I need help with part 3 please and thank you!

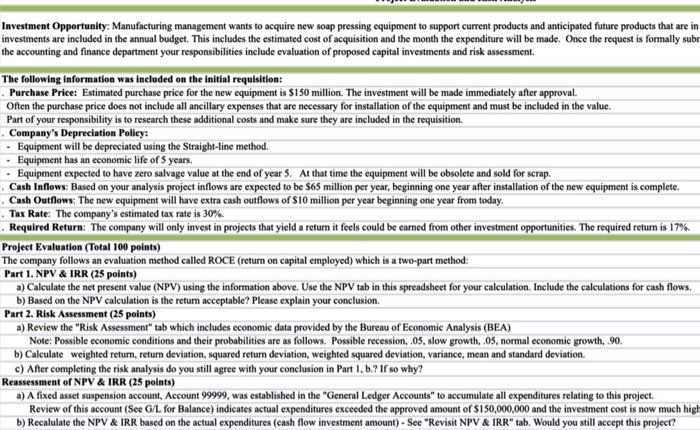

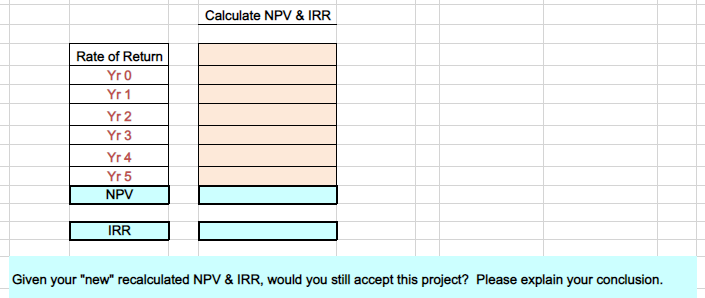

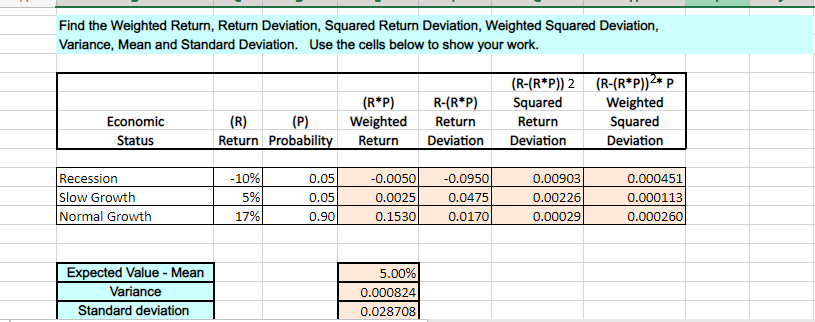

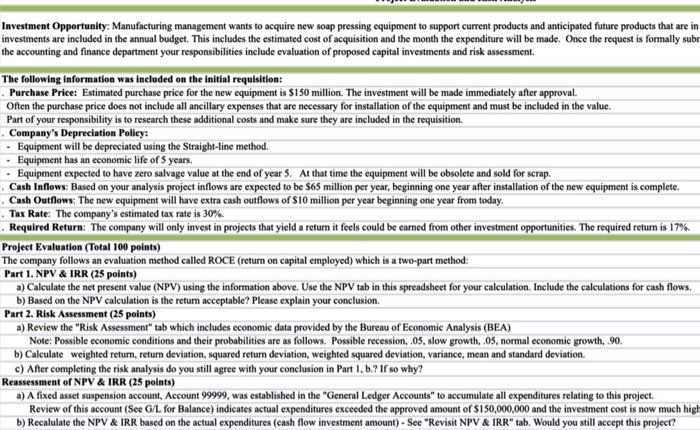

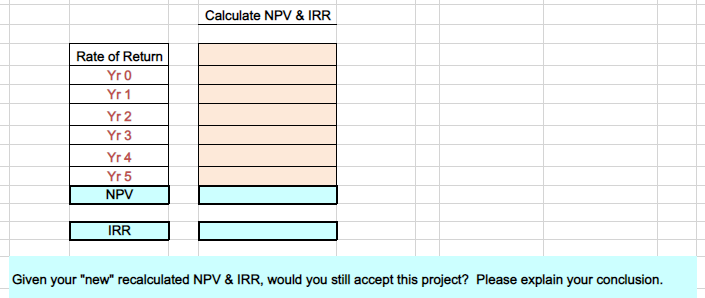

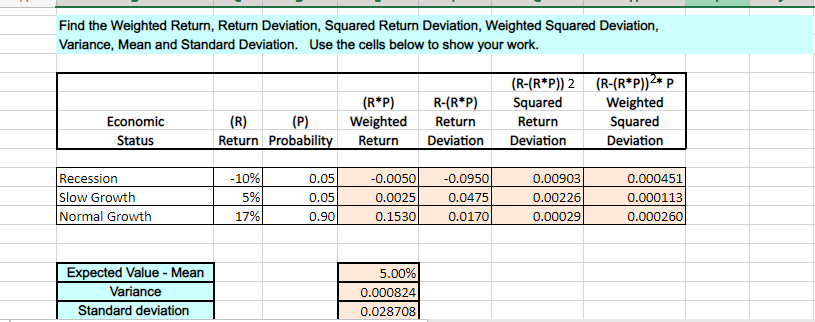

Investment Opportunity: Manufacturing management wants to acquire new soap pressing equipment to support current products and anticipated future products that are in investments are included in the annual budget. This includes the estimated cost of acquisition and the month the expenditure will be made. Once the request is formally subr the accounting and finance department your responsibilities include evaluation of proposed capital investments and risk assessment. The following information was included on the initial requisition: - Purehase Price: Estimated purchase price for the new equipment is $150 million. The investment will be made immediately after approval. Often the purchase price does not include all ancillary expenses that are necessary for installation of the equipment and must be included in the value. Part of your responsibility is to research these additional costs and make sure they are included in the requisition. - Company's Depreciation Policy: - Equipment will be depreciated using the Straight-line method. - Equipment has an economic life of 5 years. - Equipment expected to have zero salvage value at the end of year 5. At that time the equipment will be obsolete and sold for scrap. . Cash Inflows: Based on your analysis project inflows are expected to be $65 million per year, beginning one year after installation of the new equipment is complete. - Cash Outflows: The new equipment will have extra cash outflows of $10 million per year beginning one year from today. - Tax Rate: The company's estimated tax rate is 30%. - Required Return: The company will only invest in projects that yield a retum it feels could be earned from other investment opportunities. The required return is 17%. Project Evaluation (Total 100 points) The company follows an evaluation method called ROCE (return on capital employed) which is a fwo-part method: Part 1. NPV \& IRR (25 points) a) Calculate the net present value (NPV) using the information above. Use the NPV tab in this spreadsheet for your calculation. Include the calculations for cash flows. b) Based on the NPV calculation is the retur acceptable? Please explain your conclusion. Part 2. Risk Assessment (25 points) a) Review the "Risk Assessment" tab which includes economic data provided by the Bureau of Economic Analysis (BEA) Note: Possible economic conditions and their probabilities are as follows. Possible recession, .05, slow growth, ,05, normal economic growth, .90. b) Calculate weighted return, return deviation, squared return deviation, weighted squared deviation, variance, mean and standard deviation. c) After completing the risk analysis do you still agree with your conclusion in Part 1, b.? If so why? Reassessment of NPV \& IRR (25 points) a) A fixed asset suspension account, Account 99999 , was established in the "General Ledger Accounts" to accumulate all expenditures relating to this project. Review of this account (See G/L for Balance) indicates actual expenditures exceeded the approved amount of $150,000,000 and the investment cost is now much higl b) Recalulate the NPV \& IRR based on the actual expenditures (cash flow investment amount) - See "Revisit NPV \& IRR" tab. Would you still accept this project? Given your "new" recalculated NPV \& IRR, would you still accept this project? Please explain your conclusion. Find the Weighted Return, Return Deviation, Squared Return Deviation, Weighted Squared Deviation, Investment Opportunity: Manufacturing management wants to acquire new soap pressing equipment to support current products and anticipated future products that are in investments are included in the annual budget. This includes the estimated cost of acquisition and the month the expenditure will be made. Once the request is formally subr the accounting and finance department your responsibilities include evaluation of proposed capital investments and risk assessment. The following information was included on the initial requisition: - Purehase Price: Estimated purchase price for the new equipment is $150 million. The investment will be made immediately after approval. Often the purchase price does not include all ancillary expenses that are necessary for installation of the equipment and must be included in the value. Part of your responsibility is to research these additional costs and make sure they are included in the requisition. - Company's Depreciation Policy: - Equipment will be depreciated using the Straight-line method. - Equipment has an economic life of 5 years. - Equipment expected to have zero salvage value at the end of year 5. At that time the equipment will be obsolete and sold for scrap. . Cash Inflows: Based on your analysis project inflows are expected to be $65 million per year, beginning one year after installation of the new equipment is complete. - Cash Outflows: The new equipment will have extra cash outflows of $10 million per year beginning one year from today. - Tax Rate: The company's estimated tax rate is 30%. - Required Return: The company will only invest in projects that yield a retum it feels could be earned from other investment opportunities. The required return is 17%. Project Evaluation (Total 100 points) The company follows an evaluation method called ROCE (return on capital employed) which is a fwo-part method: Part 1. NPV \& IRR (25 points) a) Calculate the net present value (NPV) using the information above. Use the NPV tab in this spreadsheet for your calculation. Include the calculations for cash flows. b) Based on the NPV calculation is the retur acceptable? Please explain your conclusion. Part 2. Risk Assessment (25 points) a) Review the "Risk Assessment" tab which includes economic data provided by the Bureau of Economic Analysis (BEA) Note: Possible economic conditions and their probabilities are as follows. Possible recession, .05, slow growth, ,05, normal economic growth, .90. b) Calculate weighted return, return deviation, squared return deviation, weighted squared deviation, variance, mean and standard deviation. c) After completing the risk analysis do you still agree with your conclusion in Part 1, b.? If so why? Reassessment of NPV \& IRR (25 points) a) A fixed asset suspension account, Account 99999 , was established in the "General Ledger Accounts" to accumulate all expenditures relating to this project. Review of this account (See G/L for Balance) indicates actual expenditures exceeded the approved amount of $150,000,000 and the investment cost is now much higl b) Recalulate the NPV \& IRR based on the actual expenditures (cash flow investment amount) - See "Revisit NPV \& IRR" tab. Would you still accept this project? Given your "new" recalculated NPV \& IRR, would you still accept this project? Please explain your conclusion. Find the Weighted Return, Return Deviation, Squared Return Deviation, Weighted Squared Deviation