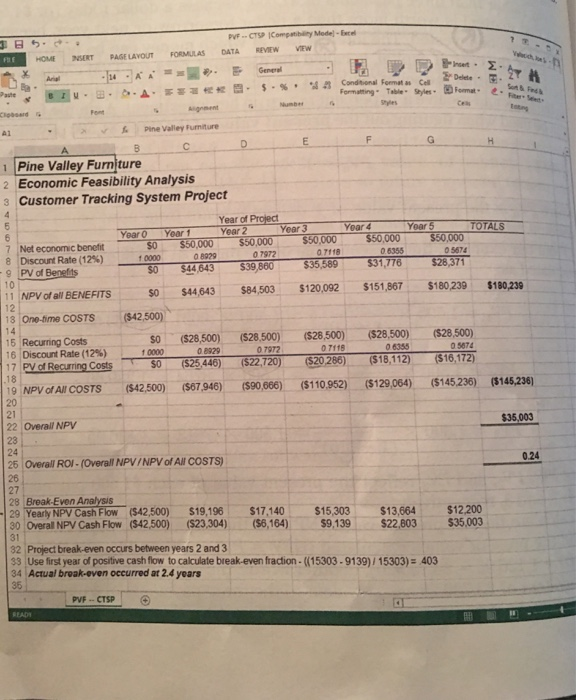

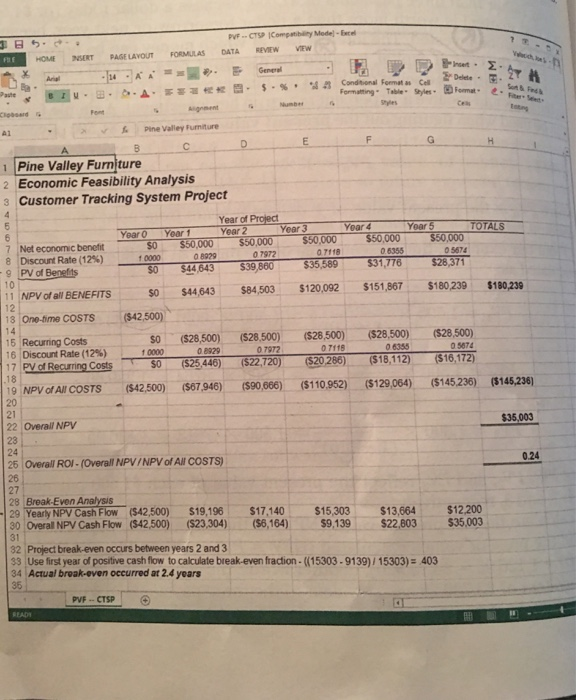

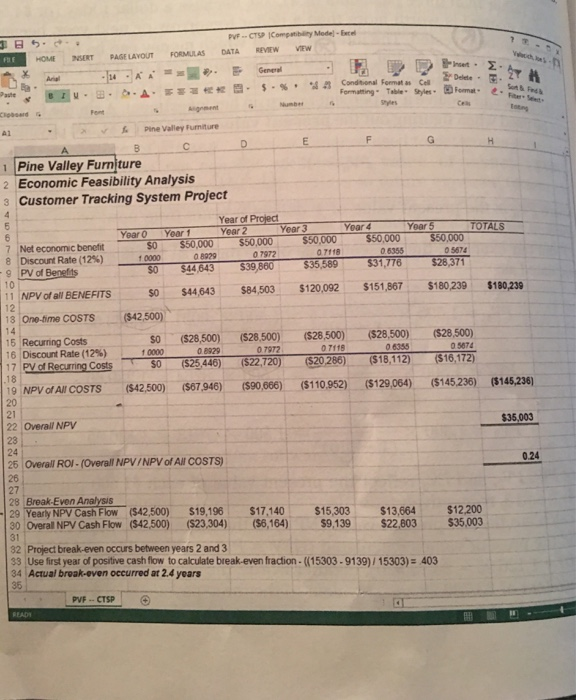

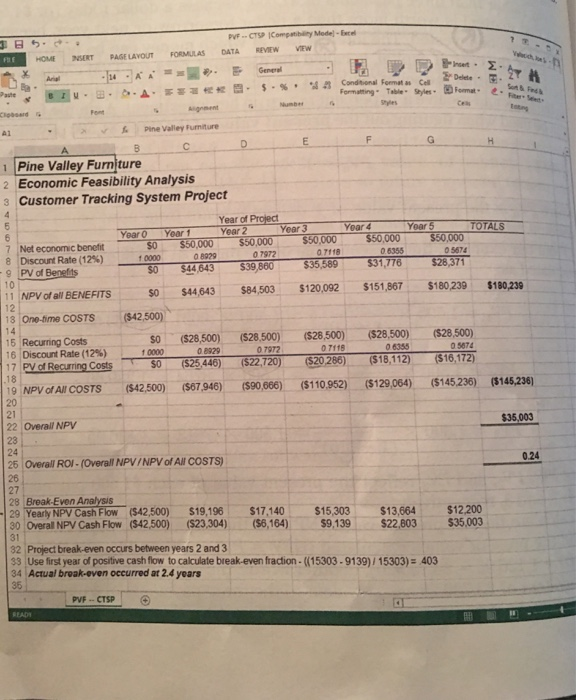

I need help with overall NPV Cash Flow. How can I get same answer in line 30 in figure? By using what formula

PVFCTSP Compatibility Medel-Ence HOME PASE LAYOUT FORMULAS DATA REVEW VIEw Formatting Table Styles-Formate.S&aek A1 v' Pine Valley Furniture 1 Pine Valley Furnture 2 Economic Feasibility Analysis Customer Tracking System Project Year of Project earo Year 1Year 2 Year 3 Year 4 Yoar 5 SO $50,000 $50,000 $50,000 $50,000 So $44643 $84,503 $120,092 $151,867 $180 239 $18 s0 ($28,500) (528,500) ($28,500) $28,500) (S28,500) $50,000 Net economic benefit 7 8 Discount Rate (12%) 1 0000 0 7972 0 7118 0 6355 : 10 11 NPV of all BENEFITS 18 One-time COSTS ($42,500) 15 Recurring Costs 16 Discount Rate (12%) 17 PV of Recurring CostsSO 0 8929 0 7972 0 7118 0 6355 0 5674 $0 ($25446) ($22,720) ($20 28) ($18,112) (S16,172) 19 NPV of A COSTS ($42,500) (S67 946) (590666) ($110 952) ($129,064) ($145236) (148,236) 20 21 22 Overalil NPV $35,003 24 25 Overall ROI-(Overall NPV /NPV of All COSTS) 26 27 0.24 29 Deuax NeV casw 42,500) $19,198 $17.140 $15,303 $13,664$12.200 Break-Even Analysis Overall NPV Cash Flow ($42,500) (S23,304) (6,164) $9,139$22,803 $35,003 31 2 Project break-even occurs between years 2 and 3 3 Use first year of positive cash flow to calculate break-even fraction-((15303-9139)/ 15303)403 4 Actual break-even occurred at 2.4 years 35 PVF-CTSP PVFCTSP Compatibiliny Medel-Ence HOME NSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW ood I Pine valley Furniture A1 Pine Valley Furnture Economic Feasibility Analysis Customer Tracking System Project 2 Year of Project Year 2 earo Year 1 Year 3 Year 4 Year 5 TOTALS Net economic benefit Discount Rate (12%) SO $50,000 $50,000 $50,000 $50,000 0.6355 $50,000 0 5674 7 8 0 8929 0 7972 0 7118 10 1 NPV of al BENEFITS $4643 84,503 $120,092 $151,867 $180239 $180,23 13 One-time COSTS ($42,500) 15 Recurring Costs 16:Discount Rate (12%) 7 PV of Recuring Costs so ($28,500) (528,500) ($28,500) ($28,500) ($28,500) $0 (S25446) ($22,720)($2028($18,112) $16,172) 0 8929 0 7972 0 7118 0 6355 0 5674 . 19 NPV of All COSTS ($42,500) ($67946) ($90,666) ($110.952) ($129,064) ($145 236) ($145,236) 20 22 Overalil NPV 23 24 26 Overall ROI-(Overall NPVINPV of All COSTS) 26 $35,003 0.24 Break-Even Analysis 29 Yeax NYCash F$42500) $19,198 $17.140 $15,303 $13.664 $12,200 0Overall NPV Cash Flow ($42,500) ($23,304) (S6,164) $9,139 $22,803 $35,003 31 2 Project break-even occurs between years 2 and 3 3 Use first year of positive cash flow to calculate break-even fraction-((15303-9139)/ 15303)403 4 Actual break-even occurred at 2.4 years 35 PVF-CTSP