Answered step by step

Verified Expert Solution

Question

1 Approved Answer

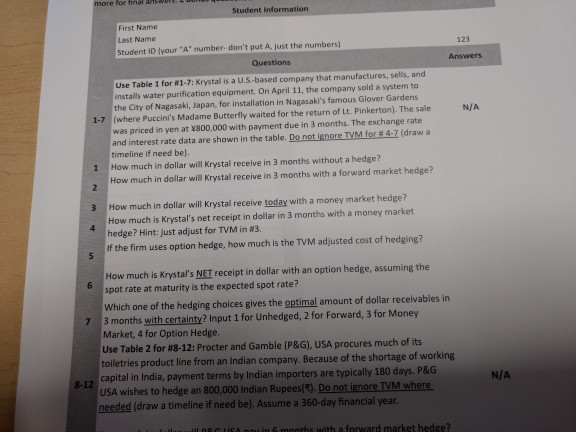

I need help with numbers 3 4 5 6 and 7 please more for tinl Student Information First Name Last Name 123 Student ID (your

I need help with numbers 3 4 5 6 and 7 please

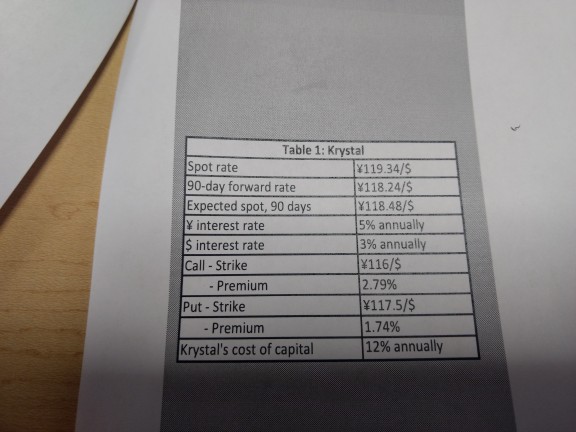

more for tinl Student Information First Name Last Name 123 Student ID (your "A" number- don't put A, just the numbers) Questions Answers Use Table 1 for #1-7: Krystal is a U.S-based company that manufactures, sells, and installs water purification equipment. On April 11, the company sold a system to the City of Nagasaki, Japan, for installation in Nagasaki's famous Glover Gardens (where Puccini's Madame Butterfly waited for the return of Lt. Pinkerton). The sale was priced in yen at Y800,000 with payment due in 3 months. The exchange rate and interest rate data are shown in the table. Do not ignore TVM for # 4-7 (draw a timeline if need be). N/A 1-7 1 How much in dollar will Krystal receive in 3 months without a hedge? How much in dollar will Krystal receive in 3 months with a forward market hedge? 3 How much in dollar will Krystal receive today with a money market hedge? How much is Krystal's net receipt in dollar in 3 months with a money market hedge? Hint: just adjust for TVM in #3. If the firm uses option hedge, how much is the TVM adjusted cost of hedging? How much is Krystal's NET receipt in dollar with an option hedge, assuming the spot rate at maturity is the expected spot rate? Which one of the hedging choices gives the optimal amount of dollar receivables in Market, 4 for Option Hedge. 7 3 months with certainty? Input 1 for Unhedged, 2 for Forward, 3 for Money Use Table 2 for #8-12: Procter and Gamble (P&G), USA procures much of its toiletries product line from an Indian company. Because of the shortage of working 8-12 capital in India, payment terms by Indian importers are typically 180 days. P&G N/A USA wishes to hedge an 800,000 Indian Rupees(). Do not ignore TVM where. needed (draw a timeline if need be). Assume a 360-day financial year l nRC ucAntu in 6 months uith a forward market hedgeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started