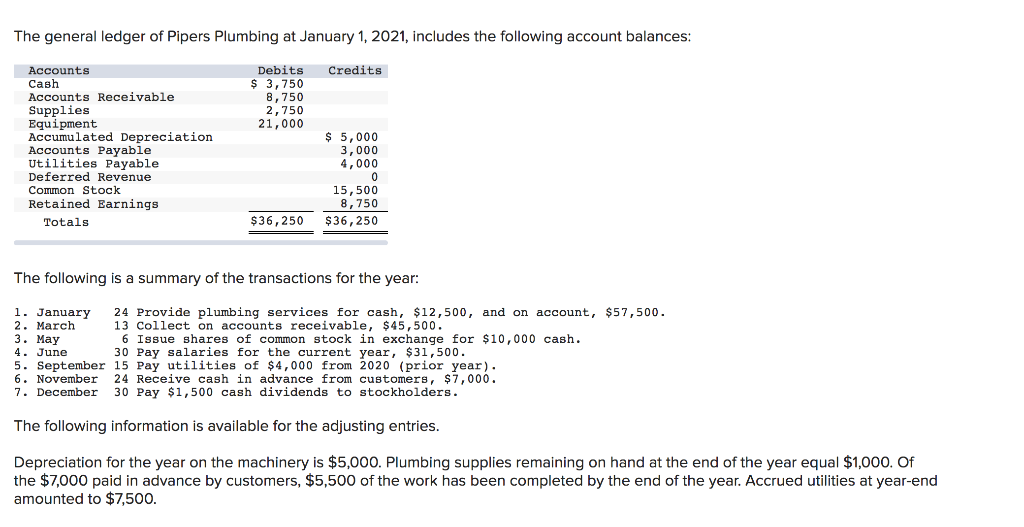

The general ledger of Pipers Plumbing at January 1, 2021, includes the following account balances: Credits Debits $ 3,750 8,750 2,750 21,000 Accounts Cash Accounts Receivable Supplies Equipment Accumulated Depreciation Accounts Payable Utilities Payable Deferred Revenue Common Stock Retained Earnings Totals $ 5,000 3,000 4,000 15,500 8,750 $36, 250 $36,250 The following is a summary of the transactions for the year: 1. January 24 Provide plumbing services for cash, $12,500, and on account, $57,500. 2. March 13 Collect on accounts receivable, $ 45,500. Issue shares of common stock in exchange for $10,000 cash. 4. June 30 Pay salaries for the current year, $31,500. 5. September 15 Pay utilities of $4,000 from 2020 (prior year). 6. November 24 Receive cash in advance from customers, $7,000. 7. December 30 Pay $1,500 cash dividends to stockholders. The following information is available for the adjusting entries. Depreciation for the year on the machinery is $5,000. Plumbing supplies remaining on hand at the end of the year equal $1,000. Of the $7,000 paid in advance by customers, $5,500 of the work has been completed by the end of the year. Accrued utilities at year-end amounted to $7,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started